blackdovfx

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 8th, 2022.

A few months ago I covered the Invesco S&P 500 Equal Weight ETF (RSP), an equal-weighted S&P 500 index ETF. RSP’s weighting scheme provides investors with comparable, even greater, diversification than a standard S&P 500 index fund, ensures a cheaper valuation, and has led to outperformance in the past. These are very strong benefits, and led me to search for a comparable equal-weighted fund tracking the Nasdaq-100 index. The Direxion NASDAQ-100 Equal Weighted Index Shares (NYSEARCA:QQQE) seems to fit the bill.

QQQE is an equal-weighted Nasdaq-100 index ETF. QQQE’s underlying index remains significantly overweight tech stocks, with all the benefits and drawbacks that entails. QQQE’s weighting scheme significantly reduces the fund’s exposure to mega-cap tech stocks, including Apple (AAPL) and Microsoft (MSFT), relative to standard Nasdaq-100 index funds. Doing so means fund performance is less dependent on the performance of a few specific stocks, significantly reducing risk, volatility, and the potential for outsized losses. Reduced exposure to these stocks has led to underperformance since inception, but outperformance YTD.

In my opinion, QQQE’s diversified portfolio and reduced mega-cap tech exposure makes the fund a buy. QQQE’s overweight tech position means the fund is more appropriate for investors looking for tech funds, or for increased tech exposure. Investors who are bearish tech, or who have sufficient tech exposure in their portfolios already, should consider other funds, in my opinion at least.

QQQE – Overview

QQQE is an equal-weighted Nasdaq-100 index ETF.

The Nasdaq-100 is an equity index, which includes the 100 largest domestic and international non-financial companies listed on the Nasdaq Stock Market. As with most indexes, applicable stocks must also meet a basic set of inclusion and exclusion criteria, but these are quite lax.

Traditional Nasdaq-100 indexes and funds, including the benchmark Invesco QQQ ETF (QQQ), use a modified market-cap weighted scheme: larger companies have disproportionally large weights, smaller companies have lower weights. QQQE, on the other hand, is an equal-weighted fund, so every holding has the same weight: 1.0%.

QQQE’s holdings include most well-known large-cap U.S. tech equities, including Apple, Microsoft, and NVIDIA (NVDA). The fund excludes financials, so no JPMorgan (JPM) or Citi (C). As the fund only invests in stocks listed in the Nasdaq exchange, several important, well-known large-caps are missing, including Johnson & Johnson (JNJ) and Coca-Cola (KO).

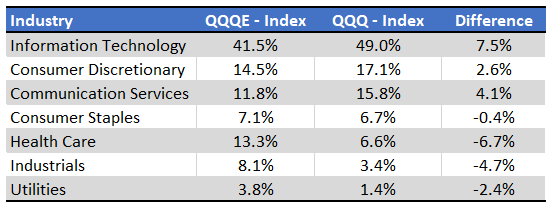

Both QQQE and QQQ are significantly overweight tech stocks, as tech is overrepresented in the Nasdaq stock exchange, especially in its top 100. Both funds are also significantly underweight old-economy industries, including utilities and industrials, to make room for tech. QQQE’s industry positions are a bit less extreme than those of QQQ, due to investing more heavily in smaller Nasdaq-100 names, but industry positions remain relatively aggressive, all things considered.

QQQE – Chart by Author

In my opinion, QQQE is a reasonably well-diversified fund, and so it could function as a core portfolio holding. Some funds, including those tracking the S&P 500 index, could function as an investor’s only equity investment. QQQE is not sufficiently diversified for this, due to being significantly underweight several important industries, and due to excluding several important large-caps from its portfolios.

