JHVEPhoto

In what should have been a pretty straightforward M&A transaction between an operating company and a hedge fund, the takeover of TEGNA (NYSE:TGNA) by Standard General is turning out to be anything but. We still think that based on the facts of the deal that regulators should approve it, however it seems that regulators are embracing the few objections (raised by a handful of groups) to the merger and doing everything in their power to drag the process out.

So What Is Happening?

The $5.4 billion deal, or roughly $8.6 billion when factoring in the assumption of debt, is now approaching the final innings – having just secured approval from Team Telecom and now in search of approval from the FCC. With some good news in hand, the management team at TEGNA and Standard General agreed to extend the deal termination date from Tuesday November 22, 2022 to February 22, 2023 – per an 8-K filing from TEGNA.

It is obvious that the two sides very much want to get a deal done, and the extension gives Standard General flexibility moving forward. While we would have preferred that TEGNA’s Board of Directors would have asked for some compensation for granting their approval to this change (or secured some form of a guaranteed payment to continue forward now that regulators have a hostile posture), we suppose that Standard General argued that the compensation (although not guaranteed unless the deal closes) would be covered by the “ticking fee schedule” – which pays out to shareholders at the close of the deal. The ticking fee schedule can be found below:

- $0.00167/share per day (or $0.05/month) if closed between 9 and 12 months

- $0.0025/share per day (or $0.075/month) if closed between 12 and 13 months

- $0.00333/share per day (or $0.10/month) if closed between 13 and 14 months

- $0.00417/share per day (or $0.125/month) if closed between 14 and 15 months

In addition to the ticking fee, TEGNA shareholders look like they will be able to continue to collect their dividends, which currently yield almost 2% on an annualized basis.

Regulatory Issues

Right now regulators are caught up in private equity firms having their tentacles stretching into the board rooms of multiple companies within the same industry. While that would not appear to impact this deal, it actually does due to the sale of the Texas stations to Apollo Global Management’s Cox Media Group, purchasing a Boston station from Apollo, and also getting capital from Apollo to fund the deal. With Apollo agreeing to pass on voting shares, and instead agreeing to take non-voting equity, the deal looked like it could pass the regulatory hurdle. Unfortunately it has not, and right now this seems to be a big sticking point on the regulatory side.

Also, union groups have stepped up to argue that Wall Street owners would slash jobs and attack journalism while cable companies have made the argument that the whole deal is designed to increase costs for consumers without the distributors being allowed to negotiate due to a loophole centered around what happens when a company purchases a station with a higher retransmission rate than the acquiring company (for those who do not know, the acquirer is allowed to use that price for its other contracts without having to renegotiate). With Democrat appointees controlling the next step in approval for this deal, this has turned into a perfect storm for the unions looking to avoid a further loss of jobs (and thus membership) and cable companies looking to keep costs down and avoid having to potentially raise prices on consumers (this is their argument at least).

While we believe that Standard General can agree to avoid job cuts and not mess with the editors (and by extension the journalism quality), they have failed to dispel the arguments that the Boston transaction is all about forcing higher retransmission rates on to other cable companies. Agreeing to price caps for a few years and to keep headcount stable in the journalism ranks for a few years should solve a number of the deal’s issues, but it appears that Standard General is being coy and trying to avoid tipping its hand with its plans for the impact on the entire business as it relates to the Boston transaction. It seems like a very easy agreement to make, but we do understand the company not wanting to give up the one play it had to increase revenues to help cover additional interest payments.

Agreeing to protect jobs and not raise prices until contracts are up for renewal would allow them to focus on the largest problem and figure out what the wish list from regulators is concerning the merger. Standard General requires debt to get the deal done and if they lose the Apollo funding, then getting banks to fund the entire deal would most likely be necessary. One has to believe that the banks already have losses on their current portion of the debt to be issued, but with an opportunity to increase fees and potentially the rate on the debt, there is a possibility that the banks do agree to finance this, although we would point out how much of a mess that would be to try and line up at the last minute.

Wait-And-See Game

Investors are now forced to either sell their shares and walk away (assuming they feel the merger will not close) or to hold their shares until the deal closes. While there is serious upside in the share price if Standard General closes on the deal, it appears that the dividends and ticking fees would result in at least 1% of additional income due to timing. It is certainly not a lot of additional cash, but at least investors are able to get some cash flows (via the dividends) and potential kicker (via the ticking fees) after the transaction closes for being patient.

Our Thoughts

Although our confidence in this deal closing has gone down, we still think that Standard General has multiple paths available to them for getting a deal structured in a way that appeases the regulators and allows them to close the deal in a way that takes care of TEGNA shareholders. Securing the approval from the unions appears easy enough, but the issue is how regulators view the loans from Apollo and the impact the Boston station purchase will have on pay-TV providers.

One issue facing TEGNA shareholders is that the economy has changed since this deal was announced. While TEGNA’s management team might very well be ecstatic to get a deal done, the banks most likely are not and Standard General has to be worried about the overall economy and the impact a downturn in the economy would have on the ad market (where we are already seeing weakness across various types of media companies). In short, the deal looks less attractive to Standard General, with unions arguing that job cuts should be a nonstarter, financing costs going up almost daily and the Boston station sale coming under enough scrutiny that the company may have to agree not to adjust contracts based off of that negotiated rate. Factor in when the deal was announced and one could easily argue that Standard General is paying above current market value for TEGNA.

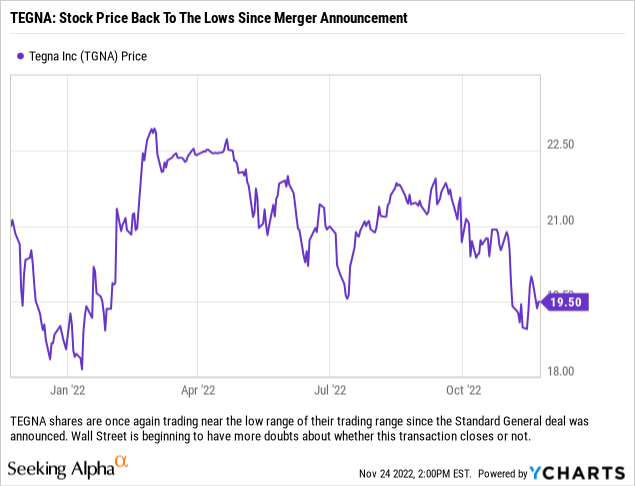

We think this is still a ‘Hold’ as there is roughly 22% upside (via capital gains) if Standard General can complete the merger, with another 1-3% in dividends and ticking fees. Right now the dividend is the only safe cash flow for investors, but we can live with 22-25% upside with this name for shares already purchased. We would not be adding exposure at this point, as the risks surrounding this merger have only increased in the last few months and make an entry at these levels tough to justify. An entry here would be high-risk with a 100% chance of a 20%+ move on news, but 50/50 on which direction that move goes. That is not compelling, in our view, and why we are holding current positions and not adding at these levels.

Be the first to comment