Justin Sullivan

In my last article about PayPal Holdings, Inc. (NASDAQ:PYPL), I urged you to take advantage of the opportunity that was created by Mister Market, as PayPal’s stock was trading for $73. Until now, the stock has returned about 24%, which is a very decent return over four months. And PayPal clearly outperformed the S&P 500 (SPY), which increased about 3.5% in the same time frame.

And if one had sold a few weeks after the article, the performance would have been even better, as the stock climbed over $100, resulting in almost a 40% return within a short time frame. Of course, I did not sell (and neither should you), as I see PayPal as a long-term investment. And at current prices, the market is providing us once again with an opportunity to add to PayPal.

In the following article, I will argue why political controversies should not disturb our fundamental analysis and explain why PayPal is a great long-term investment in my opinion.

Controversy

In our hectic and short-lived time, some might already have forgotten the controversy about PayPal one month ago. PayPal threatened to fine users up to $2,500 for spreading misinformation creating an uprising on social media. We will not see if this had any actual impact until PayPal reports its fourth quarter results. Many users threatened to delete their PayPal accounts, but in my opinion the network effects of PayPal are quite strong and, unless several million users delete their accounts, it won’t matter.

I don’t agree with PayPal’s idea to fine users (no matter if it was a mistake or not), but it reminds me of Target Corporation (TGT) and its bathroom policy. People were bashing Target completely ignore the great investment the stock was back then. And such political issues seldom have a huge lasting impact on business. Investors should not focus on that kind of noise – because in the bigger picture it is just noise. Instead, we should look at the fundamental business and start with the growth potential PayPal still has.

Growth Potential

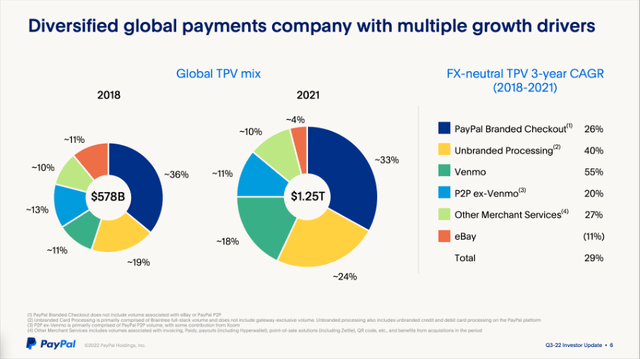

As we can see in the chart below, PayPal relied heavily on eBay, Inc. (EBAY) in the past – in 2018, the online marketplace was responsible for 11% of PayPal’s transaction payment volume. And until Q3/22 PayPal struggled with loosing eBay as a customer, but PayPal seems to have two equally great partners. The partnership with Amazon (AMZN) was already announced several months ago. And during the earnings call, Daniel Schulman introduced Apple (AAPL) as a new partner:

And next year, U.S. customers will be able to add their PayPal and Venmo network-branded credit and debit cards to their Apple wallet and use them online and in-store wherever Apple Pay is accepted. We anticipate this to be available in the first half of 2023 expanding the opportunity for our consumers to transact in-store. This is a significant step forward in our relationship with Apple and we are excited to work closely with them to bring these new capabilities to our mutual customers.

Additionally, PayPal is continuing to ramp up with Venmo on Amazon and PayPal is planning to be fully ramped before the peak of the important holiday shopping, which is generating the highest GMV of the year and, therefore, revenue for PayPal. The company once relied heavily on eBay, and such a major site with huge gross merchandise volume is an important partner for PayPal. Apple and especially Amazon could be similar partners for PayPal. Amazon is generating a huge GMV, and if only a fraction of that is paid with PayPal (or Venmo to be precise), it is a huge win for PayPal.

PayPal Q3/22 Investor Presentation

But Venmo will not only grow due to the partnership with Amazon. Right now, Venmo has almost 90 million active accounts and 57 million monthly active users. In the third quarter of fiscal 2022, Venmo processed $63.6 billion in TPV – resulting in 6% growth (on top of strong growth of 36% in Q3/21).

Aside from Venmo, PayPal’s Buy Now, Pay Later (BNPL) is another initiative with the potential for high growth rates. In the third quarter, PayPal’s BNPL processed nearly $5 billion in volume, and this is an increase of 157% year-over-year. Since PayPal launched it, over 25 million users used the service approximately 150 million times. Additionally, over 280,000 merchants are now displaying Buy Now, Pay Later on the product pages. Not only is PayPal assuming it is the largest Buy Now, Pay Later provider in the world, it was also ranked as the best according to the Wall Street Journal (both information according to the earnings call). And according to different studies, expected growth rates in the next few years are impressive – and range from “only” 26.0% CAGR between 2022 and 2030 to a CAGR of 45.0% till 2030.

Finally, PayPal will also be able to grow its bottom line by focusing on its cost structure and drive productivity. The company is on track to drive over $900 million in cost savings this year and at least $1.3 billion in cost savings next year (which should deliver at least 100 basis points of operating margin expansion).

Quarterly Results

And not only are there several growth initiatives for PayPal in the quarters and years to come. PayPal is still reporting solid quarterly results. Of course, growth slowed down, but we are far away from the catastrophe some were obviously expecting in previous quarters.

In the third quarter of fiscal 2022, PayPal could generate $6,846 million in revenue and compared to $6,182 million in revenue in the same quarter last year, the company could grow its top line 10.7% year-over-year. Operating income also increased 7.2% year-over-year from $1,043 million in Q3/21 to $1,118 million in Q3/22. Finally, diluted earnings per share could improve even 25.0% YoY, from $0.92 in the same quarter last year to $1.15 this quarter.

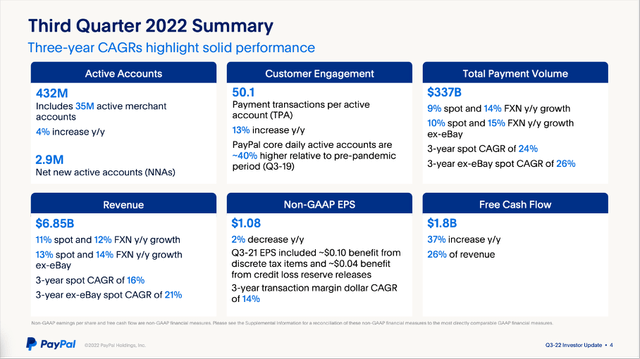

PayPal Q3/22 Investor Presentation

When looking at the two revenue segments, revenue from other value-added services increased only 6.4% YoY to $612 million, while transaction revenue increased 11.1% YoY to $6,234 million. And 58% of revenue was generated in the United States (share improved slightly) while 42% stemmed from the international business.

Aside from the income statement, we can also look at several other metrics. One of the problems PayPal is facing right now is the slow growth of active accounts. And although PayPal is struggling a bit, active accounts could still be increased by 3 million during the third quarter (to 432 million active accounts). Compared to the same quarter last year, active accounts increased 3.8%. While growth of active accounts slowed down, the number of payment transactions increased with a solid pace – 15.2% YoY growth to 5,643 million. And finally, payment transactions per active account also increased 13.3% from 44.2 in the same quarter last year to 50.1 this quarter. As a result, TPV (total payment volume) also increased from $309,910 million in Q3/21 to $336,973 million in Q3/22 – resulting in 8.7% year-over-year growth. And while most metrics could actually improve quarter-over-quarter, TPV decreased a little bit compared to the previous quarter.

PayPal Q3/22 Investor Presentation

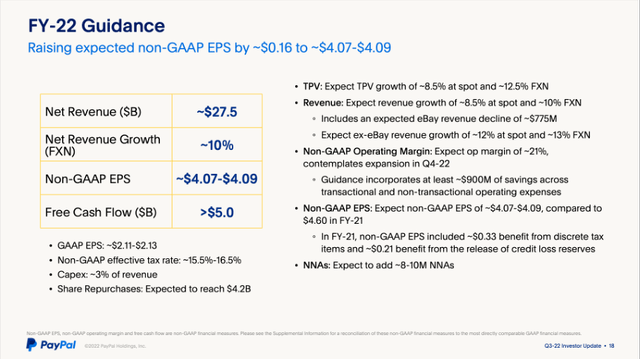

And finally, PayPal is expecting $27.5 billion in revenue for fiscal 2022, with free cash flow being above $5 billion. Non-GAAP EPS is now expected to be in a small range between $4.07 and $4.09 – an increase of $0.16 compared to the previous guidance.

Good Capital Allocation Decisions

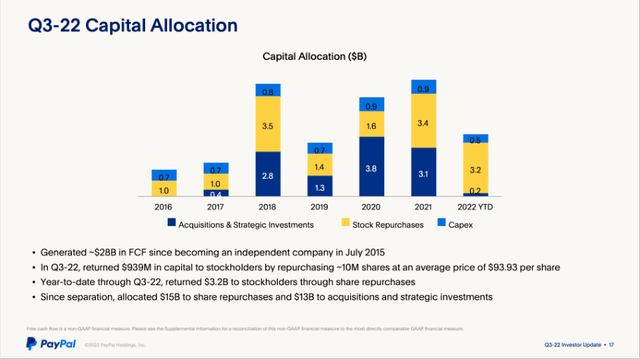

According to its guidance, PayPal will also spend about $4.2 billion on share repurchases in 2022 and the company will, therefore, spend a huge part of free cash flow on share repurchases. So far, the company already has spent $3.2 billion and is expecting to spend another $1 billion during the fourth quarter.

PayPal Q3/22 Investor Presentation

And PayPal has been repurchasing shares since 2016 and decreased the number of outstanding shares by about 6.3% since then. But, especially in the recent past, PayPal increased its share buybacks. And not every decision was smart (in Q1/21 PayPal spent $2,186 million on share repurchases when the stock was trading between $250 and $300), but increasing the money spent on share buybacks in Q4/21 and Q1/22 when the stock was already in free fall was a great decision. And although share repurchases were a bit lower in Q2/22 ($781 million) and Q3/22 ($985 million), the company is planning to spend about $1 billion in the fourth quarter and will continue to repurchase shares with a high pace.

With all the nonsense one is reading about share buybacks, dividends, and capital allocation, this seems like one of the smarter statements a CFO can make on an earnings call:

In the third quarter, we completed an additional $939 million in share repurchases. Year-to-date, we have now returned $3.2 billion to shareholders representing 78% of the free cash flow we have generated. Given our conviction in our business relative to its valuation today, and its long-term competitive advantages and ability to deliver sustainable value creation, we have taken a more aggressive approach to our capital return program this year. We believe that share repurchase remains an optimal use of capital for our shareholders, while allowing us to retain the flexibility to continue investing opportunistically in our business. We now expect to complete an additional $1 billion in share repurchases in the fourth quarter.

And CFO Gabrielle Rabinovitch added during the earnings call:

Finally, from a capital allocation standpoint, we plan to take a similarly aggressive approach to share repurchases in 2023 as we have this year.

Of course, we don’t know how PayPal’s share price will be in 2023, but right now with a market capitalization of $103 billion, the company can repurchase a mid-single digit percentage of its outstanding shares – and this has quite an impact on the bottom line. And I don’t know managements’ plans and what strategic actions are planned (that might require high capital expenditures). But, in theory, PayPal could also use parts of its $6,659 million in cash and cash equivalents as well as $4,190 million in short-term investments to buy back shares. The stock price is clearly undervalued (see next section), and management can use this opportunity to purchase shares at a cheap price.

As long as the stock price is so low, management should keep share buybacks high. And I hope, when the share price is someday above its intrinsic value again (will happen), management will reduce share buybacks again and finds smarter ways to allocate capital.