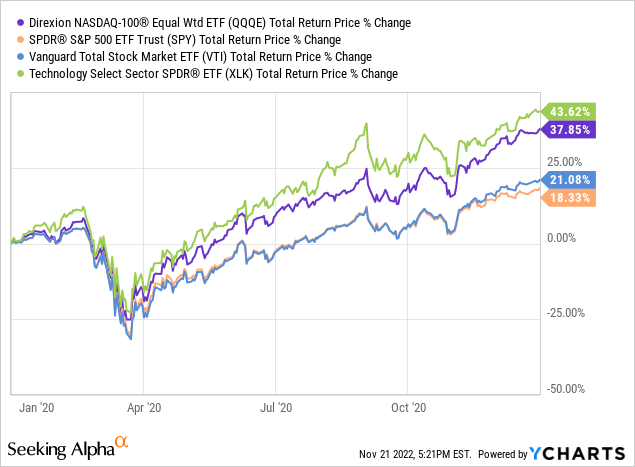

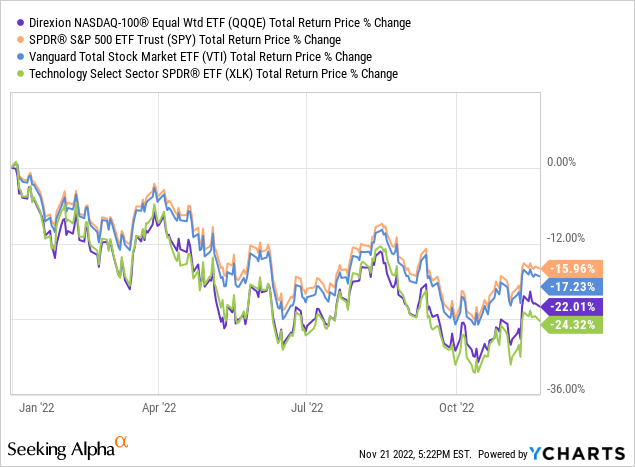

As QQQE is overweight tech, the fund’s relative performance is strongly dependent on the relative performance of said industry. Expect the fund to outperform when tech outperforms, as was the case during 2020.

Expect the fund to underperform when tech underperforms, as has been the case YTD.

As QQQE is significantly overweight tech, the fund is only appropriate for tech bulls or investors looking for tech funds or significant tech exposure, in my opinion at least.

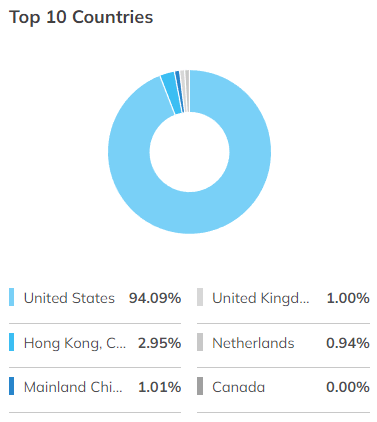

QQQE is technically a global equity fund, but, in practice, the fund is almost entirely comprised of U.S. equities, as most of the largest companies trading in the Nasdaq exchange are from the United States.

ETF.com

To summarize, QQQE is an equal-weighted Nasdaq-100 index ETF, providing investors with exposure to 100 large-cap equities, and with a significant overweight position in tech.

QQQE – Performance Analysis

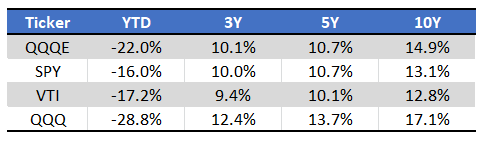

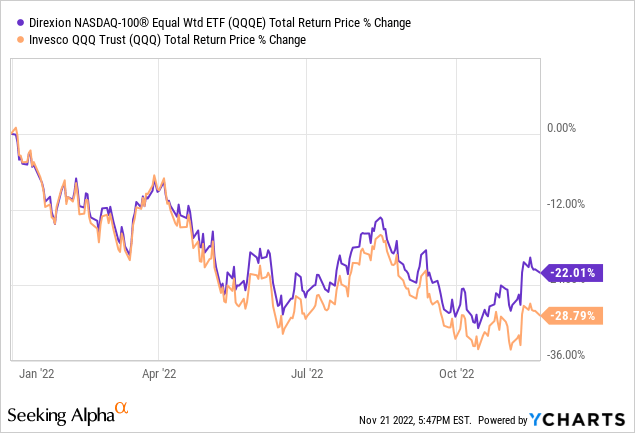

QQQE’s performance track-record is reasonably good, somewhat above-average. The fund has slightly outperformed relative to most broad-based U.S. equity indexes since inception, although slightly underperformed relative to QQQ. On the other hand, the fund has moderately underperformed relative to most broader indexes YTD, but moderately outperformed relative to QQQ.

Seeking Alpha – Chart By Author

As mentioned previously, QQQE’s relative performance is strongly influenced by the fund’s overweight tech position. The fund outperforms relative to broader indexes when tech outperforms, and vice versa. As the fund is less overweight tech than QQQ, the relationship is reversed relative to said fund.

In general terms, QQQE’s performance seems reasonable enough. The fund has outperformed the S&P 500 since inception, while suffering fewer losses than the Nasdaq-100 YTD, a good combination.

QQQE – Valuation Analysis

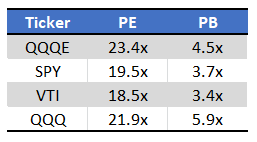

QQQE is significantly overweight tech, a relatively fast-growing, but expensive and richly valued, industry. Due to this, QQQE sports a relatively expensive valuation, with a PE ratio of 23.4x, and a PB ratio of 4.5x. Both metrics are somewhat elevated on absolute terms, and relative to broader indexes. QQQE’s valuation does not seem all that different to that of QQQ, however.

Fund Filings – Chart By Author

QQQE’s relatively expensive valuation could lead to moderate losses and underperformance moving forward, contingent on sentiment remaining bearish on tech. At this point, valuations between tech and non-tech stocks are similar enough that significant losses seem unlikely, in my opinion at least.

QQQE versus QQQ – Quick Comparison

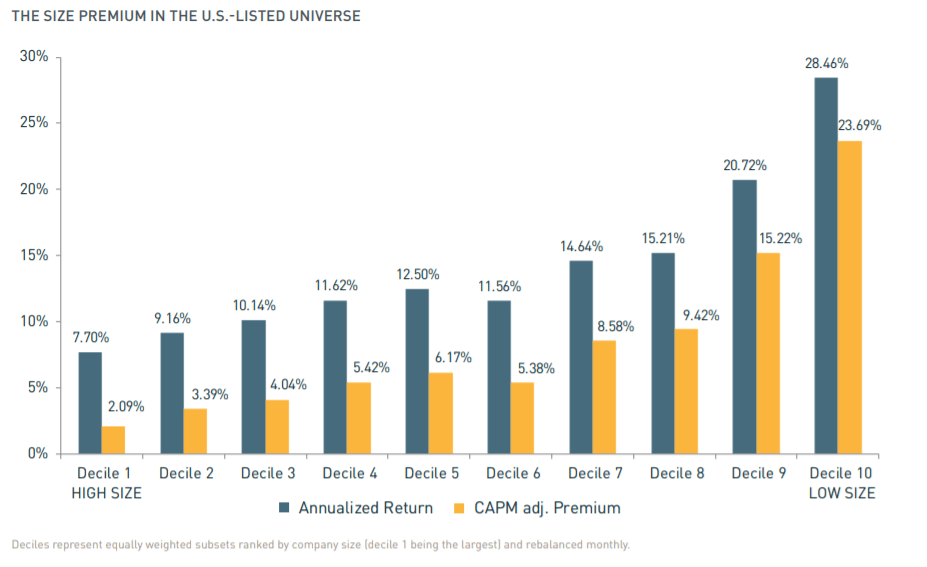

QQQE’s biggest differentiator, and selling point, is the fund’s equal-weighted portfolio. Said weighting scheme provides the fund and its investors with significantly greater exposure to comparatively small (less large) companies than more traditional market-cap weighted funds, including QQQ.

Greater exposure to smaller companies should lead to long-term outperformance, as smaller companies tend to grow faster than larger ones, leading to outperformance. This has generally been the case for decades, as shown by MSCI.

MSCI

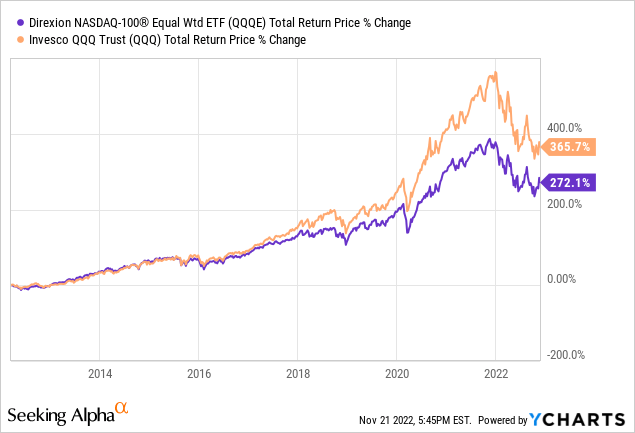

QQQE’s greater exposure to smaller companies should lead to stronger returns vis a vis QQQ, at least in the very long-term. This has not been the case since inception, as most of the largest Nasdaq-100 components have performed exceedingly well these past few years, including Apple, Microsoft, and Google. QQQ has greater exposure to these best-performing companies, and so has outperformed.

Notwithstanding the above, I do think that QQQE is likelier than not to outperform moving forward. Smaller companies tend to outperform, even if that has mostly not been the case this past decade.

QQQE’s equal-weighted portfolio has another important benefit. QQQE’s weighting scheme lowers exposure to a couple mega-cap stocks, which reduces risk, volatility, and the potential for significant underperformance. That last part is key, and is quite easy to show with an example: Facebook (META).

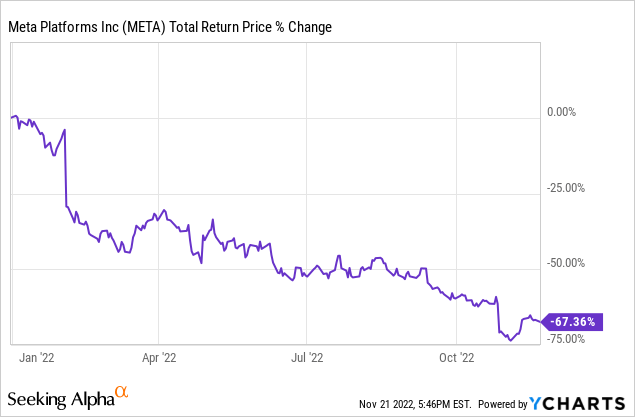

As most readers probably know, Facebook’s share price is plummeting, as investors grow weary of the company’s excessive metaverse investment. Revenues have stagnated, earnings are down, cash-flows are plummeting, and Zuckerberg is all-in on an unproven technology with uncertain prospects. Investors are incredibly bearish, with the company’s stock price tumbling down 67% YTD.

Most equity index funds have, or had, relatively large investments in Facebook, as most equity index funds are market-cap weighted, and Facebook’s market-cap was relatively large in the past (it remains large, but significantly less so). QQQ, for instance, had 3.81% of its portfolio in Facebook stock, as of September 2021. QQQ always invests in 100 stocks, so Facebook was a relatively large position, almost four times greater than average. Overweighting Facebook was a terrible idea, considering the fund’s disastrous performance these past few months.

QQQE, on the other hand, is equal-weighted, so invests 1.0% in each and every single one of its 100 holdings, including Facebook. Reduced exposure meant lower losses from Facebook’s recent decline. By my calculations, losses were reduced by 2.0%, amounting to a good chunk of QQQE’s outperformance.

Facebook had actually been responsible for most of QQQE’s outperformance when I first published this article, but then Amazon (AMZN) plummeted 20%, and QQQE outperformed by another couple percentage points. If Apple, Microsoft, or Google is next, then QQQE would outperform for another couple more percentage points.

QQQE’s equal-weighted portfolio meant lower losses from the disastrous performance of a specific company in the past, and would almost certainly reduce losses from a similar situation in the future. QQQ, for instance, invests 13.7% of its portfolio in Apple, so the fund would underperform if Apple does likewise. QQQE only invests 1.0% of its portfolio in Apple, so this is simply not an important issue or risk. Although I don’t think Apple, Microsoft, or any other mega-cap tech stock is likely to experience +70% in losses any time soon, I didn’t think it was possible for Facebook to experience losses of that magnitude either, and they happened regardless. Significant investments in any one company can always result in significant losses and underperformance, regardless of how strong or resilient the company appears to be. QQQE’s equal-weighted portfolio avoids these issues and risks, most other equity index funds do not, a significant benefit for QQQE and its shareholders.

Conclusion

In my opinion, QQQE’s diversified portfolio and reduced mega-cap tech exposure make the fund a buy. QQQE’s overweight tech position means the fund is more appropriate for investors looking for tech exposure.

Be the first to comment