HowLettery/iStock via Getty Images

We continue to be impressed by ZipRecruiter (NYSE:ZIP), which we view as a very attractive platform business that is managing to grow at a decent pace and in a profitable way.

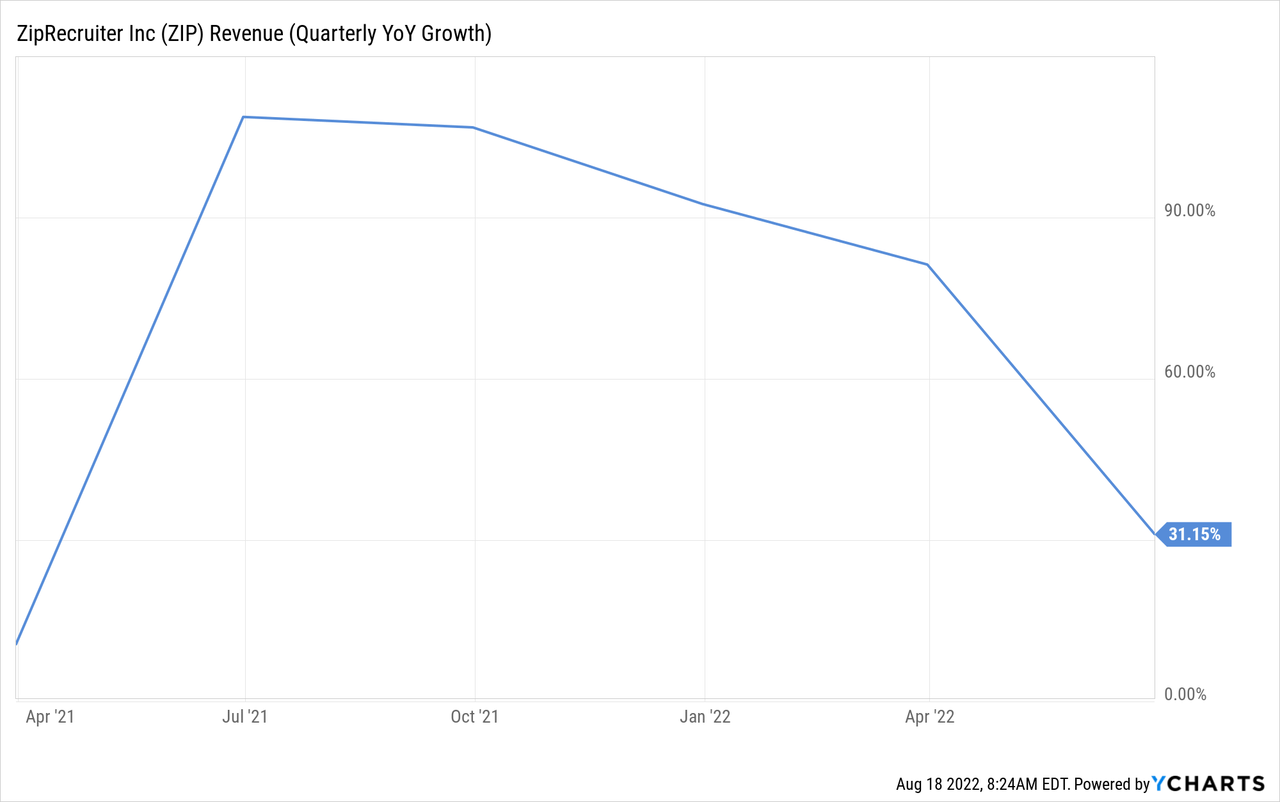

Q2 2022 was yet another strong quarter for the company, which generated a record $240 million in revenue, up 31% over the second quarter of 2021, and posted adjusted EBITDA of $45 million.

Not everything was positive from the results, however, with the company sharing during the earnings call that there is a noticeable cooling off of the job market in the US. ZipRecruiter shared that they began to see employers pulling back on job postings during the final weeks of June. From a macro perspective, US job openings fell by over 5% to 10.7 million in June of 2022. As a result of a cooling hiring environment, the company revised its 2022 revenue guidance to $890 million at the midpoint, and it expects a pullback in the economy in the back half of the year.

Something positive is that the company is seeing more and more large sophisticated customers in the performance based pricing part of its business, which has grown to 22% of total revenue in the quarter after growing 66% y/y.

Financials

Revenue per paid employer was $1,533 in the quarter, another record for ZipRecruiter. This is a 42% increase versus Q2 2021 and a 1% increase sequentially. This is great for the company as it shows that employers’ willingness to pay continues to grow.

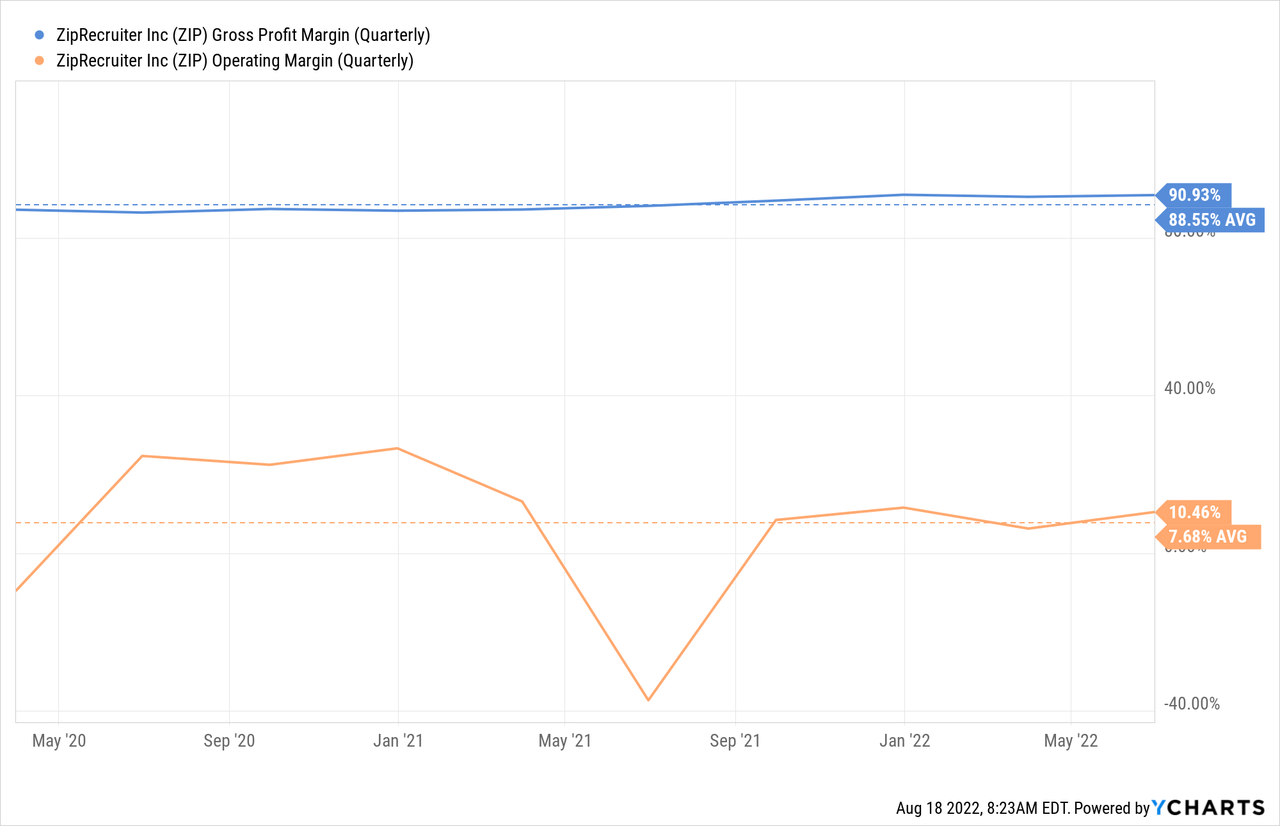

One thing we appreciate in ZipRecruiter is that it is profitable on a GAAP basis. GAAP net income was $13.1 million in the second quarter of 2022 compared to net income of $8.4 million in Q1 of the current year. The company continues to deliver exceptional gross profit margins, and the expectation is that the operating margin will improve as the company grows and matures and experiences operating leverage.

Our main worry with the company is decelerating growth, which remains high in absolute numbers, but has been quickly decelerating from the hyper growth phase that the company experienced. We believe this growth deceleration is directly responsible for a lot of the weakness in the shares.

Balance Sheet

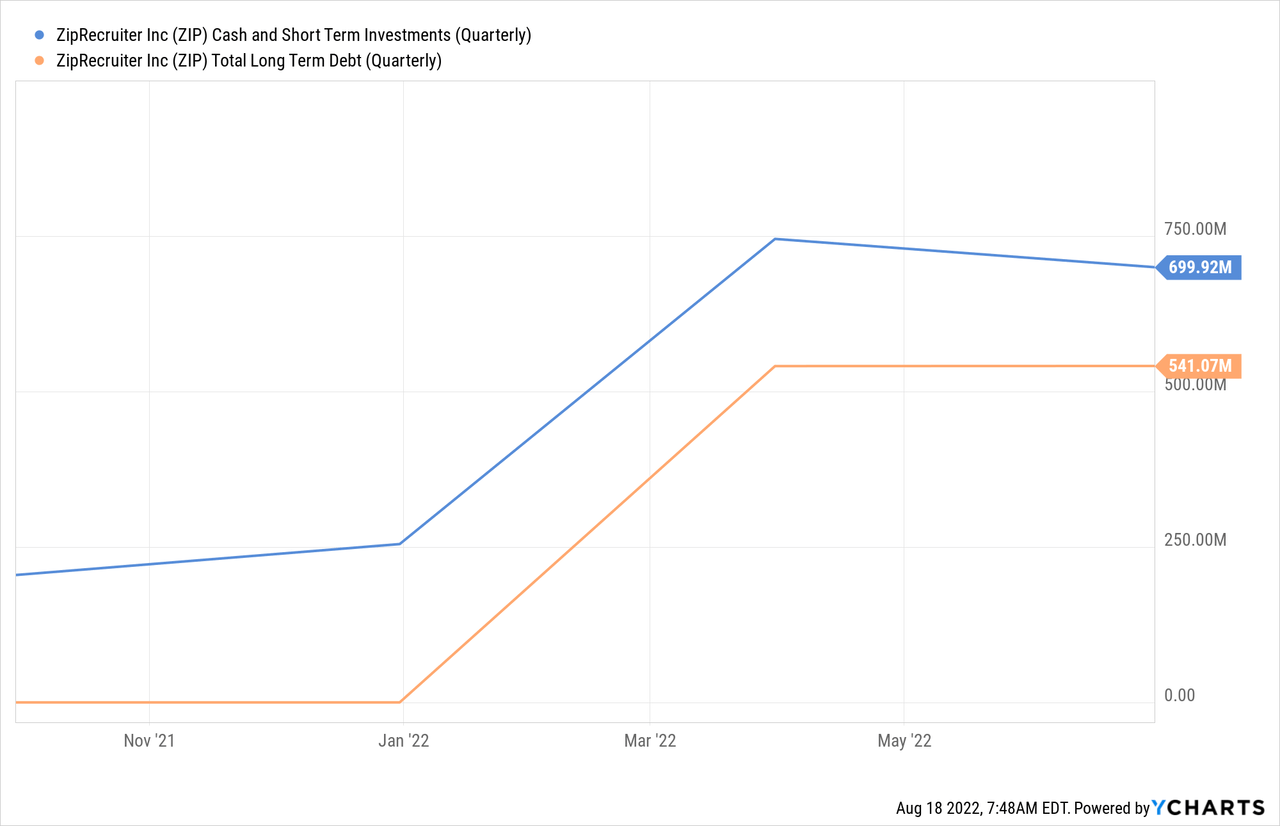

Cash and cash equivalents decreased to $699.9 million as of June 30th, 2022. The main reason being that the company spent significant amounts on share repurchases. Despite the reduction in cash and short-term investments, these remain higher than the long-term debt that the company currently has.

Guidance

The company experienced a strong April and May, but it had a much weaker June with softness continuing into July as well as August. It is clear that the record setting labor market is moderating. The company expects $220 million of revenue in Q3 2022 at the midpoint, which translates to only 3% y/y growth. ZipRecruiter now estimates revenue for the full year 2022 to be $890 million at the midpoint, representing ~20% growth versus 2021, and it expects adjusted EBITDA of $46 million at the midpoint in Q3 2022 and $170 million at the midpoint for the full year 2022.

In other words, the company took its top-line guidance modestly down, but at the same time increased the adjusted EBITDA guidance, increasing the expected margin from 16% to 19%. This is mainly because the company plans on reducing sales and marketing expenses to compensate for the softer market.

Stock Buybacks

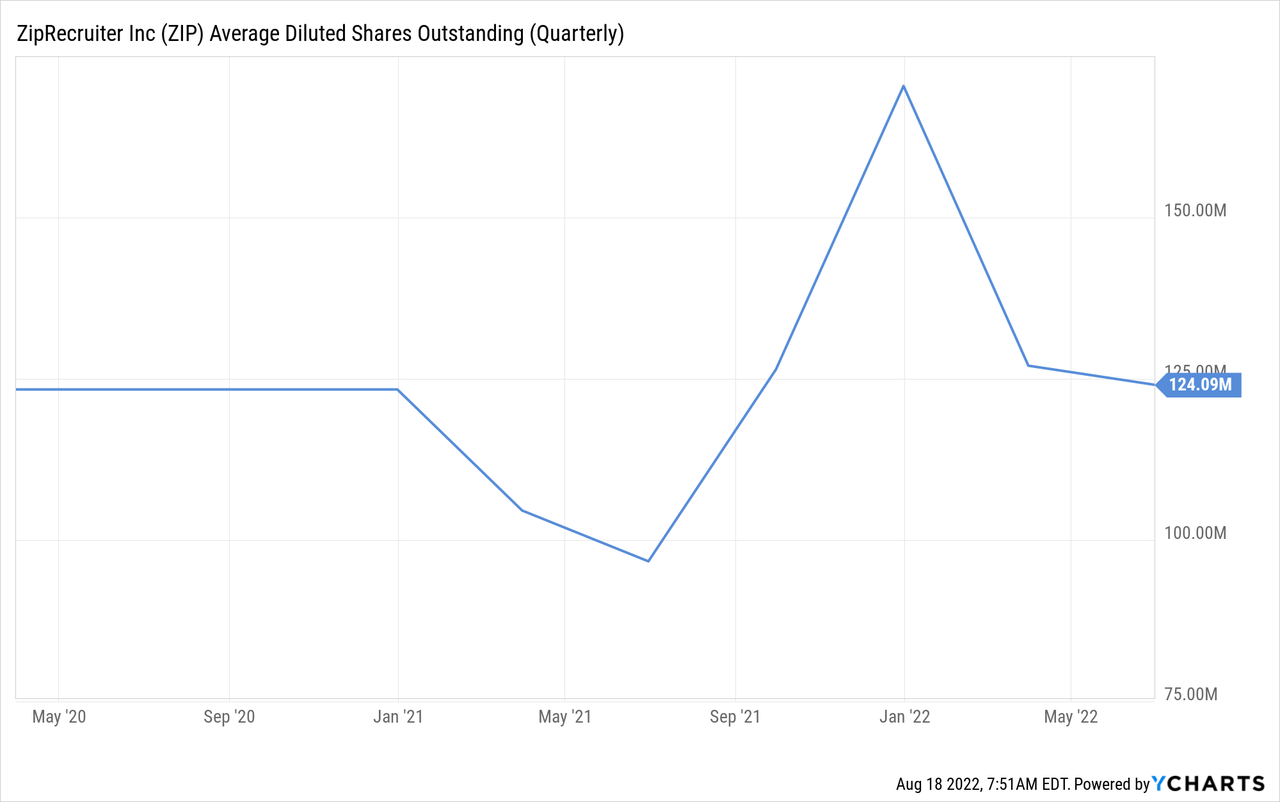

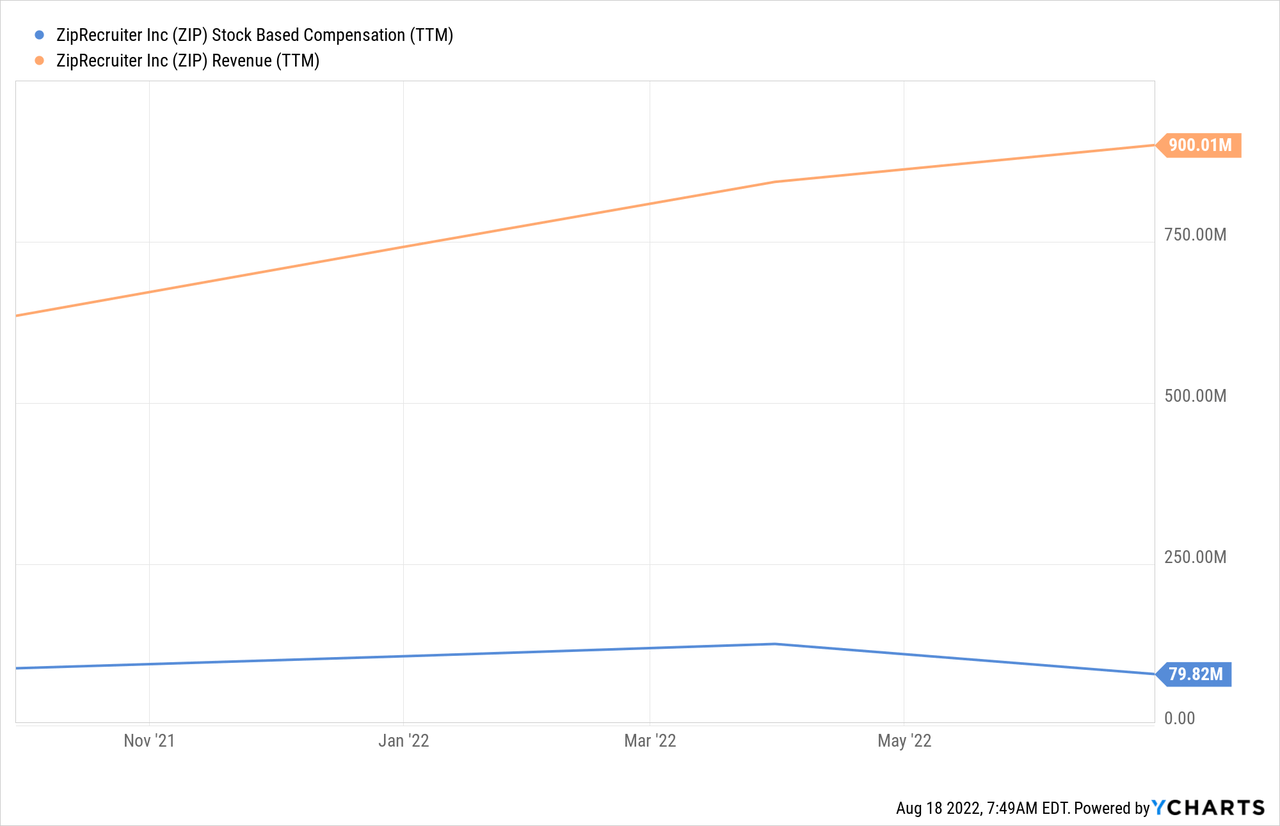

Taking a look at average diluted shares outstanding we can see that they have gone down recently thanks to the significant share repurchases, but are still at a similar level to when it direct listed. This seems to be the result of significant stock based compensation.

It seems the company is giving out ~10% of revenue in stock based compensation. For a company in this industry and level of maturity this seems to still be within the reasonable range. We have seen some companies reach ridiculous levels of stock based compensation of ~20% of revenues.

Valuation

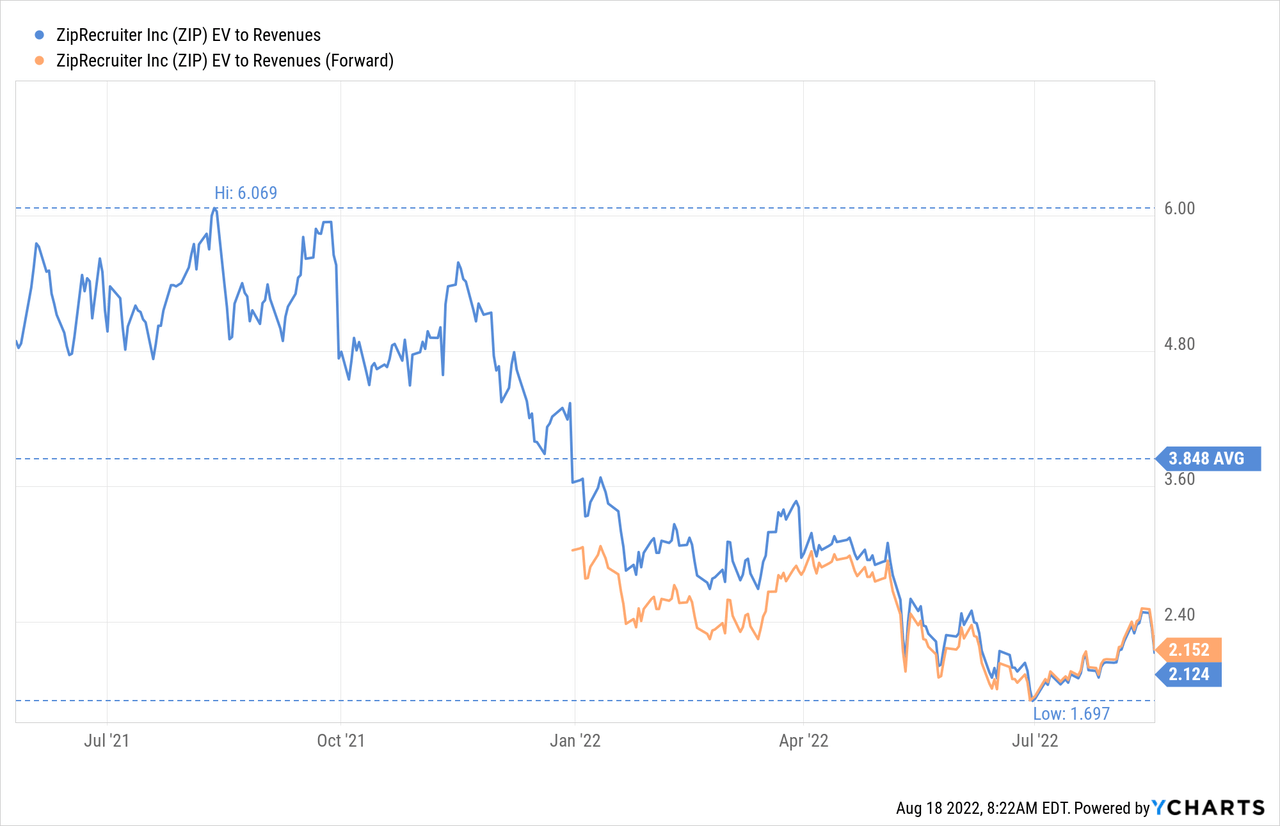

ZipRecruiter is trading with an enterprise value of ~$2 billion, which means its EV/Revenues multiple is about 2x. For a software company with ~90% gross profit margins and still growing, this valuation seems low. We believe the main reason investors are not willing to assign a higher valuation is that growth has decelerated significantly.

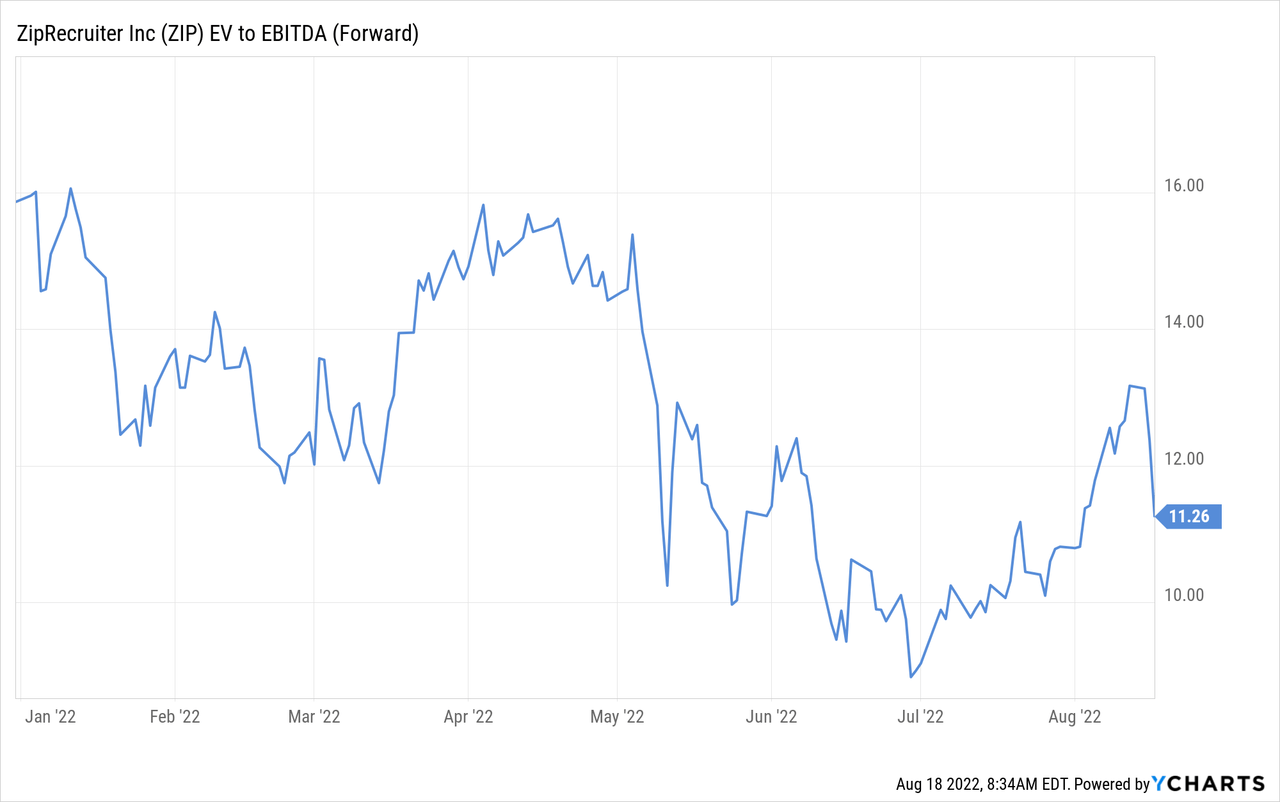

Shares look attractive too when looking at its forward EV/EBITDA, which currently stands at ~11x. This is certainly closer to the lower end of its recent historical range.

Risks

We believe ZipRecuiter is an above average risk investment given that it is still a relatively young company trying to take market share from much more established competitors, which in some cases have strong competitive advantages such as LinkedIn. Still, the risk is somewhat mitigated by the fact that the company has reached GAAP profitability, and that it has more cash and short-term investments than long-term debt.

Conclusion

ZipRecruiter delivered another strong quarter, but it is apparent that the job market in the US is cooling off. We view the current valuation as attractive, even if we consider ZipRecruiter to be an above average risk investment. It will be interesting to continue following the company, especially to see if it can re-accelerate growth in the future.

Be the first to comment