By Wylie Tollette, Head of Client Investment Solutions, Franklin Templeton Multi-Asset Solutions and Gene Podkaminer, CFA, Head of Multi-Asset Research Strategies, Franklin Templeton Multi-Asset Solutions

In some ways, the world fundamentally changed in the first quarter of 2020. March alone has shown how long-term market trends can change literally overnight. And yet, we still confront familiar tradeoffs as we turn to rebalancing and positioning our portfolios for an uncertain future. In between trying to figure out how to adapt personally and professionally to the rapidly changing COVID-19 pandemic, virtually all investors – individual and institutional – are about to confront a challenging set of decisions.

What should you do, and when should you do it? This brief list is intended to help provide investors of all types a framework to address these questions.

-

First, take a deep breath

We have experienced the fastest decline from record stock market levels to a bear market in recorded history – faster even than the 1929 crash that started the Great Depression (see chart below). Markets appear to incorporate new information more quickly these days but are still prone to over- and under-reaction – particularly when faced with an uncertainty like the coronavirus. It is virtually impossible to predict the exact peak or trough, or the behavior of market participants over the short term; nor is that likely a worthwhile endeavor.

It is understandable that investors feel like their heads are spinning. Step back from that Bloomberg terminal or TV screen, take a deep breath, and try to picture the long view. Many of us have experienced severe market corrections before. And we’ve successfully navigated our way through them, one way or another. We will see our way through this challenging time as well. Red numbers eventually turn green.

-

Take the long view

This may be a cliché in the investment industry – “that is what they always say after a terrible quarter” – but we believe taking a long-term view is truly essential in framing the asset allocation decisions ahead and positioning a portfolio for success. The asset allocation choices underpinning our portfolios are themselves based on long-term assumptions. The reptilian portions of our brains have evolved to react quickly and instinctually to immediate threats – so called “fast thinking.”1 Taking the long view is particularly important in the middle of a global virus pandemic, which likely activates our flight-or-fight response where reptilian thought processes can alter our usual investment decision making process.2 Focusing on 3-, 5-, and 10-year performance can help engage “slow thinking” and facilitate more rational decision making.

As Sir John Templeton said, “to buy when others are despondently selling and sell when others are greedily buying requires the greatest fortitude and pays the greatest reward.”

-

Think risk first

As investors, we cannot control returns – simply recall the last 6 weeks. But, we can control the risks we take (for the most part) in each part of our portfolios. Returns are essentially the “result set” of those risks. Many investors don’t fully understand their actual risk capacity until tested, as it likely was in the last six weeks.

We’ve just come out of a decade where central banks dampened volatility through unconventional monetary policy, so the recent spate of volatility has felt particularly shocking. Better to reconfirm your tolerance and capacity for volatility and align your forward-looking asset allocation with that (now better understood) risk capacity. The alternative is to bumble ahead in relative ignorance. It is better to make an explicit set of decisions than to implicitly lurch ahead.

One bright spot: viewed from a valuation perspective (the way Benjamin Graham thought about investing3), the typical portfolio is actually lower risk now than that same portfolio was six weeks ago. It probably doesn’t feel that way – more like you might be holding a grenade – but one shouldn’t focus on feelings when it comes to investing (see “fast” vs. “slow” thinking noted above).

-

Rebalance thoughtfully

Recent market performance is exactly the type of event where a disciplined policy of rebalancing back to strategic targets thrives. You are not going to get the timing exactly right (see above on calling peaks and troughs). But rebalancing is part of strategic asset allocation, and it is usually built on capital market expectations that look out 7, 10, 25 years or longer. So should your calculus of whether your approach to rebalancing is successful. We recommend starting to average your way back to target ranges over the next few months as the outlook becomes clearer, rather than a “big bang” approach of returning precisely to targets.

Even if you were ill-prepared for the recent downturn – say, for example, by having failed to rebalance out of equities as they rallied through the end of 2019 – most investors have the time horizon to focus on the 3-, 5- and 10-year returns. And, those are generally the numbers that really matter anyway.

-

Have more liquidity than you think you might need

While the current crisis looks different from 2008, some things stay the same: there’s no substitute for liquidity. When markets are melting down, few things are as handy to have on hand as cash and other truly liquid assets. Even gold – the stereotypical “safe-haven” asset for nervous savers and investors – was negatively impacted; in other words, “cash is king.” In the event investors with near-term liabilities decide to allocate a year or two of projected cash demands in cash and short-term sovereign bonds, this may allow a portfolio to avoid selling long-term assets in the short term when markets remain volatile.

-

The denominator can dominate

As of the quarter-end, investors with significant illiquid or private holdings will soon find that their public market assets have dramatically re-valued. Meanwhile, private holdings – which tend to rely on appraisal-based valuation on a quarter or more “lag” – are still sitting pretty (if stale) with December 31, 2019 market values. This will likely make the illiquid asset classes in a portfolio look larger than they truly are, as the values are surely impacted by recent market turmoil but accurate prices are not immediately observable.

Whether a parcel of real estate (for example) is owned by a REIT (valued daily) or owned by a limited partnership (valued quarterly), the actual underlying property’s true economic value should be similarly impacted. This phenomenon can make calculating allowable asset class ranges challenging, due to the unknown “total assets” denominator. A simple solution for allocators to address quarter-end rebalancing is to estimate the mark-down and include this in both the numerator and denominator.

-

Capital calls are coming

Private assets are invested based on the manager’s timing, not the investor’s. Once an investor commits capital, it may not be drawn down for years. In the current market, smart private asset managers are going to be seeking bargains and are likely to call capital – most likely, at the worst time for allocators. For a typical retail investor, a corollary exists in the form of unexpected expenses or loss of employment – difficult to predict and potentially very impactful. These types of events need to be built into your potential liability projections and rebalancing approach-another good reason to follow tip #5 above.

-

Don’t sell long-term assets in the short term

This sounds basic, but it is remarkably common, even among sophisticated investors. Following the global financial crisis, one large US institutional pension fund, for example, found its portfolio dramatically outside of its asset class ranges. In anticipation of receiving capital calls from its private equity and real estate managers, public equities were sold near the bottom of the market in 2008-2009 to raise cash. As stock markets recovered over the following several years, it missed out on the rally on those same equity assets. Similarly, some of the more levered real estate projects were taken back by banks at the depths of the crisis and its real estate portfolio is still healing, more than 10 years later.

Unrealized gains and losses are just that – unrealized. Selling long-term assets with positive forward prospects at transitory low prices violates the first truism of investing – “buy low, sell high.” See tip number 5 above about maintaining a little bit more liquidity than you think you might need, just in case.

-

Diversify

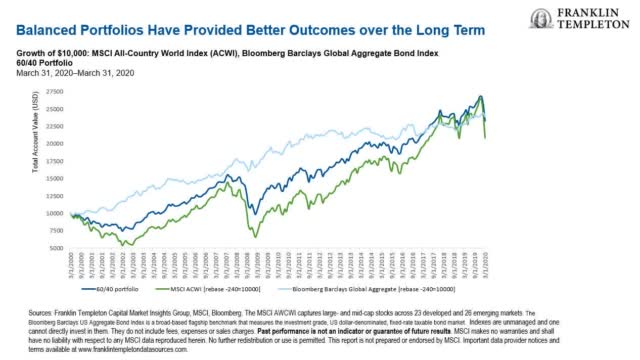

Recently, it has been very difficult to beat a “boring” 60/40 portfolio of the MSCI All-Country World Index (NASDAQ:ACWI)4/ Bloomberg Barclays Global Aggregate Bond Index (see chart below). There are two related reasons: 1) the performance of fixed income; and 2) the risk diversification from the relatively large 40% allocation to bonds during equity market drawdowns. Much of fixed income performance has been due to the behavior of long-term rates for the past 35 years – they have steadily gone down, increasing the value of long-term bonds and also providing much-needed diversification against equity factors. As sovereign bond rates approach zero – already near or below zero in much of the developed world – investors will need to look further and harder to diversify equity risk. Alternative risk premia strategies, infrastructure, real assets – even long-shunned inflation hedging assets – may start to make more sense for some investors, within a diversified portfolio.5

Finally, we expect markets to continue to be volatile until there is a clear path for both humans, economies and capital markets to navigate the pandemic. Tip #10 is to go back to #1 and read the list from the top, beginning with another deep breath. Keep calm and carry on.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com-Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton’s U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

This information is intended for US residents only.

What Are the Risks?

All investments involve risks, including possible loss of principal. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio. There is no assurance any forecast, projection or estimate will be realized. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Derivatives, including currency management strategies, involve costs and can create economic leverage in a portfolio which may result in significant volatility and cause the portfolio to participate in losses (as well as enable gains) on an amount that exceeds the portfolio’s initial investment. A strategy may not achieve the anticipated benefits, and may realize losses, when a counterparty fails to perform as promised. Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. Investments in REITs involve additional risks; since REITs typically are invested in a limited number of projects or in a particular market segment, they are more susceptible to adverse developments affecting a single project or market segment than more broadly diversified investments. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

____________________

1. Kahneman, D. Thinking, Fast and Slow, New York: Farrar, Straus and Giroux, 2011.

2. P. Slovic, M. Finucane, E. Peters, and D. MacGregor. “The affect heuristic,” European Journal of Operational Research, Vol. 177, Issue 3, March 2007; Shiller, R. “The Two Pandemics,”Project Syndicate, March 31, 2020.

3. Graham, B. The Intelligent Investor, New York: Harper Business, 2006.

4. The MSCI ACWI captures large, mid- and small-cap representation across 23 developed markets and 26 emerging markets. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

5. Diversification doesn’t guarantee profit nor protect against risk of loss.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment