Prostock-Studio/iStock via Getty Images

Investment Thesis

Lithia Motors, Inc. (NYSE:LAD) is an automotive dealership group headquartered in Medford, Oregon. In this thesis, I will primarily be analyzing the aggressive acquisition strategy of the company and its effects on the company’s growth. I will also be analyzing the financials of the company and the expectations for the Q2 2022 results. I believe LAD is on a significant growth track, with continuous strategic acquisitions boosting the company’s growth. I assign a buy rating for LAD after taking into consideration all the growth and risk factors.

Company Overview

LAD is one of the biggest automotive retailers in the United States. The company operates more than 250 dealerships in across 25 states in the United States and three provinces in Canada. The company retails new and used vehicles through its dealerships and also through its own E-commerce platforms. The company also provides automotive maintenance, repair, insurance, and financing of the vehicles, thus taking care of the complete life-cycle of the vehicles from purchase to repair to resale. This provides the customers with a one-stop solution for their vehicles. LAD operates two E-commerce platforms, Driveway and GreenCars. While the Driveway provides a wide range of products with a home delivery option, the GreenCars platform offers an electric car marketplace for the customers. The widespread chain of retail stores and E-commerce platforms make LAD’s network strong across the United States and Canada. LAD is a growth company focused on expanding its operation through acquisitions.

Acquisition Strategy to Drive Growth

LAD has an acquisition growth strategy that it has successfully implemented over the past two years and plans on continuing this strategy to reach its 2025 revenue goal of $50 billion. In 2021 alone, the company acquired 77 retail stores with a total investment of $2.3 billion. On June 28, 2022, the company announced the purchase of nine Lehman Auto World stores and two Esserman International stores in Miami. This purchase is a part of the company’s expansion plans in Florida. These 11 stores are expected to generate over $850 million in annual revenue for the company. The company also announced the purchase of Henderson Hyundai and Genesis store in Las Vegas, Nevada, with projected annual revenue of $100 million. With the purchase of these stores in Florida and Nevada, the total estimated revenue from all the acquisitions in 2022 now amounts to $2.1 billion in annualized revenue. This reflects the company’s aggressive expansion pace, which I believe will continue throughout FY22 and FY23. As per my analysis, these acquisitions will drive significant growth as these stores are well established in the local area and have an existing customer base. This is an important aspect of the company’s strategy where they acquire stores with an existing customer base rather than opening a new dealership. I believe this strategy mitigates the risk of underperformance to a great extent, given the proven historic sales record and customer base of these acquired stores. I believe LAD is a great player in the automotive retail space, and the company will maintain its positive growth trajectory in the coming years.

Financials

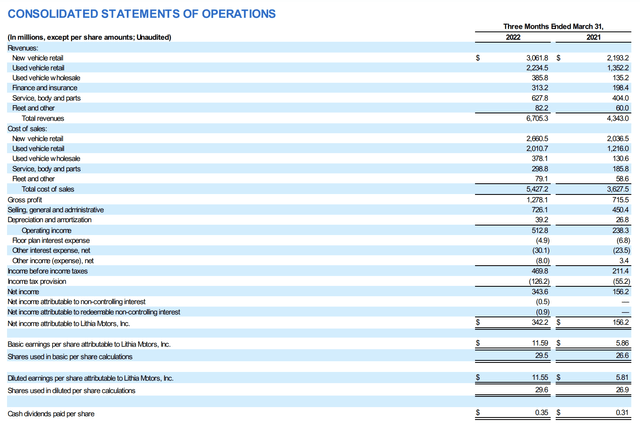

Recently, the company announced its Q1 FY2022 results. The company has reported revenue of $6.7 billion, which is a 54% increase as compared to Q1 FY2021. The revenue increase was an aggregate of the 39.6% revenue increase in a new vehicle segment, 65.2% revenue increase in Used Vehicles, and 55.4% revenue increase in service, body, and parts. Driveway Finance of the company reached 1 million monthly unique visitors and 3,100 transactions in March, which is a 1,000% increase in a quarterly transaction. Gross profit per unit increased by 55.4%, reaching $6,825, and SG&A expenses decreased by 550 bps from 62.6% to 57.1%. The company has reported adjusted net income of Q1 FY2022 is $356 million, which is a 125% increase compared to $158 million in the last year. The company’s reported adjusted Q1 FY2022 net income attributable to LAD per diluted share was $11.96, up 103% from $5.89 in the same period the previous year. The company has also announced the $0.42 per share dividend payment to all equity shareholders. It has repurchased 515,130 shares at a weighted average price of $292.80, with $572 million remaining under share repurchase authorization.

The company is expected to announce Q2 2022 results on July 20, 2022. The market’s estimate for EPS is $12.14 and market’s estimate for revenue is $7.22 billion. I believe the company will beat the consensus estimates given the strong performance and continuous acquisitions in H1 2022. The company is well positioned in terms of revenue growth with aggressive acquisition strategy and currently trading at an attractive valuation. This makes LAD a great investment in the retail automotive space.

Bryan DeBoer, Lithia & Driveway’s President and CEO, stated,

Our teams delivered another record quarter with strong results across all channels. Our highly adaptable model generated significant free cash flows, and Driveway and DFC each achieved impressive milestones. Combined with our teams’ unique ability to quickly integrate acquired businesses, our path forward to being a diversified, omnichannel retailer has never been clearer. Our recent strong performance has provided significant optionality in our execution of the 2025 Plan. We have deployed incremental capital to Driveway and DFC while maintaining our accelerated acquisition cadence and providing immediate shareholder return through opportunistic share repurchases. These actions are transforming LAD and bringing us closer to the day when each billion dollars of revenues produces significantly more than a dollar of EPS.

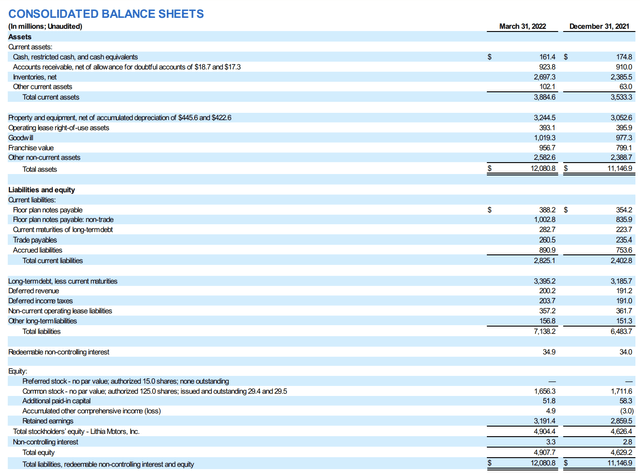

The company has ended its Q1 FY2022 with $1.6 billion in cash and available revolving lines of credit. The unfinanced real estate of the company provides additional liquidity of $1.1 billion. The company also has a considerable debt amount of $3.4 billion on its balance sheet. The company plans to expand its business by opening new dealerships and franchises. I believe that expansion plans such as acquiring Lehman Auto World stores or other dealerships will positively impact the company earnings as compared to the previous period result. The company has not given any full-year guidance, but according to my estimates, the EPS of FY22 will be $48.10.

Risk Factor

Economic Factors: The company’s product demand highly depends on consumer preferences and discretionary spending. The discretionary spending of the consumer is dependent on the current economic conditions. The rising inflation and interest rates can adversely impact the consumer’s discretionary spending, decreasing the demand for retail cars. The increasing interest rates reduce the car demand as the credit availability becomes expensive, and consumers tend to cut off spending on expensive products such as cars. The rising high crude oil and fuel prices affect consumer preference for the car.

Valuation

The company is currently trading at the share price of $295.83, which is a P/E multiple of 6.5x. The company is currently expanding its business by acquiring dealerships and retail stores. I believe this plan will open many growth paths for the company and increase its earnings. After considering all these factors, I estimate the leading EPS of $48.10, which is equivalent to the leading P/E multiple of the 5.9x. The company has been growing continuously since the last two years. That’s why I believe the share will gain momentum and trade at a higher multiple of 8x. The EPS estimate of $48.10 and P/E multiple of 8x gives a target price of $384.8, representing a 31% potential upside.

Conclusion

The company is on the path of growth and expansion with the plan of acquiring the stores and launching dealerships. It is generating high growth earnings as compared to previous quarters. After considering the company’s leading P/E multiples, I believe the company is undervalued and has great growth potential. The company might face a slight slowdown due to rising inflation in the short term, but it is an attractive investment opportunity in the long term. Thus, I assign a buy rating for LAD.

Be the first to comment