JHVEPhoto

By The Valuentum Team

Alcoa Corporation (NYSE:AA) is the world’s leading producer of primary and fabricated aluminum and is a leading miner of bauxite and refiner of alumina. Though the company is diversified across a variety of end markets – including aerospace, automotive, and packaging – the firm is tied to the economic cycle and the volatile and unpredictable nature of aluminum prices.

For 2022, the company expects its Aluminum segment shipments and Alumina segment shipments to range between 2.5-2.6 million metric tons and 13.6-13.8 million metric tons in 2022, respectively. Bauxite shipments are expected to range between 44-45 million dry metric tons on the year. Higher costs for energy and raw materials will weigh on its aluminum and alumina operations in the current quarter, but its bauxite segment is well positioned for profit growth during the third quarter given increased refinery demand.

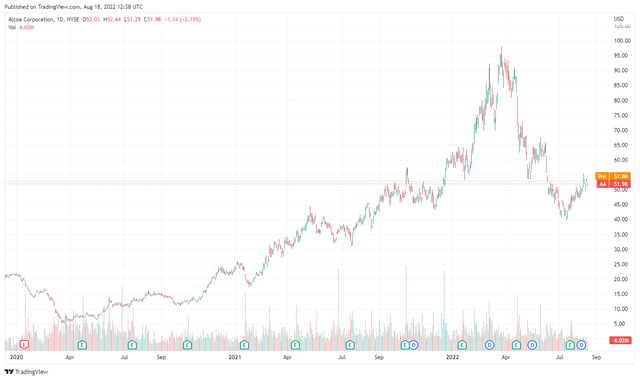

Alcoa initiated a quarterly dividend program in 2021, though the company has suspended and cut its payout numerous times in the past. Its relatively strong Dividend Cushion ratio is largely a product of its modest payout obligations. Going forward, the pace of any potential dividend increases remains to be seen, but we remain optimistic despite the inherent volatile nature of its business. Shares of Alcoa are trading about in line with our fair value estimate at this time, but what a fantastic recovery the firm has experienced since the March 2020 COVID-19 bottom! We’re keeping a close eye on shares.

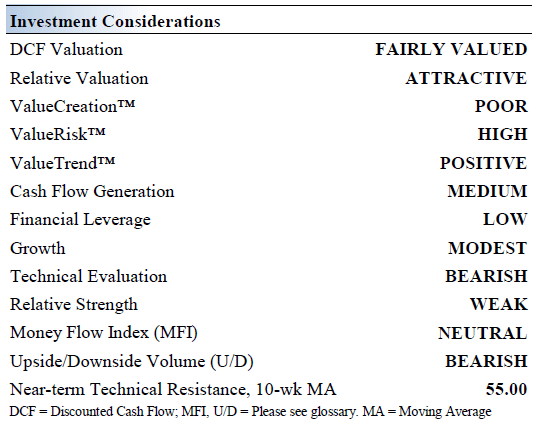

Alcoa’s Key Investment Considerations

Image Source: Valuentum

Alcoa is the world’s leading producer of primary and fabricated aluminum, as well as one of the world’s largest miners of bauxite and refiners of alumina. It also has various joint-ventures around the world. The company is diversified across a variety of end markets: aerospace, automotive, and packaging, to name a few. It was founded in 1889 and is based in New York.

Alcoa’s results can be overly exciting during economic upswings, but economic troughs – where both volume and pricing wane – are inevitable. Shares will continue to be volatile, but a renewed focus on execution should help operational flexibility.

Alcoa’s performance is tied to volatile and unpredictable aluminum prices, which are priced daily on the London Metals Exchange. The intermediary product alumina is subject to the Alumina Price Index, which can also be quite volatile. Alcoa launched a major restructuring program in 2019 to improve its profitability levels going forward.

Alcoa has a ‘first quartile cost position’ in bauxite and alumina, and a solid smelter portfolio that has great proximity to key markets. A low-cost position is the name of the game when it comes to carving out competitive advantages in the commodity business. Commodity pricing has been incredibly strong of late.

Alcoa’s long-term outlook has improved considerably in the wake of its 2019 restructuring program, which involved streamlining its organization structure and pursuing significant non-core asset sales. The firm continues to review its portfolio for potential changes.

In late July, Alcoa put up fantastic second-quarter results. In the period, revenue advanced 11% on a sequential basis thanks to higher shipment activity and increased pricing. Net income also advanced nicely, and the company’s cash flows helped fuel buybacks and dividends. The company ended the quarter with $1.6 billion in cash on hand.

