Ramil Nasibulin

My Experience With K+S & Thesis

K+S (OTCQX:KPLUF) (OTCQX:KPLUY) was one of my first investments almost a decade ago, at the end of my teenage years. Back then, I already knew a lot about stock markets in general… at least in theory. However, I didn’t know much about how to analyze and value a company. I got tempted by the high dividend yield of K+S and bought an initial position.

After happily receiving my first dividend the stock plummeted, driven by the break-up of the Belarusian Potash Company, a joint venture and important cartel between Russia’s Uralkali and Belarussian Belaruskali in 2013, which triggered a price war.

In the years that followed, there was more shadow than light in terms of the share’s performance. The attempt by Canadian Potash Corp. in 2015 to take over K+S was probably the most promising situation to sell the stock at a reasonable profit. Unfortunately, I missed the opportunity. I held the shares in the hope of an even better takeover offer, and Potash withdrew its takeover bid.

Between 2016 and 2019, I bought more shares several times to “lower my average purchase price”. To be honest, my decisions were based more on irrational hopes (“the share price certainly won’t get lower”) than on sound analysis.

These days I see many reasons to hold the shares and a promising opportunity to close my personal chapter with K+S with a happy ending. This is due to: good market prospects for potash at least in the medium term, low debt levels of the company paving the way for a significant dividend increase and maybe share buybacks, leading to a strong buy opinion for the stock.

Business Model

K+S was founded in 1889 in Kassel, Germany and operates with 10,800 employees as a supplier of mineral products like potash, magnesium and salt along the value chain. With production sites in Europe and North America, it serves a broad customer base around the world.

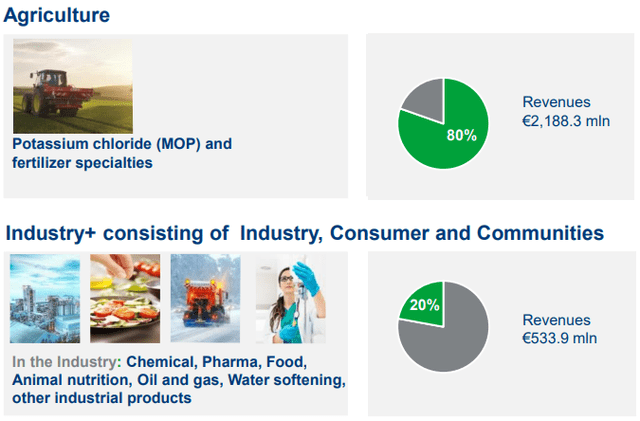

Sales are generated in two major customer segments, Agriculture and Industry+.

K+S Customer Segments – Revenues H1/2022 (K+S Compendium August 2022)

Valuation

It’s All About The Potash Price

To value K+S let’s focus on factors that determine the company’s stock price, which is mainly the price of potash. As we all know, prices are in principle dependent on demand and supply:

I expect demand to remain high in the short- to medium term due to:

- The Ukraine war, which will reduce exports of grain, so that demand will have to be met elsewhere, i.e., possibly by countries with less fertile soils, which in turn will necessitate fertilizers

- Increase in extreme weather events like extreme heat, storms and floods that destroy the crop and make it necessary to increase efficiency (via fertilizers)

- Worldwide growth of population

All the above reasons lead to generally higher grain prices, so that the use of fertilizers pays off.

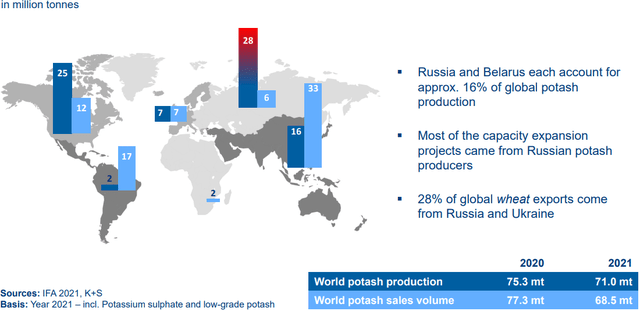

Additionally, supply is also likely to remain restricted due to sanctions on Russia and Belarus, both of which are very important countries for potash production. Each account for approx. 16% of global potash production. Additionally, 28% of global wheat exports come from Russia and Ukraine.

World Potash Production and Sales by Region (K+S Compendium August 2022, IFA)

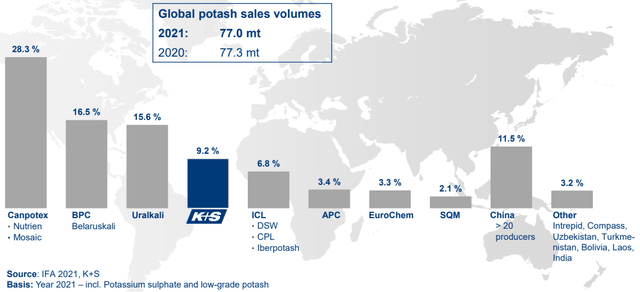

Given that Belaruskali and Uralkali are virtually eliminated from a large part of the world market, K+S is currently one of the three most important potash suppliers in the world.

Supplier Structure on the Global Potash Market (K+S Compendium August 2022, IFA)

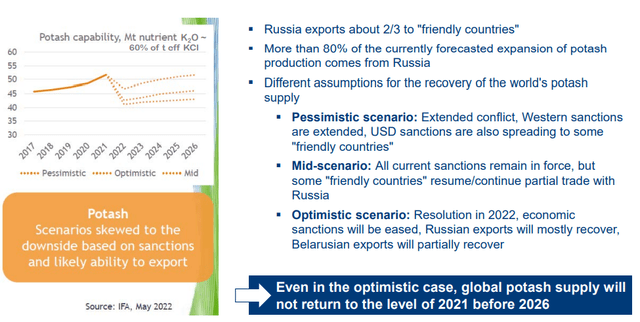

According to International Fertilizer Association (IFA), global potash supply will not return to the level of 2021 until 2026.

World Potash Supply – Geopolitical Effects (K+S Q2/2022 Presentation p. 8)

This means that prices will remain high. How high exactly is more a matter of speculation. But at least I expect them to be higher than in the past years.

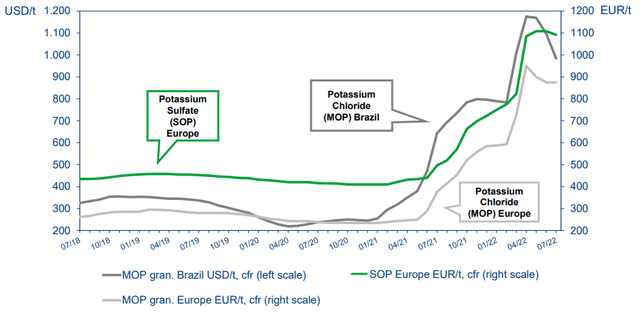

Potash Price Development (K+S Compendium August 2022 p. 27)

Even if prices normalize at the high level, a doubling compared to previous years seems realistic in the medium term.

What Happens To The Cash?

Valuing the company in a period of strong market exaggeration is quite difficult. First, let’s look at the status quo:

In 2021, the company closed the sale of its American salt business for an EV of $3.2bn (13.4x EBITDA) to reduce its debt burden. This was quite successful since net debt (incl. all lease liabilities) went down from approx. €860mn in H1/2021 to €588mn in H1/2022. It should be noted, however, that a great deal of liquidity is tied up in working capital (working capital of €1.35bn in H1/22 vs. €0.5bn in H1/21). Otherwise, net debt would be negative.

Free Cash Flow for the whole year 2022 is expected to be around €770mn to €970mn. What will K+S do with this huge amount of obtained cash? Probably the company will repay one of its two €400mn bonds, due in April 2023 (coupon 2.625%) and July 2024 (coupon 3.25%). I think a complete deleveraging is unlikely.

However, if the company repays its debt of €400 million, this will leave at least €370 million to be distributed to shareholders. With 191.4 million shares outstanding, this corresponds to around 2 euros per share – a great cash flow yield compared to the current share price of around €22.

For 2023, I expect the free cash flow generated to benefit shareholders even more. As I said, further debt reduction does not seem to make sense to me. If free cash flow is similar to 2022, K+S could distribute 4-5 euros per share. An FCF yield of 18%-22%.

An Attempt At Normalized Financial Ratios

Of course, it will be interesting to see how normalized returns look in the future. And that’s hard to say, because, in the current environment, you don’t even know what “normal” is anymore. Perhaps Belarus and Russia will remain sanctioned for a long time, at least it looks that way in the medium term.

According to valuation master Damodaran, the EV/EBITDA multiple for a company in the metals & mining sector is 7.6x (EV/EBITDA).

Assuming that K+S generates EBITDA of €800-1,000mn in the medium term, this results in an EV of about €6-7.6bn. Mind you, the multiple of 7.6x is significantly lower than the recent sale price of the salt business (around 13x) and therefore offers a good margin of safety.

The enterprise value of K+S is currently around €4.7bn.

There is still about €500-700mn in cash that will flow in by the end of the year. For 2023 it can be assumed that the year will also be very successful. At least that is what Mosaic, one of the biggest players in the industry and a competitor of K+S, expects. FCF could again reach around €1bn.

The upside in the share price due to the EV/EBITDA multiple can be conservatively estimated at 30%-60%. A further 30% is added when the potential distributions for this and next year are taken into account. I, therefore, believe it is not unlikely that the share price could double to over 40 euros. This is in line with JPMorgan’s assessment, which puts the current price target at 44.5.

In any case, the current P/E ratio of about 4x is too low, even if profits are likely to level off again in the next few years. The shares should definitely be considered as an investment at the current prices, therefore.

Conclusion

As a result of the sale of the American salt business, K+S now has a solid balance sheet and a good liquidity position. In both 2022 and 2023, free cash flows should generate returns of around 20%. High (special) dividends or even share buybacks are quite possible in my view. The current P/E of 4x is not sustainable but shows how cheap the company currently is. Based on FCF and a multiple approach, a doubling of the share price does not seem unrealistic. In any case, the share is currently too cheap and a strong buy.

Be the first to comment