andreswd/E+ via Getty Images

BRC Identifies Drivers And Challenges

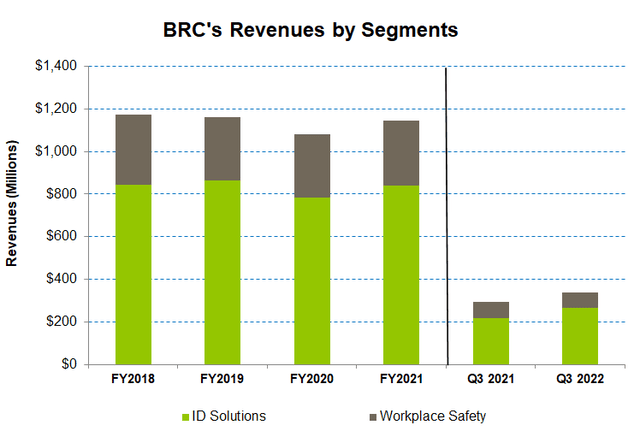

Brady Corporation (NYSE:BRC), which provides workplace safety (or WPS) and supplies identification solutions (or IDS) products, has been serving the fast-growing end markets, as I discussed in my previous article. Currently, it looks to focus on profitability and acquisitions to strengthen the long-term growth prospect. Although supply chain disruption and the inventory build-up would hurt margin expansion in the near term, it will lower costs in the medium to long term and help it outperform the competitors. Improved pricing and organic sales in Asia contributed to the sales growth in Q3.

On the other hand, a rising capex can hurt an already squeezed free cash flow in FY2022. The uncertainty over the economic indicators can also keep the topline under pressure in the short term. The stock is reasonably valued versus its peers. With steady margin drivers, low leverage, and robust liquidity, I suggest investors hold the stock at this level.

The Strategy And FY2022 Outlook

BRC, continuing with an inorganic growth strategy, scouts Southeast Asia and other markets that remain underpenetrated. The industrial track and trace are a fast-growing end market with the macro factors improving. The other leg of its strategy involves driving shareholder value through share buyback and enhancing values through investment. It uses cash to fund organic sales. Its investments include new product development and capability-enhancing and automation-focused capex.

BRC has a good track record of meeting the demand for high-quality products. It has outperformed many competitors because it stocked products sufficiently and supplied when demand rose. In 9M 2022, its revenues were up by ~16% compared to a year ago. Despite periodic lockdowns in China and the significant inflationary pressures, its focus on the faster-growing end markets is likely to pay off. So, its FY2022 earnings per share can grow by 12% to 15% over last year’s earnings.

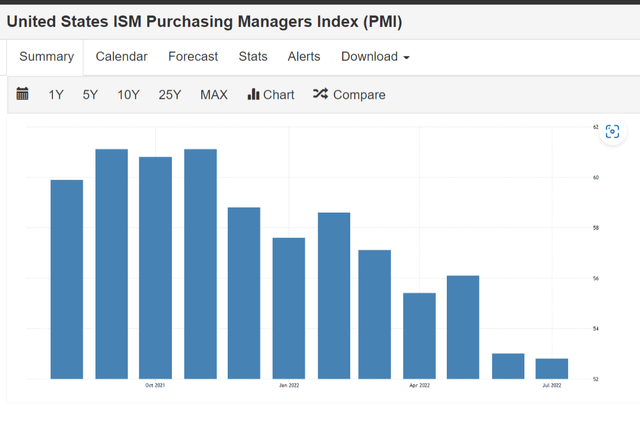

Industry Drivers Hang In Balance

The US unemployment rate declined to 3.5% in July, after steadying at 3.6% for the previous three months. This was much lower than a year ago (5.4%). The ISM Manufacturing PMI remained nearly unchanged month-over-month but lower than a year ago, which indicates a new order contraction. Supply deliveries improved, though. Compared to June, the new privately-owned housing units remained fell in July 2022. So, the effects of the current recession are circulating but not as vigorously as thought.

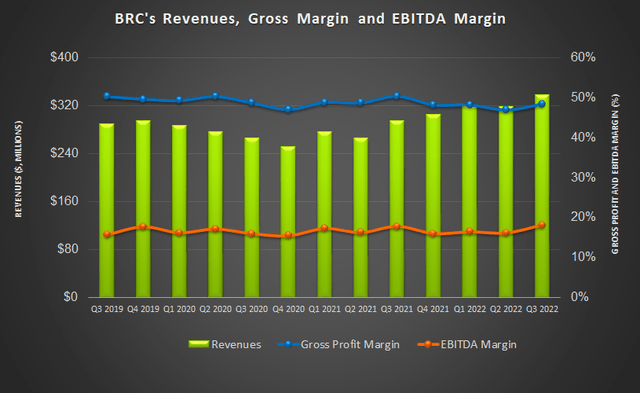

Analyzing The Q3 2022 Performance

The company’s WPS segment sales in Q3 2022 declined by 4% compared to a year ago, while the segment operating margin improved by 220 basis points. However, the ID Solutions business sales were more robust (21% up) year-over-year. Improved pricing contributed to the sales growth in Q3. Regionally, organic sales in Asia increased by “mid-single digits.” The US and EMEA regions have continued to perform well in Q3.

