Investment Thesis

While 2021-2022 was a good year for the end consumer, the farming industry remains a very cyclical sector of the economy, and we believe the major equipment investment cycle will slow down in the medium term. Due to its market position, Deere & Company (NYSE:DE) is likely to avoid a significant deterioration in financial results, but we believe that the market has started to overestimate the company’s upside. Given current prices, we assume SELL status to the stock.

Agricultural industry conditions and perspectives

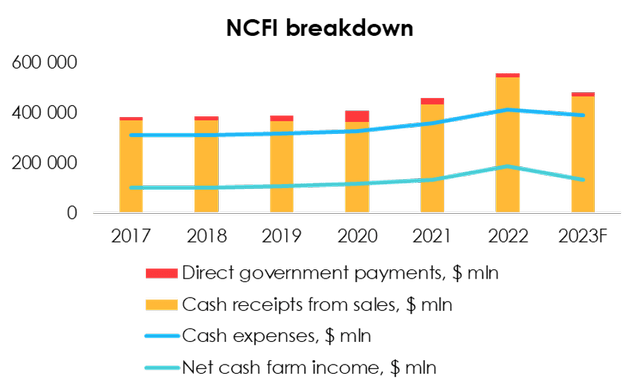

As the largest manufacturer of agricultural equipment, John Deere relies heavily on retail customers and income of farmers, which is partly invested in tractors, combine harvesters and other agricultural machinery.

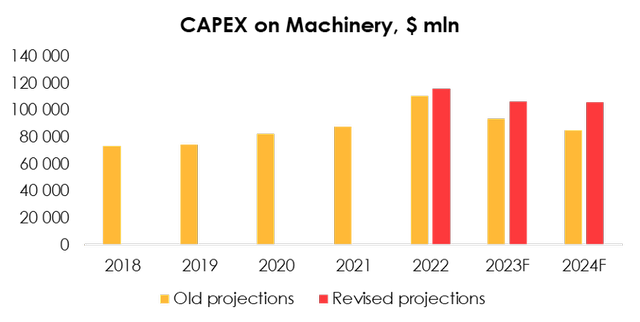

In our previous article we projected a significant decline in 2023 sales due to shrinking margin of the agricultural sector, but we have revised our medium-term expectations due to several factors:

- Deere suspended production in H1 2022 amid supply chain disruptions;

Wirestock/iStock Editorial via Getty Images

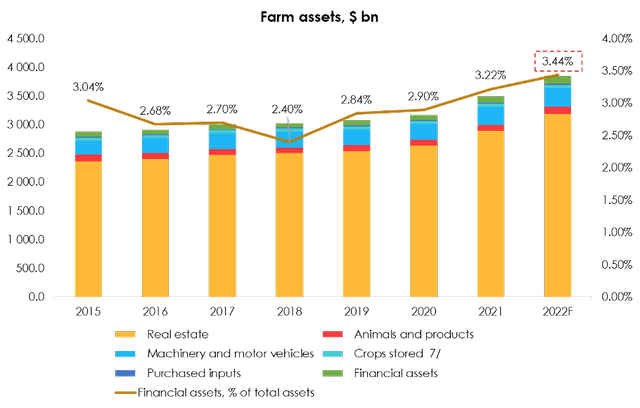

- The agricultural industry enters 2023 with a strong financial position in liquid cash assets, which will allow buyers to invest in production. High prices for agricultural products, together with delays in deliveries in H1 will allow farmers to buy equipment using their own funds, without attracting third-party financing;

- Deere reported a solid order book in H1 2023FY owing to order recovery after disrupted production cycles.

Thus, we have revised our 2022-2023 machinery capex forecast of the agricultural industry. Given the sector’s strong financial position and the supply cycles shift in 2022, now we do not project a significant drop in capex in 2023. Downside risks remain in H2 2023- 2024.

So, we maintain our forecast for a decline in machinery capex in 2023-2024. Historically, the agricultural sector is very cyclical in terms of operating and investment activity, and we expect investment in machinery to decline given the anticipated adjustments in products selling prices and large investments in 2021-2022.

Financial results are more likely to be stable

Deere has a very strong market position. Due to previous aggressive acquisitions and pricing policy, the company is a virtual monopolist in the U.S. and Canada and one of the leaders in the international market.

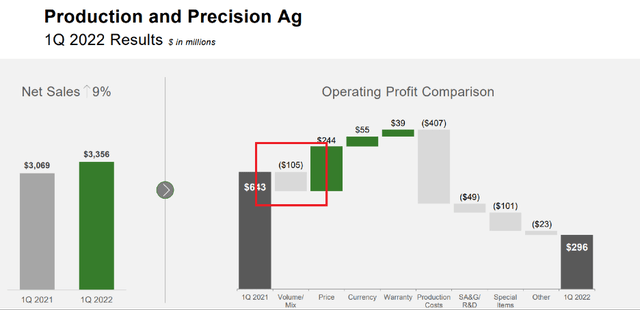

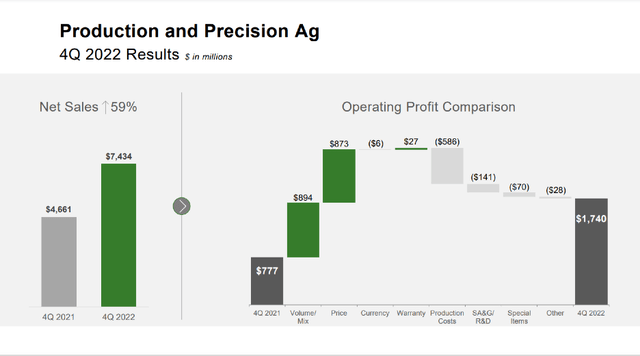

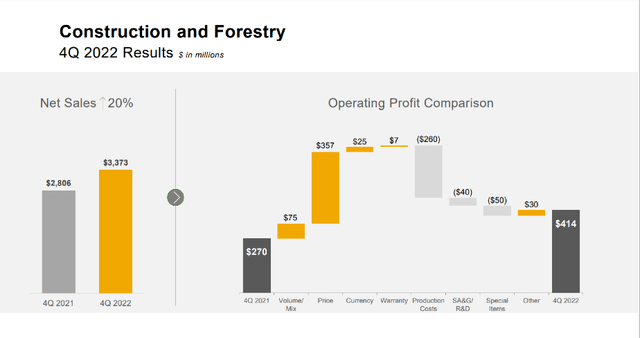

Despite strong volume increase, Deere sales continue to grow primarily through pricing.

The most likely scenario would include further revenue growth due to higher prices and a recovery in production volumes in the medium term. However, going back to the scenario of deteriorating farmers’ liquidity, Deere would have to moderate the pace of price hikes to preserve the market share.

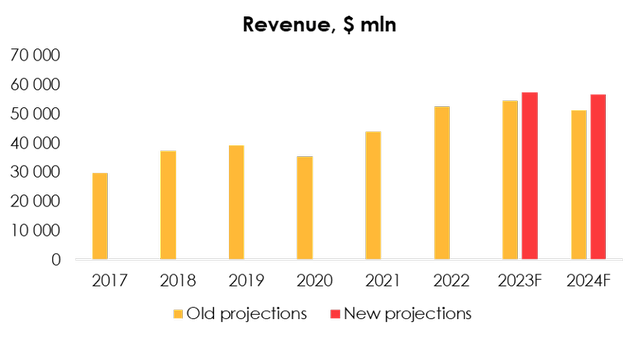

We have revised our 2023 revenue forecast upwards from $54 564 mln (+7.7% YoY) to $57 474 mln (+9.3% YoY) and from $51 504 mln (-5.6% YoY) to $56 724 mln (-1.3% YoY) for 2024 (revenue includes Other and Financial segments). We still expect a conservative sales decline in 2024, as we believe that the end consumer will still face macroeconomic challenges.

Further easing of inflationary pressures and higher product prices in 2022-2023 will allow the company not to lose margin and even slightly improve it.

