bjdlzx

Diamondback Energy (NASDAQ:FANG) recently announced another accretive acquisition. This is yet another in the long history of growing the company through acquisitions. In addition, management stated that they would dispose of some noncore parts of the acreage so that the company can still return most of the free cash flow to shareholders.

The total cost (using $145 per share) was around $1.6 billion for the October acquisition. When divided by roughly 68,000 net acres, this comes out to roughly $24,000 an acre. This is a considerably lower price than I have seen for acreage cost. That is before you consider that this acreage has some production and supporting infrastructure.

The Acquisitions

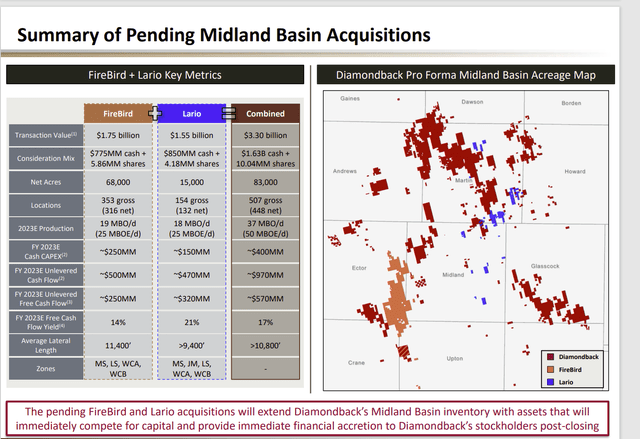

The selling price payment is roughly half in common stock and half in cash (very roughly) for both acquisitions. The details are below:

Diamondback Energy Firebird And Lario Midland Basin Acquisitions November 2022, Presentation (Diamondback Energy Midland Basin Acquisition Presentation November 2022)

The properties are located where the company does business. So, this should be a relatively easy acquisition to assimilate. The property itself is shown above and really not contiguous to much of the acreage the company already possesses. Still Diamondback has some of the best geology in the industry. So, this acreage is likely to produce darn good results.

Note that the latest acquisition has more free cash flow per acre than does the first one. That is kind of a “small window” as to why the latest acquisition costs more per acre than the first one. Free cash flow is an important determinant of value.

What is also noteworthy is that management has committed to sell some acreage when the October acquisition was announced. Even though that announcement will likely be modified due to the latest acquisition, that means that from an industry insider viewpoint, selling prices are becoming favorable enough that the experienced executives are willing to sell some noncore acreage. This company joins Exxon Mobil (XOM) as yet another company that is beginning to dispose of acreage not seen as essential to the future of the company.

Superior Strategy

Companies like Diamondback and Exxon Mobil waited for better pricing to sell their noncore properties. These are usually properties that are either too far away from supporting infrastructure to have optimal operating costs (and issues) or have mature and declining production that will only increase operating costs over time. Sometimes the geology is unexpectedly poor on the acreage.

Prices are now better than when Chevron (CVX) sold acreage to EQT (EQT) in a sale announced in October of 2020. Companies with strong balance sheets should be able to wait for better market conditions than was the case with Chevron. The proceeds from sales of the property can be considerably better as a result. In the case of this transaction, EQT shareholders will be the beneficiaries of a sale that really occurred not long after a cyclical bottom.

The sale of noncore properties often allows companies to report lower operating costs while obtaining the present value of future production in a lump sum. Of course, it is not all of the present value as there is a discount to allow the buyer to profit and there is another discount for risk. But overall, it is a way to avoid the increasing operating costs of production from older wells when the acreage has little to no prospects for future low-cost production.

Implications

For shareholders, the expectation of management should be to get and keep the lease-holding portfolio current with low-cost possibilities so that the company is not caught with high-cost acreage during an industry downturn that it has to dispose of “yesterday” for whatever reason.

Such a procedure makes a big difference in proceeds received from such sales because these sales are often heavily discounted during an industry downturn.

Most of these companies also will swap small acreage positions in an attempt to have a larger solid acreage position that allows for longer and more profitable wells. The supporting infrastructure can also be optimized through this process which leads to lower lease operating costs.

Growth

Diamondback often grows production through accretive acquisitions. That is especially true when the market is demanding the return of free cash flow. The current strategy of selling noncore acreage will allow the timely repayment of debt while keeping operating costs low as previously discussed.

Diamondback is a large company where fast growth often brings some huge logistical challenges. Accretive acquisitions in the areas of operating activity often are a superior way to grow production as prices are still perceived as reasonable by a fair number of insiders. More than a few have the opinion that it is cheaper to purchase production than organically grow it.

Still, investors can expect overtime that earnings per share will grow through a combination of accretive acquisitions combined with some organic growth as market conditions allow. The company has a very long (and successful) record of good acquisitions that benefit shareholders.

Risks

Oil and gas is a notoriously low visibility industry. Not only can prices change “overnight”, but also, the outlook for prices can rapidly change enough to require a whole new forecast.

Any acquisition can turn out to be poor. This management generally makes relatively small acquisitions in areas where it operates to minimize the risk of failure. But that does not eliminate a poor result.

The Future

This well-run company is likely at some point to be sold for the right price. Most purchasers want a bargain which constitutes a well-run company with low costs and little to no post-acquisition issues. This company clearly fits that bill.

In the meantime, the company offers a generous distribution (even though the distribution will vary with industry conditions) combined with solid growth prospects that include more future accretive acquisitions.

The company has some of the most desirable acreage in the Permian and it selectively adds to that acreage on an opportunistic basis. Similarly, management is disposing of noncore holdings promptly so that the company and investors are not “stuck” in an undesirable situation during an industry downturn.

The costs reported in the latest quarter easily demonstrate that this company breaks even with a received oil price in the $20’s. That would enable this company to easily get through any cyclical downturn except for the most extreme situation.

This company has achieved an investment grade rating. That is a relatively rare achievement for an independent. That means that the debt market will be available to the company at any time should debt be needed (at reasonable costs) to finance an acquisition or to refinance debt rather than pay it down.

Even at current stock prices, this company is likely to be a decent candidate for long term appreciation as management continues to find growth opportunities. Good management, like the management here, is often the most valuable asset not on the balance sheet. Good management often demonstrates bargains when the market does not see a bargain. Risk averse shareholders can consider this company as long as they understand how volatile stocks are in the industry.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Be the first to comment