bluejayphoto/iStock via Getty Images

By Alex Rosen

Summary

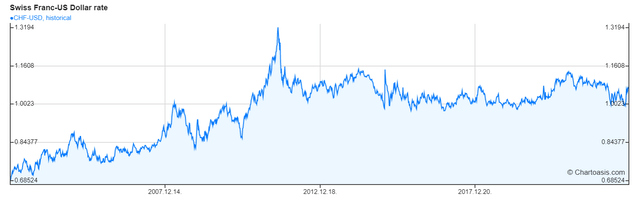

Invesco Currency Shares Swiss Franc Trust ETF (NYSEARCA:FXF) tracks the change in value of the Swiss Franc relative to the USD. For those looking to dabble in FOREX, this is an opportunity for single currency exposure. The Franc is down 3% YTD against the dollar and is at its lowest point compared to the dollar since 2010. Overall, a strong U.S. dollar has really put a hurt on other global currencies.

We rate FXF a hold as we believe in the strength of both the Swiss economy/Central bank and the overvaluation of the U.S. dollar.

Strategy

The fund strategy is to simply invest in Swiss Francs. A straightforward model with no tricks or gimmicks. The fund has an expense ratio of .4%.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Currency

-

Sub-Segment: Europe

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

Like many single equity funds, FXF’s holding analysis is extremely not complex. One item, one country, one sector. FXF owns Swiss Francs.

Strengths

When investing in a country’s currency, what is really happening is funds are betting on the future of a country’s economy, especially when compared to the U.S.

The U.S. dollar has been on quite a tear lately. I know this first hand, because recently I was consulting for a Swiss research organization, and was getting paid in Francs to my U.S. dollar account. Every month I watched as less and less money hit my account. Eventually it hit par and that was the end for me. It’s not just the Franc, though. The British Pound Sterling is in danger of hitting par with the U.S. dollar as well.

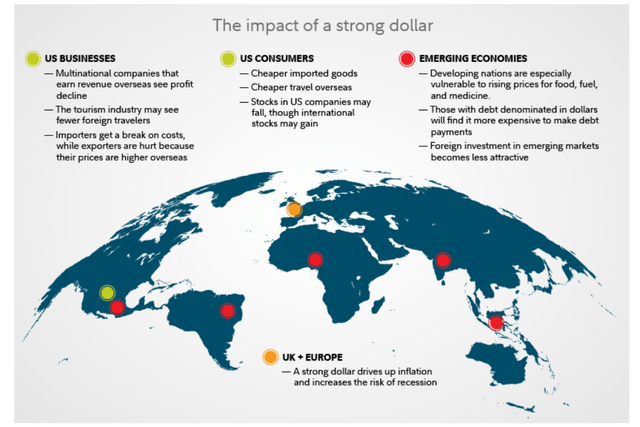

What Does A Strong Dollar Mean for The Rest of The World? (Fidelity)

What does this mean that the dollar is strong? For one thing it means an increased trade deficit. When a country’s currency is sliding compared to another countries, they can sell their goods in the foreign market at the same rate and receive more of their currency in return. So a country like Switzerland might be inclined to sell more chocolate or watches in the U.S. market, or in reality pharmaceutical products, organic chemicals, optic and medical instruments.

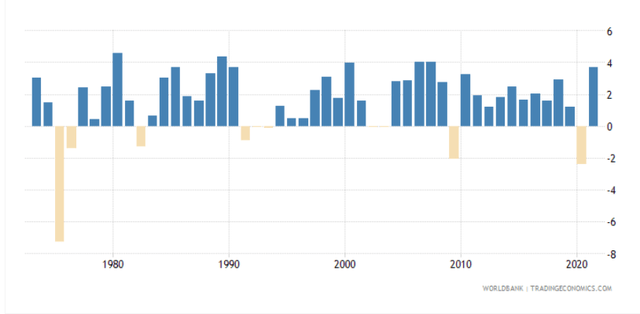

How is a strong dollar good for the Swiss Franc? Switzerland has an extremely mature and very stable economy as well as a sophisticated Central Bank capable of effectively control currency values and inflation. It is not subject to wild swings in GDP growth. It will not suddenly see double digit rises or falls, and, as you can see from the chart below, is fairly recession proof. When the Franc is down, chances are it will come back up.

Swiss GDP growth over the last fifty years (World Bank)

Weaknesses

It is possible that it could be a while before the economy really stabilizes, especially relative to the U.S. dollar. Right now it is estimated that Swiss banks are holding some $200 billion in Russian Assets. Of these assets, some $7.5 billion is frozen. It is entirely possible, that the remaining holdings could be withdrawn from the Swiss banks before more assets are frozen.

All indications point to Europe heading towards recession at the end of this year. Naturally, most of Switzerland’s largest trading partners are in Europe. As those countries enter into recession, the ability to conduct trade weakens, meaning the Swiss Central Bank will have to work even harder to maintain current exchange rates against the dollar.

Opportunities

I believe the Swiss Franc will rebound. I say this because it has to. 25% of the world’s overseas assets are held in Switzerland, and the country has a long history of stability and neutrality. Additionally, the Swiss Central Bank maintains tight controls on the currency through foreign reserve holdings. They have the institutional capacity and sophistication to ensure the Franc stays at a level they deem appropriate. In late September, the Central Bank finally stopped buying foreign currencies which they have been doing to hold down the price of the Franc.

The Franc has always been strong and relatively stable compared to the dollar. (Chart Oasis)

Threats

The Swiss central bank has worked extremely hard to protect the Franc from over valuation. The continued purchasing of foreign currencies has been an attempt to protect Swiss exports from becoming too expensive. It has worked, but now they find themselves with vaults full of foreign currencies. Many of these currencies, the Euro, the Pound, the Ruble, and the Japanese Yen, have been fighting the tide of the strengthening dollar. Even the U.S. central bank has been trying to reign it in through systematic interest rate hikes, but so far has had little success.

Switzerland is a tiny country who’s global presence far exceeds the actual power it wields. Switzerland can easily get swept up in the recession that is looming for the European Union. The U.S. efforts to make market corrections could cause a much greater strain on other economies who will then have to move assets. This could potentially have an adverse effect on the Swiss Franc.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

A fund like FXF doesn’t really have a unique quality opinion. After all, it trades the Swiss Franc and nothing more. Based on the intended strategy of the fund, I would rate FXF as a high quality fund.

ETF Investment Opinion

A bet on FXF is a bet on the Swiss economy, especially in comparison to the U.S. Dollar. Currently the U.S. Dollar is seeing all time highs relative to other currencies. So much so that the U.S. central bank is using all manner of monetary policy to control it. Otherwise, it will be a very expensive Christmas in the U.S.

Switzerland sells itself on stability and security. The Swiss central bank is quite capable of accurately manipulating its currency, and it already has. They have a target rate and they know how to get there. Therefore, we rate FXF a Hold for the mean time and as trends move, a long term Buy.

Be the first to comment