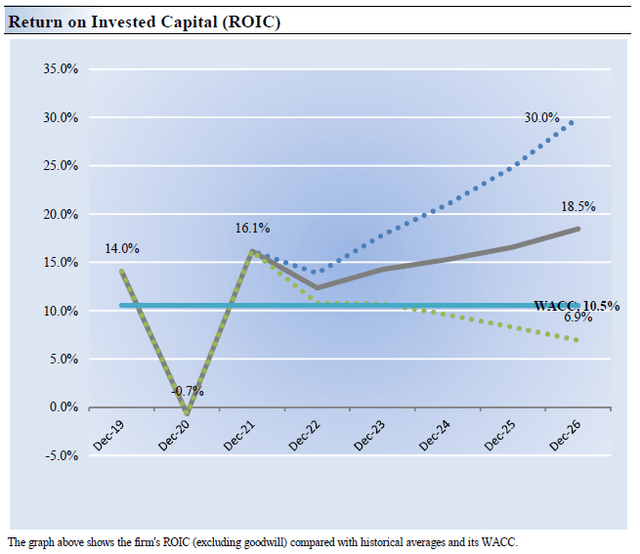

Alcoa’s Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Alcoa’s 3-year historical return on invested capital (without goodwill) is 9.8%, which is below the estimate of its cost of capital of 10.5%.

In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Though Alcoa has had some trouble driving strength in ROIC in the past, we think the firm is better positioned to generate value for shareholders going forward.

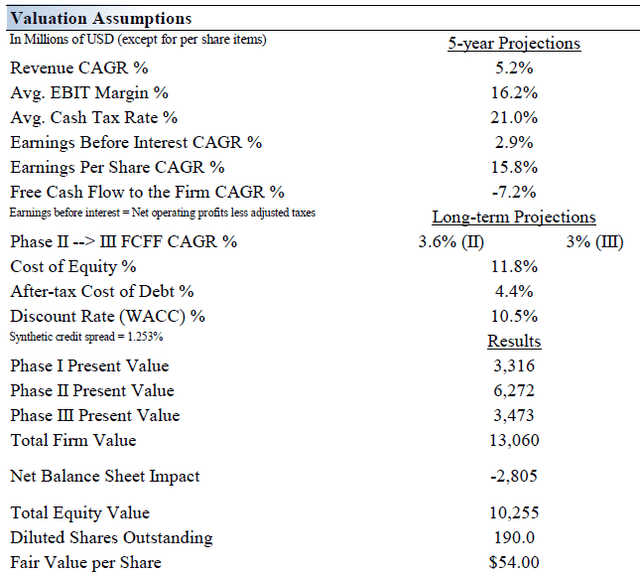

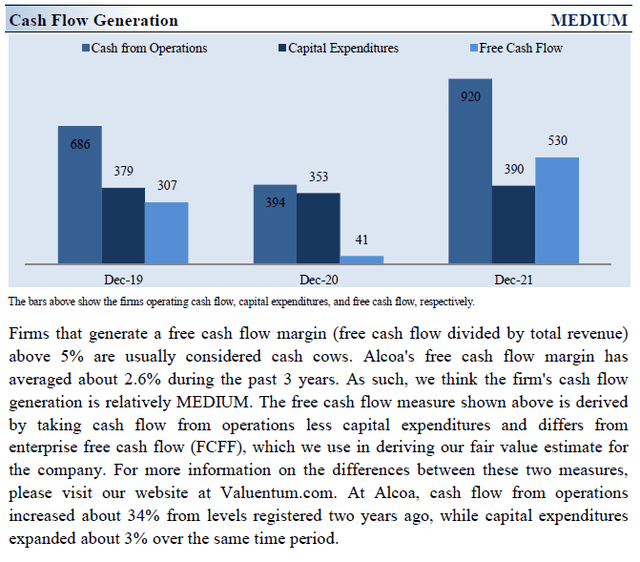

Alcoa’s Cash Flow Valuation Analysis

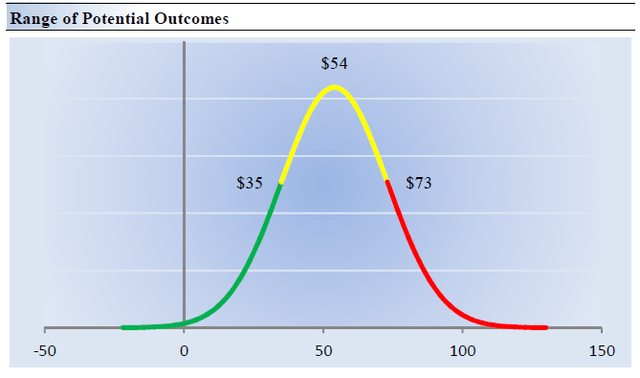

We think Alcoa is worth $54 per share at this time with a fair value range of $35.00 – $73.00. This is a rather large range, but Alcoa’s fundamentals have a wide range of outcomes, in our view, particularly in light of commodity price volatility. The margin of safety around our fair value estimate is driven by the company’s HIGH ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 5.2% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of -3.2%.

