Editor’s note: Seeking Alpha is proud to welcome GrowthInvesting as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

mrtekmekci

Alico, Inc. (NASDAQ:ALCO), along with its subsidiaries, is involved in the agricultural business, primarily the cultivation of citrus trees and the production of citrus. The company also operates a land management business; however, citrus production accounts for more than 95% of its revenue. Alico is based in Fort Myers, Florida, and owns around 84,000 acres of land in eight counties in the state. It is one of the largest citrus cultivators in the United States. My thesis is primarily based on Alico’s strong dividend payout and recent quarterly results and the company’s growth prospects. However, the falling revenues and profitability are a serious cause of concern for the company and I therefore assign a hold rating for ALCO.

5.75% Dividend Yield

Nasdaq

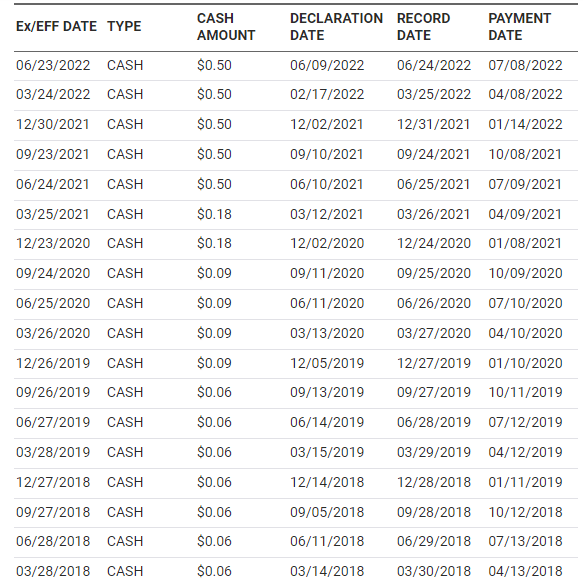

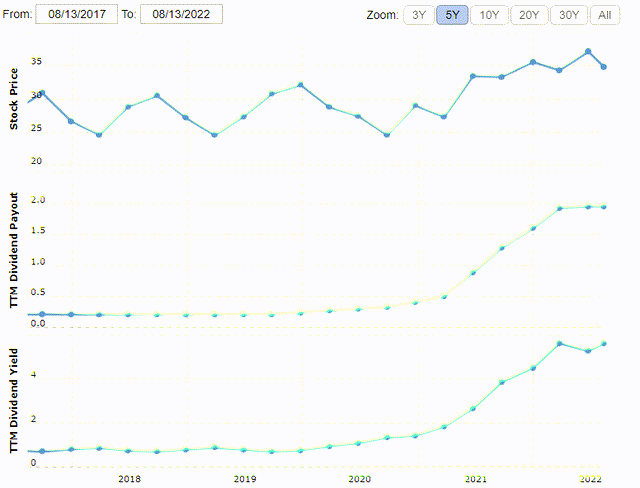

Alico has been consistent with its dividend payout in the last five years. The company declared a $0.50 dividend per share for the third quarter of 2022, and this payout has steadily increased from $0.06 per quarter in 2018. It must be noted that this payout has been consistent even during the peak of COVID-19. This reflects the cash management of the company and its intent to return earnings to shareholders. The annual dividend yield stands at 5.75% at the current share price of $35.

Now let us look at the stock price over the past 5 years and the dividend payout and dividend yield comparison. As we can see in the chart above, the stock price has been quite consistent for the last five years in the range of $25-$35, and simultaneously, the dividend payout and dividend yield have seen a steep increase since mid-2020. The chart clearly reflects the company’s resolve to payback shareholders. The current payout ratio stands at 57%, and I think there is a sufficient scope for an increase in the coming quarters. The annual dividend has witnessed a 5-year CAGR of 52%, which is a strong growth in the rate of return to investors.

Financial Analysis

Alico recently announced third quarter results for fiscal 2022. The results were drastic and missed both EPS and revenue estimates by 5% and 3.5%, respectively. My analysis suggests that the results were mainly impacted by a lower harvest and production due to bad weather in Florida during the harvest season and the freezing event that occurred around January, which greatly affected the harvest of fruits. However, the management expects that the freeze event won’t have any long-term impact on the orange trees and farms owned by Alico.

Alico, Inc.

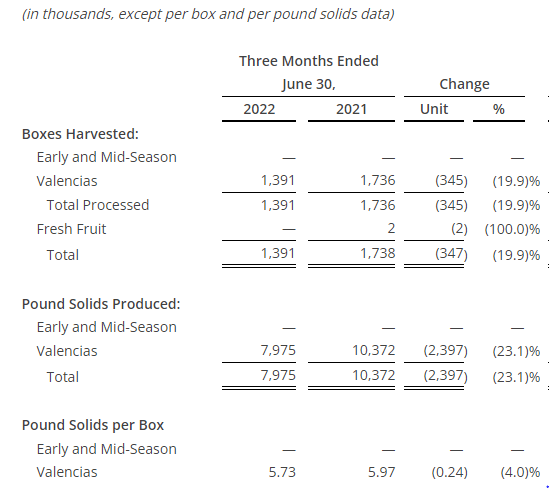

Now let us look at the citrus production for the quarter ending June 30, 2022. Boxes of the Valencias variety harvested during Q3 2022 stood at 1.39 million, a 20% fall compared to the same quarter harvest last year. My research indicates that the harvest was greatly affected by the bad weather conditions and certain tree diseases. The freeze event also affected the quality of the fruit, with total pound solids decreasing 23% from 10.37 million to 7.97 million in Q3 2022. The impact of the weak harvest season and the drop in the quantity and quality of the fruits has significantly affected the company’s performance.

Let us look at the Q3 2022 results of the company. Revenue for the quarter was $25.93 million, a fall of 25.6% from $34.2 million in the same quarter the previous year. As per my analysis, the weak harvest was the main factor behind this fall. The management stated that they experienced strong demand; however, the production was not enough, leading to a supply deficit. The average product price saw an increase of 5%, but it was not sufficient to cover the revenue gap. The operating expenses decreased 6% from $26.3 million in Q3 2021 to $24.6 million in Q3 2022. However, when compared to the total revenue decrease of 25.6%, the expense appears to have increased. I believe the primary reason behind the increased expenses was the rising fuel and fertilizer prices. Net income attributable to the company’s common shareholders was $2.7 million, a massive 90% fall from $27.1 million in the same quarter last year. The increased operating expenses and the general and administrative expenses led to this drastic decline in net income. The diluted EPS saw a $3.25 decline from $3.61 in Q3 2021 to $0.36 in Q3 2022. The weak results resulted in the management’s revision of the full year 2022 net income guidance from $35.6-$38.9 million to $30.7-$33.3 million. I think the revision is justified as the results are not expected to show a significant turnaround in the next quarter.

John Kiernan, President and Chief Executive Officer, commented,

The past harvesting season presented several challenges for the Company, as well as the entire Florida citrus industry, resulting in a disappointing financial result. We experienced a greater rate of fruit drop than in the previous year, and then in late January 2022, we were hit with a freeze event, which was at an intensity that we believe had not occurred in Florida for almost twenty years. Not only did the Company experience a decline in boxes from the freeze event for its Valencia crop, we also saw fruit fail to mature to its fullest levels, as normally occurs throughout the season, resulting in lower-than-anticipated pound solids. Because of these factors, the Company has revised its guidance to reflect the disappointing harvest season.

Is Alico Worth Buying?

Alico has a current share price/sales ratio of 2.77x; when compared to the industry standard of 1.45x, we realize that the company is trading at a much higher premium. The P/S ratio is a company’s market cap/revenue over the last 12 months. Alico has a market cap of $262 million and has reported a revenue of $94.92 million in the past 12 months, giving us a P/S ratio of 2.77x. With FY22 revenue estimates of $92.82 million, we get a forward P/S multiple of 2.83x which reflects no improvement. I therefore believe the company is overvalued in terms of its P/S ratio compared to industry standards. However, Alico is significantly undervalued as per the price/earnings valuation. The ALCO stock is trading at a P/E multiple of 8.08x against the industry standard of 17x. Though the company is undervalued as per the P/E evaluation, it could soon change if it doesn’t recover from the current downfall in revenue and earnings. Alico has reported an EPS of $3.6 so far in FY22, and with a Q4 FY22 EPS estimate of -$0.30 we get a FY22 EPS of $3.30, giving us a forward FY22 P/E ratio of 10.60x. With uncertainty around FY23 earnings, I think investors should wait for an improvement in the company’s performance before investing in the stock at the current valuation.

Competitive Analysis

Alico is overvalued than most of its competitors in terms of valuation and is among the only few profitable companies in the agricultural products space. However, Alico has seen a downfall in revenue and earnings and has underperformed compared to its competitors so far in FY22. Alico’s main competitors include Limoneira (LMNR), Local Bounti Corporation (LOCL) and, Bunge Limited (BG). Out of these, LMNR and LOCL are not profitable but have performed exceedingly better in recent quarters than Alico. However, in terms of valuation Alico is better positioned than LOCL which has a sales/price ratio of 36x compared to Alico’s 2.77x. However, LMNR and BG are undervalued compared to Alico with a price/sales ratio of 1.45x and 0.24x respectively. The reason for using price/sales ratio is that most of companies in this space are not profitable and I believe P/S is an efficient parameter to judge their performance. Alico has underperformed against its competitors and I believe there are better investment opportunities in the market with better growth prospects.

Main Cause of Concern

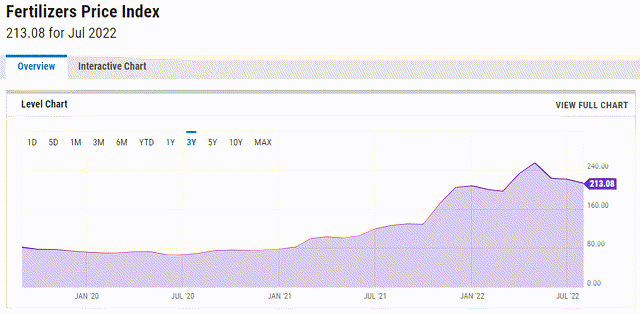

Increasing fertilizer and fuel prices

The chart above shows the price index of fertilizers in the US over the last three years. The increase in fertilizer prices is quite significant. Alico has a huge reliance on fertilizers to ensure high fruit productivity. Increased fertilizer prices are putting a dent in the company’s profit margins. Similarly, the fuel required to process the citrus is getting expensive, resulting in increased operating expenses. Fertilizer and fuel prices are expected to be high throughout FY22, which is not positive news for Alico. I believe investors should consider this risk before taking a position in the company.

Bottom Line

The weak harvest season has resulted in a drastic fall in Alico’s performance, with a severe decline in revenue and net income. Alico has witnessed strong growth in dividend payout over the past five years, but its falling revenue and profitability are a serious concern. The company is highly overvalued on the price/sales multiple, which reflects that the current P/E multiple of 8.08x could soon see a surge. I recommend investors to hold the stock for now due to the 5.75% dividend yield, but taking any fresh buying position in the stock is not advisable given the company’s current performance.

Be the first to comment