Matt Cardy

Introduction

The geopolitical tensions around the world have exposed the countries that have drawn the short stick when it comes to military might. Consequently, it has made Teddy Roosevelt’s Big Stick Diplomacy in vogue again. The former President’s wise words:

Speak softly, and carry a big stick

is inspiring major nations to ramp up their defense spends lest their power at the diplomatic negotiating tables dwindle even further.

This is the reality I see. And BAE Systems (OTCPK:BAESF) (OTCPK:BAESY) is my opportunity. To secure a small win toward my goal of financial freedom. All aligning with my motto; SEE ACT WIN.

A Brief on BAE Systems

BAE Systems is Europe’s largest defense contractor. It claims the top spot for being the primary defense contractor for the UK and Australia, and a top 10 spot for the US. BAE has a diverse business across land, sea, air, space and cyber. It has pockets of leadership position across the spectrum and is the global market leader in electronic warfare.

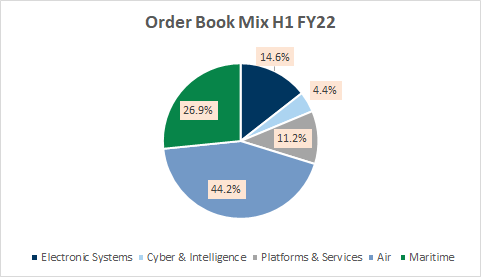

Air and maritime make up more than 70% of the company’s GBP 52.7 billion order book position as of H1 FY22:

Order Book Mix in H1 FY22 (Company Filings, Author’s Analysis)

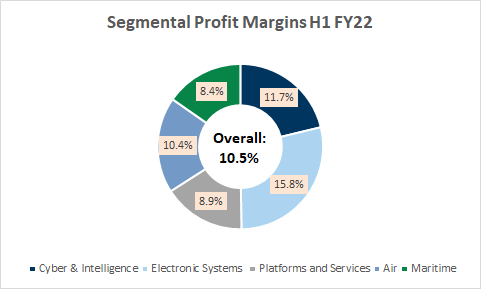

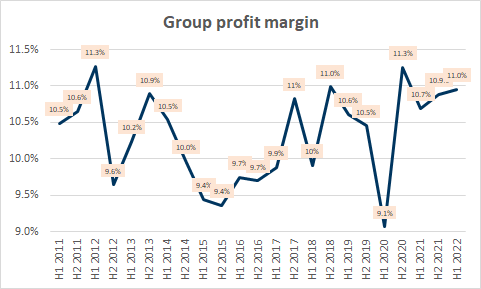

Overall, the company makes 10.5% profit margins. Here is the segmental breakup:

Segmental Profit Margins H1 FY22 (Company Filings, Author’s Analysis)

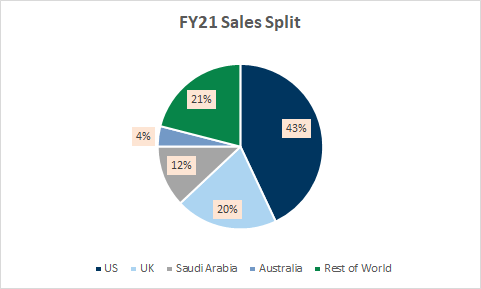

The large budget of the US makes it the most important market for BAE:

FY21 Sales Split (Company Filings, Author’s Analysis)

Almost 90% of BAE’s business comes from governments.

Today, BAE Systems is facing a very attractive demand environment and is ready to capitalize on the opportunity with operational discipline for the benefit of its shareholders.

My Thesis for BAE Systems

My bullish view on BAE Systems is based on three key reasons:

- BAE has a long growth runway fueled by higher defense spending

- BAE has good operational execution with room for continued margins improvement

- BAE is ready to prioritize shareholder returns

Here’s my argument for each reason:

BAE has a long growth runway fueled by higher defense spending

It is important to focus on the relevant leading indicators when analyzing defense stocks or more generally, any other business that has order books executable over multiple years. I analyze BAE systems under the following framework:

Book to bills and order inflows

Book to bill ratios and order inflows assess top-line execution by focusing on the tangible leading indicators instead of revenues, which follows from the order book. Waiting for meaningful traction in the order book to revenue bill ratios, driven by order inflows can help one avoid false starts.

