Torsten Asmus

In normal times, the calendar 4th quarter is a time for investors to harvest tax losses by selling shares for losses that can wash realized capital gains from other issues. In our inflation fighting, rapidly rising interest rates, high anxiety 4th quarter 2022, things seem more complex than normal which may have contributed to both investment peril and opportunity. As an example, we will look at the trading in Gladstone Commercial (GOOD) equities and Gladstone Commercial Series G preferred (NASDAQ:GOODO), specifically.

GOOD has been a solid monthly dividend producer since its IPO in 2003. We didn’t really get involved with GOOD until after the financial crisis when its outsized dividend yield made it stand out amongst other triple net REITS. In 2012, after CEO David Gladstone pointed out the tax advantages of that high monthly dividend, GOOD became a staple in our taxable portfolios.

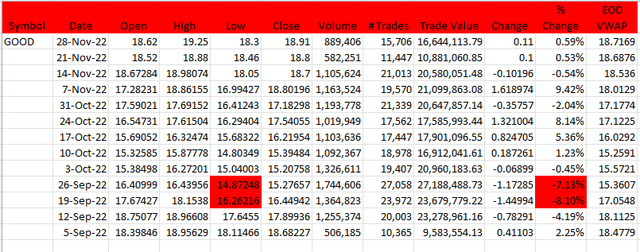

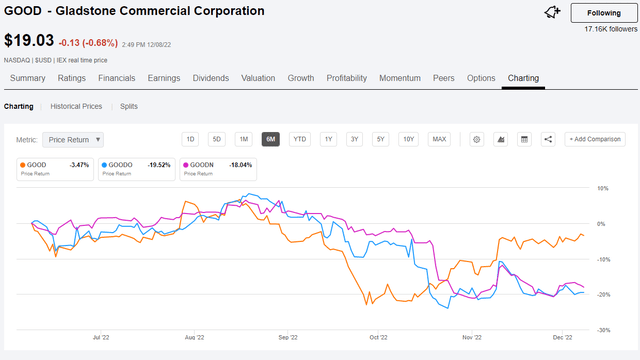

It has been a tough year for REITs in general, but by the end of September GOOD shares were nearly in freefall. Nothing unusual was happening with Gladstone Commercial on an operational basis, we suspect it was just REIT investors wanting to quickly get to cash in the absence of anyone wanting to buy their shares.

Fortunately, by early November GOOD regained some footing and in December has again traded above $19.00. The anomalous and interesting activity, however, has not been in the Gladstone common, but in its preferred shares.

The Capital Stack

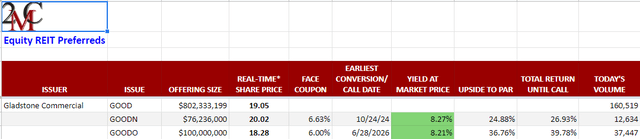

Over time, Gladstone has gone to the capital markets with many series of preferred share offerings that they redeemed with proceeds from follow-on offerings of lower coupon preferreds. Today, only the 6.625% Series E (GOODN) and the 6.00% Series G (GOODO) remain outstanding.

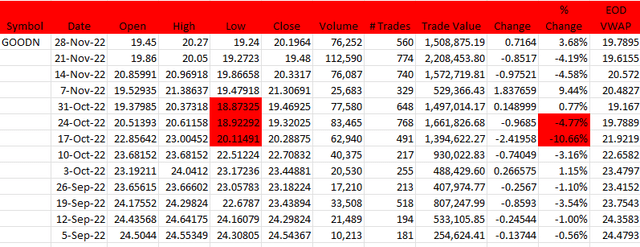

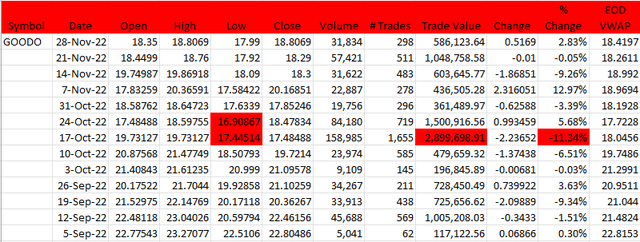

Over the last 52 weeks, both GOODN and GOODO traded above their $25 par values ($27+ each), but that premium started to fade about the time the Fed started hiking interest rates. In late October, a true dislocation between buyers and sellers opened up on higher than normal volume and both preferred issues experienced double digit price declines.

Quote Stream Media 12/08/2022 Quote Stream Media 12/08/2022

The dislocation continues today.

So, What’s Happening?

It is hard to pinpoint what might be motivating investors to sell their shares. It might be a general anxiety and a desire to get to cash, get to the sidelines. Since it is the close of the year, it might be a need to harvest losses in an investor’s tax planning. What is strange, and what the SA chart illustrates below, is that the common shares and the preferred shares are trading disparately across the calendar. The common shares cratered in September, but the preferred shares didn’t really fall apart until the end of October and they have not yet stabilized. To the intrepid, this might look like an opportunity to improve yield from the same issuer.

Yield Arbitrage within the Capital Stack

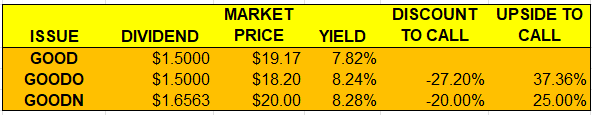

If we examine the dividend schedules for each of the three Gladstone equities, the yield advantages of the preferreds at current market pricing are obvious.

2MCAC 12/08/2022

The other striking factor is GOODO’s 37% upside to call; if the Fed defeats inflation and we return to the idyllic, post-pandemic economy of early 2021, maybe GOODO can trade at par again and deliver capital appreciation along with superior yield.

Dividends from the Same Issuer are Largely Fungible. Why Not Get More?

It might seem an obvious choice for a holder of GOOD to swap shares for the superior yield and appreciation potential of GOODO, but for taxable accounts the decision is a little subtler than that. In my July report detailing GOOD’s significant tax advantages, I described that 71% of the common’s 2021 dividend was characterized as a return of capital (taxation is deferred until shares are sold). That translates to a much higher after-tax, carrying yield for GOOD vs. GOODO because GOODO’s dividend is characterized as ordinary dividend income (taxable currently).

Our Trades

If we held GOOD in IRA/tax sheltered accounts, we swapped the shares for GOODO or GOODN. We improved the current yield by 40 basis points and can wait to see if the markets deliver capital appreciation in 2023. For taxable accounts, we may continue to hold the common and collect the steady, tax advantaged monthly dividends.

Be the first to comment