Olemedia

Investment thesis

Autodesk (NASDAQ:ADSK) provides a unique investment opportunity to invest into leading company providing leading design software for global companies. In my view, the company looks set to continue to grow in the double-digits and margin expansion is also in the cards. Put together, these two drivers will lead to improving and outsized returns for investors.

Autodesk is a highly differentiated player compared to other design and vertical peers as it has a growth profile that is diversified across different applications, all of which benefit from tailwinds. Some of the tailwinds supporting growth in the business includes digitalization, increasing infrastructure spending and specific company and industry growth drivers.

In the near-term, Autodesk looks well positioned to outperform as it has demonstrated resilient demand for its offerings, as the company continues to beat expectations while other peers have underperformed. In addition, there are no signs of deal slippage or deal delays as other software firms have experienced. In addition, management continues to reiterate guidance in an uncertain macroeconomic environment. Checks with partners and customers show that demand remains resilient, and feedback was positive as Autodesk continues to add value to customers.

Overview

Autodesk is a leading provider of 2D and 3D computer-assisted design (“CAD”) software. The applications for its software ranges from architecture, engineering, construction and the manufacturing sectors. The company has been in operations since 1982 and is known for their flagship design tool, AutoCAD. The company has been increasingly focused, in the past decade, to expand its product portfolio to target broader industry segments.

Through the use of Autodesk’s software and solutions, this enables customers to catalyze innovation, optimize designs and improve their manufacturing processes. This translates to cost savings, improved processes and quality, and better collaboration and outcomes for its customers, who continue to see the benefits Autodesk brings to their business.

Autodesk’s software products are sold through a vast network of almost 1,700 resellers and channel partners around the world.

Business segments

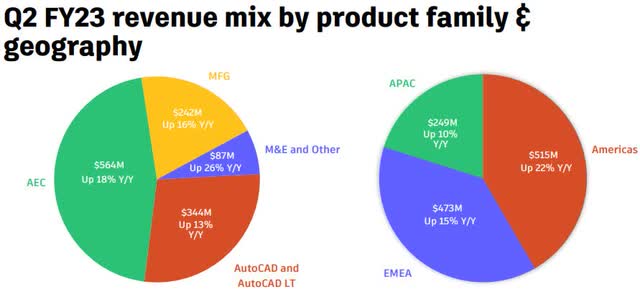

46% of Autodesk’s revenues come from its largest Architecture, Engineering and Construction (“AEC”) segment. The AEC segment comprises of the BIM 360 construction management cloud-based software, AutoCAD Civil 3D solution which is for civil engineers to do surveying, designing and analysis, and Autodesk Build, which are project management and collaboration tools used by the construction industry.

28% of Autodesk’s revenues come from AutoCAD and AutoCAD LT segment. AutoCAD is Autodesk’s flagship design tool that allows for professional design, drafting, detailing and visualization work for different applications from construction to manufacturing and civil engineering. AutoCAD LT is a software that was purpose built for professional drafting and detailing.

20% of Autodesk’s revenues come from the Manufacturing segment. This segment includes solutions like its computer-aided manufacturing (“CAM”) software used for developing leading solutions for manufacturing, Fusion 360, Inventor, and more.

Autodesk business segments (Autodesk IR)

Remaining resilient while peers’ falter

Looking into their second quarter results, while it was not a very strong beat against expectations, Autodesk actually managed to achieve a slight beat despite other software peers missing expectations for the current quarter or reducing guidance for the next.

I take the view that Autodesk has performed well against the chatter and concerns about a recession and its implications on its business. In the second quarter, we saw that Autodesk revenues grew at 17% year on year and was ahead of guidance as AEC and manufacturing revenues grew 18% and 16% year on year. For AEC, it continued to benefit from the tailwinds of digitalization as Autodesk Build increased MAUs by 45% from the prior quarter. Momentum was also strong with the manufacturing segment as Fusion 360 reached 205,000 subscribers and had its first ever $1 million deal in this quarter. Lastly, Autodesk disclosed that 7 license compliant deals over $500,000, of which 3 were over $1 million, were closed in the quarter.

As a result, I take the view that the demand momentum for Autodesk’s products and solutions remains strong as the tailwinds of digitalization continue to offset the fears of a recession. The resiliency of growth is what I look out for in this climate and Autodesk is one of the few software companies that did not mention deal slippage in their recent quarter which really showed the relative strength of Autodesk relative to its other software peers.

Guidance reiterated in an environment of lowering guidance and outlook

I think that the management’s outlook for FY2023 was rather positive against the backdrop of the overall market. FY2023 guidance was largely reiterated although there are likely some incremental FX headwinds that the business could experience.

