imaginima

Overview

Similarweb (NYSE:SMWB) is an early-stage web analytics company. Their core business is providing internet-scale analytics on a business-to-business basis. The firm’s technology allows for market researchers and analysts to quantify web traffic across websites globally. There are several use cases for their offering, including digital marketing, sales intelligence, and of course website usage measurement.

An interesting development is the company’s entrance into the alternative data market. Alternative data is data outside of accounting statements that is used by active institutional investors such as hedge funds. Similarweb’s technology has positioned it well for delivering this kind of data, and notably it was named the best alternative data provider for 2021 by HedgeWeek. While it appears that the firm’s operations within this niche are still relatively early stage, it is worth paying attention to this segment of their revenues going forward.

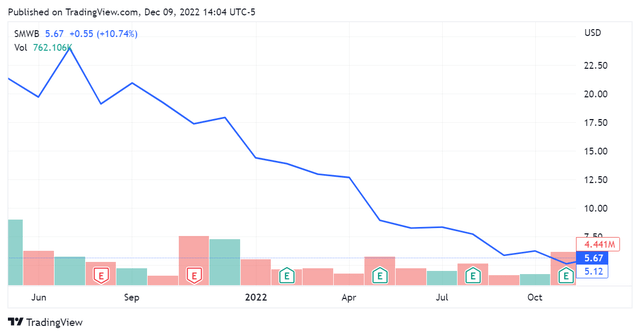

As to the stock, Similarweb first entered the public markets in Q2 2021 at $22 per share. Since then the security has depreciated significantly, now trading at $5.67 as of this article.

This article will review the company’s financials and determine the direction that it is headed.

Financials

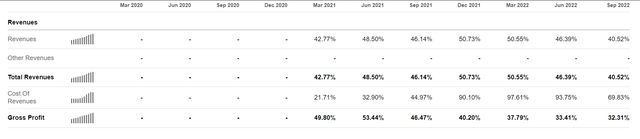

First and foremost, Similarweb has displayed consistent growth in its revenues and gross profit over the last 10 quarters.

SeekingAlpha.com SMWB 12.9.22 SeekingAlpha.com SMWB 12.9.22

What is good about this trendline is the fact that the company has not had a quarterly decline in revenues over this period. Additionally, YoY growth continues to be strong, as seen in the bottom picture for Q2 2021 and after. This high-double digit growth rate can be considered healthy for the firm’s stage of growth.

Nonetheless operating income has continued to be negative, and increasingly so quarter-over-quarter. The reduced size of the firm’s operating loss in Q3 2022 indicates that it may have begun swinging towards profitability, but it is far too early to gauge that with any certainty. The company’s growth in cost structure indicates to me that it is still very much in growth mode.

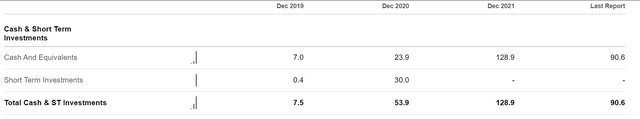

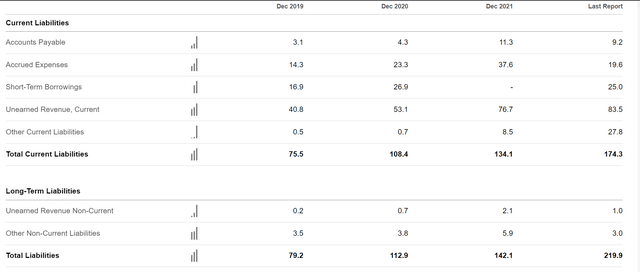

Since this company is still losing money from operations, we must take a look at its balance sheet to see how it is positioned for future growth. The firm has been drawn down about 30% of its 2021 cash reserves YTD as well as significantly increased its overall liabilities.

SeekingAlpha.com SMWB 12.9.22 SeekingAlpha.com SMWB 12.9.22

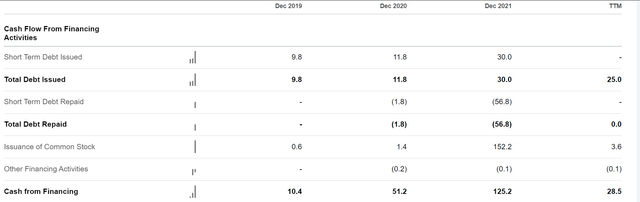

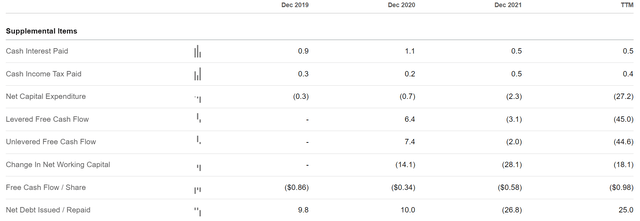

Additionally, the bulk of its capital structure is indexed towards the short-term (12 months), with current liabilities at $174.3M versus total liabilities of $219.9M overall. The company’s financing has slowed YTD, with no new short-term debt issued and only $25M additional debt issuance for 2022 thus far. This tells us that the firm is managing its previous capital raise for operations this year and has not been overly eager to take on new debt over the last several quarters.

This is contextualized further by Similarweb’s positive book value, indicating that its assets are still that much greater than its debts – although it is quite close to zero overall as of its last (Q3 2022) filing. We can’t infer too much from this as of yet, but it’s worth watching this firm’s capital structure as it continues to grow.

Interest costs overall appear reasonable and still a relatively small portion of revenues – note the small difference between levered and unlevered free cash flow as well as the relatively minor cash interest payments. If these numbers stay low it’s fair to say that Similarweb has a relatively low cost of capital, although this is not assured going forward within the current context.

In line with the fact that it is quite early in its growth cycle, we see that cash flows overall are still negative. The firm appears to have burned through significantly more cash YTD than previously. Since it has scaled revenues significantly during this time, we can chalk that up to growth costs.

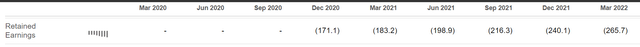

Retained earnings are still increasingly negative, indicating again that this company has not turned the corner on profit generation.

These numbers can be interpreted in several ways. For the investor that is used to seeing mature entities with a track record of profits as well as cash flow generation, this stock doesn’t look so great – it is nowhere near that stage in its growth cycle.

For an early stage growth investor, however, it isn’t all bad: revenues are growing briskly and the company is financed at competitive rates, with a reasonable overall capital structure at present.

Conclusion

Reiterating the early stage nature of this stock, I actually like certain aspects of it. Namely, revenue growth has not stalled. While Similarweb isn’t producing exponential growth in revenues, it is posting consistent increases that look good YoY. Additionally, its capital structure appears to be well-managed, with low interest costs and a positive book value even at its early stage; it is commonplace to see the opposite of this for companies at this stage.

When looking at companies that are this early in their lifecycle, we must always consider the market that it is addressing and whether it will be able to saturate it. I am comfortable saying that there are few offerings out there that are as technically sophisticated as Similarweb’s. Internet-scale analytics isn’t rocket science, but I don’t think it’s that far off; I couldn’t name another public company selling this at present.

Additionally, I think the company’s entrance into alternative data could end up being a major revenue driver. While this space is nascent and not particularly well-known, it is already over $3B in revenues yearly and is expected to grow significantly over the next decade. Yearly growth in alternative data expenditures is coming in at 20-30%, and there are various estimates positing that it will be a double-digit billion dollar space within the decade. While I think the $100B 2030 figure provided by Similarweb is a bit too optimistic, I am comfortable saying it should be a $25B business by 2030. If Similarweb can capture even 10% of this market, this will be quite good for its revenues. Since they are well-positioned to do so from a technical standpoint, I see no reason that they should not be able to. Competition here is limited by technical constraints as well as the early-stage nature of the alternative data business in general.

Taking all of this together, I believe that Similarweb is targeting a significant and growing market for its offering. There are multiple use cases for its technology – with alternative data being the most interesting one from my perspective. This gives me comfort that it can scale revenues into the multiple hundred millions and keep them there for some time. At that point it should be able to fund itself through its own cash and generate the double-digit net margins that successful software companies do. This is several years into the future, but as a technology investor I am going to call it a buy at this price.

Be the first to comment