LeonU/iStock Unreleased via Getty Images

The investment thesis

Railroad stocks have a history of strong total returns. Multiple moats which are inherent to the railroad business allow them to generate cash flows with high margins and returns on invested capital. As a result, railroads are able to aggressively buy back shares, driving earnings per share growth, and grow the dividend at high rates. The Canadian and U.S. railroad markets are dominated by only a handful of operators. Based on various key metrics, I believe that Canadian National Railway (NYSE:CNI) is the most stable railroad stock investors can buy today. In this article I will show you why.

Railroads: a wide moat business

I have always liked the railroad business as it boasts multiple moats. Each railway company has its own operating geography, creating a near impenetrable barrier to entry. Once you build a railway line, you own it, and you can operate it without the fear of a new entrant replicating it. The upfront infrastructure costs would be very high, and creating excess transport capacity with limited demand growth would destroy value for existing operators and new railroad entrants. Existing railroad companies have a scale advantage as most customers and busy corridors are already served by one or two railroads, so there is no demand for additional railroad operators. Further, railroads are the best low-cost option for transporting bulk commodities if origin and desitination are not connected through waterways. Fuel efficiency, combined with greater railcar capacity and train length, provide cost advantages over truckload shipping. This has been also the case for intermodal container freight, which mainly involves consumer products.

Canadian National Railway in short

Looking more specifically at Canadian National Railway, the competitive advantage from geography and scale is clearly visible as it operates a tri-coastal system spanning Canada from east to west, and down through the U.S. to New Orleans. The total network of roughly 20,000 route-miles is depicted in the figure below. Canadian National Railway’s access to port facilities at the three coasts allows the company to connect Canada and the American Midwest with markets overseas. For example, Canadian National has exclusive access to the Port of Prince Rupert (Canada west coast), which contributes to its international intermodal growth prospects.

CN Network map (Canadian National Railway)

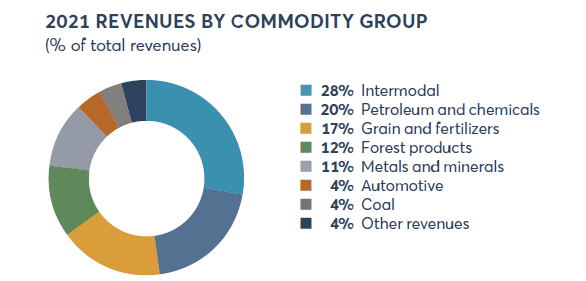

In FY2021, overseas transport flows were responsible for 35% of total freight revenue, highlighting the importance of access to port facilities. Freight revenue is also generated through transborder flows, Canadian domestic flows, and U.S. domestic flows which accounted for respectively 31%, 18%, and 16% of freight revenue. If we look at the commodity mix, it can be observed that Canadian National has a well-diversified portfolio (see graph below). We can immediately see that intermodal freight transport is the dominant source of revenue. Apart from that, the company is not overly exposed to any commodity group.

Commodity group revenue mix (Canadian National Railway Investor Fact Book)

The railroad business is interesting for investors and Canadian National Railway’s network gives them exposure to a wide variety of North American and overseas freight flows. Apart from the network, the question remains why I believe that Canadian National’s business has an edge over other railroad operators. To clarify that, I will consider the historical performance, financials, and valuation of Canadian National Railway in comparison to its main peers: Canadian Pacific Railway (CP), Union Pacific Corp (UNP), CSX Corp (CSX), and Norfolk Southern Corp. (NSC).

Shareholders returns

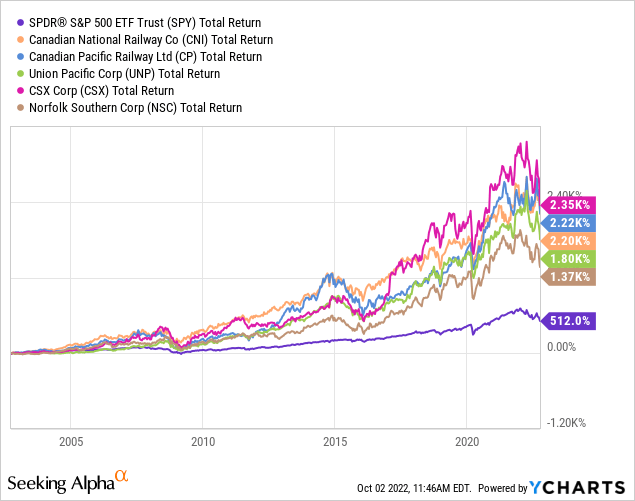

Both Canadian and U.S. railroad stocks have been very lucrative for shareholders over the past twenty years. The following graph shows that all considered railroad stocks have outperformed the S&P 500 index (SPY) by a very wide margin. Canadian National Railway is right in the middle of the pack, generating a total annual return of 16.7% versus 8.5% for the S&P 500 index. CSX Corp performed the best, realizing a slightly higher CAGR of 17.1%. Keep in mind that there is no clear winner here, as it largely depends on the time period you consider.

Historical financial performance

Revenue growth

As a first financial metric, we take a look at historical revenue growth. I took revenue data in the table below from Seeking Alpha’s financials page. The revenue for Canadian National Railway and Canadian Pacific Railway is in CAD, to compare them with their U.S. peers based on underlying performance. Over the past decade, the Canadian railroad companies have done a much better job compared to their U.S. peers. Canadian National Railway has achieved the highest revenue CAGR of 4.3%, followed by Canadian Pacific Railway with a revenue CAGR of 3.8%. For all three U.S. railroad companies, revenue growth has been negligible. This holds especially for Norfolk Southern Corp, which has also lacked its peers in terms of total return (see previous graph).

| CNI | CP | UNP | CSX | NSC | |

| Revenue 2012 ($ billion) | $9.9 | $5.7 | $20.9 | $11.8 | $11.0 |

| Revenue 2021 ($ billion) | $14.5 | $8.0 | $21.8 | $12.5 | $11.1 |

| CAGR (%) | 4.3% | 3.8% | 0.5% | 0.6% | 0.1% |

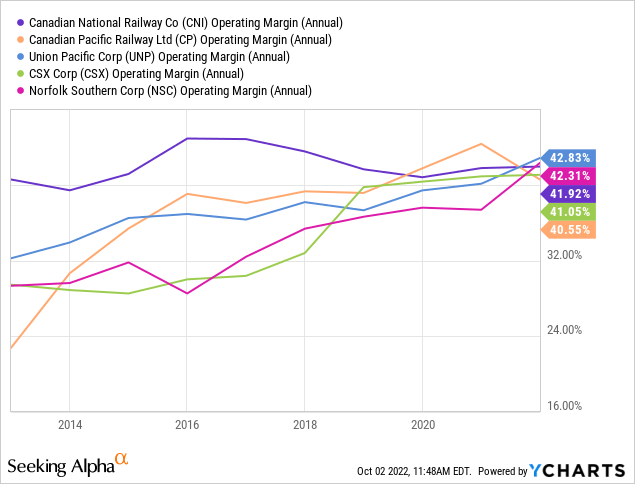

Operating margin development

The following graph depicts operating margin development over the last decade. Interestingly, Canadian National Railway’s operating margin was significantly higher compared to its peers ten years ago. Since then, operating margins of the other railroad companies have caught up with Canadian National. The underperformance in efficiency over the past years was addressed by TCI Fund last year, but things settled after Tracy Robinson was named CEO at the start of this year. It seems that things are moving in the right direction with Robinson’s new focus on operations, and the company reported an encouraging operating ratio improvement of 230 bps during the most recent Q2 quarter.

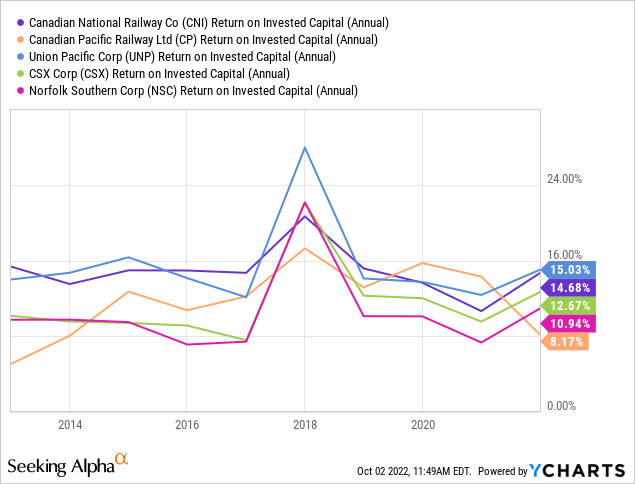

Return on invested capital

I personally attach a lot of value to a company’s return on invested capital (or ROIC). It gives a sense how well a company is able to generate higher cash flows from capital reinvested into the business. It can be seen that Canadian National Railway and Union Pacific have been the winners in terms of ROIC over the past decade. What I also like is that their ROIC has been constantly above the 10% threshold.

Share repurchases

Railroads are well-known for their aggressive buyback programmes. Canadian National Railway has achieved the smallest buyback CAGR of all railroad stocks in recent years. Still, lowering the number of shares outstanding with 2.3% per year on average is very good. Remarkably, the U.S. railroad stocks have been way more aggressive with share buybacks than their Canadian peers, despite revenue has been roughly flat over the same period.

| CNI | CP | UNP | CSX | NSC | |

| Shares outstanding 2012 (# billion) | 0.88 | 0.87 | 0.95 | 3.12 | 0.33 |

| Shares outstanding 2021 (# billion) | 0.71 | 0.68 | 0.66 | 2.26 | 0.25 |

| CAGR (%) | -2.3% | -2.6% | -4.1% | -3.5% | -2.9% |

Dividends

Besides buybacks, railroad stocks have a long history of increasing dividends. The following table shows how the dividend per share has grown from 2012 to 2021 (numbers of Canadian National and Canadian Pacific are in CAD). While Canadian National Railway was behind its peers in terms of annual buybacks, it has increased the dividend with the highest CAGR over the last decade. Last year, the pay-out ratio was only 35.7%. Combined with a growing earnings per share, this allows Canadian National Railway to continue its dividend growth streak.

| CNI | CP | UNP | CSX | NSC | |

| Dividend per share 2012 ($) | $0.75 | $0.28 | $1.38 | $0.19 | $2.00 |

| Dividend per share 2021 ($) | $2.46 | $0.76 | $4.28 | $0.37 | $4.36 |

| CAGR (%) | 14.1% | 11.7% | 13.4% | 7.7% | 9.0% |

| Earnings per share 2021 ($) | $6.89 | $4.18 | $9.95 | $1.68 | $12.11 |

| Pay-out ratio (%) | 35.7% | 18.2% | 43.0% | 22.0% | 36.0% |

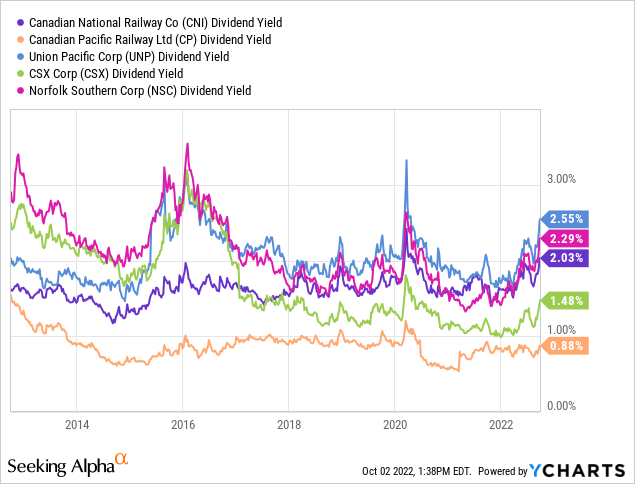

At the time of writing Canadian National Railway has a dividend yield of 2.03%, placing the stock in the middle of its peers. This is not that high in the current macro-economic environment with the 10YR treasury yield approaching 4%. On the other hand, the yield-on-cost can increase significantly over the years due to double-digit dividend growth.

Balance sheet

To conclude the financial performance comparison, we consider the debt of each railroad company. I prefer companies with a low leverage, especially with interest rate projections on the rise. Companies with a low leverage have more room for investments in the business, future dividend increases, and buyback programmes. The next table shows the net debt and leverage of each company based on the most recent earnings reports (data used from Seeking Alpha’s financials page; number of Canadian National and Canadian Pacific are in CAD).

Canadian National Railway has clearly the lowest leverage of all railroad companies. S&P Global’s (SPGI) rating division has rewarded Canadian National with an A credit rating. This will give them more flexibility to increase buybacks and dividends in the future. So despite having the lowest historical buyback CAGR, I think that Canadian National Railway has the best position for further future buybacks.

Note that the high leverage of Canadian Pacific is temporary due to its acquisition of Kansas City Southern. The EBITDA in FY2023 will increase significantly, so the expected over FY2023 will be around 2.6x. Still, Canadian National has the best balance sheet.

|

CNI |

CP |

UNP |

CSX |

NSC |

|

|

Cash & Cash equivalents ($ billion) |

$0.5 |

$0.2 |

$0.8 |

$0.8 |

$1.3 |

|

Short-term & current debt ($ billion) |

$2.4 |

$1.7 |

$2.3 |

$0.2 |

$0.6 |

|

Long term debt ($ billion) |

$11.9 |

$18.4 |

$29.4 |

$16.0 |

$15.0 |

|

Net debt ($ billion) |

$13.8 |

$19.9 |

$30.9 |

$15.4 |

$14.3 |

|

EBIDTA 2022 (expected) ($ billion) |

$8.4 |

$4.3 |

$12.6 |

$7.4 |

$6.1 |

|

Net leverage |

1.6x |

4.6x |

2.5x |

2.1x |

2.3x |

Valuation

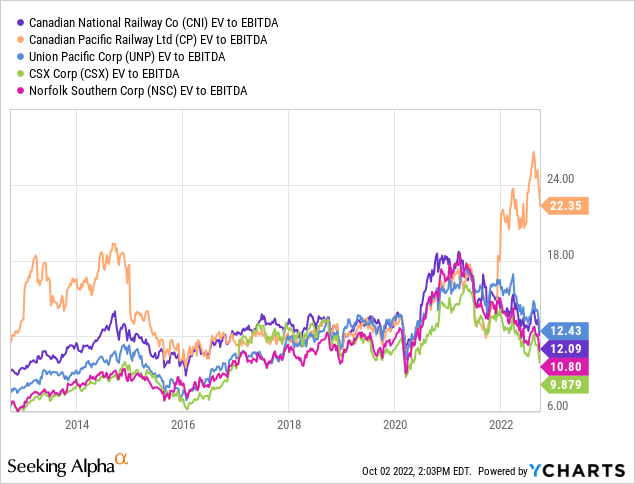

Now it is time to consider the valuations of the railroad stocks. Note that Canadian Pacific Railway is an outlier in the graph below due to this year’s huge debt increase.

After having peaked in 2021, valuations of railroad stocks have been trending down, and this is still the case today. EV/EBITDA multiples have reached pre-COVID levels which makes railroad stocks interesting again. It can be seen that most of the time, Canadian National has been trading at a premium compared to its U.S. peers. But, I believe that this is justified given its strong financial performance and healthy balance sheet.

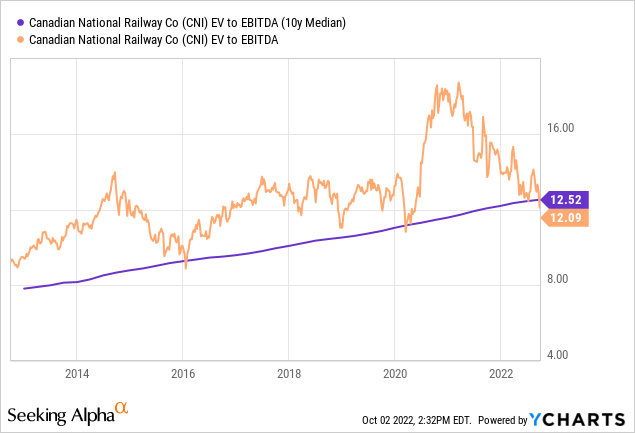

In terms of EV/EBITDA, the valuation of Canadian National Railway is starting to look attractive. The EV/EBITDA multiple has dropped below its 10YR average as shown in the graph below. The last two times when this happened were at the end of 2016 when a decline in coal shipments hurt railroads, and March 2020 when the pandemic hit the markets.

Final thoughts

I think that all railroad stocks will continue to perform well in the future and could be a good buy at the right price. However, I believe that Canadian National is the superior railway company here in terms of stability. It has the best top-line growth, good margins, excellent ROIC, an impressive dividend CAGR, and the most healthy balance sheet.

A concern for me is the flat operating margin. But, the operating ratio improvement in recent Q2 under new CEO Tracy Robinson seems promising for future margin expansion. Also, Canadian National is exposed to the health of both Canadian and U.S. economies, including retail and industrial end markets. Downside risk to freight demand is currently elevated due to inflation and less consumer spending. I think these threats will subside in the mid-term.

To conclude, Canadian National Railway is a wide moat business and now available at an attractive price if we consider historical valuations. I think that investors should be cautious with looking at historical valuations, as the macroeconomic outlook is changing. I will therefore give a ‘hold’ rating to Canadian National Railway stock. On the other hand, buying quality dividend stocks while everyone is turning negative usually works out pretty good in the long run.

Happy investing!

Be the first to comment