Our valuation model reflects a 5-year projected average operating margin of 16.2%, which is above Alcoa’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3.6% for the next 15 years and 3% in perpetuity. For Alcoa, we use a 10.5% weighted average cost of capital to discount future free cash flows.

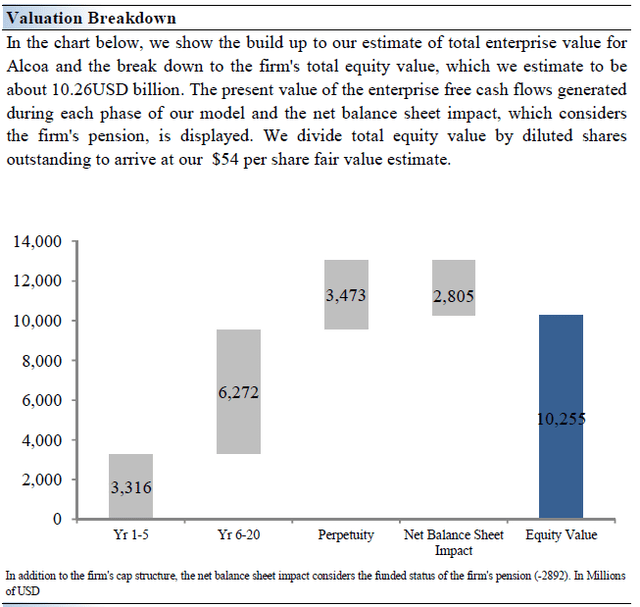

Image Source: Valuentum Image Source: Valuentum

Alcoa’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Alcoa’s fair value at about $54 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

This is an important way to view the markets as an iterative function of future expectations. As future expectations change, so should the company’s value and its stock price. Stock prices are not a function of fixed historical data but rather act in such a way to capture future expectations within the enterprise valuation construct. This is a key part of our book Value Trap: Theory of Universal Valuation.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Alcoa. We think the firm is attractive below $35 per share (the green line), but quite expensive above $73 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

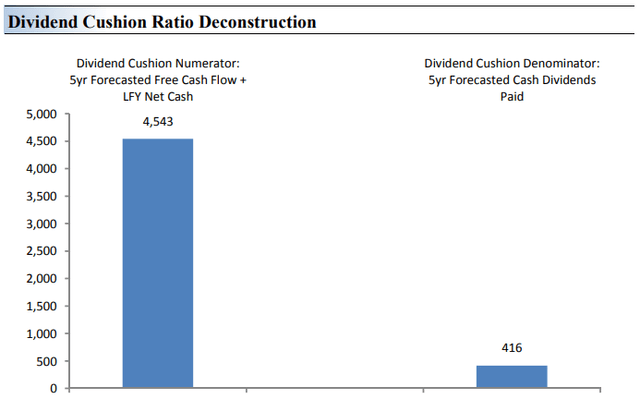

Alcoa’s Dividend Analysis

Dividend Cushion Ratio Deconstruction (Image Source: Valuentum)

The Dividend Cushion Ratio Deconstruction, shown in the image above, reveals the numerator and denominator of the Dividend Cushion ratio. At the core, the larger the numerator, or the healthier a company’s balance sheet and future free cash flow generation, relative to the denominator, or a company’s cash dividend obligations, the more durable the dividend.

In the context of the Dividend Cushion ratio, Alcoa’s numerator is larger than its denominator suggesting strong dividend coverage in the future. The Dividend Cushion Ratio Deconstruction image puts sources of free cash in the context of financial obligations next to expected cash dividend payments over the next 5 years on a side-by-side comparison. Because the Dividend Cushion ratio and many of its components are forward-looking, our dividend evaluation may change upon subsequent updates as future forecasts are altered to reflect new information.

Concluding Thoughts

Alcoa’s shares have surged since the COVID-19 panic bottom, but they have pulled back considerably in recent months. (Image Source: TradingView)

Though it is easy to get excited about Alcoa’s performance during economic upswings, the firm will inevitably be pressured during economic troughs, as was evident in 2009 when it cut its quarterly payout or in 2014 when it suspended its dividend. The company’s lackluster dividend track record and its exposure to the economic cycle indicates that its payout is not as safe as its strong Dividend Cushion ratio indicates, which is largely a product of its relatively modest payout obligations. Alcoa’s financial performance is heavily influenced by forces that the firm has little to no control over. We stand in awe of its stock price performance since the March 2020 COVID-19 bottom, but we think shares are fairly valued at the moment after its recent pullback. All things considered, however, we think Alcoa is one for the radar given substantial improvements in its business.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment