Rawf8/iStock via Getty Images

Dear Readers,

I wrote an article on Old Republic International (NYSE:ORI) a few months back. At the time, I bought the stock and considered it a good “BUY” given what the company offered. The return since the time, around 3% total RoR compared to a negative 5.6% from the S&P500, makes this a fairly decent call, though nothing major overall.

Let’s see what we can expect from the company going forward.

Old Republic International – Updating on the company

The Old Republic International Corporation is a business that’s been paying a cash dividend for nearly 80 years. It’s also a holding company based in Chicago, that specializes in one business – insurance underwriting (and related services). Operations are not conducted through ORI itself, but through various subsidiaries which in turn are organized into three segments.

As with most insurance businesses, ORI earns its money through both insurance premiums related to underwriting and services, as well as income generated from investments, which aims for stable income from dividends and interest, while also serving the need for protection of capital and immediate liquidity availability in case of payable obligations.

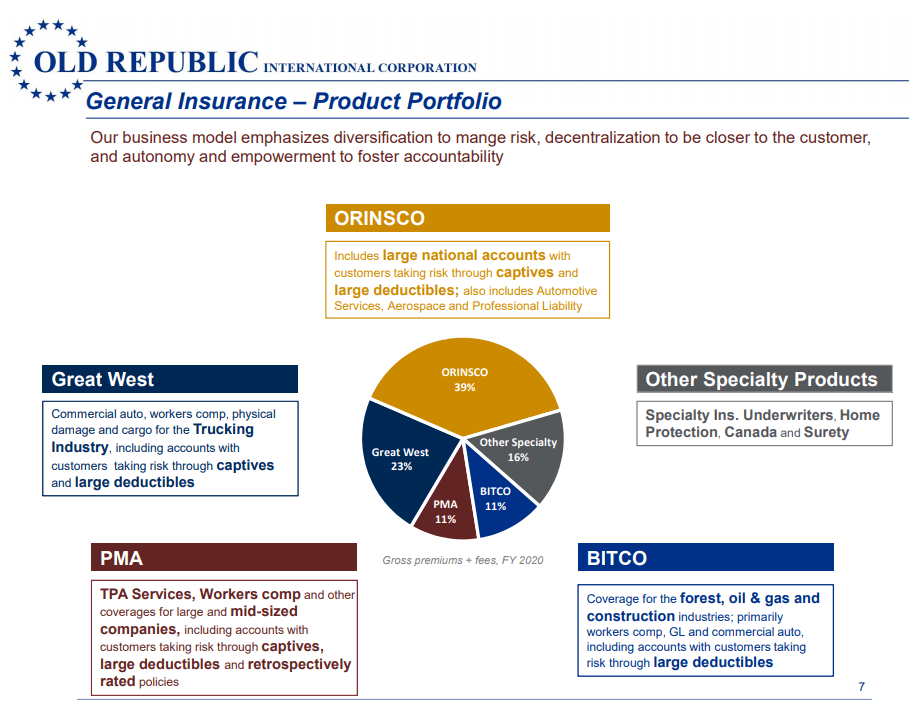

For more detailed information on the company’s basics, I refer you to my very first article on the company, though some of the info might be outdated at this point. However, the general insurance segment of ORI can be split into the following subsegments.

ORI IR (ORI IR)

This is also a segment that has been able to grow premiums at a fairly impressive and steady overall rate, ever since we saw the financial crisis. Even COVID-19 only resulted in a slight decline for the company, showcasing its great quality here. However, what else is to be expected with an extensive history going back 99 years, 81 years of cash dividends, with 41 years of raises. The company isn’t a dividend king yet – but it’s pushing towards it.

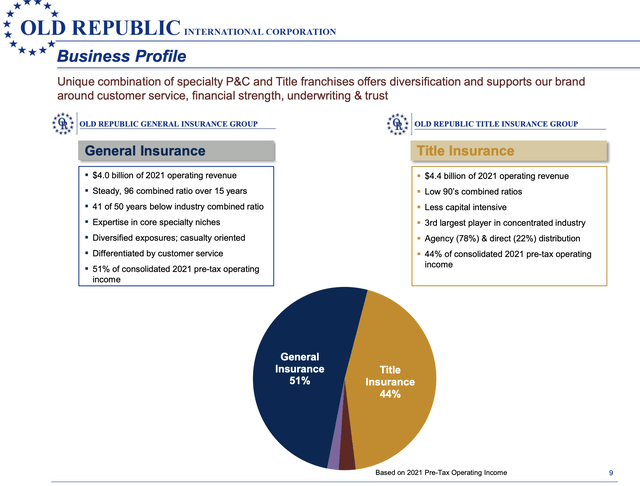

Also, it’s worth mentioning that ORI is the #3 Title insurer in all of the US, and it’s one of America’s 50-largest shareholder-owner businesses.

2Q22 was a decent quarter for the business. ORI saw a slight decrease in operating EPS due to mortgage interest effects on insurance results, but still managed to deliver nearly $2B in net premiums and fees, with a sub-91% combined ratio. ORI also delivered a dividend bump – around 4.5% from the YoY.

Its split between title and general insurance continues to work in the company’s favor.

The company has showcased very good growth in general insurance, but also shown a willingness to contract during periods of inadequate rate levels. It specializes in niches through its structure with agent & broker distribution, lending the company both flexibility and local know-how.

The company’s investment portfolio remains 98% investment grade in terms of its bonds/cash portfolio, with A+ average investment quality with a 2.7% market yield on 99% marketable securities. These represent 74% of the company’s $15.9B investment portfolio, with another 26% invested in Blue-chip equities, value stocks, and utilities coming to a 3.3% dividend yield.

Reserves are, of course, a big question for insurance companies, given the necessary reserves for these types of business. Overall, General Insurance has over 90% of the company’s necessary reserves here, at around $6B, though it has been some time since the company saw any significant unfavorable development in net premiums and fees in General insurance (7 years), and even longer in title insurance (11 years). The company has also improved its runoff reserves, down from almost $2B to less than $130M in 10 years, as significant stabilization has occurred.

It wasn’t the greatest quarter ever – but nor was it a bad one. With dividend increases and the company’s ongoing prudent capital management and with the company strictly investing in Bonds & stocks (no hybrid or other investments), this is a very safe player and a good investment at the right price.

Goodwill/intangibles make up less than 3.2% of the company’s capital in this business – again, there’s much to like here.

Company revenues and earnings have a long tradition of growing over time, and despite this current quarter, this shows no long-term implications of really slowing down.

The title and General Insurance segments have furthermore shown resiliency over the course of entire market cycles, with small dips about every 6-7 years or so. While this company’s combined ratio is far from as low as some European peers, such as Sampo (OTCPK:SAXPF), these insurance companies are somewhat different and operate in different markets.

It should also be noted that ORI is one of the few American companies that, at times, declare special dividends – as they did in 2021. This might of course be appealing for some, while I don’t view it as a reason by itself to invest in the company. Nonetheless, the annual yield inclusive of the extraordinary dividend for 2021 was around 9%, which is certainly impressive, and much like with any company that does this, this is a repeat potential.

So while this quarter might not go down in history as the most profitable, there are still results to like and forecasts to make for ORI. Let’s see what we have here.

ORI stock valuation

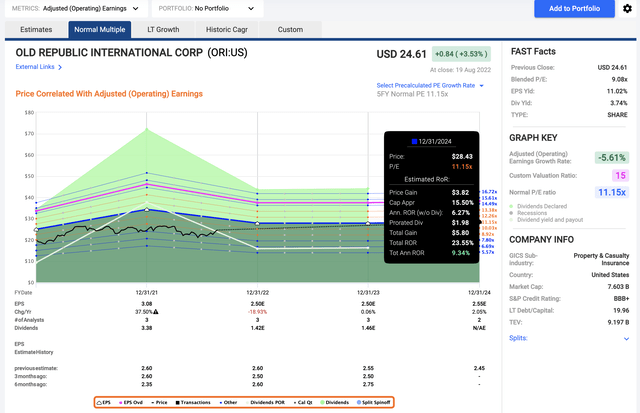

The current results suggest that we’re looking at an EPS decline for this year. Given the 2021A results, this is not surprising. The question is how much of a decline we are realistically looking at. The market suggests around 19%, with FactSet being at 18.93%, followed by slight growth picking up once again in 2023.

The company’s yield is around 3.7%, which is on the higher side for ORI, but lower than many good insurance companies on the market, both within and without North America.

Nonetheless – we’re below 10x P/E here, and this makes the company interesting to me.

Its incredibly low debt, high credit rating, and strong fundamentals would indicate a “BUY” being possible here. Indeed, even on a conservative 11.1X P/E, expecting 2022E EPS to drop by 19% and averaging a negative 3-year CAGR of 5% in terms of EPS, the reversal/growth upside at a current average weighed P/E of 9X is 9.34% – market-beating as I see the market going for the next few years, and a total RoR of 23.55%.

While it’s not the greatest upside, nor the best in the sector, it’s a decent one considering the overall fundamentals of the business. It’s a safe 3%+ yield and a 9%+ yield for NTM.

However, I’d be remiss not to point out that the company actually is fairly terrible at meeting targets – or analysts are poor at forecasting it – however way you want to look at it. An almost 40% miss ratio means that the future set of income numbers could be considered slightly indicative, but no more. Furthermore, if we base our forward valuation upon any shorter-term forward multiple, accepting that there might be some near-term volatility here, we quickly see that if ORI doesn’t trade up to 12X P/E at the very least, your returns drop below 7% inclusive of dividends very quickly. The upside here is partially based on a slight amount of reversal to a very long-term average P/E – which might or might not materialize.

Seen by itself, I still find it very hard to argue against investing in ORI here. The upside is slight, but it’s a decent yield and while slight, the upside is definitely there. It’s also very safe – which is really something that we’re looking for when we’re interested in investing here.

Underlying fundamentals and results spell a company market to continue growing, or at the very least, not fall all that far. Analysts also consider this company to have an existing upside close to double digits based solely on the share price and valuation – though it should be noted that that is only 1 analyst targeting a $28 share price (Source: S&P Global).

Old Republic is, as it happens, a very underfollowed business both by analysts as well as by the market as a whole. I’d love to buy it even cheaper – like when it was troughing close to $20/share back in June/July of 2022 – but at the time, I was busy buying other companies.

Still, at current ratings and at the current forecasts, I consider this company appealing with a share price of around $24.5, giving us an upside of around 9%.

I would, however, argue that there are better insurance plays available today. Allianz (OTCPK:ALIZY) and Munich RE (OTCPK:MURGY) come to mind, though it’s also hard to argue with the 9% NTM yield and the excellent fundamentals of the business here. Also, it’s US-based, which might be even more crucial for most investors.

Nonetheless, there’s upside here – and here is how I would structure my updated ORI thesis.

Thesis

I would structure my thesis for Old Republic International as follows for the time being.

- Old Republic International is a slightly undervalued business with excellent fundamentals. It has a well-covered yield, and low debt, and results are promising.

- The company’s 20-year history shows a bit of volatility for extended periods of time – but the company has righted and adjusted since, and overall I view the company as “safe.”

- The upside is there, but I definitely consider that upside to currently be in the single digits even with the dividend.

- By itself, the company is a “BUY”. In the broader context of the overall market, I would say there are better alternatives for you to consider here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them:

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment