JossK

Purpose

Dollarama Inc. (TSX:DOL:CA), the largest discount dollar store chain in Canada, reported Q3 earnings that beat analysts expectations, customers continued to trade down, especially in consumables, amid a high inflation environment. The company posted strong numbers across the top and bottom lines, and increased their guidance for same store sales and the total store forecast of Dollar City. The stock shot upwards after the earnings release, up 5% to $84 at the close on December 7th. My recent Q2 report on DOL:CA re-iterated my bullish view on the stock since the summer, and the company has remained resilient throughout 2022. DOL:CA remains well positioned to succeed and doesn’t have a true competitor at scale in Canada – I rate the company as a cautious “Buy” with an $88 price target over an 18-month view, up from $85 previously.

Q3 Review

DOL:CA reported $1.3Bn in revenue in Q3, sporting impressive sales growth of 14.9% and an increase in same store sales growth of 10.8%. Margins slid a bit to 43.3%, down 100 basis points from last year, as consumables continued to remain a material part of the sales mix. EBITDA increased to $386.2MM from $347MM and totaled 29.9% of total sales. DOL:CA generated $201.6MM of net income and notched $0.70 earnings per share, easily beating last year’s Q2, which registered $0.61 of earnings per share. SG&A spend increased to $181.8MM, but represented 14.1% of sales for Q3 of FY2023, compared to 14.2% of sales for the third quarter of FY2022, as the company’s tight cost structure held up even in the high growth quarter. While inventory was elevated in Q3 at $1Bn, executives attributed the increase to higher in-transit inventory and the purchasing of seasonal goods earlier than historically.

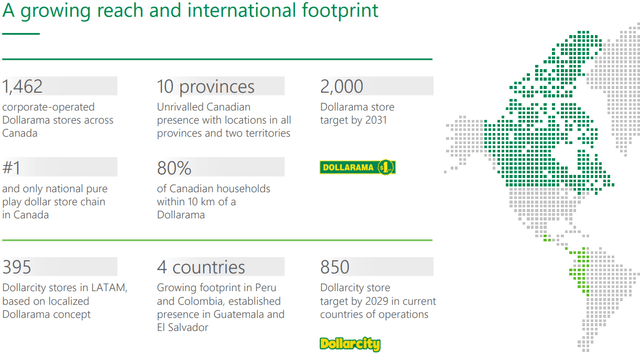

Dollarcity, the company’s 50.1% owned South American subsidiary, posted $9.2MM in net earnings for the company, and has continued to slowly grow into a material part of the earnings portfolio. The company also opened 18 net new stores and bought back almost 1MM of shares. The company upgraded same store sales guidance yet again and provided a new 850 store target for Dollarcity, up from 600. DOL:CA also announced the purchase of industrial property in Quebec for $87.3MM, which will create a domestic logistics hub that’s strategically placed nearby their distribution center. Overall, Q3 was strong, but some minor operational issues came into play. Notably, inventory jumped 68%, above last year’s figure of $600MM; however, with sales still rocketing higher, margins holding mostly steady, and positive updates to the long term strategy, DOL:CA remains a cautious buy with a price target of $88 over an 18-month term.

Executives highlighted the company strategy and key financial and operating metrics in the conference call. Net debt to EBITDA registered 2.79X, well within the previously announced target of 2.75x to 3x. J.P. Towner, CFO of DOL:CA, highlighted the recent $700MM offering at ~5.1% that the company issued, and expressed pleasure that DOL:CA’s MSCI ESG rating increased to A from BBB. DOL:CA believes that being an ESG leader, especially among retailers who have large emissions bases, will enhance value long term and drive investor satisfaction. Executives also highlighted that the recent logistics hub purchase is a necessary investment to reach their previously announced target of 2,000 stores in Canada by 2031.

The key guidance updates that management highlighted were stronger than historical demand for lower margin consumable products and very strong same store sales performance. These developments led to an increased guidance figure of 9.5%-10.5% same store sales growth, a big jump from the previous 6.5%-7.5% range. On gross margin, the change in sales mix and the timing of higher logistics costs were the drivers to why the gross margin range for FY2023 narrowed to 43.1%-43.6% of sales, from 42.9%-43.9% previously. The company also highlighted to analysts that given that global supply chain costs are starting to drop, they believe margins will be positively impacted. This leads me to believe they are under promising on margin guidance and plan to overdeliver. Given management’s confidence in achieving these goals, the positive developments in ESG ratings and overall impressive growth, DOL:CA delivered a solid quarter that should continue to fuel momentum into 2023.

Model Shows Some Upside

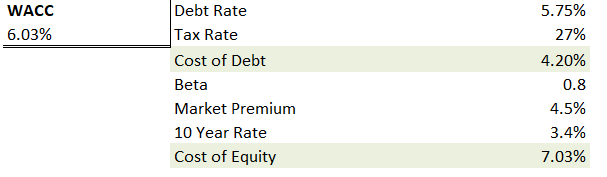

DOL:CA keeps chugging along quietly, and the fundamentals support a lift in share price – though the company remains almost fully valued compared to its peers in discount retail. The company has sufficient cash balances and outstanding revolvers to fund current growth plans. The model forecasts a WACC of 6%. With rising rates, I anticipate the forecasted cost of debt rising a bit above their recent issuance coupon of ~5.1%. Their previous fixed rate debt rates are between 1.5%-3.6%.

Author WACC Forecast

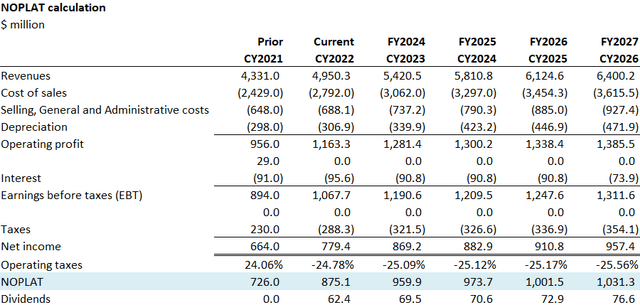

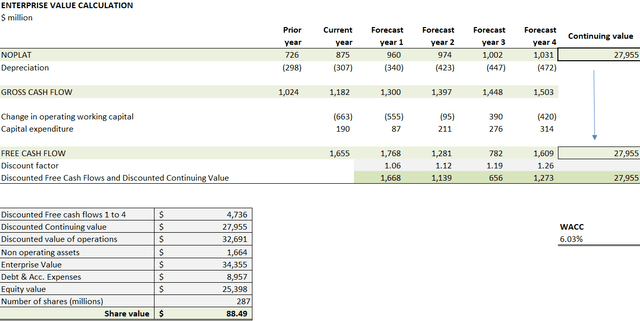

I forecast the continuing value of almost $28B, given a 14% revenue increase this year and blended revenue growth of ~6.75% for three years, as same store sales growth and Dollarcity continue to impress in the near future. I see the margins ending up near the top of guidance, at 43.6%, for the year. I hold other cost ratios mostly equal to guidance, as they were already conservative given the strong Q2 numbers. An $88 share price (see below) can be supported with fundamentals. The share price is supported by a 21.2 FY2024 EV/EBITDA ratio, in line with industry peers and analyst estimates.

Author NOPLAT Forecast Author EV and Share Price Forecast

Conclusion

DOL:CA posted a good Q3 and remains the leader in discount retail within Canada. The company should benefit from high inflation as consumers trade down, notably in consumables. The company sports robust operations and continues to improve its growth forecasts, notably in South America via Dollarcity. While almost fairly valued, I think DOL:CA is worth a cautious buy, and I forecast a share price of $88 CAD over an 18-month term.

Be the first to comment