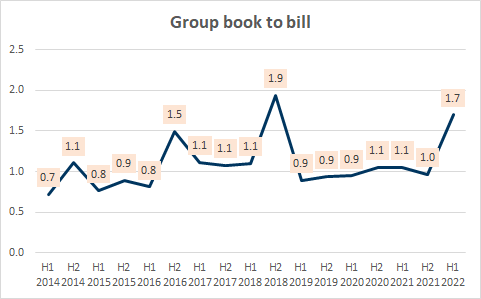

In the case of BAE, H1 FY22 printed a breakout book to bill ratio of 1.7x at the group level:

Overall Book to Bill (Company filings, Author’s Analysis)

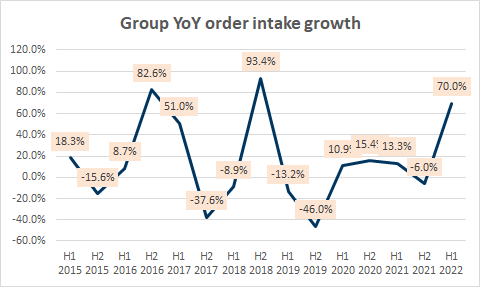

Importantly, this group-wide book to bill uptick is fueled by a 70% YoY incremental growth in order inflows rather than slower revenue billings, which would artificially inflate the book to bill ratios:

Overall order inflows YoY growth (Company filings, Author’s Analysis)

The overall higher book to bill is quite broad based:

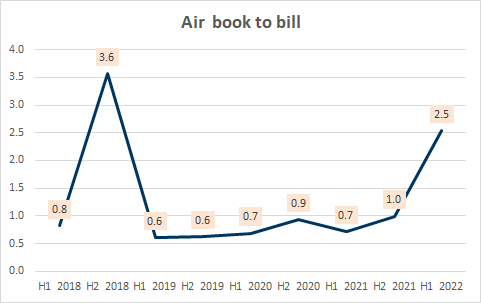

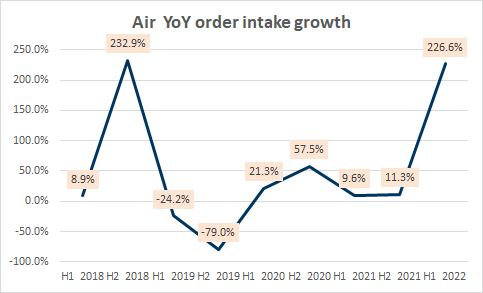

Air book to bill (Company filings, Author’s Analysis) Air order inflows YoY growth (Company filings, Author’s Analysis)

BAE’s air segment’s book to bill has multiplied by 2.5x, driven by a 227% increase in order inflows.

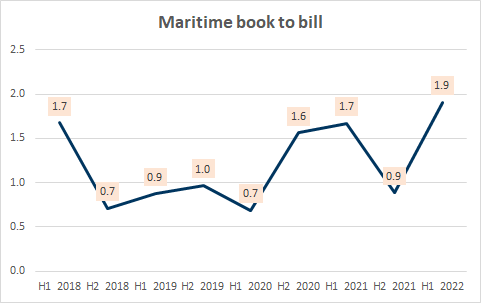

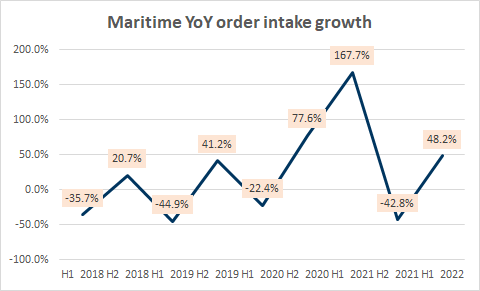

Maritime book to bill (Company filings, Author’s Analysis) Maritime order inflows YoY growth (Company filings, Author’s Analysis)

The maritime division has been in strong positive momentum since H2 2022 and this trend is continuing.

