naisupakit/iStock via Getty Images

Published on the Value Lab 11/15/22

The Direxion Daily Junior Gold Miners Index Bull (NYSEARCA:JNUG) is an ETF that tracks gold miners such that daily close prices from previous closes vary by 2x more than the underlying ETF, the MVIS Global Junior Gold Miners Index. As such, it is a more levered and aggressive play on the movements in the MVIS ETF of gold miners, which in turn move on the prospects of the price of their underlying commodity, gold. Is now the time to buy gold? It has held a certain degree of value thanks to uncertainty in markets, but rising rates have been an issue. We think rates have a way to go, and what’s more is that rates may continue a steady rise as markets get used to the status quo, and less attached to the safety of gold. We don’t think now is the best time for JNUG.

Gold Prices

Looking at the SPDR Gold Trust (GLD) we can get a read on how the price of gold has been doing.

Altogether, it has stayed resilient. This is in spite of rising rates raising the value of investing in government bonds denominated in currencies like the USD, and likely because there is latent demand from uncertainty in the markets and gold as a safe haven alternative and on the supply side the issue of declining gold reserves.

How are we seeing interest rate evolutions? The negative pressures could grow. Markets have been back speculating on gold with the recent news of an inflation slowdown in CPI figures. Inflation remains quite high, but the fact that it can go down is probably very reassuring to markets and has spurred the recent revival in stock prices.

The issue is that the Fed has been very clear on its intentions. They are fully willing to overshoot with rate increases and create a recession if it means that they can eliminate any chance of runaway inflation. The concern then comes from the Michigan inflation expectations report which came the day after and showed that inflation is expected by consumers a year from now too, which means that consumers may propagate the inflation with their decisions to negotiate higher wages or upfront spending. This is basically a surefire sign that more rate hikes will come, the question is then if they’ll at least shrink, and how the markets have priced that in.

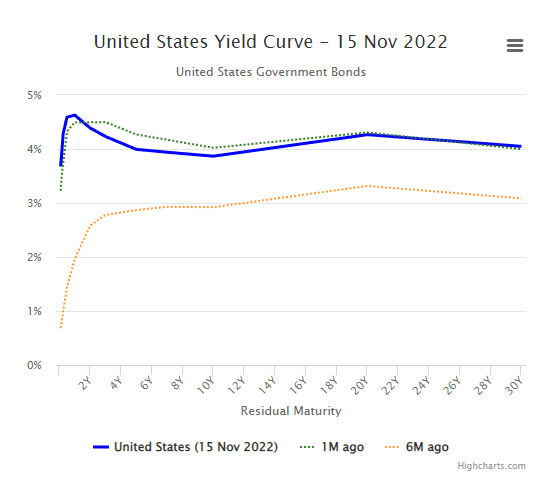

Yield Curve (worldgovernmentbonds.com)

As far as the yield curve goes, the markets are actually not pricing in any meaningful increase over the next several months that would come from even slower rate hikes, but it’s likely pricing in persisting ones to snuff the inflation embers. This signals downside to the market and similarly to gold prices, which have moved on a peak inflation expectation.

Bottom Line

The performance of JNUG has been a lot worse than that of gold, beyond the 2x aggressiveness that comes with how the ETF is structured.

This is because while gold miners depend a lot on the price of gold, which is correlated now to interest rates. It also depends on rates for financing, so higher rates have a double effect on the ETF. Therefore, a reversal in expectations as rates potentially keep rising could mean further downside to JNUG.

There is also the matter of markets adjusting to higher rate environments and getting used to the more conflict-ridden geopolitical situation. Comfort with the status quo is not good for gold’s safe haven proposition.

There is another risk that investors should be aware of. The aggressiveness of these ETFs can change. Direxion ETFs in some cases have gone from having 3x leverage to 2x leverage. It is unlikely to decline further because it would defeat the purpose of the ETF, but investors should consider that the profile of these ETFs can change, and stay updated on that in case they decide to grow the leverage in the future.

The expense ratio is over 1% for this ETF because it is quite exotic. That is another reason to be careful in committing to a gold trade with JNUG, beyond the leverage. With the balance of the arguments pointing at least to a limited upside, we think it’s not the time for JNUG.

Be the first to comment