ipopba

Biogen (NASDAQ:BIIB) has recently surged again on positive results from their Alzheimer’s drug portfolio. Investors are more tepid on the drug benefits this time after the approved aducanumab drug failed to gain market traction due to drug pricing and perceived limited benefits. My investment thesis is mildly Bullish on the stock after the rally to $280 knowing the last Alzheimer’s drug approval sent Biogen to over $400.

Strong Pipeline

The market focuses most of the Biogen attention on the Alzheimer drugs offering potential breakthrough therapies for an unsolvable disease. While aducanumab failed to live up to the hype, lecanemab promises to deliver benefits to Alzheimer patients.

The drug provided a statistically significant reduction in the decline of the 1,800 patients in the study. Biogen expects an FED decision on accelerated approval by January 6 while partner Eisai (OTCPK:ESALF, OTCPK:ESALY) plans to file for a traditional regulatory approval in the U.S., E.U. and Japan by the end of Q1’23.

As CEO Michel Vounatsos stated on the Q3’22 earnings call, lecanemab provides. a huge step forward for Alzheimer patients:

With an FDA decision on accelerated approval expected by January 6 of next year, and Eisai’s plan to file for traditional approval in the US, EU and Japan by the end of Q1 2023, lecanemab has the potential to be the first globally approved treatment to slow the progression of Alzheimer’s disease.

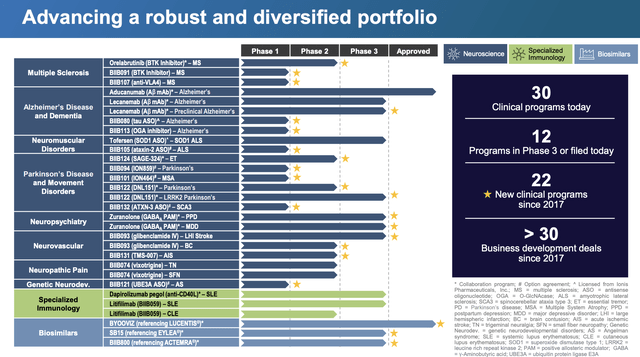

The biopharma has a far more diverse pipeline in other diseases including depression and multiple sclerosis, but the whole market focus is on Alzheimer’s now. Biogen has a solid 12 programs in Phase 3 trials or filed for regulatory approvals.

Source: Biogen Q3’22 presentation

Of course, the problem with the stock is revenue declines centered around the declines in multiple sclerosis drug sales by 11% to $1.6 billion in Q3’22. This similar story has played out in multiple developed biopharma stocks as loss of exclusivity on old drug leads to a constant revenues churn as new drugs obtain FDA approval.

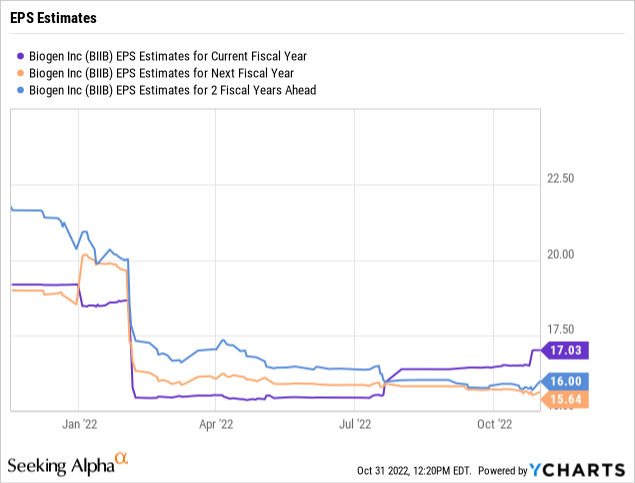

Regardless, the prospects for the business appear weak without strong sales from lecanemab. Analysts forecast a $17 EPS in 2022 turning into somewhere around $16 per share in earnings over the next couple of years on revenue dips to $9.3 billion.

Alzheimer’s Upside

The promise of lecanemab is where the stock gets interesting. Goldman Sachs recently raised the price target on Biogen to $370 based on strong global sales potential for the Alzheimer’s drug. The analyst firm predicted peak global drug sales of $14 billion, which is substantially above the current revenue base of Biogen.

Note though, the drug is co-developed with Eisai and involves the following reporting per CFO Michael McDonnell on the Q3’22 earnings call:

let me say a few words about lecanemab. We are excited to be collaborating with Eisai on this important opportunity under a global 50-50 profit sharing agreement. As a reminder, Biogen has the right to co-commercialize and co-promote lecanemab with Eisai who has final decision-making authority. After approval, our share of profits or losses will be booked as a component of other revenue. The lecanemab component of other revenue may be negative in the initial quarters of the launch.

The key here is that the above analyst consensus estimates don’t generally factor in the EPS estimates on this drug approval. The high EPS estimates hit $24 per share in 2025 and jump to $32 in 2027.

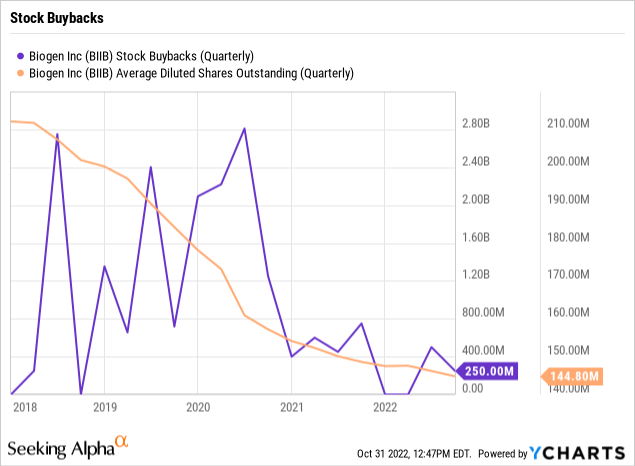

The stock only has 145 million shares outstanding with a market cap of ~$40 billion. At this limited share count due to massive share buybacks over the last few years, lecanemab could produce up to $100 in revenues per outstanding share.

Biogen spent from 2018 through 2020 regularly repurchasing over $1 billion worth of shares on a quarterly basis. The company successfully reduced the diluted share count from over 210 million shares back in 2018 to only 145 million now.

Elevated Risk

Of course, an investor buying the stock here faces the risk of a repeated drug failure again. Biogen regularly traded below $200 and any failed traction of lecanemab could lead to an $80 dip in the stock for a nearly 30% loss from here.

The news of a patient death possibly contributed to the use of the Alzheimer’s therapy lecanemab could have a devastating impact on the drug approval. Japanese partner Eisai places the blame on multiple falls by the patent in addition to a heart attack and a stroke. The Clarity AD study involved 1,800 patients questioning whether one dire outcome would impact and FDA approval.

In addition, another failed Alzheimer drug could led to Biogen falling to new lows. If the biopharma only has a legitimate path to lower earnings, nothing would prevent the stock from trading at 10x adjusted earnings of $16, or the equivalent of $160.

Takeaway

The key investor takeaway is that Biogen is cheap based on the likely approval of lecanemab. The stock faces a binary scenario where any failure to obtain drug approval or payment would send Biogen likely to new lows.

Be the first to comment