Vertigo3d

Thesis

We posited in our pre-earnings update that The Trade Desk, Inc. (NASDAQ:TTD) stock had bottomed out decisively in May, even as it consolidated over the next two to three months. Therefore, despite the macro headwinds impacting ad-tech players and the broad economy, we urged investors to buy TTD’s bottom.

However, we didn’t expect the post-earnings reaction to be so massive, as TTD surged more than 53% from our buy point to its post-earnings August highs. Also, it appears to be forming a potential bull trap (indicating the market denied further buying upside decisively), given the rapid buying surge.

While The Trade Desk reported a rock-solid Q2 earnings release, coupled with robust guidance, we didn’t think it justified the buying surge. As a result, TTD is back hovering in overvalued territory, and we believe it’s appropriate for investors who bought the May lows to take profits and rotate.

Therefore, we revise our rating from Buy to Sell.

Solid Q2 Earnings For The Trade Desk

We respect CEO Jeff Green and his team’s remarkable execution over the past year through some of the most challenging macro headwinds that have buffeted the ad-tech industry.

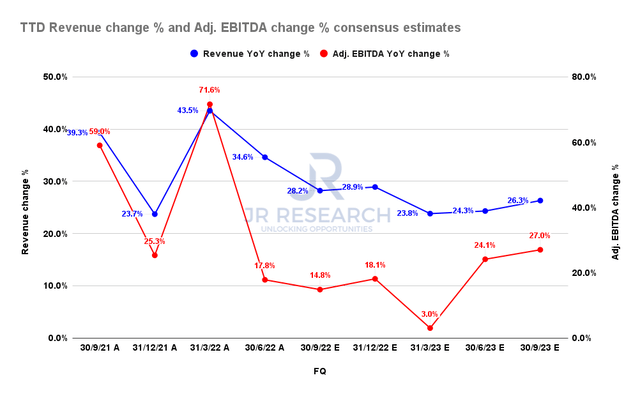

Therefore, for the company to report 35% YoY revenue growth against an ominous macro backdrop was a testament to The Trade Desk’s execution prowess under Green’s capable leadership. Furthermore, it also posted an adjusted EBITDA growth of 17.8%, well ahead of the consensus estimates of 4.5% growth. Therefore, the market rewarded investors who bought the dips in May with a massive post-earnings surge.

The Trade Desk revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The revised consensus estimates (bullish) were upgraded given the company’s robust Q3 guidance. However, estimates further out through FY23 were given a slight bump up, but not markedly enough to justify the surge in TTD stock.

Notwithstanding, we believe The Trade Desk’s Open Internet DSP strategy has been incredibly well-received by its advertising partners. It has weathered the advertising slowdown resiliently as it gained share in CTV ads, which has really propelled its growth. Therefore, we could understand why investors remain big fans of Green & co-given their strategic positioning in the CTV ad space.

Furthermore, the opportunity to work with some of the most premium CTV inventory in the market, including Disney (DIS) and Netflix (NFLX), is highly enticing. Green took the opportunity on the earnings call to discuss its longer-term opportunity with Netflix, even as it partners with Xandr (MSFT) as its SSP platform. He articulated:

The Netflix partnership with Microsoft is very positive news for the open Internet. The fact that Netflix didn’t choose Google (GOOGL) (GOOG) is very telling. Xandr is a strong sell-side partner and has been a great partner of ours for years. Once they’ve done the work on the supply side, driving as much demand as possible toward those ad impressions will come next. Over time, Netflix is very well positioned to open [its] ad inventory on the demand side to the open Internet. I think that we’re extremely likely to have a great partnership with them over the long term, but there’s a lot of stuff that has to be done in order for Netflix to be the leader in AVOD that they’ve been in SVOD. So — but I’m looking forward to it. (The Trade Desk FQ2’22 earnings call)

Watch TTD’s Valuation

We shared in our previous article that we didn’t think TTD was undervalued, as it still had an embedded growth premium. However, with the post-earnings surge, we posit that TTD has risen to the overvalued territory. Coupled with the extent and pace of its surge, we postulate that a subsequent deep pullback could set in as the market digests its unsustainable surge.

Therefore, the surge has brought TTD’s FY24 free cash flow (FCF) yield down to 2.18%, which is aggressively configured. As such, we don’t envisage a reasonable margin of safety at the current levels unless the company could guide to much better guidance from FY23 and beyond.

TTD’s Price Action Warrants Significant Caution

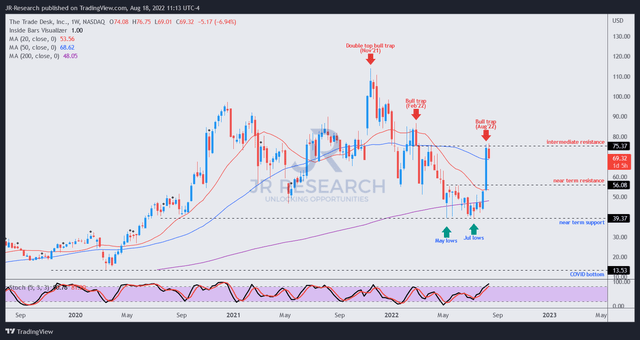

TTD price chart (weekly) (TradingView)

As seen above, TTD’s massive surge also formed a potential bull trap (pending validation) at its intermediate resistance. Therefore, we postulate that intense selling pressure could overwhelm further buying upside at the current levels, coupled with well-overbought technicals.

Hence, we urge buyers to exercise significant caution at the current levels.

Is TTD Stock A Buy, Sell, Or Hold?

We revise our rating on TTD from Buy to Sell.

We believe the rapid surge from its July lows is not sustainable and has sent TTD into well-overvalued zones. Therefore, the reward-to-risk profile is unattractive at the current levels, which is also corroborated by TTD’s price action and valuations.

As such, we urge investors who bought the lows from May to July to use the recent momentum spike to take profits and rotate to other beaten-down growth stocks.

Be the first to comment