Avalon_Studio/iStock via Getty Images

Investment Thesis

Alpha Metallurgical Resources (NYSE:AMR) is a metallurgical producer for the steel industry. That means that its prospects are tied to steel.

Furthermore, if one believes that China’s real estate market is about to get some much-needed relief, that would mean that demand for steel is going to increase substantially in the near term.

By extension, this would mean that demand for coking coal would also dramatically increase. Hence, this business with a strong net cash position, that’s printing robust free cash flows and is cheaply valued, remains a very attractive investment.

What’s more, AMR is now making so much free cash flow, that it’s ramping up its capital returns with a $5 special dividend.

What’s Happening Right Now?

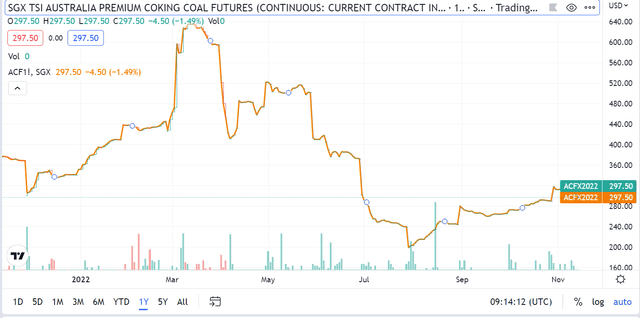

We were told on the earnings call that coal indices’ have come down from their early-2022 historic highs. I don’t have access to global coking coal prices, but I believe that for our purposes, the chart below of Australia’s coking coal prices will suffice.

This is what was said during the earnings call:

Australian indices that averaged $250 per metric ton in the third quarter are currently reflecting $300 in the recent time.

This is a reminder of just how volatile coking coal has been in 2022.

On the other hand, we should keep in mind that AMR’s total debt amounts to approximately $70 million. This figure includes its $64 million in letters of credit, plus approximately $5 million in debt. Meanwhile, this figure is offset by approximately $400 million of unrestricted cash.

Consequently, we are looking at a business that’s valued at $2.6 billion, while 13% of its market cap is made up of cash.

Capital Allocation Surprise, 13.3% Annualized Dividend

AMR announced a special dividend of $5 to shareholders on record on December 15. That means AMR’s shareholders will get the special dividend plus the base dividend, the equivalent of $21.67 annualized.

Altogether, this annualizes as 13.3%.

Additionally, AMR has increased its buyback program to $1 billion. Now, if you follow tech companies a lot, you’ll be forgiven for being dismissive of any company that announces a buyback program. In tech, those that ultimately do buy back their shares, are often a small portion of those that make the announcements.

But that’s not the case with AMR. Indeed, during Q3, AMR actually repurchased nearly $400 million worth of stock. This means that when AMR reports in Q4 2022, its total number of shares will be down 14% y/y.

Put another way, even if net earnings are the same in Q4 compared with last year, AMR’s EPS figure would be up 14% y/y, all else equal. Not bad for a coal miner!

AMR Stock Valuation – Approximately 2x Next This EPS

We are about to wrap up 2022. With the trailing nine months reporting $65 of EPS, I’m inclined to believe that around $80 of EPS seems very achievable.

Now, this is the big question. What’s 2023 going to be like, when compared with 2022?

I don’t believe we should hope to see record met sales again. That being said, this doesn’t mean that on average, 2023 couldn’t still be in line with 2022.

This would mean that rather than the mean reversion which analysts presently estimate to see next year, where AMR’s EPS is expected to be cut by 40%, we could very well see AMR reporting somewhere around $70 to $80 of EPS, for a second consecutive year.

That would mean that investors coming in today would only need 2024 to be yet another middle-of-the-road year, and an investment in AMR has largely paid for itself.

That would mean that everything that this met coal producer generates as free cash flow in 2025 to 2026 and beyond is all free upside to shareholders.

The Bottom Line

I find it surprising that even now, given everything that we know, coal companies are still so cheaply priced. We can clearly see enough evidence that coking coal remains in high demand.

We also know that the likelihood that significantly more new coking coal companies being built are unlikely. And even if they are built, I don’t believe there will be enough to meaningfully change the supply dynamics.

Is it not the case that what I’m describing is a moat? There is regulatory constriction, there are capital restrictions, and there are political headwinds. All the while, there’s still demand. To me, this all looks extremely bullish.

Be the first to comment