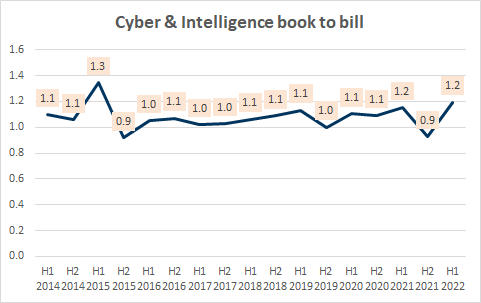

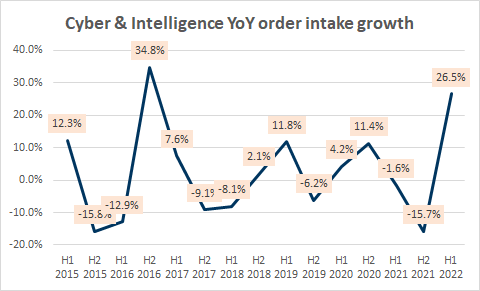

Cyber & Intelligence book to bill (Company filings, Author’s Analysis) Cyber & Intelligence order inflows YoY growth (Company filings, Author’s Analysis)

BAE’s Cyber & Intelligence business also saw a sharp rebound in order inflow growth to almost 27% YoY; the highest increase since 2017.

Overall, the numbers support management’s claims of strong demand commentary. And the fact that this is broad-based across segments reduces the chances of a false start in the broader defense spending cycle.

Defense budgets

Defense budgets are leading indicators of order inflows. Hence, they are a key monitorable as well.

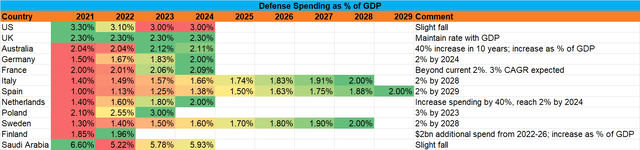

In many of BAE’s key markets, defense spending as a % of GDP is accelerating. The table below describes my gradual growth assumptions based on defense spend targets obtained from various sources. The key sources include BAE’s H2 FY22 results presentation, Statista, Europa, World Bank, Janes, Global Data reports and Global Data news.

Defense Spending as % of GDP for various countries (BAE Systems H2 FY22 results presentation, Statista, Europa, World Bank, Janes, Global Data reports, Global Data news, Author’s Analysis)

Clearly, this highlights a global acceleration in defense spends around the world, presenting a long term tailwind for defense companies such as BAE Systems. In terms of more specific growth drivers for BAE’s major markets…

Growth drivers in US defense

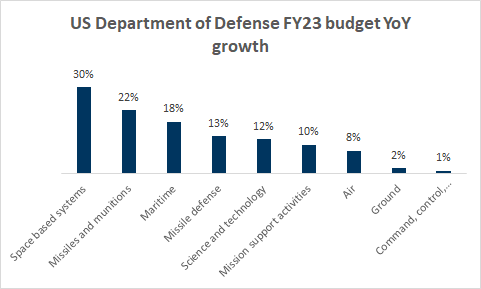

In the US, space, missiles and munitions and maritime segments have seen the highest YoY growth in the Department of Defense’s FY23 budget:

US Department of Defense FY23 budget YoY growth (US Department of Defense, Author’s Analysis)

BAE is well-placed to benefit due to its global market leadership in electronic warfare and prime positions in various maritime categories. This was discussed in a company conference presentation in August 2022. Additionally, in another call in October 2022, David Armstrong, the head of Digital Intelligence at BAE Systems, noted:

Space in simple terms is sensors and communication systems. No one can challenge BAE about its ability to put sensors on war ships, on fighter jet aircraft and other land-based platforms, integrate them and turn them into a solution.

In particular, BAE Systems’ focus within the space vertical is in the low-Earth orbit market, which management estimates will grow at a 17% CAGR over the next decade. The company has articulated a clear plan for scaling up this opportunity:

Firstly, we will build and consolidate within the U.K. We’ll start to move into the home markets that we know already in BAE Systems and then move and extend further into other international markets.

Group Finance Director Bradley Greve highlighted that he expects the US to ramp up investments in hypersonic capabilities. BAE is likely to be the sole beneficiary here as it is the only GPS player that can operate in hypersonic conditions and be able to communicate via Military Code (M-Code) signals.

