VioletaStoimenova

Northrim BanCorp, Inc. (NASDAQ:NRIM) continues to thwart the potential risks of macroeconomic changes. Revenues and margins increase as NRIM reaps the reward of its interest-sensitive assets. Despite this, NRIM maintains a conservative approach to growth. Indeed, it is a robust and secure company with adequate returns. It is no wonder it can sustain dividends and cover borrowings. Likewise, the stock price uptrend persists and adheres to fundamentals. But the target value using our estimates has a narrow gap from the current stock price.

Company Performance

It is typical for banks to become vulnerable to macroeconomic headwinds. There may be hammered growth and skyrocketing expenses. Capital outflows may become overwhelming without proper asset management. Yet, Northrim Bancorp, Inc. is an exception. It is a spectacular company that uses the situation to its advantage.

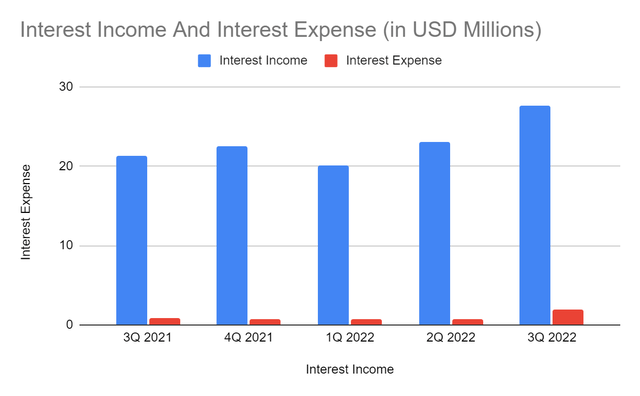

The primary revenue components of NRIM are interests, commissions, and fees. The interest segment shows impeccable performance. The most recent interest income reached $27.56 million, a 30% year-over-year growth. Various factors contributed to the substantial increase. I will focus on the two.

Interest Income And Interest Expense (MarketWatch)

First, it maintains efficient management of loans and deposits. These are the lifeblood of the core operations. Although loans decreased in value on a year-over-year basis, yields skyrocketed. We can attribute it to the series of interest and interest rate hikes. But what drove interest income growth was the quality of loans. Most of NRIM’s loans are interest-sensitive. So an increase in loans leads to an immediate rise in yields. Also, the commercial and industrial segment comprises most of the loans. Even real estate loans are from the commercial segment. With that, loans are more secure when the economy steers into reversal.

Second, NRIM demonstrates prudent earning asset management and portfolio diversification. We can verify it with investment and bank deposit yields. Often, financial securities do not benefit from inflation and interest rate hikes. But NRIM managed to generate more yields due to the nature of its investments. Most investments are government-backed securities. These are more inflation-linked and can hedge risks and lower valuation. Likewise, bank deposits earned more interest despite their lower value. Overall, NRIM’s earning assets are interest-sensitive and well-diversified.

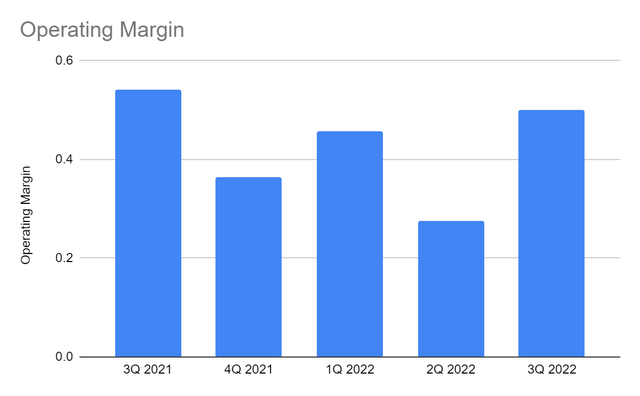

Meanwhile, the non-interest segment had a noticeable downtrend. It was mainly due to lower mortgage banking income. It was logical since housing sales have started cooling down. Also, mortgage rates rose, so the demand dropped. Nevertheless, NRIM was able to stabilize costs and expenses. Hence, revenue growth offsets the increase in expenses. The operating margin reached 50%, a huge rebound after the decrease in the last three quarters. The percentage decreased on a year-over-year basis, but it remained high. Also, the quarterly comparison showed a drastic improvement.

Operating Margin (MarketWatch)

Market Risks, Opportunities, And Core Competencies

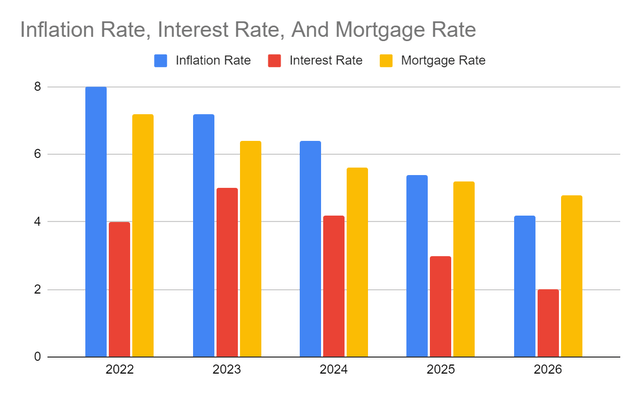

We have already seen a glimpse of macroeconomic headwinds. Despite the sustained performance, Northrim Bancorp, Inc. must be more careful. Although higher inflation and interest rates mean higher loan returns, defaults are possible. And even if most loans have collateral, the fair value may not match the principal. It must also watch out for the potential housing market crash. It may have to increase provisions and manage loans better to preserve liquidity.