Intrinsic Value Calculation

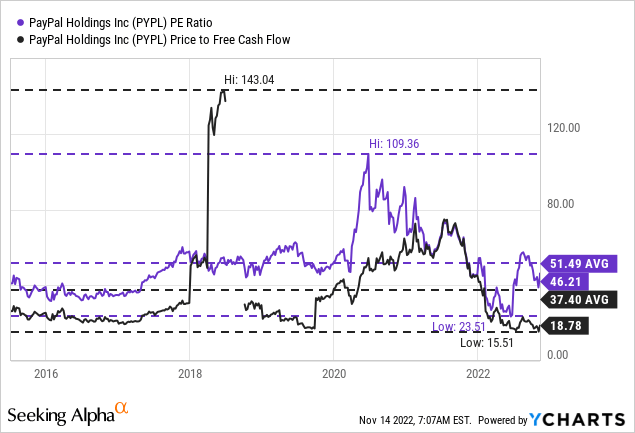

When looking at PayPal’s price-earnings ratio, we are not necessarily getting the impression of PayPal being cheap. Right now, the stock is trading for 46 times earnings, and although this is below the average P/E ratio of 51.49 since PayPal went public, it is certainly not cheap. But when calculating with expected non-GAAP earnings per share of $4.08 for fiscal 2022, we get a P/E ratio of 22, which is more acceptable.

And instead of earnings, we should instead focus on free cash flow (“FCF”). At the time of writing, PayPal is trading for about 18 times free cash flow, and this is not only very close to the lowest P/FCF the stock has ever been trading for, it is also below the average P/FCF ratio of 37.40. And trading for 16 times free cash flow not only seems reasonable for a company like PayPal that is able to grow with a high pace – it rather makes PayPal a bargain in my opinion.

This assessment can be backed up by using a discount cash flow (“DCF”) calculation to determine an intrinsic value for PayPal. In the last four quarters, PayPal generated $5,658 million in free cash flow and, according to the company’s guidance for fiscal 2022, it is expecting at least $5 billion in free cash flow. So, let’s be cautious and assume $5 billion in free cash flow as the basis in our calculation. And although PayPal is a company for which I expect rather high growth rates in the years to come, let’s be cautious for fiscal 2023 and assume only a similar FCF (after all, we expect a recession which will affect the shopping behavior). And let’s also be cautious for the following years and assume only 5% annual growth (until perpetuity). When taking 1,157 million outstanding shares and a 10% discount rate, we get an intrinsic value of $82.50 for PayPal, and the stock can be called more or less fairly valued.

But I don’t know if we can justify being so pessimistic about PayPal. We mentioned above that PayPal is able to increase its bottom line in the low-to-mid single digits just by using larger parts of its free cash flow to buy back shares. And we should not forget that TTM revenue is still growing in the double-digits right now (although PayPal is seen as a struggling business). Analysts are also expecting PayPal’s bottom line to grow with a CAGR of 12.42%. So, we should be confident enough to assume 10% growth in 2024. For the following years, until 2032, we assume growth to slow down to 6% – a level at which it could stay till perpetuity. Using these assumptions, we get an intrinsic value of $119.76 for PayPal – and in my opinion these are still rather cautious assumptions for PayPal.

Conclusion

After losing about 75% of its previous market capitalization, PayPal is not an extreme bargain yet (i.e., still trading for almost 20 times free cash flow). But as we are looking at one of the large-cap businesses with the highest growth potential in the years to come, the stock might be rather close to its cyclical bottom, and it seems possible the downside risk below $70 is limited – even in the case of a brutal bear market in 2023.

I am not expecting PayPal to rally in the coming quarters, as the economic environment (and market sentiment) will make it rather difficult for individual stocks to increase in value. But I also consider PayPal rather close to its bottom, and when taking a mid-to-long-term horizon, the company (and stock) is a great investment in my opinion.

Be the first to comment