B4LLS

A Quick Take On Braze

Braze (NASDAQ:BRZE) went public in November 2021, raising approximately $565 million in gross proceeds from an IPO that priced at $65.00 per share.

The firm provides customer communications software and related services.

Braze is producing increasing operating losses in a market that severely punishes money-losing companies due to a higher cost of capital environment.

I don’t see a significant organic catalyst in the near term, so I’m on Hold for BRZE at this time.

Braze Overview

New York, New York-based Braze was founded to assist organizations in automating and analyzing their customer communications and engagement efforts.

Management is headed by Chief Executive Officer William Magnuson, who has been with the firm since 2011 and previously received advanced degrees from M.I.T.

The company’s primary offering functionalities include:

-

Data ingestion

-

Classification

-

Orchestration

-

Personalization

-

Execution

The company sells subscriptions to its platform primarily through direct sales efforts, with operations in the U.S., UK, Germany, Japan and Singapore.

Braze’s Market & Competition

The customer communications market comprises solutions and services that enable organizations to manage customer interactions and automate customer communications across various channels. The solutions and services in this market include customer communication management [CCM] solutions, customer experience management [CEM] solutions, customer relationship management [CRM] solutions, and customer engagement solutions.

According to a 2021 market research report by MarketsAndMarkets, the global customer communications market will be an estimated $1.3 billion in 2021 and is forecast to reach $2.2 billion by 2026.

This represents a forecast CAGR of 11.2% from 2022 to 2026.

The main drivers for this expected growth are a growing adoption of digital customer communication solutions that are tailored for various industry verticals, with the North America region expected to retain the largest market share through 2026 but the APAC being expected to grow at the fastest rate of growth.

Also, the COVID-19 pandemic likely has pulled demand forward for digital customer communication solutions and businesses of all sizes sought to retain and enhance customer relationships despite the pandemic’s dislocations.

Major competitive or other industry participants include:

-

Adobe

-

Salesforce

-

Airship

-

Iterable

-

Leanplum

-

MailChimp

-

MoEngage

-

Weave Communications

Braze’s Recent Financial Performance

-

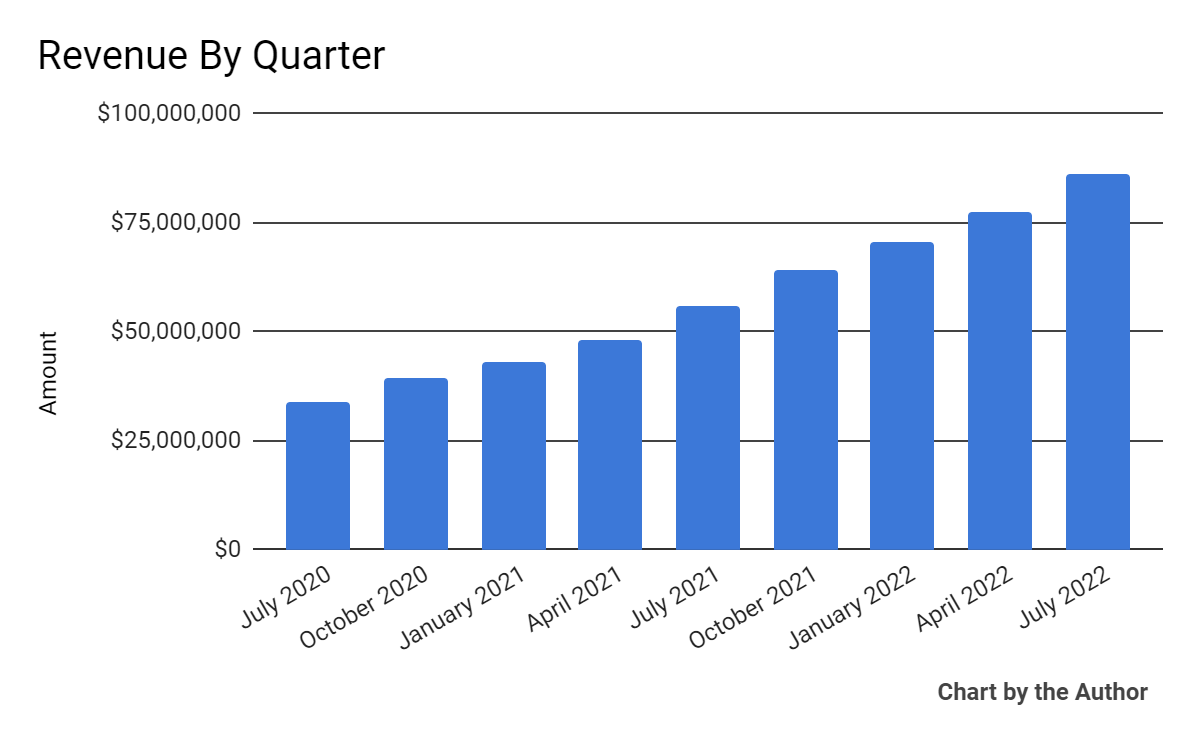

Total revenue by quarter has grown markedly as the chart shows below:

9 Quarter Total Revenue (Seeking Alpha)

-

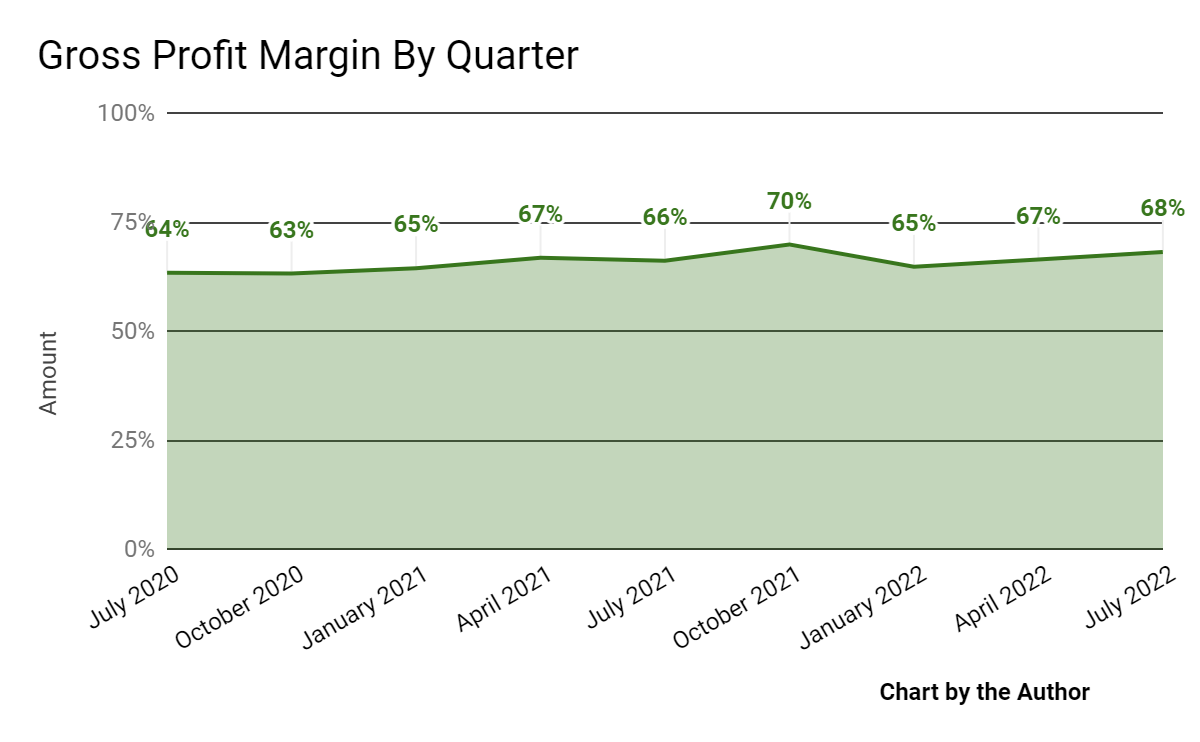

Gross profit margin by quarter has trended higher in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

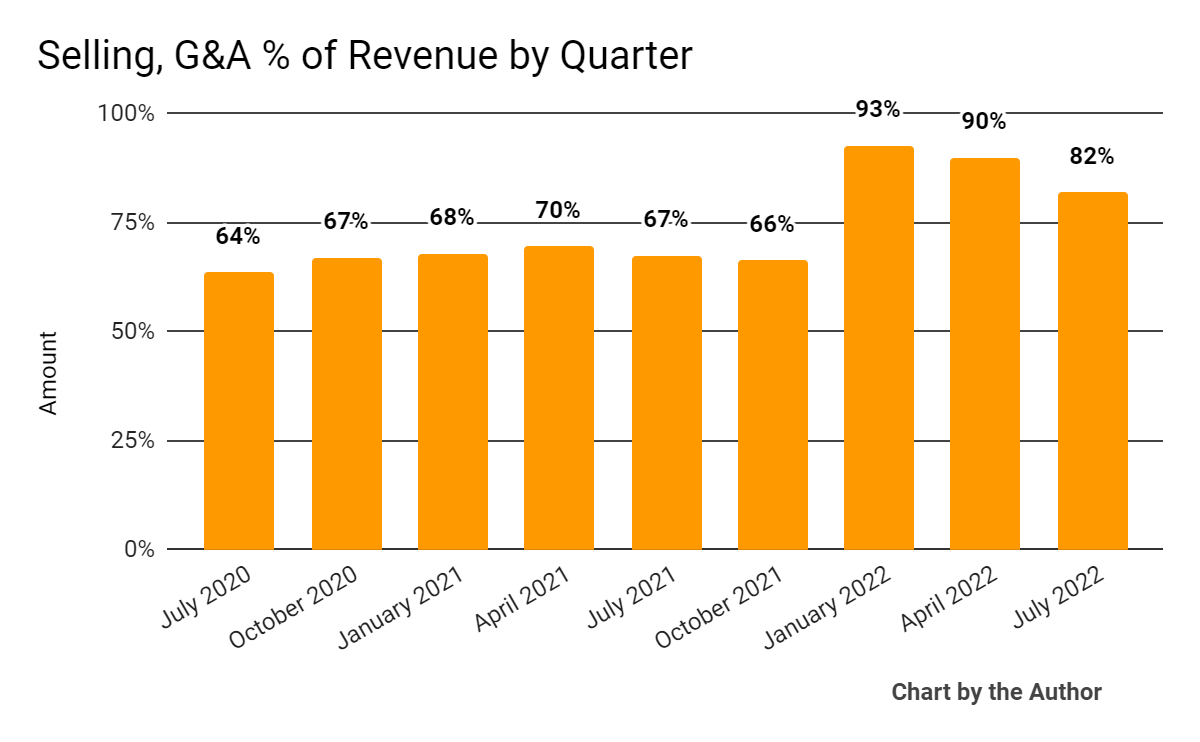

Selling, G&A expenses as a percentage of total revenue by quarter have risen significantly in recent quarters, indicating the firm is becoming less efficient in generating additional revenue as a function of its SG&A spending:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

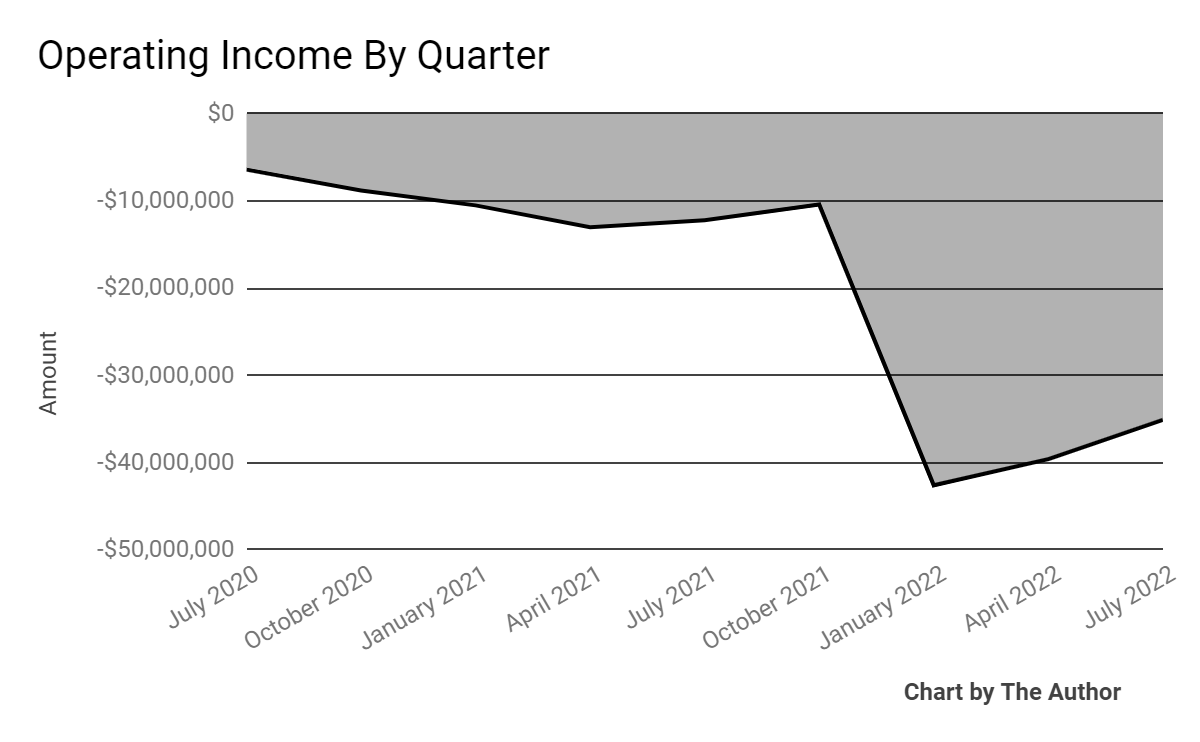

Operating losses by quarter have worsened markedly in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

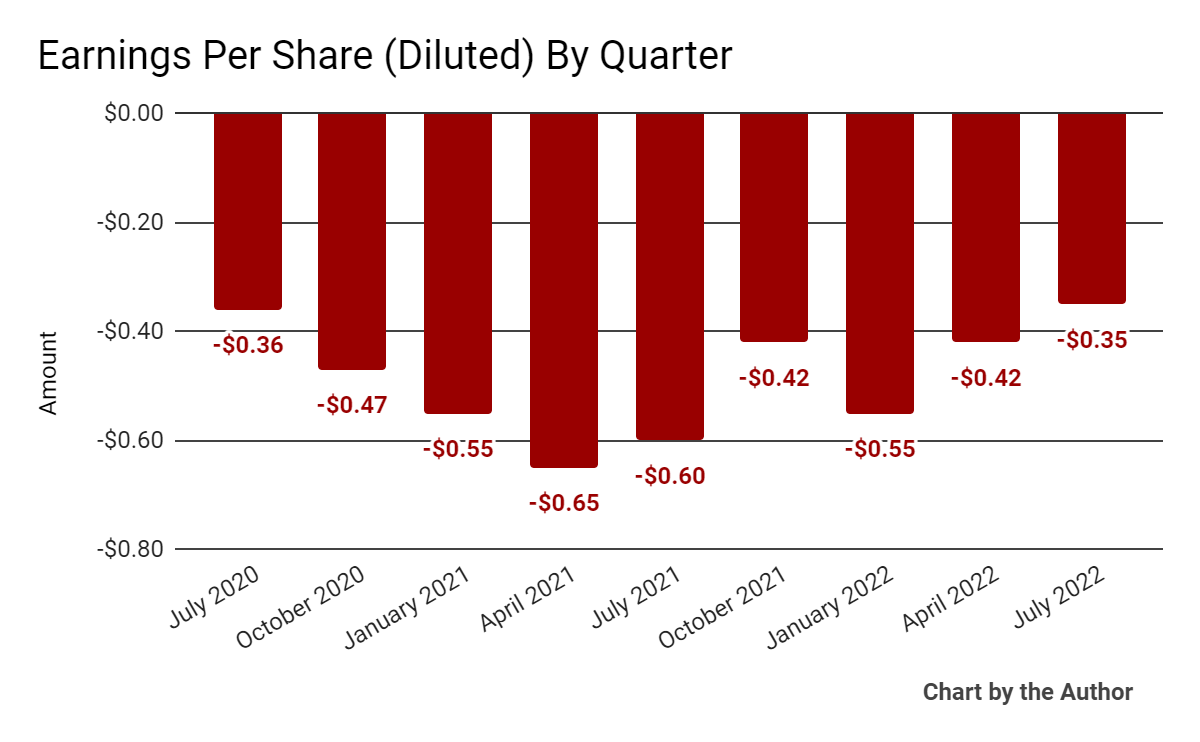

Earnings per share (Diluted) have remained heavily negative, as shown below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

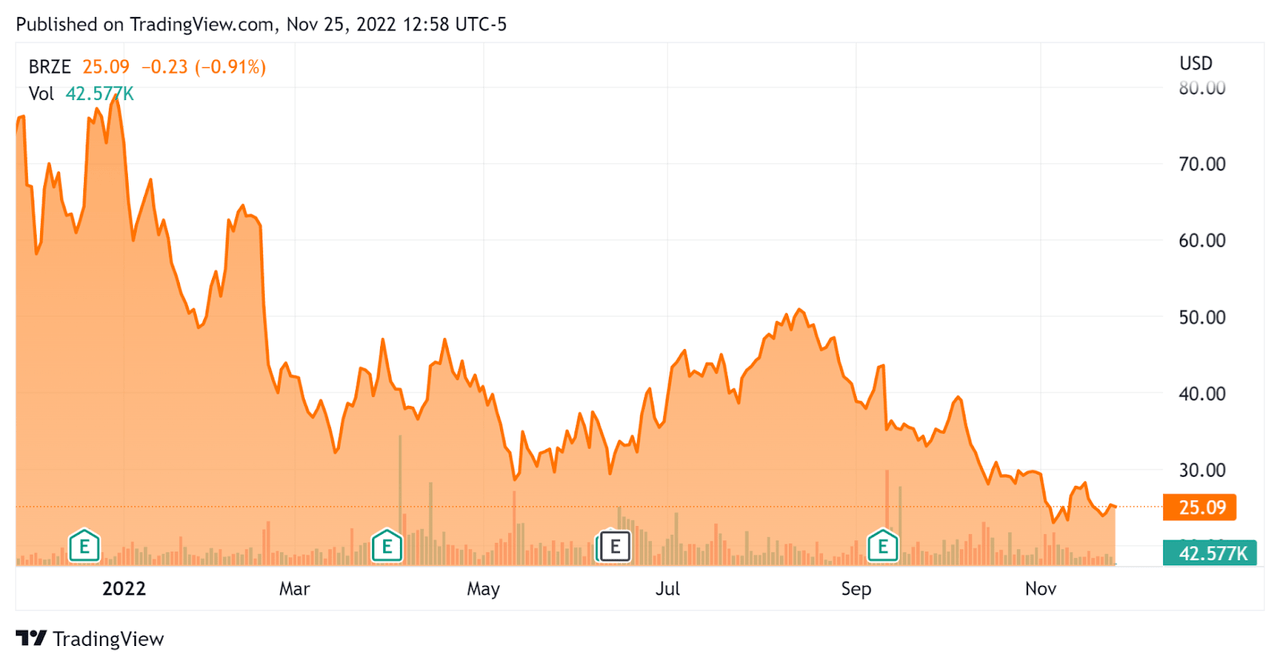

Since its IPO, BRZE’s stock price has fallen 67.1% vs. the U.S. S&P 500 index’ drop of around 12.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Braze

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

6.6 |

|

Revenue Growth Rate |

60.3% |

|

Net Income Margin |

-41.5% |

|

GAAP EBITDA % |

-42.3% |

|

Market Capitalization |

$2,410,000,000 |

|

Enterprise Value |

$1,960,000,000 |

|

Operating Cash Flow |

-$25 |

|

Earnings Per Share (Fully Diluted) |

-$1.74 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

BRZE’s most recent GAAP Rule of 40 calculation was 18% as of FQ2 2023, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

60.3% |

|

GAAP EBITDA % |

-42.3% |

|

Total |

18.0% |

(Source – Seeking Alpha)

Commentary On Braze

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted the growth of its large-customer count, increasing 70% year-over-year.

However, sales cycles have lengthened as prospective customers have slowed their decision-making process due to a deteriorating economic environment.

As to its financial results, revenue rose 55% year-over-year, increasing its customer base by 43% in the trailing twelve-month period.

Notably, international revenue contributed 42% of total revenue during the quarter.

The company’s dollar-based retention rate was 126%, indicating good product/market fit and strong sales & marketing efficiency.

The firm’s Rule of 40 results have been a disappointing 18.0%, well shy of a positive result for this key performance metric.

Remaining performance obligation [RPO] rose 53% year-over-year, while ‘dollar-weighted contract length remains at approximately two years.’

Operating losses worsened sharply year-over-year as the company sought to improve its execution in several areas including sales.

For the balance sheet, the firm finished the quarter with $506.6 million in cash, equivalents and short-term investments and no debt, so the company has a strong balance sheet.

Over the trailing twelve months, the firm used free cash of $36.8 million, of which capital expenditures accounted for 11.4 million of cash used.

Looking ahead, management raised its non-GAAP gross margin target to around 70% at the midpoint of the range, with full-year fiscal 2023 revenue growth to be approximately 46%.

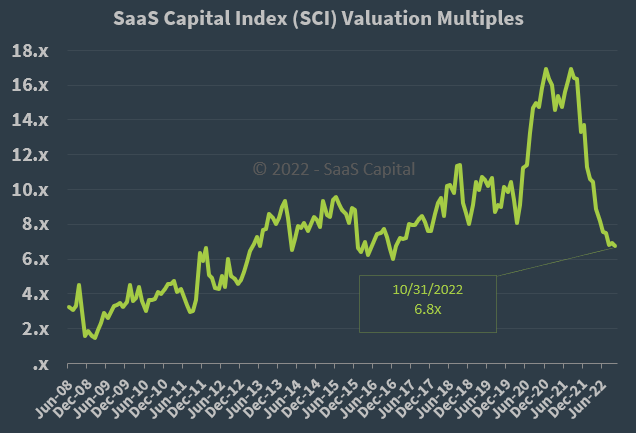

Regarding valuation, the market is valuing BRZE at an EV/Sales multiple of around 6.6x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at October 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, BRZE is currently valued by the market at a slight discount to the broader SaaS Capital Index, at least as of October 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a slower rate of interest rate hikes or a ‘short and shallow’ recession in the U.S. as well as a weaker US dollar.

Braze is producing increasing operating losses in a market that severely punishes money-losing companies due to a higher cost of capital environment.

I don’t see a significant organic catalyst in the near term, so I’m Neutral on BRZE at this time.

Be the first to comment