Inflation Rate, Interest Rate, And Mortgage Rate (Barron’s, Forbes, And Author Estimation)

On a lighter note, unemployment remains far from the Great Recession. So borrowers can pay their outstanding loans. A potential recession may have a mixed impact on NRIM. The probability of default may decrease, and so credit losses provisions. But the lower loan yields may offset it. Customers still have the high purchasing power to avail of banking services. But it may decrease further, as shown by the downtrend in mortgage banking. Overall, NRIM manages earning assets with increased efficiency and prudence. It uses its interest-sensitive Balance Sheet to generate more income and increase margins. It must manage loans and investments better when the recession hits the US.

Meanwhile, NRIM sees potential opportunities as Alaska’s economy rebounds. Despite the still uncertain movement in unemployment, it had a considerable decrease. It is also at an advantage as Alaska enjoys the impact of higher crude oil prices. Alaska is well-endowed with crude oil. Reserves average two billion barrels, making it the fourth-largest producer in the US. As a primary growth driver of the state, the local economy may remain robust. Employment may stay stable. It may lead to higher purchasing and borrowing power of people and businesses.

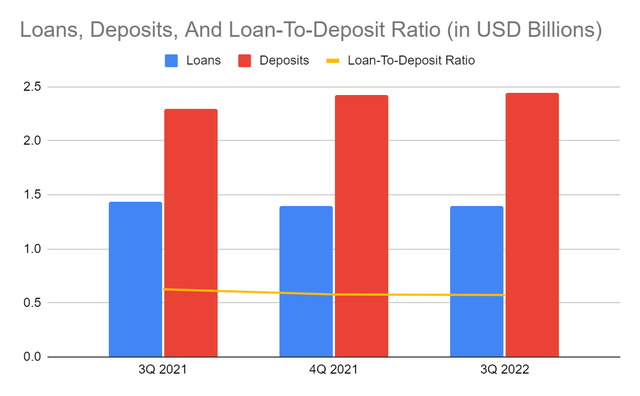

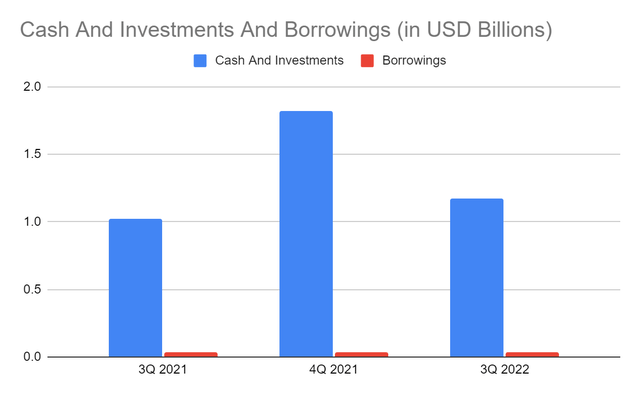

But what makes NRIM a durable company is its solid positioning. It has a stellar Balance Sheet driven by interest-sensitive assets. Loans are relatively stable with impressive yields. Even better, it maintains a conservative approach to growth. Credit loss provisions increased from 0.083 to 0.087 despite having lower loans. Also, the loan-to-deposit ratio remains low at 57%. It is way lower than the average range of 80-90%, so NRIM has more reserves in case of defaults. It also has more flexibility to increase its loans if deemed viable. Moreover, cash and investments comprise 43% of the total assets. The combined value can cover all liabilities aside from deposits. It can be confirmed by the cash flow statement, given the adequate cash inflows. FCF/Sales ratio remains high at 41%. It shows the capacity of the company to turn operating revenues into cash. So, borrowings and dividends are well-covered. Meanwhile, ROAA and ROAE remain high at 1.08% and 12.9%, respectively. These are reasonable since NRIM has one billion in assets and is considered a large bank.

Loans, Deposits, And Loan-To-Deposit Ratio (MarketWatch) Cash And Investments And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Northrim Bancorp, Inc. had a slight cooldown in the last two weeks. But the sharp uptrend is still evident. At $54.8, it is already 29% higher than the stock price. It appears fairly valued, as shown by its price-earnings multiple of 10.8x. If we multiply it by NASDAQ estimates of $5.38, the target price will increase to $58.1.

Meanwhile, the BV multiple of NRIM is 1.47x per share. It is already way higher than the 1.2x average before. If we multiply the current BV of 38.3x by the average multiple, the target price will decrease to $45.9. By averaging the two, the target price will still be lower at $52. It shows a 5% decrease in the stock price.

Meanwhile, dividends make the stock more enticing. Payouts are consistent with a yield of 3.6%. It is way higher than the S&P 600 and NASDAQ composite average of 1.41% and 1.26%. Indeed, NRIM is a relatively viable and generous stock. However, the stock price does not appear cheap anymore. Investors must assess the potential upside drivers before making a position. To assess the stock price better, we will use the DCF Model.

FCFF $20,252,000

Cash $20,100,000

Borrowings $34,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Stock Price $54.8

Derived Value $56

The derived value adheres to the estimation using the PE Ratio. But the upside is still low at 2.1% for the next 12-18 months. Investors must be more careful before buying stocks.

Bottomline

Northrim BanCorp, Inc. remains a robust bank despite recessionary headwinds. Revenues and margins are impressive, which shows efficient asset management. Also, it has a stellar Balance Sheet with excellent loan quality and a diverse portfolio. The company is very liquid and conservative, with adequate reserves. This attribute makes it more flexible and secure even when there are defaults.

With solid fundamentals and well-covered dividends, the stock price has a sharp uptrend. However, it appears to be approaching the maximum level. It is still reasonable, but the upside potential is low. The recommendation, for now, is that Northrim Bancorp, Inc. is a hold.

Be the first to comment