Year-over-year, BRC’s gross profit margin (48.4%) deflated (by 200 basis points). Inflationary pressures in many cost categories, including wages, utilities, and shipping costs, were high due to supply challenges for the critical components from Asia. Against this backdrop, BRC invested in building inventory (30% up in the past year), leading to higher air freight costs and partially offsetting the margin growth. It has recently started to build inventory by resorting to cargo containers instead of airfreight. Because the cost inflation is unlikely to cool down soon, the company may have to keep pricing elevated to mitigate the adverse effects on the margin.

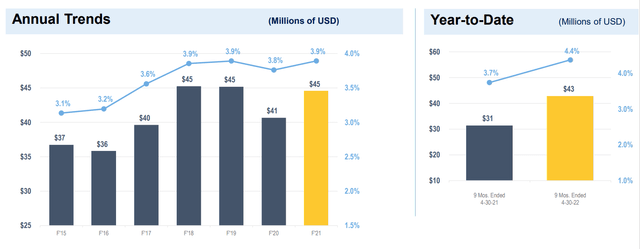

R&D Spend Is Up

BRC typically invests in industrial track and trace platforms. In Q3 2022, its R&D expenditure increased by 32% compared to a year ago. The management plans to maintain this increased level of investment. Much of its investments will flow into printers, high-quality materials, RFID scanners, and barcode scanners.

Dividend And Dividend Yield

Brady’s annual dividend is $0.90 per share, which means a 1.78% forward dividend yield. MSA Safety’s (MSA) forward dividend yield is 1.39% for a yearly dividend of $1.84.

Cash Flows And Liquidity

In 9M 2022, BRC’s cash flow from operations (or CFO) was $65 million, 58% lower than a year ago. Free cash flow (or FCF) dipped by 68% in the past year. Despite a 17% revenue rise, inventory purchases to reduce the risk of supply chain disruption led to the fall of the CFO. In FY2022, its capex can increase by 12% compared to a year ago.

The company’s debt-to-equity (0.08x) is much lower than its competitors (MSA, RRD, and DOV). Plus, with $424 million of liquidity, the financial risks are close to nil. The management believes that the stock’s valuation can potentially go up. So, in Q3, it repurchased nearly 1.4 million shares.

Linear Regression Based Forecast

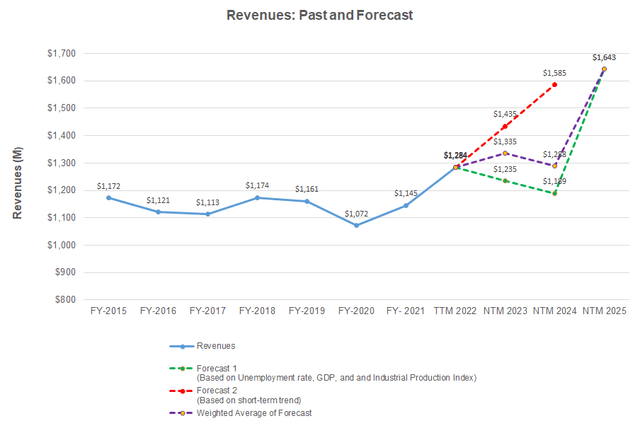

Author created, Seeking Alpha, and FRED Economic Research

In a regression equation based on the historical relationship between the US GDP, unemployment rate, Industrial Production Index, and BRC’s revenues for the past seven years and the previous four quarters, I expect revenues to increase modestly in the next 12 months (or NTM 2023). However, it can decrease in NTM 2024.

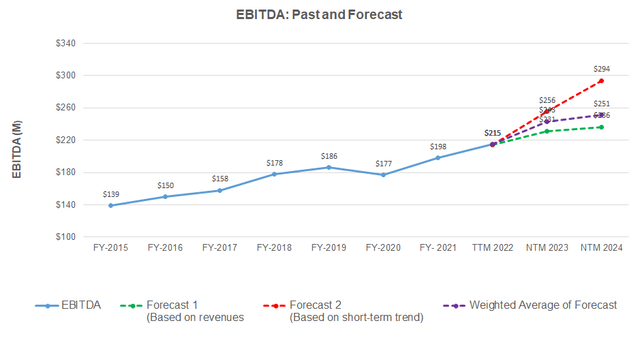

Author created and Seeking Alpha

Based on the regression model, I expect the company’s EBITDA to improve in NTM 2023, but the growth rate can decelerate in NTM 2024.

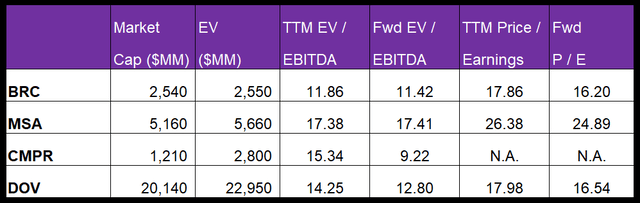

Target Price And Relative Valuation

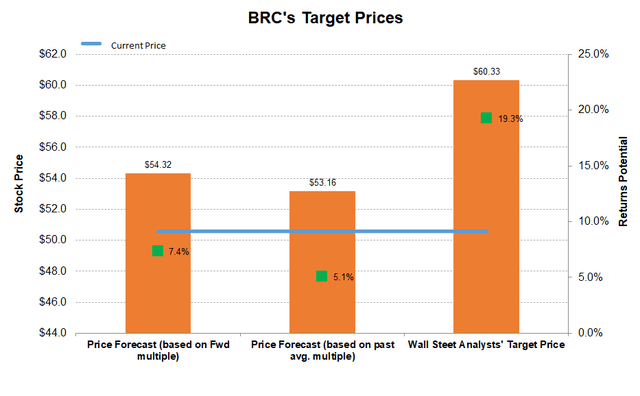

Author Created and Seeking Alpha

Returns potential using BRC’s forward multiple (11.4x) is higher (7% upside) than the returns potential using the past five-year average (5% upside). The sell-side analysts have a higher upside potential (19%) for the stock in the next year.

BRC’s forward EV-to-EBITDA, multiple contractions versus the current EV/EBITDA, suggests its EBITDA would increase less steeply than the peers (MSA, CMPR, and DOV) in the next four quarters. The company’s EV/EBITDA multiple is lower than its peers, which is justified. So, the stock is reasonably valued versus its peers.

Why I Kept My Call Unchanged?

In my previous article, I identified that BRC changed its strategy from modest organic growth to building a base exceeding GDP growth. It removed structural inefficiencies and simplified the business. I wrote:

Because BRC’s topline is unlikely to ramp up quickly, the company is removing structural inefficiencies and simplifying the business to boost its operating margin. The cost hikes due to the supply chain disruption would hold any possibility of margin expansion.

After Q3, I noticed that it focuses on profitability, acquisitions, and fast-growing end markets, including industrial track and trace in regions witnessing rapid growth. It also plans to increase shareholder returns through share buyback plans. However, the economic factors in the US are not conducive to steep growth. So, I remain conservative and maintain my “hold” rating on the stock.

What’s The Take On BRC?

In Q3, BRC made substantial strides in improving the ID Solutions sales over the past year. The Workplace Safety segment, despite a lower topline, saw a margin expansion. Inflationary pressures in many cost categories were high. So, the company mitigated it through inventory stocking and price hikes. The inventory stockpiling will lower costs in the medium to long term.

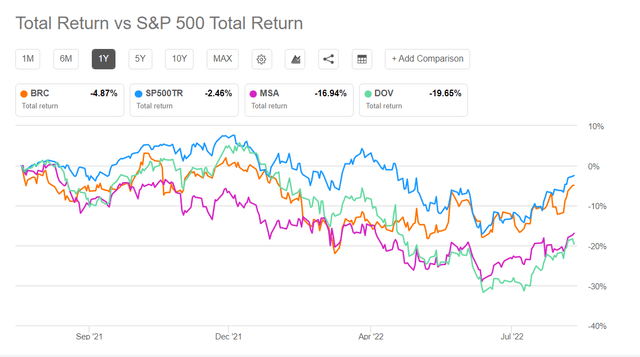

Cash flows, however, were on the receiving end of the inventory accumulation. Low cash flows and a rising capex can hurt free cash flows further in FY2022. Supply chain and raw material cost overrun will be the clear headwinds in the short term. So, the stock underperformed SPDR S&P 500 Trust ETF (SPY) in the past year. BRC has low leverage and robust liquidity. With steady margin drivers, I expect the stock to produce moderate returns that would justify my “hold” recommendation.

Be the first to comment