The revenue guidance was largely the same at the mid-point and was in fact narrowed, as the third quarter revenue guidance was above the market by 2 percentage points at the mid-point of the guidance. This does imply a rather conservative fourth quarter, implying about 8% to 10% revenue growth. Billings guidance was also narrowed which implies a back end loaded seasonality impact for billings due to larger renewals in the second half.

Autodesk continues to reiterate operating margins of 36% while EPS rose slightly. Free cash flow guidance was also reiterated although management has stated earlier that there is a $5 million incremental FX impact.

Again, in the backdrop of recession fears as well as the guidance cuts by peers, Autodesk’s guidance remains to be solid relative to other software peers that have guided more softly or with outlooks that are dimmer than expected.

Strong customer demand and continued strategy improvements

At the Autodesk University Conference earlier, based on conversations with the top 25 customers of Autodesk, the demand for Autodesk remains robust and there were positive comments about the company’s offerings. However, there were some concerns about the macroeconomic environment. That said, one of Autodesk’s top customers expect to grow its number of designers by 30% this year while one of Autodesk’s resellers indicated that sales exceeded its business plan this year.

Management expects Autodesk to continue to innovate and improve their offerings. First, the company expects to use an industry cloud strategy to transition into a more common data environment that allows for better re-using and collaboration of data models. This shift to the industry cloud model is significant but it will take time in my view. In addition, Autodesk expects to improve integration with third party technologies like Rhino and EPIC games. This is positive in my view as Autodesk seems to be shifting in their mindsets from an in-house technology company to a more open platform company.

Margin expansion opportunity

As I have mentioned before, Autodesk has the opportunity to bring margin expansion on top of strong revenue growth, which will bring outsized returns to investors. With a target of double-digit revenue CAGR, this is meant to be a floor to the company’s revenue growth ambitions, with potential upside to come with execution.

The company also guides operating margins to be in the 38% to 40% range, which from the current 36% expected today. In addition, the company expects free cash flow growth to be in the double-digits, further providing a floor to its valuation with its solid free cash flow generation capability. The guidance for operating margins and free cash flow enables the management to limit their expectations for spending and investment to ensure long-term profitable and sustainable growth.

Valuation

I use a DCF method to derive my 1-year target price for Autodesk. The forecast for the company goes on until FY2026 and I applied an EV/FCF multiple of 26x in FY2026. I assume a discount rate 10% to discount to a year forward. I think that the 26x EV/FCF multiple is warranted given Autodesk’s leadership in the design software space and its continued strong revenue and profitability growth. I have embedded into my forecasts the expectations for double-digit revenue and free cash flow growth, as well as FY2026 38% operating margins.

My 1-year target price for Autodesk is $276, implying 25% upside from current levels.

Risks

Macroeconomic environment

If the macroeconomic environment were to worsen, this could cause some negative impact on the Autodesk business. In addition, higher and elevated inflation and prolonged supply chain issues could also adversely affect Autodesk business as customers struggle with operating in the difficult environment.

Slowdown in key sectors

While the demand from the company’s key customers remains strong today, there is a risk that one of the key sectors which it services may experience a slowdown in the near-term, causing potential weakness for Autodesk in the near-term. The manufacturing, engineering, architecture and construction sectors are cyclical and can experience substantial drops in revenues during an economic slowdown. As a result, these customers may reduce spend with Autodesk in the near-term if the macroeconomic environment worsens materially.

Risk to profitability and cash flows

As margin expansion is an expectation for my Autodesk forecasts and investment thesis, there is a chance that the transition to annual contracts as well as potential mergers and acquisition transactions may lead to Autodesk being unable to achieve its double-digit free cash flow growth until FY2026.

Conclusion

Autodesk looks to me to be a unique investment opportunity to invest in a company with a differentiated design software offering with continued strong growth in demand. While other software companies are seeing deal slippages and deal delays, Autodesk continues to post strong growth with a beat on revenue expectations in the recent quarter even as peer software companies see some softening. This is likely due to Autodesk’s differentiated product offering that enables it to value add to different industries and sectors while benefiting from secular tailwinds like digitalization and increasing infrastructure spending.

The company, in my view, will bring outsized returns for investors as it focuses on double-digit revenue growth, double-digit free cash flow growth and margin expansion in the next few years. I like that the demand for the company’s software and solutions remains resilient in a challenging macroeconomic environment, which shows how essential the company’s design software is to its customers. Furthermore, the outlook and guidance for the company is reiterated as management’s visibility into the business shows continued near-term momentum. My 1-year target price for Autodesk is $276, implying 25% upside from current levels.

Be the first to comment