vlastas

Anything that just costs money is cheap.”― John Steinbeck

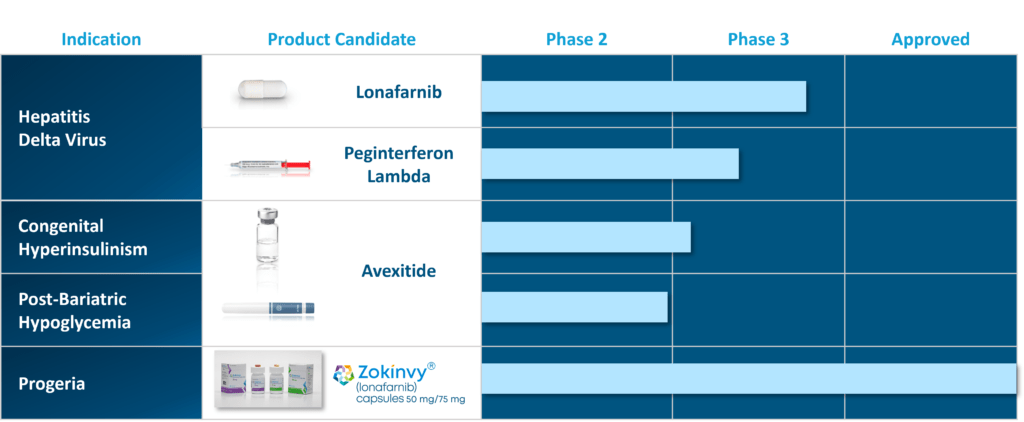

My last article on Eiger BioPharmaceuticals, Inc. (NASDAQ:EIGR) was in March of 2021, soon after the company garnered its first FDA approval for Zokinvy which was greenlighted to treat ultra-rare Hutchinson-Gilford progeria syndrome. Zokinvy also known as lonafarnib was approved for the same indication in Europe early this summer.

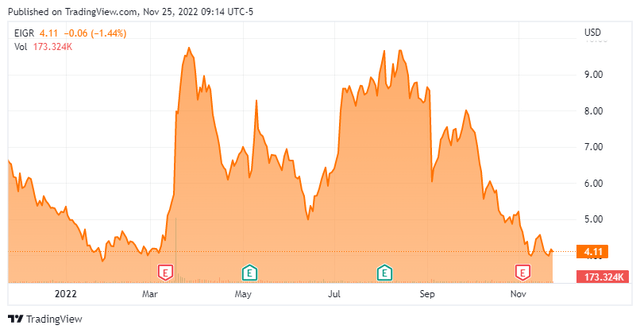

Eiger at current trading levels has a compelling risk/reward profile. The stock is trading at far below analyst firm price targets and the current market seems to be substantially undervaluing the company’s assets and potential. An analysis follows below.

Company Overview:

Eiger BioPharmaceuticals, Inc. is headquartered in Palo Alto, California. The company is focused on the development and commercialization of targeted therapies for rare and ultra-rare diseases. The stock currently trades around four bucks a share and sports an approximate market capitalization of $180 million.

Company Website

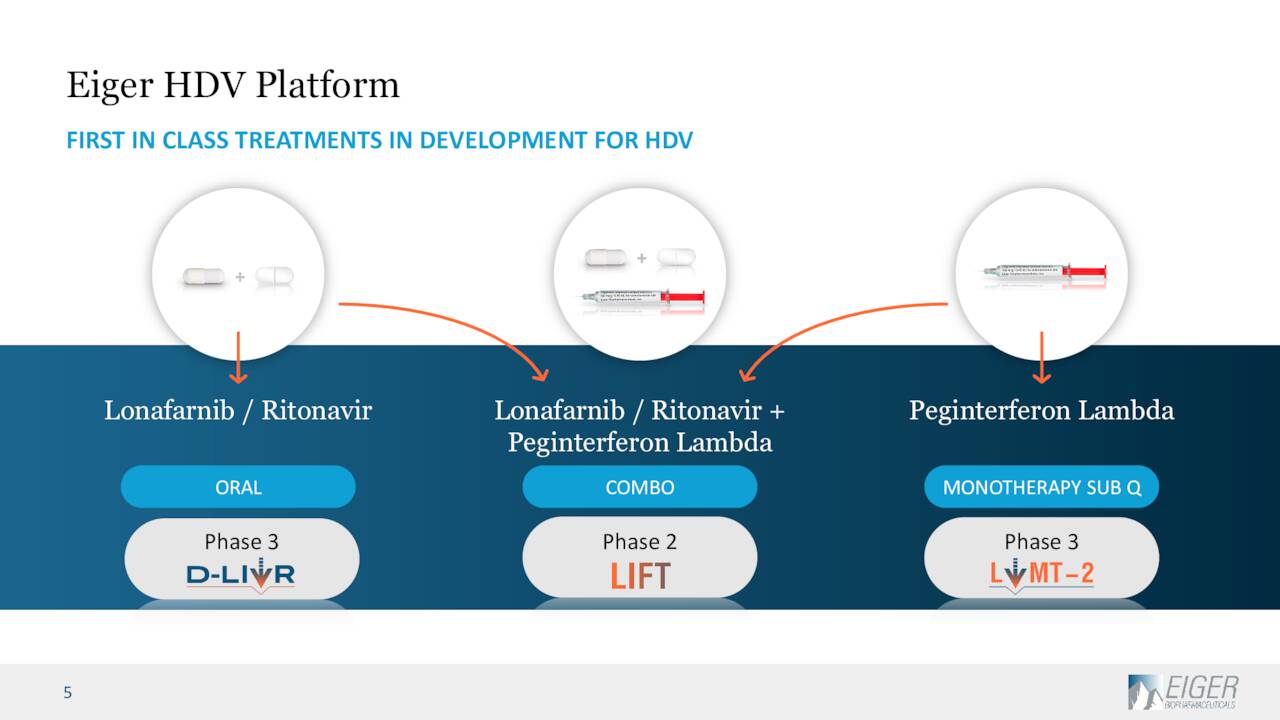

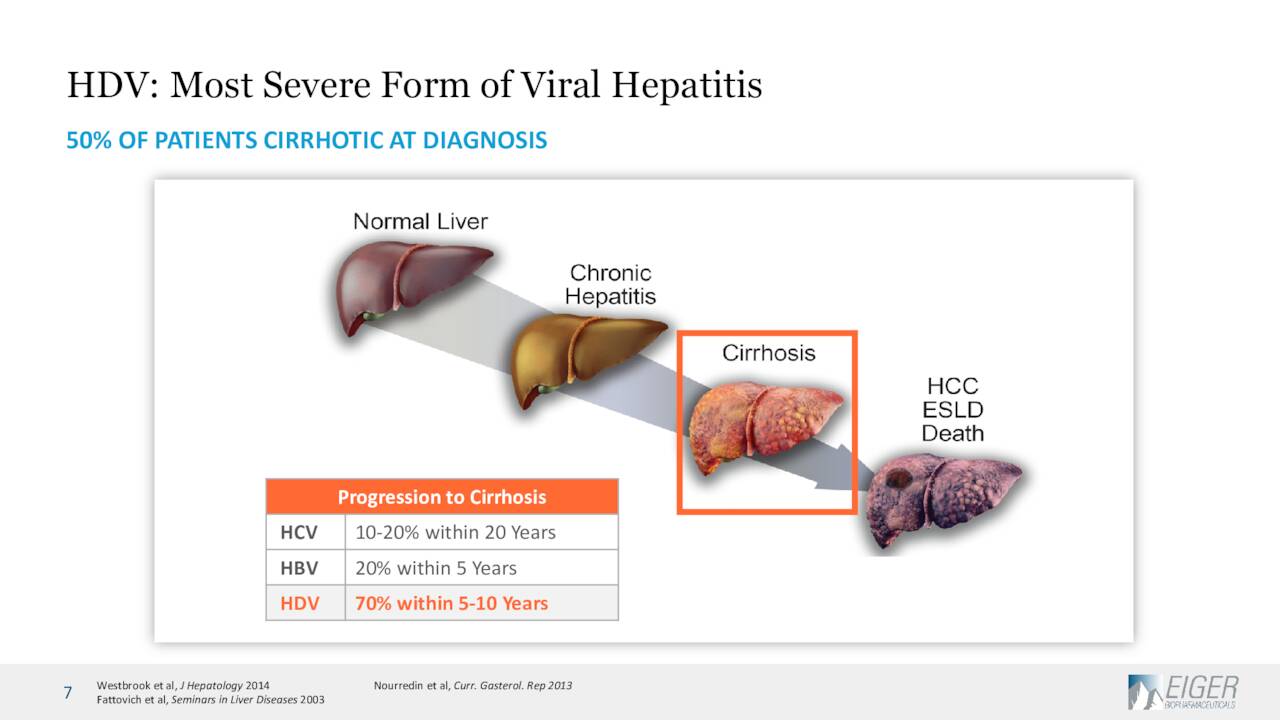

Zokinvy is currently being evaluated in a Phase 3 D-LIVR’ ‘study in combination for the treatment of patients with Hepatitis Delta Virus or HDV. If results are positive, Zokinvy could be approved for this indication in combination with ritonavir and separately in combination with peginterferon alfa. Topline data from this D-LIVR study should be out by yearend. Zokinvy had net product sales of $4 million in third quarter, which should increase nicely at it is rolled out in Europe. The company has a marketing partnership with AnGes, Inc. who will spearhead the process of getting regulatory approval and lead commercialization of Zokinvy in Japan.

April Company Presentation

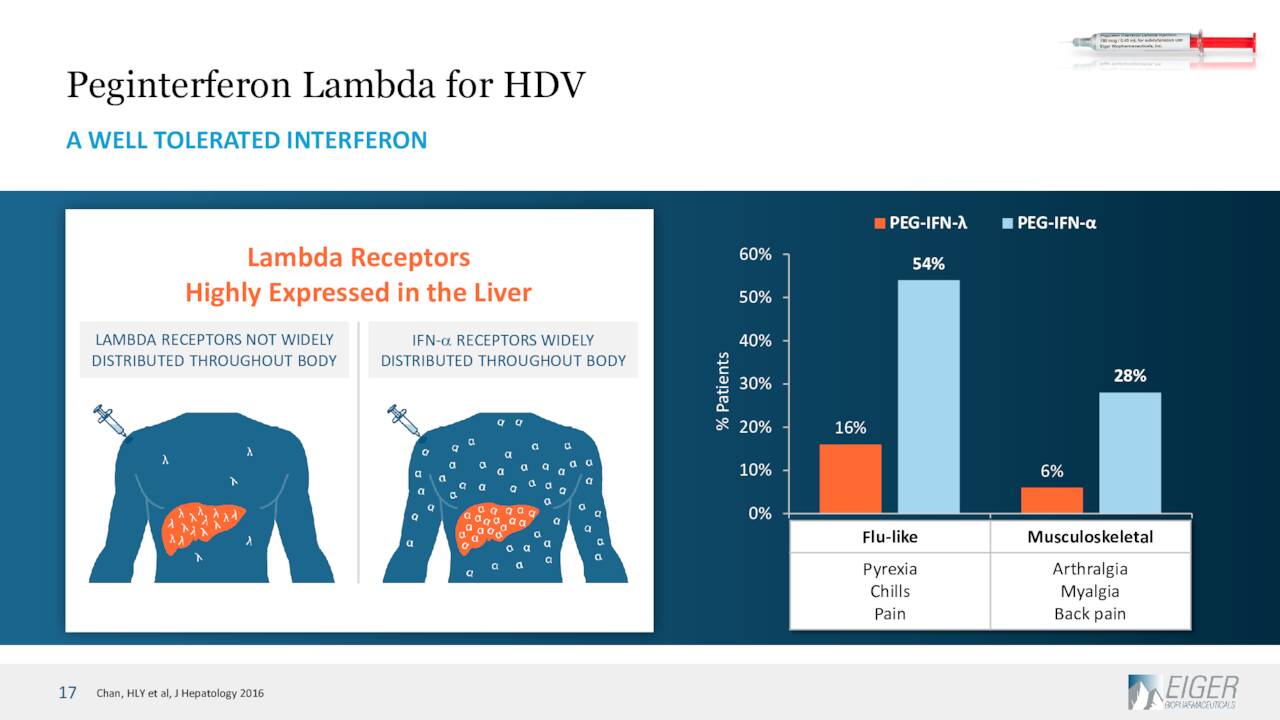

Eiger is also developing Peginterferon Lambda for HDV as well. Peginterferon Lambda is a first-in-class, well-tolerated interferon which management believes has the potential to be interferon of choice in HDV combination therapies.

April Company Presentation

The company is currently enrolling approximately 150 patients in a Phase 3 study ‘LIMT-2’ to evaluate Peginterferon Lambda as a monotherapy for HDV. A Phase 2 study combining Peginterferon Lambda and Zokinvy to treat HDV was recently initiated.

April Company Presentation

Until recently, the company was also developing Peginterferon Lambda was being developed to treat Newly Diagnosed Outpatient COVID-19 Infections. After a recent meeting with the FDA, the company dropped this effort in October of this year. This news caused a quick 20% decline in the shares.

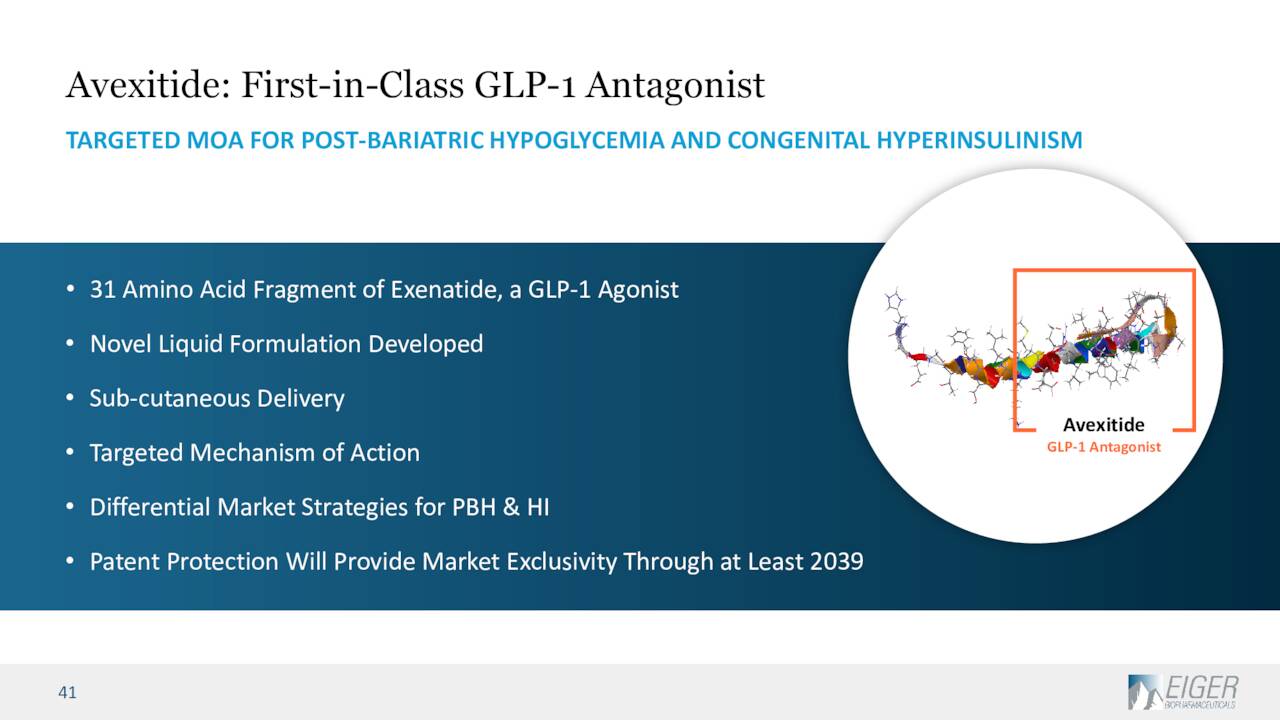

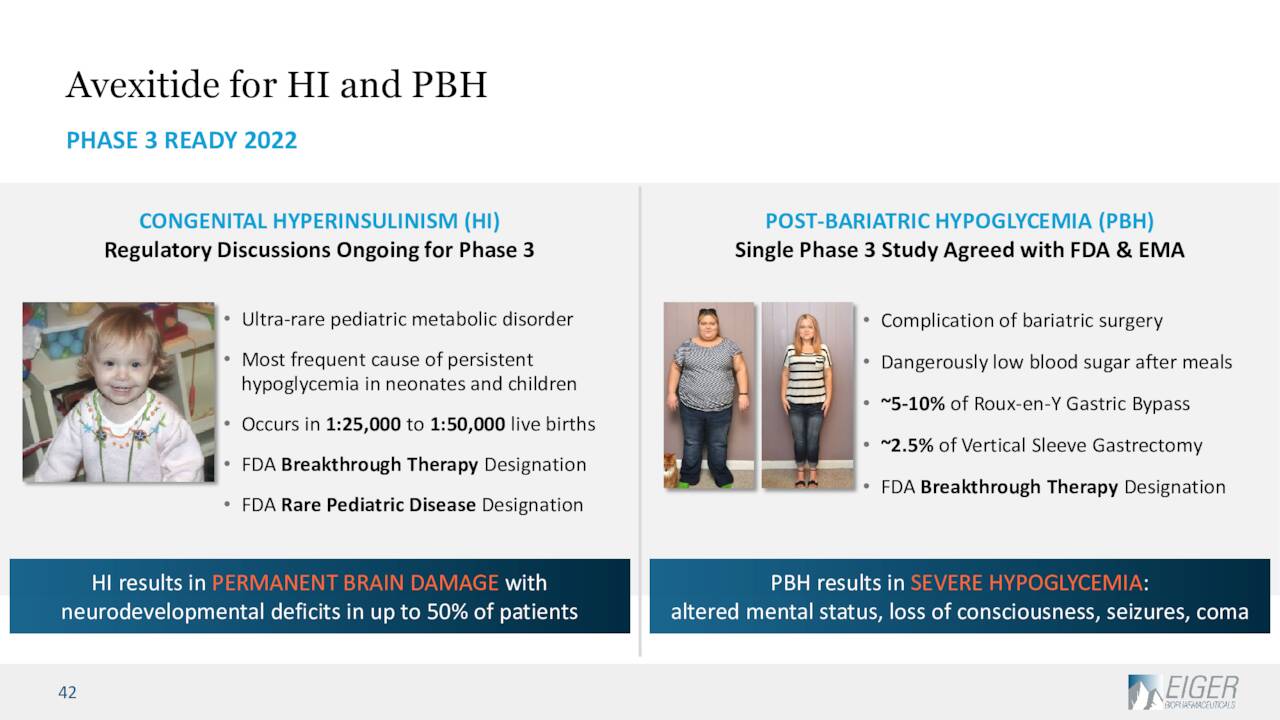

Finally, the company is developing Avexitide for rare metabolic disorders. This compound is aa first-in-class GLP-1 antagonist. Eiger recently initiated a Phase 3 study ‘AVANT’ designed to evaluate Avexitide to treat congenital hyperinsulinism or HI and will start screening patients for inclusion in this study early in 2023.

April Company Presentation

Avexitide has both Rare Pediatric Disease and Breakthrough Therapy designations for this indication. If approved for HI, Eiger would receive a priority review voucher. These vouchers have been receiving $100 million to $125 million on the open market over the past few years, so this would be a valuable asset. It also should be noted that all five Eiger rare disease programs have been granted FDA breakthrough therapy designation.

April Company Presentation

Analyst Commentary & Balance Sheet:

Only three analyst firms have chimed in around Eiger BioPharmaceuticals so far in 2022. BTIG maintained their Buy rating and street high $48 price target on EIGR on September 7th. Both Robert W. Baird ($29 price target) and Ladenburg Thalmann ($28 price target) have reissued their own Buy ratings over the past few months as well.

Several insiders have sold just under $80,000 worth of shares in aggregate so far in 2022. There have been no insider purchases in the equity so far this year. Approximately five percent of the outstanding shares in EIGR are currently held short. Eiger ended the third quarter with just over $120 million worth of cash and marketable securities on its balance sheet against just under $40 million worth of long term debt.

The company also term loan agreement with Innovatus Capital Partners. This was done to refinance a previous debt facility, extend interest-only period by 5 years, and strengthen the company’s cash position ahead of key milestones. Eiger has the ability to access up to an additional $35 million over two tranches from this debt facility pending certain milestones. The company had a net loss of $27.1 million in third quarter.

Verdict:

The current analyst firm consensus has the company losing some $2.30 a share in FY2022 as revenues grow just over 30% to some $16 million. Revenues are projected to rise by two thirds in FY2023 and Eiger’s net loss is forecast to fall somewhat as well. It should be noted that analysts have a wide range of estimates for earnings and sales for 2023.

April Company Presentation

Despite the recent setback with its Covid program, Eiger appears to be a solid ‘sum of the parts’ story trading at five bucks a share. Let’s break it down. The company’s current market cap is approximately $180 million. The company has roughly $80 million in net cash as of the end of the third quarter. Zokinvy is already approved for one indication in both the U.S. and Europe. The company has it and Peginterferon Lambda in late stage development for HDV, which in itself could be a $1 billion + market opportunity.

April Company Presentation

Now add in Avexitide which could both be approved for HI and garner a priority review voucher worth north of $100 million in the foreseeable future. The company’s current cash burn is somewhat concerning but should lesson as Zokinvy ramps up in the U.S. and rolls out in Europe.

Add it all up, and one can see why current analyst firm price targets are so far above the current trading levels of the stock which has been knocked down further by the recent news around its Covid program. However, this provides a solid entry point to pick up the rest of Eiger’s assets on the cheap.

It is not always the same thing to be a good man and a good citizen.”― Aristotle

Be the first to comment