Growth drivers in UK defense

In the UK, according to data from the Military Balance, the UK’s defense equipment stock in the navy and the air force is broadly 40% of what it was 3 decades ago. I expect the heightened geopolitical threats to spur the gradual replenishment of the UK’s military equipment stock over the next decade. Indeed, some traction is being witnessed under the new government in the development of next-generation aircraft and undersea surveillance.

As the UK’s primary defense contractor, BAE Systems is ready to capture these spends with its diverse capability set.

Russia-Ukraine and China spends not reflected in H1 FY22 order book

In the August 2022 company conference presentation, management noted that the company’s all-time high GBP 52.7 billion order book does not capture any spends related to the Russia-Ukraine conflict or China tensions. This is a bullish sign as it suggests that there is further room for further order inflows to arise from these two themes.

Conversion of budgeted spends into order inflows

Optimistic defense budget plans alone is insufficient to cause a genuine up-cycle in defense spending. It is important for governments to follow through with minimal delays and cancellations.

On November 15 2022, BAE provided a Trading Update, disclosing that H2 FY22 has so far seen an additional GBP 10 billion in order inflows. This proof of momentum is good to see.

Thinking more medium to long term, I believe the broad-based defense budget upticks prove that spending on defense is a priority again for governments, particularly in modern technologies. David Armstrong mentioned in his talk on Digital Intelligence that whilst 84% of their customers believe a digital advantage is crucial to their organization, only 21% of customers consider themselves digitally mature. This shows that further penetration opportunities are still there for BAE Systems.

Overall assessment on growth

Overall, I think the combination of strong traction in order inflows, broad-based expansion in defense budgets, and heightened priorities amid a precarious geopolitical balance all leads to a healthy growth outlook for BAE Systems.

BAE has good operational execution with room for continued margins improvement

Margins track record

BAE’s profit margins have been consistently improving since 2016:

BAE System Operating Profit Margins (Company Filings, Author’s Analysis)

The key drivers of improvement have been:

Divestment out of non-core areas

BAE Divestment out of non-core areas outside core competency such as commercial cyber and financial crime to focus more on defense and security.

Effective commercial model risk management

After prior mistakes, management has gotten better at evaluating commercial contract risks and devising of better contract models. For example, in the Q4 FY20 earnings call, CEO Charles Woodburn noted how in design and development work, the company moved from fixed price models to cost-plus or target cost incentive models for new maritime contracts.

Currently, the business has 70% exposure to fixed price contracts. Thus, inflation is a headwind that BAE has to manage themselves without much customer support except in the case of escalation causes. Management notes that the long-term nature of the contract has allowed them to secure long term rates with suppliers, thus insulating the impact of inflation to some degree.

Strong operational execution

Dr Charles Woodburn is the current CEO of BAE Systems, holding the post since July 1 2017. Prior to this role, he served as COO in the same company for a year since May 2016. His operational expertise has led to a revamp of the operational practices in ways that reduce internal resource constraints and enable faster decision making. As can be seen in the profit margins chart earlier, BAE’s profit margins troughed (excluding the initial COVID-19 impacted H1 2020 half-year) in 2016 when Woodburn became COO. Since then, the company has operated better, leading to margin improvements.

Drivers for further margin improvement

Management continues to aspire for margin expansion on priority. Incrementally, this would be driven by more operational efficiencies and leverage.

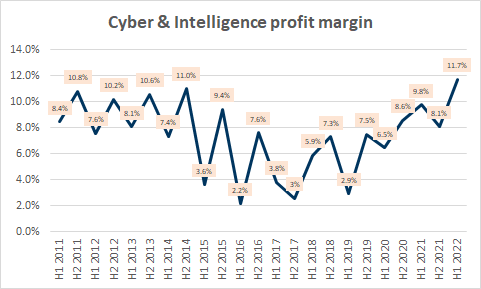

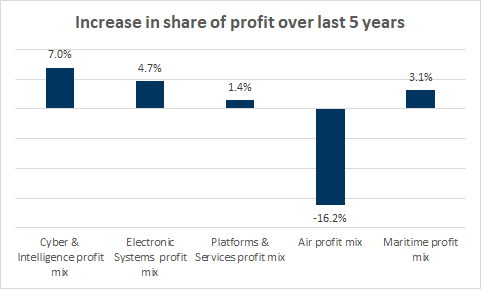

A key segmental source of margin improvement is expected to come from Cyber & Intelligence. This part of the business has seen the highest margin improvement over the past 5 years:

