Chris Hondros

JPMorgan Chase (NYSE:JPM) recently reported its second quarter earnings that released lots of negative data. The bank missed on revenue and EPS estimates due to much lower fees from investment banking and higher provisions for credit losses. This reaffirms that bank’s negative outlook for the economy and possibility of future loan losses. It also suspended its share buyback program and left its dividend unchanged to build its capital buffer after the recent stress test results. With the likelihood investment banking is going to suffer into the continued future, many investors who want to jump into the financial sector may be looking to banks with less of a focus on this segment. Therefore, JPM stock may not be the best pick for many individuals.

JPMorgan Chase Missed Q2 Earnings Estimates and Profit Fell Heavily

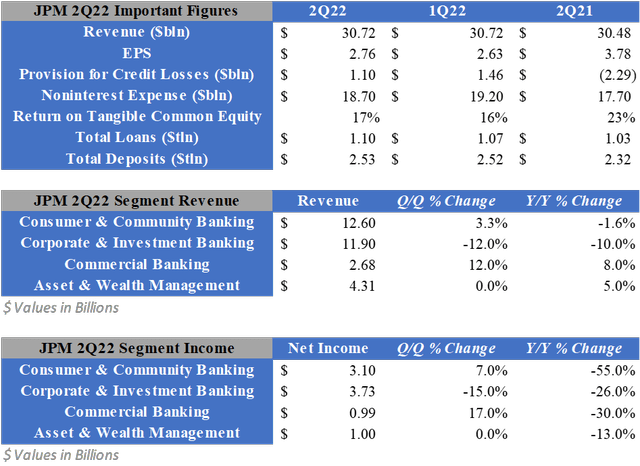

JPM reported its second quarter earnings before the market opened on July 14 and was mainly negative. The bank reported a net revenue of $30.72 billion which is up about 0.7% Y/Y but still missed analyst estimates by $1.12 billion. It also missed on earnings as EPS came in at $2.76, down 27% Y/Y and missing estimates by $0.13. Noninterest expenses increased by 6% Y/Y due to investments into technology, marketing, and compensation. However, it did drop since last quarter. The final key pieces of data in the report are total loans and deposits rising by 7% and 9% Y/Y, respectively.

JPM 2Q22 Key Data (Created by Author)

To further understand why JPM’s financials came in below expectations, we can look at how each of its segments performed. The first is Consumer & Community Banking which decreased its Y/Y revenue by 1.6% but has grown since last quarter by 3.3%. Spending on credit cards rose 21% Y/Y and 15% Q/Q, but the fees collected have fallen. Furthermore, loans on big ticket items have been slowing down with mortgage originations dropping 45% and auto loans and leases dropping 44% Y/Y. On the bright side, consumer and business banking net revenue was up 9% Y/Y due to growth in deposits. This growth allowed the segment’s net income to increase by 7% Q/Q, however its earnings fell by 55% Y/Y due to the provision for credit losses increasing from -$1.87 billion to $761 million.

The Corporate & Investment Banking segment saw revenue declines on a quarterly and annual basis. The segment generated $11.9 billion in revenue in the second quarter, down 12% Q/Q and 10% Y/Y. This is primarily due to revenue from investment banking fees dropping 61%. On the other hand, the bank’s revenue from trading fees was $8.72 billion, up 8% Y/Y. This is due to markets, fixed income, and equity markets all generating 15% higher revenue since last year. The overall decline in revenue also caused the segment’s net income to fall 15% Q/Q and 26% Y/Y.

The Commercial Banking segment generated higher revenue compared to last quarter and the year prior. It achieved a revenue of $2.68 billion which is an increase of 12% Q/Q and 8% Y/Y. This is mainly due to higher deposit margins and caused the segment to achieve a net income of $994 million, higher by 17% Q/Q but lower by 30% Y/Y due to higher credit loss provisions.

Finally, Asset & Wealth Management’s revenue was flat Q/Q and increased by 5% Y/Y. This is due to higher deposits and loans being offset by lower performance fees. The segment’s net income was also flat Q/Q but dropped 13% Y/Y due to higher credit losses.

As for general and aggregate data, total loans increased by 9% and allowed for higher profits due to the Federal Reserve’s previous rate hikes. JPM’s net interest margin is now 1.80%, up from 1.67% previously. Also, the bank reported total credit losses of $1.1 billion, comprised of a $428 million net reserve buildup and $657 million in net charge-offs. The buildup is due to its pessimistic view of the U.S. economy and possible deterioration of loans.

Despite this poor quarter, JPM rose or restated previous guidance. The bank now expects FY22 net interest income to be at least $58 billion, up from previous estimates of at least $53 billion. Its outlooks for noninterest expenses of about $77 billion and card net charge-off rate to be less than 2% were restated.

JPM Suspended Its Buyback Program to Build Its Buffer

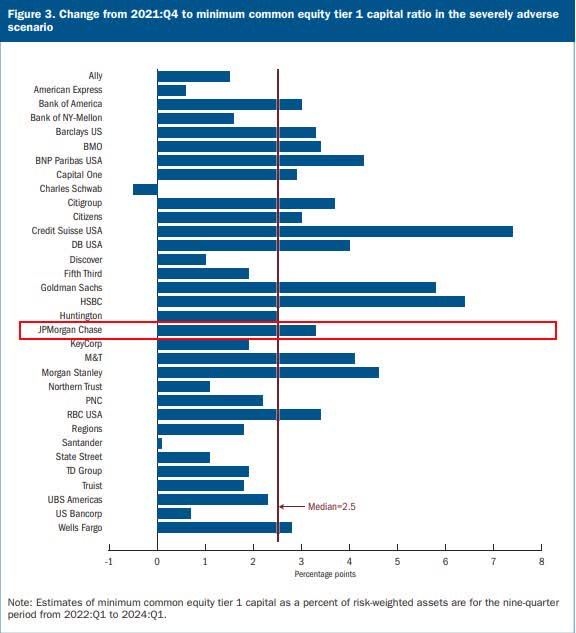

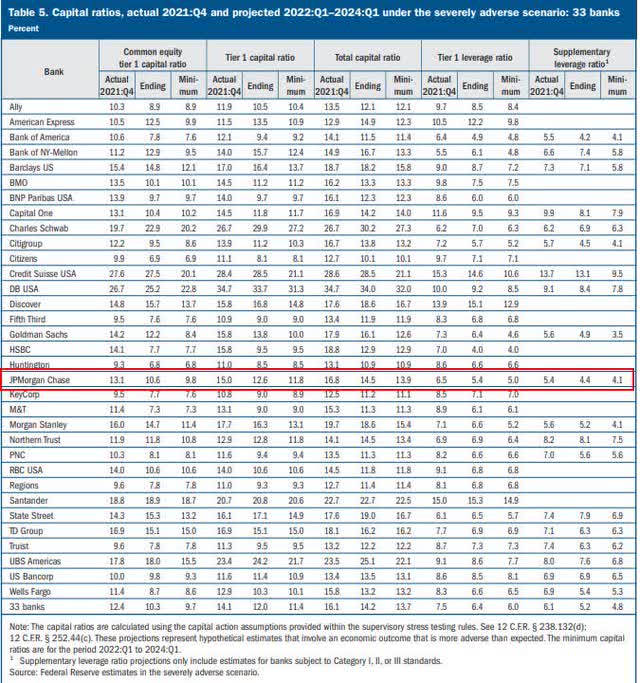

A concerning part of the most recent earnings report is the decision for JPM to suspend its share buyback program. This is being done so the bank can quickly meet its new requirements after the recent data from the stress test. JPM’s Stress Capital Buffer, SCB, is raising from 3.2% to 4.0%. Its Standardized Common Equity Tier 1 ratio requirement is also raising from 11.2% to 12%.

2022 Stress Test Results (Federal Reserve)

2022 Stress Test Results (Federal Reserve)

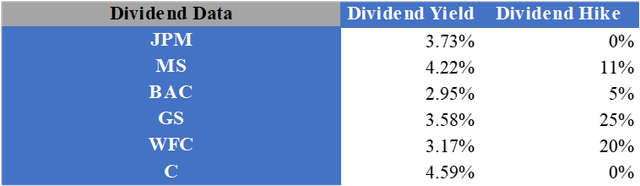

Along with suspending its share buyback program, JPM also underperformed its peers when it comes to dividend hikes. After the stress test results, four big banks increased their dividends. This includes Morgan Stanley (MS), Bank of America (BAC), Goldman Sachs (GS), and Wells Fargo (WFC). However, JPM and Citigroup (C) left their dividends unchanged. Since many investors look to JPM because it has a great dividend, its competitors’ hikes are making their stocks relatively more competitive. Although Citigroup also did not raise its dividend, it already has a significantly higher dividend yield than JPM and trades at much lower multiples.

Big Banks Dividend Data (Created by Author)

What Could All of This Mean for Banks?

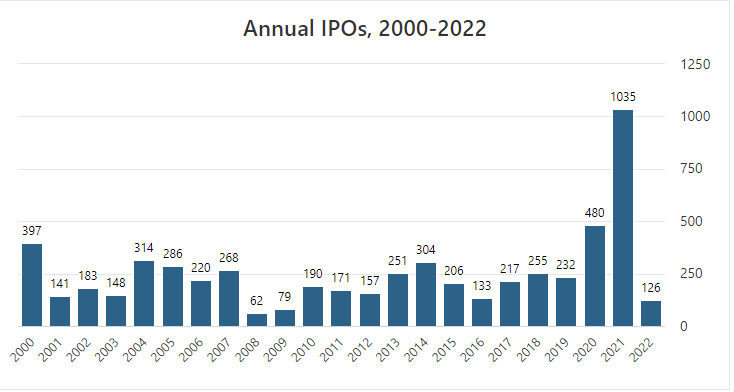

Due to rising rates and inflation causing a bear market, many investors already expected JPM’s investment banking division to underperform. This is because less companies seek to make huge deals or go public during times of uncertainty. Since 2000, there have been about 5,879 IPOs and about 17.6% of those occurred in 2021. Conversely, the worst year was 2008 during the Great Recession when only 62 companies went public. This large number of big deals in 2021 caused large investment banks, like JPM, to have great business in 2021 which is now cooling off drastically.

IPO Data, 2000-2022 (StockAnalysis.com)

Now, commercial banks are starting to become an attractive segment due to its outperformance among others. Therefore, investors who want to dive into the financial sector may want to look into banks that focus heavily on this segment and not on investment banking.

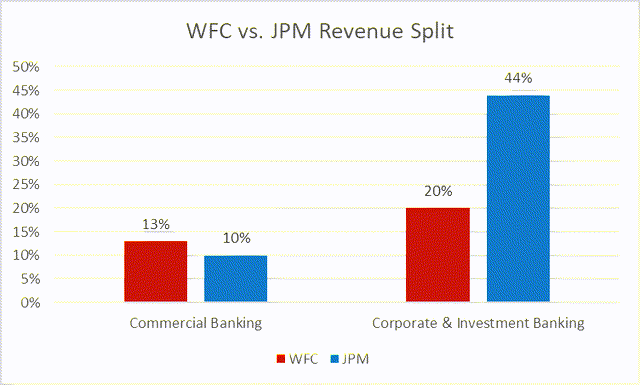

This could mean to focus on other banks like Wells Fargo, which reports earnings on July 15. In the first quarter of 2022, 13% of Wells Fargo’s revenue was derived from commercial banking while only 20% was derived from investment banking. On the other hand, only 10% of JPM’s revenue was generated through commercial banking while 44% was generated through investment banking in the first quarter. With deposits on the rise and margins increasing, Wells Fargo’s smaller focus on investment banking may be beneficial.

WFC vs. JPM Revenue Split (Created by Author)

JPM Stock Valuation

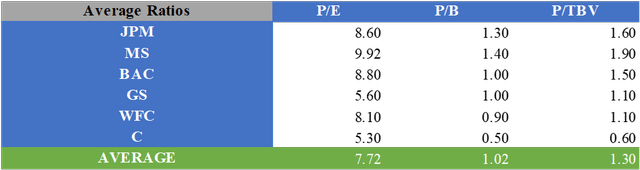

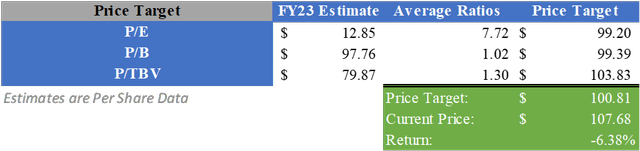

Although JPM often trades at higher multiples than its competitors, I think it is important to have a conservative valuation especially due to uncertainties regarding investment banking in the future. Therefore, a relative valuation can be calculated by using the average valuation multiples of JPM with its competitors. By multiplying the average multiples for P/E, P/B, and P/TBV of JPM and its peers by consensus analyst estimates for FY23, a price target of $100.81 can be calculated. This implies a downside of about 6.38%.

Average Multiples of Banks (Created by Author)

Relative Valuation of JPM Stock (Created by Author)

What Does This Mean for Investors?

JPM recently reported its financial data for the second quarter of 2022 and was overall negative. The bank missed on revenue and EPS estimates due to drastically lower investment banking revenue and much higher provisions for credit losses. This further reinforces the bank’s pessimistic view on the U.S. economy and preparation for losses in the future. It also suspended its share buyback program because it needs to raise capital to meet requirements from the recent Stress Test. However, many other banks raised their dividends and buyback programs to become more competitive to JPM’s attractive payout. With investment banking likely having a rough future, investors may look to banks with a lower focus on the segment and a stronger focus on better performing segments such as commercial banking. This could cause Wells Fargo to become more attractive among investors, which reports its earnings on July 15. Due to these factors, as well as the stock’s high multiples, I will apply a Hold rating at this time.

Be the first to comment