naphtalina/iStock via Getty Images

There has been a lot of talk about the U.S. Department of Defense recently awarding billions of dollars of contracts to hyperscalers Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (AMZN), Google (GOOG), and even Oracle (ORCL). The name of International Business Machines Corporation (NYSE:IBM), or Big Blue, is not part of the list. However, as this thesis will show, the company is repositioning itself in IT consulting by taking advantage of its expertise both in hybrid cloud and AI.

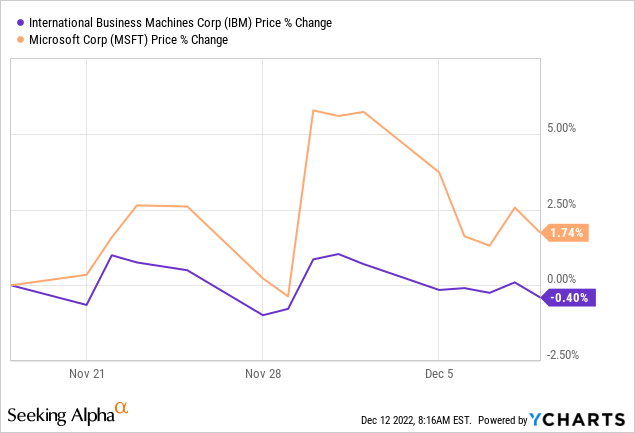

The main objective is to compare its inorganic growth strategy with software giant Microsoft, whose intended acquisition of gaming play Activision Blizzard, Inc. (ATVI) and winning of the above-mentioned contract have partly contributed to its stock outperforming in the last three weeks, as shown below.

However, in light of the Federal Reserve continuing to tighten monetary policy into 2023, investors are wrong to give more weight to catchy headlines as it is no longer business as usual.

Comparing the Inorganic Growth Strategy

First, a look at Microsoft through its most recent acquisition attempt reveals that the business model which consists of acquiring big companies to rapidly gain market share in the hope that regulators will give the go-ahead has remained more or less the same. However, this time around, despite the software giant providing clarifications about the deal in advance, the Federal Trade Commission has filed suit to block the acquisition, in what SA terms as the “biggest regulatory threat to Microsoft in 20 years.”

Now, twenty years back, the 2001-2002 period was marked by recession, and one of the solutions to kick start economic growth was the easing of monetary policy, just like in the aftermath of the Great Recession of 2008-2009 and the Covid freeze of 2020. The Fed’s keeping rates low for a long time resulted in expansionary monetary policy also termed “cheap money” and triggered more deals even if valuations (the costs of acquiring) were sky-high. In sharp contrast, M&A activities have been subdued in the first part of this year despite tech valuations going down as the NASDAQ has fallen by 29%.

Therefore, acquirers seem to be facing more problems in raising capital as the inverse of monetary expansion is happening today with the Federal Reserve remaining hawkish in its fight against inflation. Also, since corporations have to pay more to retain talent, regulators are aware that they cannot just allow cash-rich conglomerates to buy out the competition, at the expense of small players.

Therefore, in these circumstances, instead of a growth strategy driven by large acquisitions to rapidly grow market share, it is better to focus on one where there are incremental buyouts while at the same time taking advantage of existing poles of expertise to create a “multiplier effect.” This is what IBM has done, namely by repositioning its global business services into IBM consulting in October last year as shown below.

Contrasting IBM”s Consultancy with Microsoft’s Acquisition approach (www.ibm.com)

Thinking aloud, converting to the consultancy business has been traditionally more difficult for IT companies, especially those tied to a brand like IBM, which sells servers and its own cloud infrastructure. The reason is that being tied to a particular brand name goes against the concept of “technology independence,” which is so important for consultants when having to advise customers on what to choose or where to migrate their data to.

Comparing Cash Generation

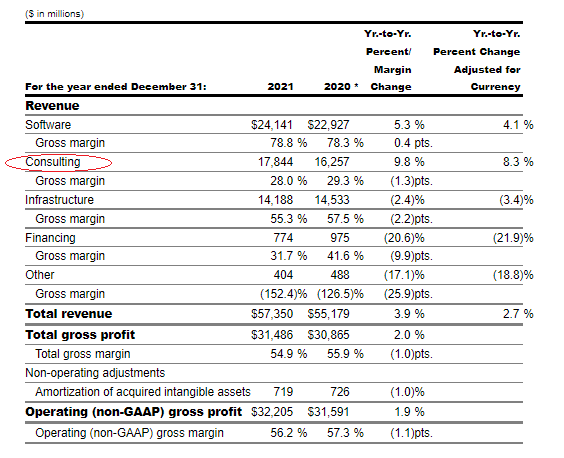

In this respect, the 5% or 16% in constant currency year-on-year growth for its consulting business for the quarter which ended September 2022 shows that IBM’s consultants are in high demand. For the last fiscal year (or 2021), consultancy grew by 9.8% compared to 2020 and generated $17.8 billion and was also the fastest-growing segment in front of software which grew by 5.3%.

SEC Filing (seekingalpha.com)

As can also be seen above, the Infrastructure segment regressed by 2.4% on an annual basis. In a way, this regression when viewed in the context of the progression of the consultancy business shows that IBM’s consultants are not overly skewed toward the company’s products.

Along the same lines, the acquisition of Neudesic, a cloud services consultancy specializing in Microsoft’s Azure cloud platform also shows this intent of being “product neutral.” Furthermore, capacity building in consulting also saw IBM acquiring another 13 companies since April 2020.

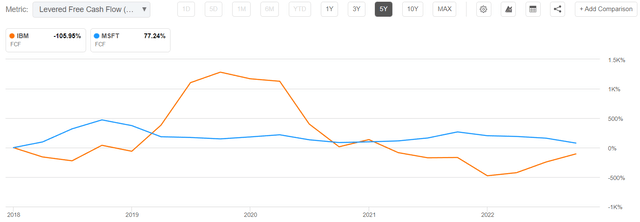

Viewed from the cash utilization perspective, this incremental acquisition strategy has resulted in its levered free cash flow progressing in 2022 as shown by the orange chart below, compared to a regression for Microsoft.

Comparison of Performance (www.seekingalpha.com)

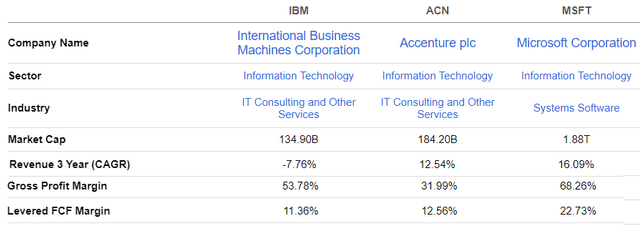

However, investors will note that Microsoft is growing faster (as per the table below) and has better profitability metrics including the levered free cash flow margin, obtained after dividing FCF by total revenues.

Thus, the software giant is highly profitable and should continue to grow its Azure cloud. However, competition remains tough and after the Covid-induced digital transformation where many companies had no choice but to migrate their service to the cloud rapidly in order to stay operational, there are signs of weakening demand as economic slowdown looms. Along the same lines, international expansion is a less profitable alternative as the strong greenback constitutes headwinds as the Fed continues to increase interest rates.

Now, with the U.S. central bank tightening aggressively and putting an end to the era of cheap money, there are increasing risks of liquidity problems occurring in 2023, unless there is a reversal in monetary policy. This is the reason why, in absence of Activision-driven growth, Microsoft’s FCF could continue on its downtrend while IBM’s portfolio mix has allowed for solid cash generation in the first three quarters of the year.

Comparison of Metrics (www.seekingalpha.com)

Now, for those wondering why I have added Accenture plc (ACN) to the above comparison, it happens to be one of the world’s largest consulting companies. Here, its gross margin of 31.99% is only about 1.7% higher than IBM’s 29.3% despite the fact that it is in the game for a much longer period and derived $61.6 billion of sales from consultancy in fiscal 2021 compared to $17.8 billion for big blue.

The Consulting Multiplier, Inflationary Pressures, and Valuations

Therefore, IBM is delivering its consulting operations more effectively in a marketplace driven by the need for digital transformation, cloud readiness, and application operations. Pursuing on a cautionary tone, since consulting is a labor-intensive business, the company has suffered from a highly inflationary environment throughout 2022, with gross margins falling by nearly 1% in Q3 compared to the same period in 2021. Still, operating margins progressed by 0.74%, which the executives attribute to a “more effective and aligned streamlined go-to-market model” made possible by the Kyndryl Holdings (KD) separation earlier this year.

They also talk about consulting driving a multiplier effect, as it helps to generate more business for IBM’s hybrid cloud platform. In this respect, the acquisition of Octo, a digital transformation services provider not only brings more government business but along with 1500 employees, is an alternative to tapping the tight labor market and onboarding more consulting talent.

Consequently, IBM’s growth strategy is better for the current corporate environment, where, faced with uncertainty about the economy and high wage inflation, enterprises are reducing IT spending while, on the other hand, the government has a budget of $65 billion devoted to modernization and cybersecurity, just for 2023.

This strategy also entails relatively lower cash spend than incurred in large deals which are more likely to be heavily scrutinized by regulators on anti-trust grounds. Interestingly, while Microsoft plans to spend $68.7 billion on Activision, IBM spent only $1 billion on acquisitions in the first three quarters of 2022, which were more than offset by proceeds from divested businesses.

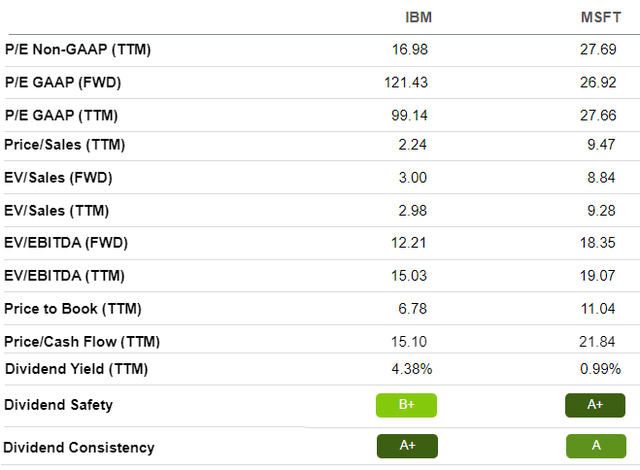

Moreover, the company generated $4.1 billion of cash in the first three quarters, or more than $900 million year-on-year, which is important for a company that pays dividends with a 4.4% yield compared to 1% for Microsoft (table below). Now, the software giant may enjoy better growth or profitability which justifies its higher valuations based on related metrics, but ultimately, it is cash generation both for paying debts and dividends that counts, when considering that 98% of Chief Executive Officers are predicting a recession in 2023.

Comparison of metrics (seekingalpha.com)

This is the reason why I consider the trailing Price-to-Cash flow multiple to better reflects IBM’s improving figures, and, based on Microsoft’s multiple of 21.84x, I obtain a target of $217 ((21.84/15.1)x150) for IBM based on the current share price of $150. This target is way above Wall Street’s forecast of $141. Instead, analysts are strongly bullish on Microsoft, but this rating is not appropriate given Microsoft’s growth strategy not being aligned to monetary conditions in 2023 as I have explained throughout this thesis.

Concluding with Microsoft’s “Big Bang” Vs IBM’s Incremental Approach

This thesis has shown that IBM’s growth strategy consisting of incremental acquisition to build up its consultancy which will eventually also reverberate across its infrastructure segment makes more sense than Microsoft’s “big bang” approach which is fraught with regulatory risks. Big Blue, whose largest acquisition was Red Hat for $34 billion in 2019, also has a more appropriate approach when it comes to cash usage, especially in a period where money is becoming more expensive. This means that in contrast to what is shown in the above table for “dividend safety,” IBM has a better chance to offer safer dividends in 2022.

Finally, in what is likely going to be a tougher year for IT, 2022 should see more CEOs becoming risk-averse and dedicating more time to evaluating projects for priorities and compliance before committing multi-million dollar decisions to Azure and other clouds. It is precisely here that IBM’s consultancy services should get more traction, and even reach an inflection point in terms of adoption. For this purpose, in addition to its own infrastructure, the company has formed close partnerships with Microsoft, Amazon, and Google.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment