DKosig

Energy Transfer (NYSE:ET) is one of the largest companies by enterprise value, supported by the company’s massive debt load. The company has an almost $40 billion market capitalization and an almost 9% dividend yield. As we’ll see throughout this article, the company’s reliable cash flow makes it a valuable investment.

Energy Transfer’s Overview

Energy Transfer has a strong business overall that has performed quite well.

Energy Transfer Investor Presentation

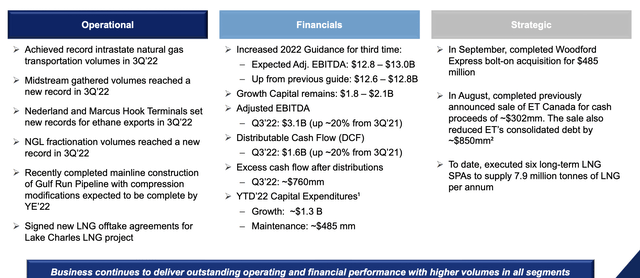

The company achieved record volumes in the quarter, across all of its businesses, as it has continued to complete new assets. The company has signed new LNG off-take agreements for the Lake Charles LNG, which will support the project’s success and enable it to continue to invest in growth. On top of that, the company has continued to use bolt-on acquisitions.

Financially, the company has once again increased guidance for $12.9 billion in adjusted EBITDA with $2 billion in growth capital. The company’s DCF in the quarter was $1.6 billion, up 20% YoY, and annualized at roughly $6.4 billion. That left the company with $3 billion in excess FCF (annualized) after an almost 9% dividend yield.

The company’s maintenance growth capital is minimal ~$650 million for the year, with growth capital expected to be more like $1.6 billion. The company’s capital spending is comfortably covered by its extra cash flow after dividends.

Energy Transfer’s Investments

Energy Transfer has continued to invest heavily in its business, with annualized growth capital expected to be roughly $2 billion.

Energy Transfer Investor Presentation

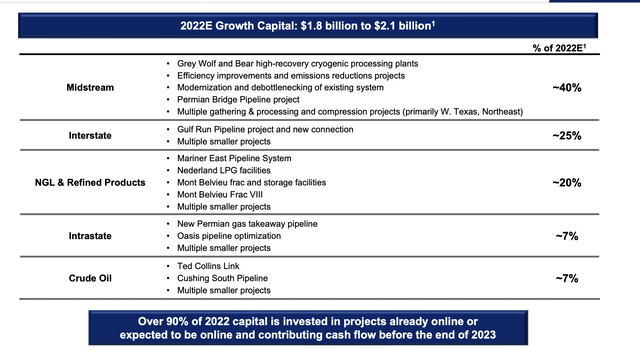

The majority, 40%, is expected to be midstream with another 25% interstate. That’s more than a billion in growth capital among those two categories. 90% of this is expected by contributing cash flow by the end of 2023. The company is using capital spending for most of its bolt-on acquisitions, which tend to drive much higher returns.

Energy Transfer’s Insider Support

Energy Transfer continues to have some of the strongest support from insiders for its equity, highlighting its financial strength.

Energy Transfer Investor Presentation

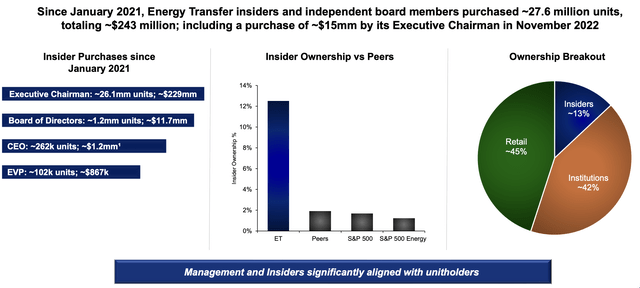

The company has double-digit insider ownership, and it continues to have major insider purchases. Total purchases since January 2021 total more than $240 million. The company’s insider ownership and continued investment show their continued belief in the business, although it’s worth noting most of this is with the executive chairman’s insider ownership.

Shareholder Return Potential

Energy Transfer has the ability to drive substantial shareholder returns.

The core of the company’s returns is its dividend yield of almost 9%. That costs the company roughly $3.2 billion and it’s a number that the company can comfortably afford. The company’s annualized FCF of roughly $6 billion leaves plenty of cash post dividend to drive substantial shareholder returns and cover the company’s capital expenditures.

We’d like to see the company substantially expand share repurchases, however, in the meantime, regardless of how it spends the cash, we expect substantial shareholder returns.

Thesis Risk

The largest risk to the thesis is the company’s debt load. The company is continuing to pay several billion annualized on this debt load. While it can continue to pay its dividends and capital expenditures, there’s a risk, especially in a rising interest rate environment, for the company’s future returns as debt rolls over. That’s worth paying close attention to.

Conclusion

Energy Transfer has a unique and incredibly strong portfolio of assets. The company has continued to generate massive cash flow with an almost 9% dividend yield. The company is also aggressively spending on growth capital to the tune of roughly 6-7% annualized, which can help support long-term growth with high-yield bolt-on projects.

Going forward, we expect the company to continue modestly paying its dividend yield and investing on growth. However, we’d like to see it buy back stock and pay down debt. Especially in a higher interest rate environment, paying back debt is more essential. Regardless of how the company spends the cash, it’s a valuable long-term investment.

Be the first to comment