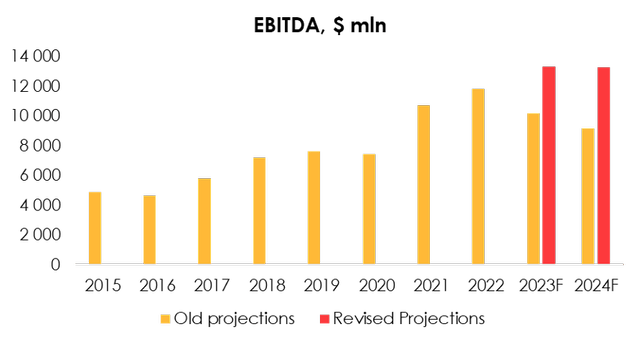

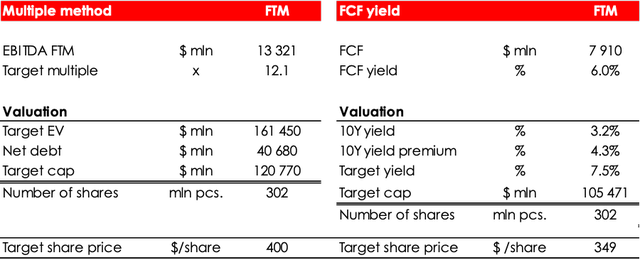

Due to better revenue forecast, we have revised our 2023 EBITDA forecast upwards from $9 108 mln (-5.5% YoY) to $13 321 mln (+1.7% YoY) and from $9 183 mln (+1.7% YoY) to $13 321 mln (+1.7% YoY) for 2024.

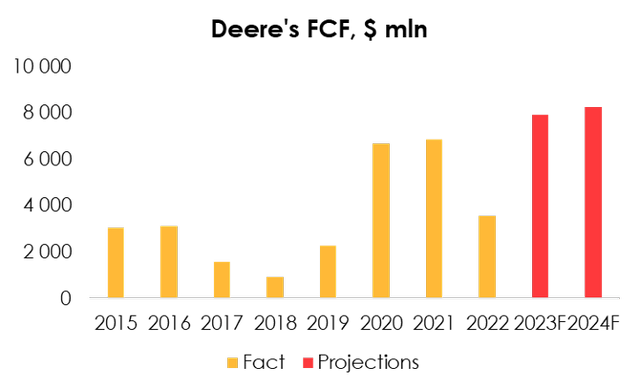

Deere continues to generate stable cash flows, and while the company reached only $3.6 bn in 2022FY excluding finance lease or $911 mln including it, this decline was largely due to higher working capital and the production shutdown in Q1. The company’s management has already started to reduce inventory and we expect the trend to continue next year.

Deere is quite conservative in terms of its machinery investments (according to the company data, the 2023 capex is ~$1.4 bn), and we do not believe the policy will be revised anytime soon given the size of the company and established product lines.

We expect free cash flow (“FCF”) to be $7 910 mln in 2023 and $8 241 mln in 2024, which would allow the company to increase its dividend payout. However, with a dividend estimate of $4.59/share, at current prices the yield would be less than 1% p.a., so we do not believe it is a strong factor behind the investment decision.

Valuation

We are evaluating DE target price based on FTM EV/EBITDA multiples & FCF Yield methods (average price between methods are taken).

The fair value price for the shares is $374. Based on the new assumptions, we are downgrading the rating to SELL. The downside is 15%.

Conclusion

Owing to its virtually monopolistic position in the agricultural machinery market, Deere is likely to feel more comfortable than other players across the industry, but eventually it will also face challenges due to the demand. While we don’t assume a significant deterioration of the company’s financial results, it is starting to look expensive at current prices owing to a very modest medium-term growth rate. We do not recommend holding such shares, so our stock status is SELL after significant price growth in the last 3 months.

To manage the position, we recommend keeping an eye on Deere financials, publication of statistics from agricultural machinery dealers and overall industry sales, USDA reports and key agricultural indicators (input prices, production volumes, etc.).

Be the first to comment