BAE Systems Cyber & Intelligence Profit Margin (Company Filings, Author’s Analysis)

It has also contributed the most to the company’s overall profit margins, as evidenced by the highest increase in the share of overall profit over the past 5 years:

Increase in share of profit over last 5 years (Company Filings, Author’s Analysis)

In H1 FY22, BAE’s Cyber & Intelligence margins printed 11.7%. In that quarter’s earnings call, management said they expect the Cyber & Intelligence to hit low-double digit margins longer term as well.

BAE is ready to prioritize shareholder returns

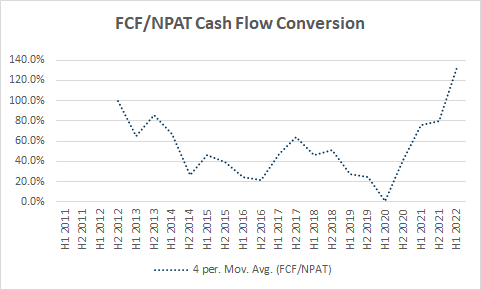

The strong operational execution has led to improved free cash flow conversion for BAE Systems:

FCF/NPAT Cash Flow Conversion (Company Filings, Author’s Analysis)

As can be seen from the chart above, BAE has dramatically improved its cash flow conversion upwards from 50-60%. Going forward, it is expected to convert ~90% of its profit into cash.

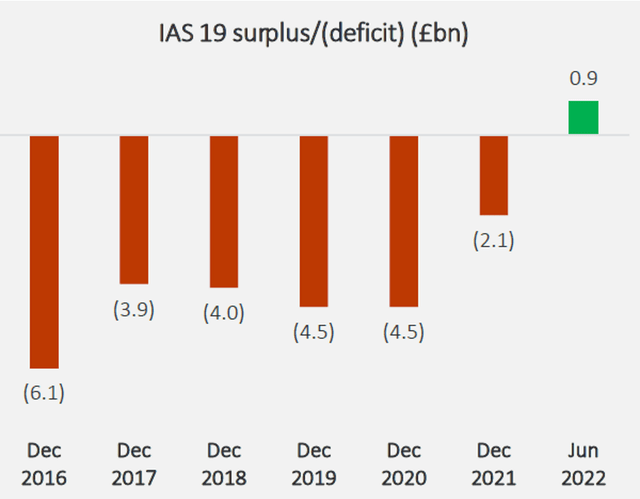

In prior years, BAE was focused on utilizing its cash flows to manage its pension deficits. But this year, BAE resolved its multi-year pension deficit problem by finally hitting a surplus position in H1 FY22:

BAE Systems Pension Surplus/(Deficit) Position (BAE Systems H1 FY22 Presentation)

The high interest rate environment we are in currently is expected to sustain this surplus. Thus, the company is now free to improve shareholder returns via accretive bolt-on acquisitions, smart reinvestments back into the business or redistribution of value to shareholders via dividends or buybacks.

This is precisely what the company is doing; in addition to a ~50% dividend payback ratio, BAE Systems is buying back GBP 1.5 billion of its own shares over the next 3 years. Altogether, based on FY21 financials, this translates to a ~75% of net profit returned to shareholders.

Valuation

Management has guided for a 4-6% YoY increase in EPS for FY22. At the midpoint of this range, this corresponds to a FY22 EPS of 50.19 pence. The stock is currently trading at a 19.3x LTM P/E:

BAE Systems LTM PE (Capital IQ)

I believe the business is in a far better place in top-line growth prospects, margins execution and shareholder return prospects than it was during the start of 2016 or mid-2018, which corresponds to previous local highs on the LTM P/E chart. Hence, I believe BAE deserves at least a 25.0x P/E multiple, if not higher. At this multiple, the implied value/share comes out to be 1254.75 pence, corresponding to a 52% upside from the current price of 825.6 pence.

Technical Analysis

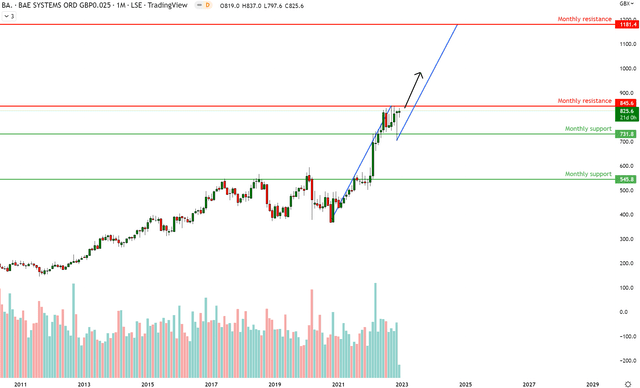

BAE Systems Technical Analysis (TradingView, Author’s Analysis)

BAE is currently in a tight range after an initial leg of breakout emerging from a 5-year consolidation. I believe the stock is undergoing a temporary pause in its uptrend before it begins its second leg up. I have estimated the second leg up to go till 1181.4 pence based on the measured move of the first leg up.

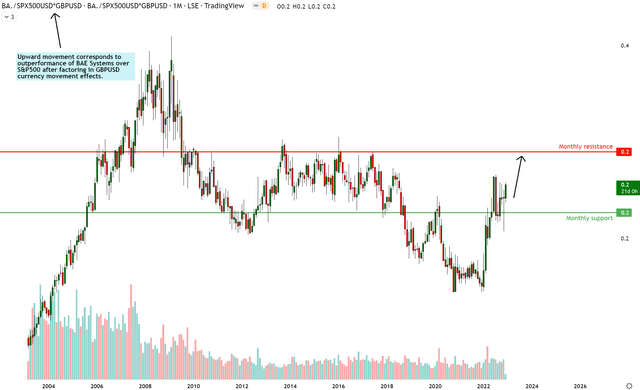

BAE Systems vs S&P 500 Technical Analysis (TradingView, Author’s Analysis)

On the relative chart of BAE Systems vs. S&P 500 (SPY), prices are again consolidating after an initial strong move up since the start of 2022. I anticipate the bullish momentum to continue towards the monthly resistance area marked.

Overall, my read of both the absolute and relative charts of BAE Systems give me additional reasons to be bullish on this stock.

Key Risks and Monitorables

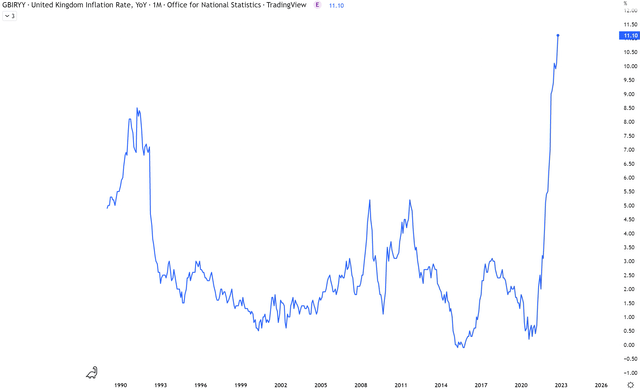

I am confident that management will be able to maintain operating margins and focus on shareholder value. A key monitorable for me would be tracking defense spend sentiment to gauge healthiness of continued order inflows. I am also keeping an eye on inflation because although the company has managed these headwinds well before, newer fixed price contracts may be badly positioned if inflation continues over the next few quarters. Note that unlike US inflation, UK inflation is at 11.1% and is yet to show signs of peaking:

UK Inflation Rate (TradingView)

Summary

With better than ever top-line growth, margins profile, dividends and buybacks, I think BAE Systems is a great buy, especially for retirees. For tracking future performance of this company, one must note that it takes 18 months for a fresh order to make its way into the top-line. So the real uptick in revenue boost following from H1 FY22’s 70% YoY order inflows growth should be seen in FY24. I suggest focusing on the right leading indicator metrics such as order inflows to assess growth, book to bill to assess top-line execution, and margins to evaluate operational effectiveness.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment