supernitram/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the PCM Fund (NYSE:PCM) as an investment option at its current market price. This is a closed-end fund whose investment objective is “to seek high current income by investing in a portfolio comprised primarily of commercial mortgage-backed securities”.

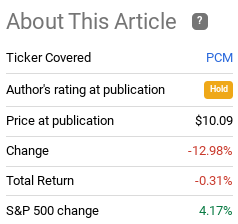

I have covered PCM for a long time, but it has been a while since my last review. Certainly, a lot has happened since then, but it is still productive to evaluate how it has performed over time. During that review, I suggested PCM should have a neutral or hold rating. In hindsight, this call was spot-on, with PCM delivering a flat return once distributions were accounted for:

Fund Performance (Seeking Alpha)

Looking ahead, I continue to believe this cautious approach makes sense. Personally, I find there are attributes about PCM that I like, and others that I don’t, so the balancing act remains in place. The leverage and valuation are a concern, but the underlying holdings and income stream are strengths. Ultimately, these factors combine to suggest a hold rating is appropriate, and I will explain why in more detail below.

Let’s Start With The Good – Income

To begin, I want to highlight some of the positive aspects of PCM as I see them. The first regards income, as PCM has been a constant income provider delivering a high distribution rate without the income cuts that plague some of its peers. In fact, one would be hard pressed to find a PIMCO CEF that has as strong of an income history. Yet, despite this, PCM is not as popular of a ticker – by trading volume or reader interest – as some of its sister funds. Simply put, the income story is extremely positive and, perhaps more importantly, it looks like it will stay that way going forward.

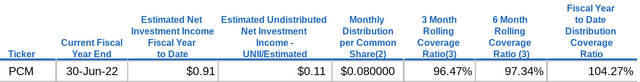

To understand why, readers should note PCM has some of the strongest income metrics in the PIMCO CEF family. It currently has a healthy UNII balance, and all its coverage ratios are 96% or higher, as shown below:

The conclusion I draw here is that PCM keeps on doing what it is best at – delivering income. The distribution has stayed steady for a long time, and current income metrics do not indicate that is going to change in the short-term. For those with an income focus, this is a CEF to at least take a look at.

I View The Holdings Attractively

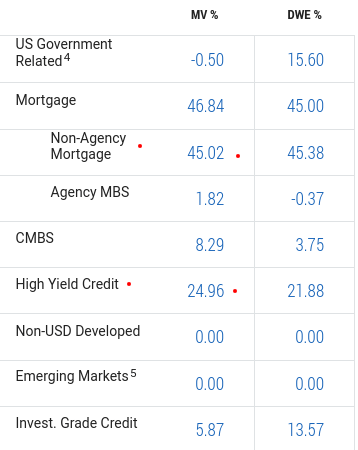

I will now shift to the underlying holdings of PCM, which is another area I view as a net positive. Similar to most PIMCO CEFs, PCM holds a variety of securities in different sectors. It is certainly diversified, but readers should acknowledge that a bet on PCM is primarily a bet on two different sectors. These include the high yield credit market and the non-agency MBS market, which combine to make up around 70% of total fund assets:

PCM’s Holdings (PIMCO)

Now, I want to emphasize these sectors are not “safe” in the traditional word. I personally see an environment where they will deliver gains in the second half of 2022. Yet, these are sectors that are not of investment grade quality (most of the time) and should be approached cautiously. If readers are not able to withstand some heightened risk and/or volatility, then this is not a fund for them. One would need to have a positive view of these holdings before buying PCM – it should not be done blindly. I personally do, but these are not risk-free assets and, in fact, have a heightened probability of delinquency or default compared to their IG peers.

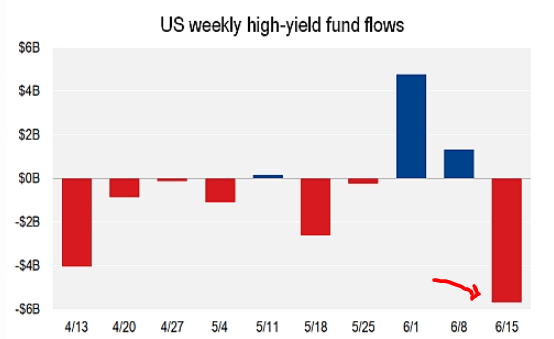

With that disclaimer noted, I will explain why I find these sectors favorable at the moment. Starting with high yield, a key rationale behind it is that this is an unloved sector right now. Simply, I like to buy into stocks/sectors/funds when other people are not. It is a contrarian play, which is my nature, and this is certainly an environment for that outlook right now. To understand why, consider that as recession risks and rising interest rates are dampening investor sentiment, higher risks assets like below-investment grade debt are falling out of favor. Fund flows into the high yield sector have turned dramatically negative of late, reversing the trend of inflows at the beginning of the month:

Fund Flows (High Yield) (S&P Global)

Of course, there are multiple conclusions that could be drawn from this. One could be that this is a sector to avoid, as it is losing momentum for justifiable reasons. That is a fair point, which supports why I have already said to approach this with the understanding there will be enhanced risk and volatility. It is not right for everyone. But for those who can withstand some ups and downs, the contrarian nature of me is screaming this is a sector to consider.

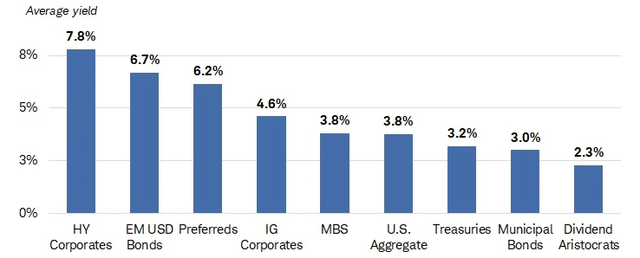

On top of that, income-oriented investors would note that because of the outflow of cash in this arena, yields have been rising. In fact, price drops have been dramatic enough that the high yield credit sector is offering yields well above IG sectors:

Current Yields (by sector) (Charles Schwab)

To me, this suggests the risk is worth the reward. Investors seem to be fleeing the sector, but the income is high enough to warrant dipping in. The income stream is high enough to offset some further price declines and still deliver a positive return. Whether PCM is the right way to play it is debatable, but at the very least the high yield sector is one to look at.

Non-Agency MBS Not At Risk Of Fed Taper Plans

Time to dive into non-agency MBS. This is a sector that is smaller than the agency MBS market, and gained notoriety during the financial crisis over a decade ago. However, since then, lending standards have tightened to the point where there is less inherent risk in the non-agency market. Many of these loans are “jumbo”, offered for high-income households for home purchases outside the conventional terms backed by federal agencies. They can also be used to purchase second homes, vacation homes, or rental properties. And, of course, they can be reserved for borrowers who do not have the credit standing of individuals and families that qualify for the agency protection. All of these factors make non-agency MBS less conforming, and more risky. Yet, I still feel confident about this space that giving it a position in my portfolio does not make me nervous.

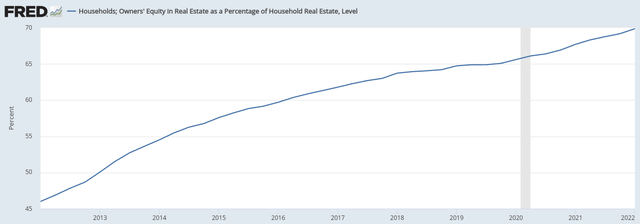

The support for this comes from a few areas. One, home prices have continued to rise year-over-year. As asset values increase, borrowers have added incentive to stay current. They can tap into home equity to meet other financial obligations, and it generally puts them in a more sound position. In fact, owner’s equity in their homes has done nothing but rise over the past decade. As gains continue to come in, this reality has been amplified and hit a new decade high just recently:

Owners’ Equity in Real Estate as a Percentage of Household Real Estate (St. Louis Fed)

This bodes well because I do not see defaults having a meaningful impact on this space. If we enter a recession and the job market takes a significant tumble, I will reassess this outlook. But, for now, non-agency MBS is not a sector to be scared of.

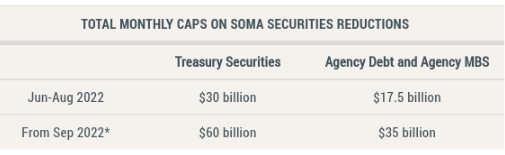

Expanding on this view, we should also acknowledge a headwind for the MBS market more broadly. This is Fed tapering, which is getting underway as we speak. What this means is the Fed, after years of buying securities, is starting to offload them (either through selling or letting existing holdings mature without replacing them). This is significant for the MBS market because the Fed predominantly bought two types of assets – treasuries and agency MBS. Notice, however, that I said agency MBS. The Fed did not do much buying of non-agency securities. What this means is, the headwind of Fed tapering that is clouding the outlook of the agency sector is not going to have much of an impact on non-agency. This is a tailwind for funds like PCM that hold mostly non-agency.

This is no small matter by the way. If we look at the Fed’s tapering plans, we see it is planning to reduce its positions in treasury and agency MBS by a fairly large amount. The current reduction rate is listed below, but notice how it is expected to double in size come September:

Fed Tapering Plans (Federal Reserve)

My takeaway from this is that despite agency MBS being a traditionally “safer” asset class, I actually prefer non-agency right now. It offers a higher yield, which trickles into PCM’s coverage ratios, and it doesn’t have the macro-headwind of Fed tapering. To me, this is a win-win.

So, What’s The Downside?

So far in this review my opinion on PCM has seemed pretty bullish. In fairness, the fund does have many positive qualities, as I listed above. So it stands to reason that readers are probably questioning why I don’t have a “buy” rating on this CEF, as opposed to the “hold” rating I said I was reaffirming at the beginning of this article. It is a valid question and one that I do have an answer to.

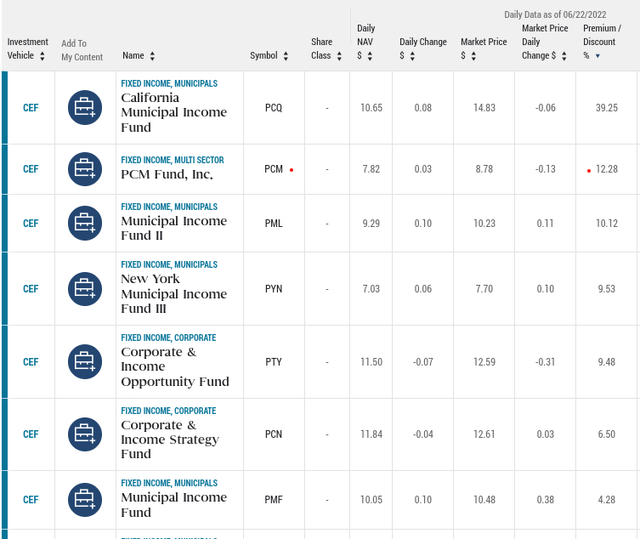

The first is the most obvious – valuation. As my followers know, this is a major point of contention for me when I evaluate CEFs. Personally, I prefer funds at a discount, but I am willing to consider a premium in the low single-digit range. At this juncture, PCM does not offer that. In fact, its premium is a bit scary in my view, coming in over 12%. Of course, historically speaking this is not unusual for PIMCO CEFs. So, if PCM’s premium was in-line (or lower) than its PIMCO peers, this wouldn’t seem too scary. However, since last year premiums have narrowed considerably across the CEF universe. This includes PIMCO. The end result is that PCM’s 12% premium actually puts it at the high end right now. If we take out muni-focused CEFs, PCM has the highest premium of the PIMCO offerings. This is not something I view positively:

There really isn’t much else to say here. Some followers of PIMCO’s funds will insist “premiums don’t matter”. I can say confidently that they do. If one doesn’t agree, that is fine. I won’t spend time trying to convince them otherwise, but simply suggest they review PIMCO CEF performance over time with regards to valuation. In fairness, it is a subjective decision, so if a high premium is not something that deters you, go for it. But in my view this is a reason to not be overly optimistic on PCM at this time.

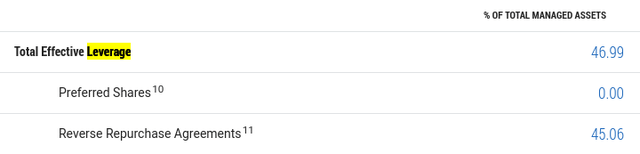

Word Of Caution On Leverage

My final point touches on leverage. PCM’s use of it, and the risks of using it right now. This is an attribute not unique to PCM in isolation, as most CEFs use leverage and therefore face this risk. I have discussed this in other reviews recently, so I won’t go into too much detail here. But it is important to highlight because PCM uses a large amount of leverage to amplify returns:

PCM’s Leverage (PIMCO)

When a fund uses leverage, this increases the inherent risk of the fund. Not surprisingly, with risk-off mode dominating the market and interest rates rising, leveraged CEFs have taken it on the chin. This is true for corporate debt, municipal debt, foreign debt – you name it. While I am not suggesting PCM would be having a stellar year if it hadn’t been using leverage, we should acknowledge the impact it has had on its returns in 2022 so far:

PCM YTD Return (Seeking Alpha)

This is a topic to monitor very carefully going forward. I bring it up because while leverage can be fruitful under the right circumstances, it can be very detrimental under the wrong ones. Case in point is when short-term rates rise faster than long-term rates, this reduces the effectiveness of leverage.

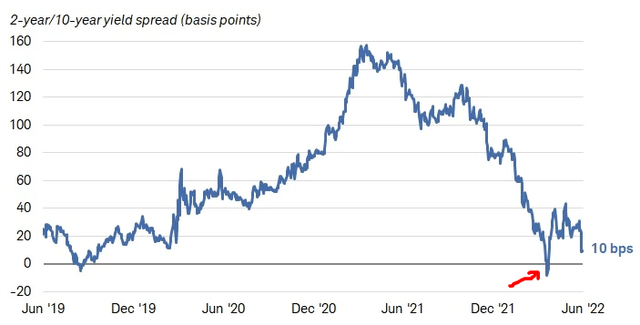

This scenario occurs when the yield curve is flattening, and especially when it is inverting. This is an important concept because the basic thought is when interest rates rise, the income CEFs can earn increases. While short-term rates increase the leverage expense, the yield pick-up from longer term rates should more than offset this. However, this assumes that longer-dated securities are offering more in yield than shorter-dated ones. With an inverted yield curve short-term borrowing expenses can rise faster than the income stream from those long-term securities. Why is this important? Because the yield curve has already inverted this year, and may very well do so again:

The conclusion here is not to necessarily avoid leverage. Rather, investors need to understand the risks facing this concept right now, and manage their portfolio appropriately. If one already has a lot of exposure to leveraged funds, adding more to the mix now probably is not the wisest move.

Bottom-line

PCM remains a mixed-bag for me. Its income stream is very attractive, with its stability being second to none and the current yield very high (around 11%). While its top sectors are on the riskier end, I see merit to being long both high yield credit and non-agency MBS. So that supports at least a neutral outlook. However, the fund’s lofty valuation and extensive use of leverage have me concerned. These attributes balance out some of the positive ones to a degree. This suggests a cautious approach continues to be warranted. As a result, I am keeping the “hold” rating in place, and I would encourage readers to be very selective on any entry points in PCM at this time.

Be the first to comment