Mongkol Onnuan

The Schwab U.S Dividend Equity ETF (NYSEARCA:SCHD) has been a favorite among investors for many reasons. Prior to rate hikes, SCHD offered a considerable amount of yield in a yield-starved environment. Now that the tide has turned, and investors can generate over 4.5% from 1-year Treasury Bills or over 4% from a number of 1-Year CDs, the days of taking on risk to generate yield are gone. Many of the popular dividend-focused ETFs from Vanguard, Schwab, iShares, State Street, and Invesco provide investors with lower yields than 1-year treasuries or CDs. Since investors have no-risk options when looking for modest income generation from their capital, dividend-focused ETFs can’t rely on sub-4 % dividend yields to remain appealing. The market has been pummeled as the Nasdaq is in a bear market, while the S&P has crossed into bear market territory several times throughout 2022. There is less of a reason to take on risk from equities when looking for yield today than in 2021. This is why the quality of ETFs and their track records are more important than ever, as the appeal of a 3.5% yield doesn’t generate the same enthusiasm as it once did. SCHD offers investors prospects of capital appreciation that rivals S&P 500 index funds while throwing off a dividend yield of 3.24%. SCHD has appreciated by 55.94% over the previous 5 years and, in 2022, has mitigated downside risk well, as it declined by -4.83% compared to the major indices either being in a bear market or tittering on the edge of one. I am still bullish on SCHD and believe it provides investors with a perfect blend of capital appreciation and yield.

SCHD has outperformed the major indices, and its peers over the past 5-years while providing more downside protection than S&P 500 index funds

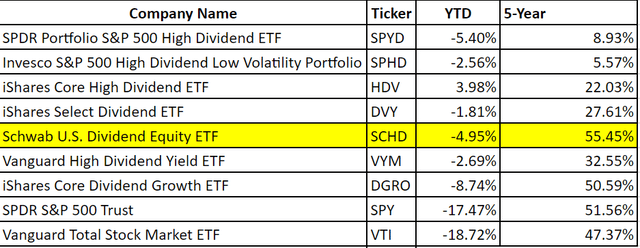

Past results do not represent future performance, but they can be utilized as a comparison tool and an indication of what could occur. SCHD is Schwab’s U.S dividend ETF, so I am interested in how it compares to other popular dividend ETFs and standard index or total market funds. I like to compare several aspects, including the past performance over the previous 5-years, and YTD basis, in addition to the dividend yield. Below are the different funds that I compare SCHD against, as these are its peer group from the other major firms, in addition to an S&P index fund and a total market fund.

For an S&P 500 index fund and a Total Market Fund I have selected:

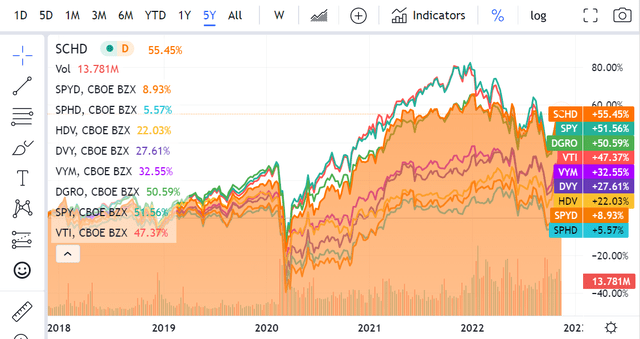

Over the past 5-years, these 9 ETFs have appreciated between 5.57% and 55.45%. SPY, which is the S&P index fund, appreciated by 51.56%, and some investors may be surprised that SCHD outperformed SPY by just under 4%. Only 1 other dividend-focused ETF, which was DGRO, generated more than a 40% return over the past 5-years. VYM had the third largest amount of appreciation out of the dividend-focused ETF, and it just barely cracked the 30% level. Over the past 5-years, SCHD has outperformed all its peers, in addition to an S&P 500 index fund and a total market fund. SCHD has shown that investors can have it all, as SCHD has been a well-balanced fund providing investors with above-average yields and large amounts of capital appreciation.

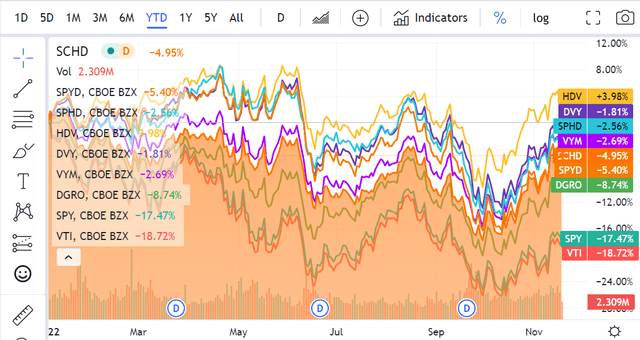

2022 hasn’t been an optimal investment environment as inflation has run rampant, and the macro environment has presented numerous challenges. Currently, SPY is down -17.47% on the year, while VTI has declined by -18.72%. This is one of the years where the more conservative dividend-focused funds outperform SPY and VTI as they range from appreciating by 3.98% to declining by -8.74%. In 2022 SCHD has not been the best performer, as HDV has appreciated by 3.98%, but compared to SPY and VTI, SCHD has mitigated risk quite well. SCHD has declined by -4.95%, which is significantly better than just investing in the major indices throughout 2022.

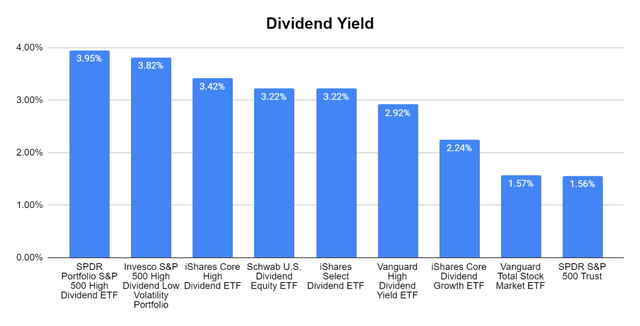

SPDR is the largest-yielding ETF in the peer group as it has a forward yield of 3.95%, and SPY comes in with the lowest yield at 1.56%. Including SPY, and VTI, the average yield of these ETFs is 2.88%. SCHD is generating a forward yield of 3.22%, which is more than double the yield investors can find in VTI and SPY, while being in the middle of the range for the dividend-focused ETFs.

Steven Fiorillo, Seeking Alpha

While previous performance is not an indication of what will occur, investors have done quite well with SCHD over the years. It has all the components to fit in a wide range of portfolios. From its peer group, SCHD has appreciated the most, has mitigated risk well, and generates more than double the yield from traditional index funds. I believe that SCHD’s history has provided an interesting investment case and that an argument can be made that SCHD is the crown jewel from dividend-focused ETFs.

Steven Fiorillo, Seeking Alpha

Outside of past performance, SCHD is a well-balanced ETF that has a well-rounded investment strategy, and solid dividend growth characteristics

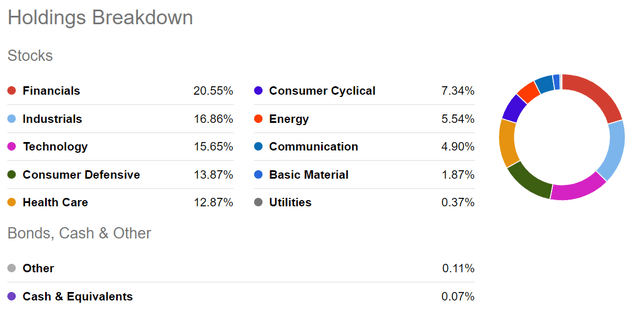

SCHD does a good job of mitigating risk, and this is derived from its investment principles. SCHD follows an investment premise that SCHD follows an investment premise that individual equities can’t exceed 4%, and a specific sector can’t exceed 25% of its assets. Being a dividend fund that tracks the Dow Jones U.S. Dividend 100 index, SCHD’s positions must have a minimum of ten consecutive years of dividend payments and a minimum float-adjusted market capitalization of $500 million. The Dow Jones U.S Dividend Index is evaluated by the highest dividend-yielding stocks based on cash flow to total debt, return on equity, dividend yield, and 5-year dividend growth rate. SCHD invests at least 90% of its assets in these equities and utilizes cash-flow to debt ratio, ROE, dividend yield, and dividend growth rate to make its decisions. SCHD is rebalanced quarterly to make sure its positions meet the 4% and 25% criteria, and the overall composition is reviewed on an annual basis.

No matter which equities you’re looking to invest in, there is always a level of risk. Even Apple (AAPL) sees fluctuations and downtrends. By incorporating all of these investment principles, SCHD is a fund that’s built to withstand volatility, and this is proven by its YTD performance. Within SCHD’s top holdings, you will find companies such as Merck & CO (MRK), International Business Machines (IBM), PepsiCo (PEP), and Cisco Systems (CSCO). SCHD is built to be a conservative fund that mitigates risk by investing in the largest companies with strong track records.

From a dividend growth standpoint, SCHD is a quintessential ETF. SCHD has a forward yield of 3.22% and has increased its dividend for 9 consecutive years. Investors have been rewarded through a dividend growth program that has a 12.10% average growth rate over the past 5-years. Over the past 10 years, since SCHD’s 1st full year of paying dividends, its annual dividend has grown by 177.65%, increasing from $0.81 to $2.25. In the previous 5-years, investors have benefited from its dividend increasing from $1.35 to $2.25.

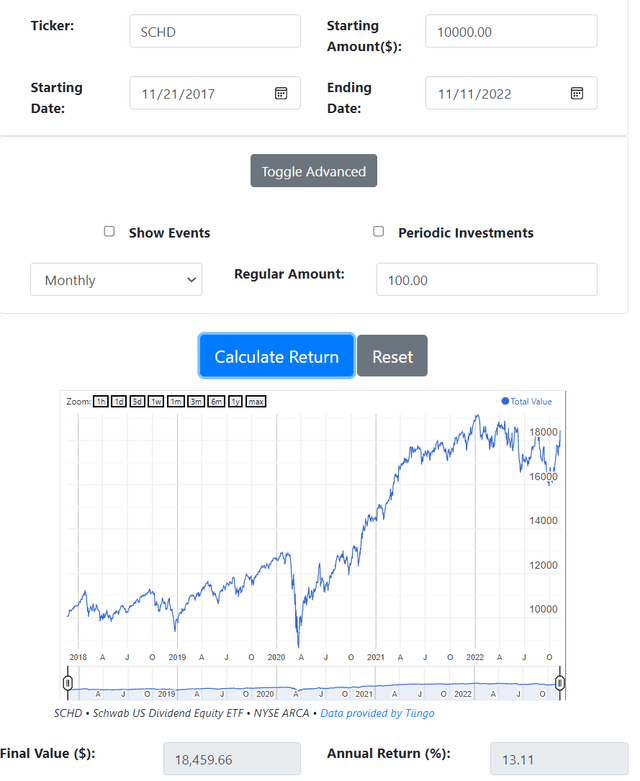

SCHD’s modest dividend growth and capital appreciation have led to a substantial total return over the past 5-years. While SCHD has appreciated by 55.45%, its dividends have provided an additional 29.14% in returns. An investment of $10,000 5-years ago would now be worth $18,459.66. This is an average annual rate of return of 13.11%, which is well above the S&P 500’s historical average.

Conclusion, and why I believe SCHD is the perfect blend for capital appreciation and growth

The low-yield environment is gone, and the Fed is unlikely to bring down rates anytime soon. Regardless if they pivot in December and go with a .50 basis point hike or keep it at the previously indicated .75 basis points, investors will be able to find strong yields in CDs or T-bills with no risk. This creates a challenge for income investing, as many companies do not pay a yield that exceeds 4.5%, and many standard equity dividend funds do not exceed 4.5%. If you’re looking for income, it’s going to be hard to make an argument for deploying capital anywhere else when you could potentially get 5% after the next increase from a CD or a T-bill.

We have been living in a bear market where the swings have been quite volatile, yet SCHD has mitigated downside risk quite well. SCHD has proven to generate substantial capital appreciation over the years, and its dividend growth has helped provide a total return that exceeds 80% over the past 5-years. Income investors and investors looking for capital appreciation can both benefit from SCHD. SCHD offers a high-quality dividend with exceptional dividend growth, and is positioned to benefit when the market rebounds. Unlike other equity dividend ETFs, SCHD has provided substantially higher returns when the market has appreciated, and its dividend growth should be enticing for income investors. While I have been an investor in SCHD for years, I just added it to my Dividend Harvesting Portfolio, which is a dividend investing series on Seeking Alpha.

Be the first to comment