Spencer Platt/Getty Images News

Investment Thesis

PayPal (NASDAQ:PYPL) has seen its share price tumble in the past few months. As we look through and start to price in 2023, PayPal’s stock is now trading at approximately 26x next year’s GAAP EPS.

Given that stocks don’t trade in a vacuum and that PayPal is a much higher quality business than many payment solutions out there, I upgrade my stance on the stock to neutral.

Why I’m Now Less Bearish on PayPal

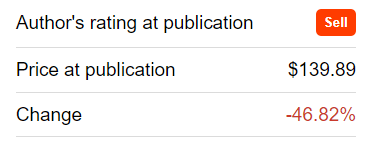

Back in February, I turned bearish on PayPal.

Author’s coverage

Since that time, the stock went from $140 a share to $74. Put another way, all the enthusiasm that investors had for PayPal has now left the stock.

Or better said, back in February, investors were in a state of belief. Let’s call this the ”believing” investment style. Today, investors are in the ”show-me” style. That difference may not sound significant, but it’s a very different setup. Why?

Because the investor coming to the stock today over the next 3 months aren’t likely to have to embrace a further +40% sell-off. The investor coming to the stock today, putting fresh capital to work, is thinking very astutely about the likelihood that PayPal is going to be dead money for a while.

This is a very different shareholder base. A lot of the loose hands are now out of the stock.

New money coming to work, thinks with a long-term view. The number of sellers of PayPal is becoming less and the number of investors holding on tightly is increasing.

To be absolutely clear, I’m in no way shape or form making the argument that PayPal is ready for a quick rebound. That’s not what I’m alluding to here. What I am alluding to is that the odds of making some upside here over the next 18 months are substantially better than they were back in February.

This is a Stock Picker’s Market

Back in 2020, there was very little dispersion in the market. Anything that was in any way viewed as a disruptor was feverishly welcome by investors and saw its share prices soar. It didn’t matter all that much about company culture, market opportunities, or profit margins.

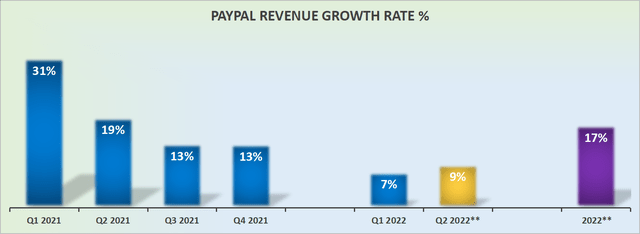

Today, the opportunity is very different. Investors are pushing back from any business that is either: reporting decelerating revenue growth rates compared with the prior COVID period or hasn’t got a clear path to profitability, with PayPal being the former of the two.

PayPal revenue growth rates, on a reported basis

PayPal was a business that many assumed had what it took to grow at 20% CAGR in a sustainable manner.

However, as we are now coming to see, that is not the case. The outlook now is a lot fuzzier and it’s meaningfully less clear whether or not PayPal could return to growing at 20% CAGR.

However, with the stock now down meaningfully, I believe that insight has started to be largely priced in.

PYPL Stock Valuation – Priced at 26x 2023 EPS

Here are some back-of-the-envelope calculations. We know that PayPal is guiding for GAAP earnings of $2.34 this year. If we presume that next year’s EPS is able to grow by 15% to 20% from this year, we are looking at $2.70 to perhaps $2.85 per share. Let’s call it $2.80 of GAAP EPS in 2023.

This puts PayPal priced at 26x next year’s GAAP EPS.

To this consideration, bulls would push back that tech companies shouldn’t be valued on GAAP earnings. And while I recognize that was the case in the past several years, I’m not entirely convinced that is still the case today.

I believe that investors are now very mindful of management’s stock-based compensations.

Investment Risks

PayPal is a business that is likely to benefit from the digital transformation. However, in the event of a slowing global economy, this payment solution provider will be materially impacted. There’s really no way to get around this.

Similarly, lest we forget, PayPal is far from unique in this space. There is a myriad of competitors all vying for payment flows.

Previously, it was assumed that PayPal would continue to dominate the online payment solution space. Could the same be said in 2023 and beyond?

It’s not only competition from the likes of newer players in the space, such as Apple Pay (AAPL), Amazon Pay (AMZN), and Stripe (Private), but older players too, such as Visa (V) and other payment solutions, all clamoring for this lucrative space.

It will not be a winner-take-most-market. It will be a highly fragment market, with platforms clamoring for payment flows. This will make the overall industry more competitive and decrease the margin potential for payment providers.

The Bottom Line

Is PayPal cheap or expensive? It depends.

Previously, a high-quality company growing at a mid-10s% CAGR that was priced at an earnings multiple in the mid-20s was viewed as expensive. But in this market? This does not appear to be the case.

In sum, there’s a lot to like about PayPal. As there’s always been. And it is now clearly more attractive than it was back in February. Hence, I’m upgrading this stock to a neutral rating.

Be the first to comment