Spencer Platt

Thesis

PayPal (NASDAQ:PYPL) stock was brutalized lately. Its 2022 Q1 earnings release (“ER”) reported a sharp profit decline AND margin compression. It posted a net income of $0.43 per share in Q1, more than a 50% decline YoY. At the same time, what is even more concerning to me is that its operating margin suffered a 630-basis-point contraction too. The causes of the contraction included higher transaction costs, general & administrative, R&D expenses, and also general inflation.

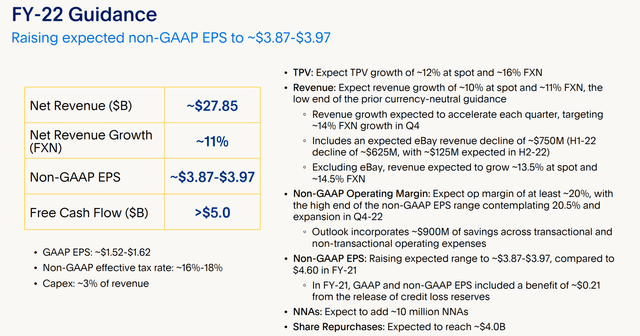

To shareholders’ relief, Q2 results reversed the trend. It reported results beating consensus estimates on both lines. EPS came in at $0.93 (on a Non-GAAP basis), beating the consensus estimate by $0.06. And revenue came in at $6.8B, beating consensus by $20M.

More importantly, it reported an expansion in operating margin. Looking forward, the firm expects a ~$900M of cost savings in operating expenses for the remainder of the year and another $1.3B for 2023, which would send the operating margin to the ~20% range, also as to be elaborated in the next section.

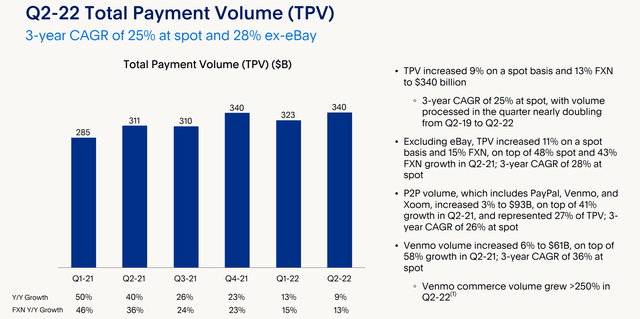

Such margin expansion, when combined with robust transaction volume growth and shareholder return programs, is projected to deliver outsized return potentials for the next 3~5 years.

PYPL Q2 ER

Operating Margin

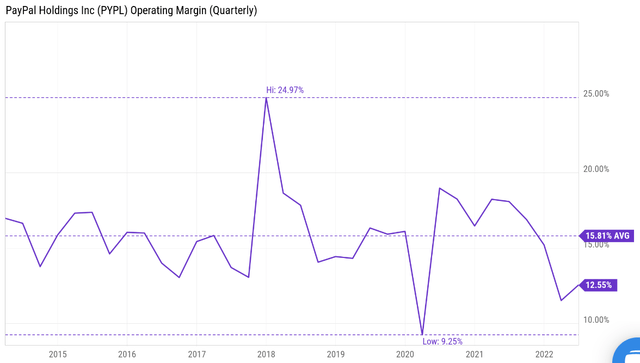

As aforementioned, PYPL suffered a 630-basis-point operating margin contraction during Q1. To put the contraction under perspective, the following chart shows its operating margin in the past decade.

As seen, its operating margin has been quite stable and only fluctuated in a narrow range in the past. Historically, its margin varied between about 12% and 17% with the exception of 2018 and 2020 when the pandemic broke out. Its long-term average is 15.8%. And you can see the sharp contraction during Q1 2022, sending its operating margin to the bottom of the historical spectrum.

Now, Q2 results reported a reversal of the trend as you can see. The operating margin has increased to 12.55%. The expansion was due to better cost control programs, and management not only expects these programs to continue but also to produce permanent benefits on a run rate basis. As CEO Daniel Schulman commented during the Q2 ER (abridged and emphases added by me)

…we are meaningfully reducing our cost structure… over the past 6 months, we have taken action to exit the year with operating margin leverage that will continue to grow in 2023.

We are leveraging our enhanced scale coming out of the pandemic to drive meaningful reductions in unit costs across our supplier base. As a result, we will realize our target of approximately $900 million of savings in 2022 across our OpEx and transaction expenses… We anticipate this reduction in our cost structure will result in at least $1.3 billion of cost savings in 2023, which will result in operating margin expansion next year. These cost savings are not onetime in nature and will continue to benefit the company on a run rate basis.

These cost savings will further expand the margin from the current level of 12.55%. And I anticipate the operating margin to continue into 2023. All told, by the time the business has materialized the $900M cost savings in 2022 and also the $1.3B in 2023, my estimate of the operating margin would be ~21% (a bit higher than management’s guidance), toward the peak level of its historical spectrum.

The margin expansion, combined with healthy transaction volume growth, will drive robust profitability. As a sign of management’s confidence in the future, PYPL announced an “invigorated” capital return program in Q2, as detailed next.

Seeking Alpha

Invigorated capital return

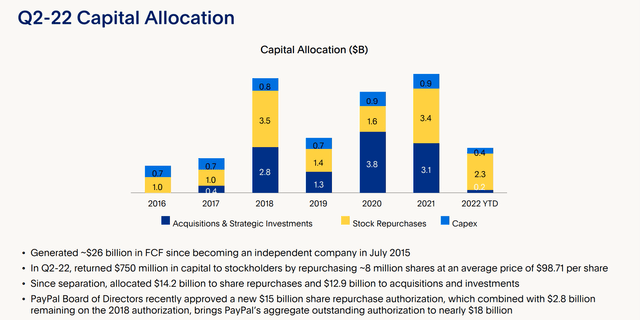

Thanks to the margin expansion mentioned above, PYPL generated a total of $1.3B in free cash flow (“FCF”) in Q2, a 22% growth YoY. And also thanks to its capital-light business model and spectacular return on capital employed (see details from my earlier article here), the business was able to return ~95% of the FCF to shareholders through share repurchases. All told, it returned $2.25 billion to shareholders in 1H of 2022, and the full-year 2022 share repurchases are expected to reach ~$4.0B.

Looking forward, it has just announced a new $15 billion share repurchase authorization. And it is also working with Elliott Investment Management L.P. to evaluate a comprehensive capital return strategy. And I will project the potential impacts of these developments in the next section.

PYPL Q2 ER

Total shareholder yield and projected returns

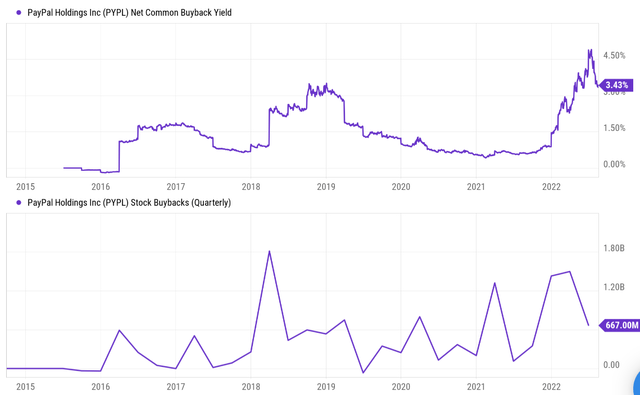

PYPL does not pay a dividend. However, as I have repeatedly argued in my early articles (e.g., in this most recent one analyzing Apple and Berkshire overpowering double repurchases), long-term shareholders should pay more attention to the total shareholder yield rather than a dividend yield.

When the total shareholder yield is considered, PYPL is a “high-yield” stock. As aforementioned, PYPL spent $2.25 billion in 1H 2022 on share repurchases. Assuming it spends the same amount during the rest of 2022, the annualized buyback yield would be 3.91% based on its current market cap. Its newly announced $15 billion share repurchase authorization, assuming spread over a total of 4 years, would create an annual buyback yield of 3.26% again based on its current market cap.

The following chart put these numbers under a historical perspective. As you can see, PYPL has been a consistent buyer of its own stocks, which is never a bad sign. It shows that the management A) has the cash to do so, and B) has the confidence in their own business. And you can also see that the anticipated buyback yield (in the range of 3.2% to 3.9%) is quite attractive in both absolute terms and also relative to its own historical average.

Finally, projected returns. I am projecting an upper single-digit growth rate in payment volumes for the years ahead (say 8% to 9%). Combined with the margin expansion analyzed above, I am optimistic that the net profit growth would be easily in the mid-teens (say 12%), which would represent the long-term total return for shareholders.

Seeking Alpha

PYPL Q2 ER

Final thoughts and risks

After a brutal Q1, PayPal seemed to have found a bottom in Q2 both in terms of stock prices and fundamentals. In terms of fundamentals, the cost control programs are working and the benefits are expected to further expand. When/if 2022 and 2023 cost savings are materialized, my estimated operating margin would be ~21%, toward the peak level of its historical spectrum. In terms of price actions, the market sentiment seemed to be reversed too. Its stock prices rallied by 13% after the Q2 report alone.

Finally, risks. Macroscopic risks are certainly a concern in the near future, such as the possibility for the overall domestic economy to suffer a recession and also the impact of the ongoing Russian/Ukraine situation. Specific to PYPL, rising rates could pressure its profit. The Fed’s ongoing tightening cycle could force firms like PYPL to borrow at higher rates, as Fed President Patrick Harker remarked during a recent Fintech Conference below:

… Forced to borrow at higher rates, these firms are facing pressures they simply weren’t last November. Unsurprisingly, major operators in the space have retrenched, with one of the leading lenders shedding 10% of its workforce last month.

Be the first to comment