designer491

Thesis

President Biden just signed the Inflation Reduction Act (“IRA”) into law. It is a major act that would create impacts for many of us – both in investing and beyond, and I highly encourage you to take a look and see how you might be impacted. In this article, I will focus on its potential impact on our investment decisions, especially on large corporations such as the FAAMG stocks.

The most direct ways that the IRA will impact these large-cap stocks are through the changes in the tax codes and also the 1% tax charged on share repurchases. The gist of the tax code change is a 15% minimum tax on corporate profits. The IRA will also plug some tax loopholes and enable the IRS for better enforcement. The 1% tax on stock buybacks is quite self-explaining and straightforward. As a background, overachievers like the FAAMG have created totally new business models that have generated unprecedented profits (to enable share repurchases at a sizable scale), and also at the same time new leeway to reduce their tax burdens. As a result, all of them will be impacted by the IRA in both ways. Although the mix of impacts will be different for each and every one of them.

Thus, it is the goal of this article to examine two representative examples at each extreme of the spectrum: Amazon.com, Inc. (NASDAQ:AMZN) and Microsoft Corporation (NASDAQ:MSFT). You will see in the remainder of this article detailed analyses of the impacts AMZN and MSFT are expected to feel from the IRA. And you will also see that conclusions are: A) AMZN’s impact will primarily come from the tax code changes; B) MSFT’s impact will primarily come from the 1% buyback taxes; and C) the impact on AMZN is anticipated to be much larger than that on MSFT.

Even though the analyses are specific to AMZN and MSFT, I believe the observations and methods are applicable (or easily extendable) to other large-cap stocks.

Recap of Inflation Reduction Act

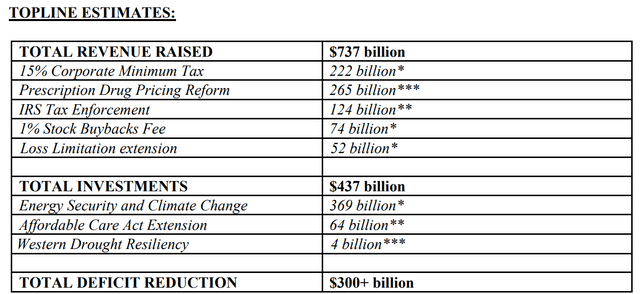

The main components of the act are summarized below. As seen, the two parts that are of direct relevance to today’s topic are the 15% Corporate Minimum Tax and the 1% Stock Buybacks Fee. The former is expected to generate an aggregated impact of $222 billion, and the latter $74 billion. For readers interested in other sectors and stocks, the largest items in the IRA would actually come from the drug pricing reform (a total of $265 billion impact) and the investments in energy security and climate change (a total of $369 billion impact). We have just written an analysis of the impact of the drug pricing reform on the healthcare sector, and our research on the energy and infrastructure sector is ongoing.

AMZN and MSFT’s past taxes

Let’s first examine the impact of the 15% minimum taxes. It is public knowledge that the wealthy has more means (and can better afford them) to reduce their tax burdens than average taxpayers like you and me. However, even among the super richest, they avoid taxes to a different degree, as I will illustrate here by the MSFT and AMZN comparison.

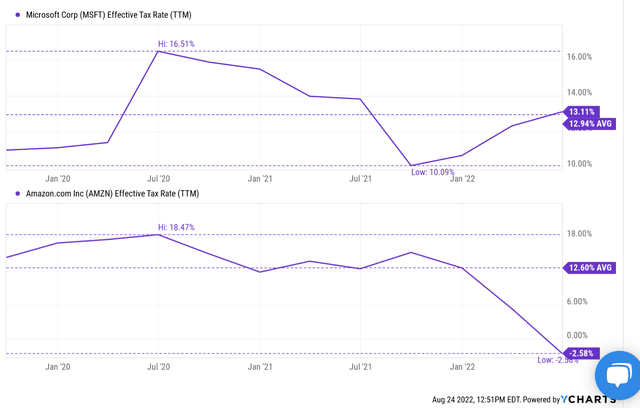

As you can see from the following chart, on the surface, both MSFT and AMZN have been paying taxes at about the same effective rates over the years. To wit, the effective tax rates for MSFT have fluctuated in the past 3 years between 10.0% and 16.5% with an average of 12.94%. And its current rate of 13.1% is on par with the average, just slightly higher. Similarly, AMZN’s effective tax rates showed some fluctuations in the past 3 years, too, and its average has been 12.6%, almost identical to MSFT’s 12.9%.

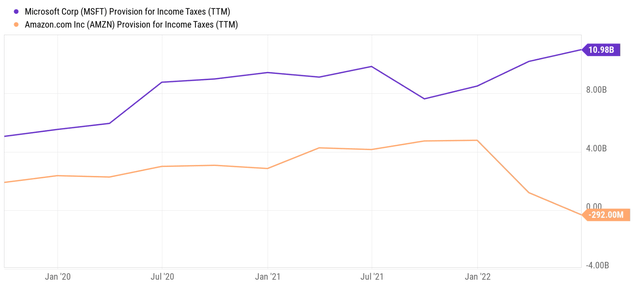

However, the above tax RATES could be misleading because different companies have different deductions and exemptions available to them and/or apply these deductions with different degrees of aggressiveness. As a result, a large amount of earnings could be deducted, and the total amount of taxes could be reduced even when the tax rates are the same. As you can see from the next chart below, in terms of the absolute dollar amount of their taxes, MSFT has been paying on average more than 2x than AMZN over the recent few years. Take 2021 as a specific example. MSFT paid a total of $9.8B for its taxes and AMZN paid a total of $2.8B, less than 1/3 of that MSFT paid. However, MSFT and AMZN had about the same amount of operating cash flow that year ($76B for MSFT and $66B for AMZN).

Based on this, we will estimate the tax impact on AMZN from the IRA next.

AMZN’s future taxes

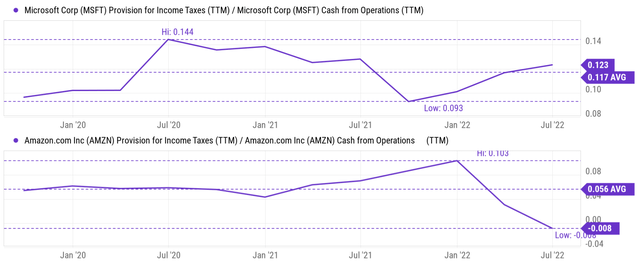

I am not going to pretend to be an expert on high-profile corporate taxes. But based on the analyses above, I am quite confident that AMZN will feel more impact on the tax code changes than MSFT. To put the above numbers under perspective, the next chart shows their taxes as a fraction of their operating cash flow (which is harder to hide than earnings). And you can clearly see that AMZN’s taxes have been on average 5.6% of its operating cash flow, only about ½ of what MSFT has been paying on average (about 11.7%).

Since I am not an expert, let me rely on the estimate from people with more expertise here. According to this ITEP estimate, if AMZN had paid the statutory tax rate of 21% in 2021 without any tax breaks, its total taxes would have been ~$7.3 billion instead of the $2.8 billion we just mentioned.

So going forward, assuming the IRA has removed the loopholes so AMZN would have to pay the 21% statutory tax rate, then AMZN’s taxes would increase by about $4.5B for a year like 2021. Even if it only pays a tax rate of 15% (the minimum required by the IRA), its taxes would be about $5.7B, an increase of about $2.9B before the IRA.

To put an increased tax provision of $2.9B to $4.5B into perspective, AMZN’s net earnings have been about $60B to $70B in recent years. So the additional taxes would reduce its earnings by about 4% to 6%, not a life-or-death difference, but not negligible either.

And next, we will see this impact is much larger than the impact I anticipate for MSFT.

1% share repurchase tax

Unlike AMZN, the IRA’s impact on MSFT would mostly come from the 1% repurchase tax. Firstly, MSFT has been paying a lot more taxes than AMZN already before the IRA so the IRA impact on this front would be a lot smaller. And secondly, MSFT has been buying buy its own share much more aggressively than AMZN as you can see from the following chart.

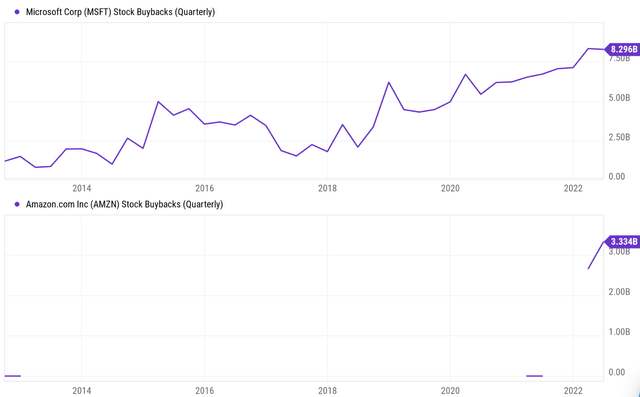

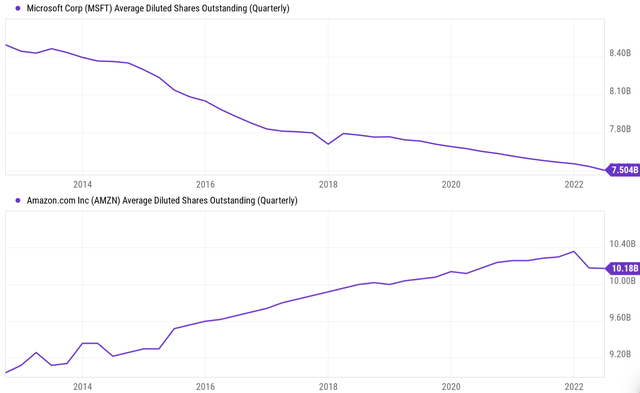

In FY 2022 alone, MSFT spent $32.1 billion on share repurchases. As you can see from the top panel of the following chart, it has already been spending about $2.5B on average per quarter on share repurchases between 2012 and 2018. And the amount has steadily grown to the $8.3B it spent last quarter. In contrast, AMZN has been doing the opposite (i.e., issuing new shares) for the most part in the past decade and only started repurchasing its shares recently. And the amount of the repurchase ($3.3B) is only a fraction of what MSFT spends.

You can also clearly see the differences in the total number of shares outstanding for both of them. As shown in the second chart below, the number of outstanding shares for Microsoft has been steadily declining over the past decade. Its share count has declined from over 8.4 billion shares in 2012 to the current 7.5 billion shares, a decline of more than 10%. In contrast, the share count for Amazon has been steadily expanding. It increased from about 9.1 billion shares in 2012 to the current 10.2 billion shares, a dilution of about 12%.

And next, we will see how the 1% buyback tax can impact MSFT.

1% share repurchase tax impact on MSFT

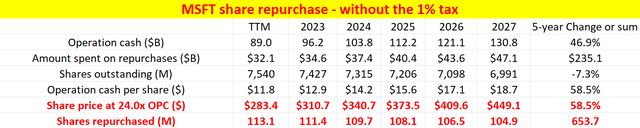

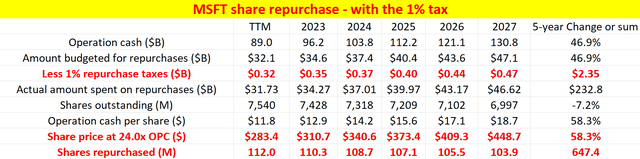

The following two tables provide an assessment of the impact by projecting MSFT share repurchases in the next five with and without the 1% share repurchase taxes.

Both projections are made under the same assumptions and the only difference is the 1% tax on the amount spent on the repurchases. These assumptions have been detailed in my earlier article and a brief summary is provided here for ease of reference:

- Firstly, it assumes that MSFT spends a fixed percentage of its operating cash flow on share repurchases. The percentage is taken to be 36%, consistent with the average in recent years. It spent 36.7% of its operating cash in FY 2022 on share repurchases, and 36.0% in FY 2021.

- Secondly, it assumes that MSFT’s profits grow at an 8% CAGR according. The consensus estimates project about 10% CAGR in the next 5 years. I will 8% to be on the conservative side.

- And finally, it assumes that MSFT’s valuation is maintained at 24x of its operating cash, which is its current valuation. To me, a multiple of 24x operating cash is a bit on the expensive side and I will address this in the risk section. But I suppose part of the risk is canceled off in this projection because by assuming a higher multiple, the potency of share repurchases is also reduced.

Based on these assumptions, you can see that MSFT is projected to spend a total of $235B on share repurchases in the next 5 years. And it will need to pay a total of $2.35B of taxes for these repurchases – a much smaller impact than the tax headwinds estimated for AMZN above (about $2.9B to $4.5B per year for a year like 2021).

Also, you can see that without the 1% buyback taxes, MSFT is projected to reduce its total share count by another 7.3% in the next 5 years. And with the 1% buyback taxes, the percentage is only slightly lower, at 7.2%. In terms of the total number of shares repurchased, it is projected to repurchase a total of 653.7 million shares without the 1% buyback tax and 647.4 million shares with it. Finally, due to the fewer numbers of shares repurchased, its share price is also projected to be a bit lower with the 1% buyback tax, but not by that much.

Final thoughts and other risks

To summarize, the goal of this article is to illustrate the potential impact of the IRA by examining two representative examples: AMZN and MSFT. The former is expected to see its impact primarily from the 15% minimum tax rates and removal of deduction loopholes. And the impact is estimated to be about 4% to 6% for a year like 2021. And the latter is expected to see the impact primarily come from the 1% buyback taxes. Furthermore, the 1% buyback impacts are relatively minor and would only cause minimal impact on MSFT based on my projections (about $2.35B of total impact distributed over the next 5 years). I believe the observations are applicable to other large caps that aggressively buy back their shares such as Apple.

Finally, risks. As aforementioned, MSFT faces a valuation risk. Its current valuation (about 24x of its operating cash) is on the expensive side and could suffer large corrections. In the near term, its Activision Blizzard deal also adds some uncertainties. It is the largest acquisition in Microsoft’s history and the upside is obvious – if approved. But if not, it could trigger a shift in sentiment and also its stock prices. For AMZN, it faces valuation risks too as detailed in our earlier articles. Furthermore, the free cash flow has kept deteriorating in recent quarters and the business is bleeding a sizable amount of cash per quarter now. The tax codes change, combined with its capital requirements to keep growing its AWS, could further exacerbate its cash flow problems.

Be the first to comment