Bet_Noire/iStock via Getty Images

Introduction

Being raised a value investor, I have a soft spot for a company like Goedeker (NYSE:GOED) that is trading at a paltry 2x EBITDA. Upon conducting a deep-dive, I came to agree with the current coverage’s stance that the name should in no way be trading at distressed levels. I believe a short-term bounce is in order, but there are storm clouds on the horizon that may prevent me from holding this name over the long term. Let’s dive in.

Who is Goedeker?

Goedeker is a company that sells luxury appliances, furniture, and services involving the installation of the two. Most of Goedeker’s sales is generated virtually either through its digital channels (primarily its website) or remotely from a sales-representative. Its physical locations serve as showrooms (instead of retail stores), and very few transactions actually occur in person. Because of this, Goedeker is a closer comparison to the likes of Wayfair (W) and Amazon (AMZN) than the likes of Home Depot (HD) and Lowe’s (LOW).

A Tumultuous Beginning

In October of 2020, Goedeker announced the acquisition of Appliances Connection, a move that would 10x the company’s revenue and put its bottom-line in the green for the first time. This seemed like a slam dunk deal, and this notion was reinforced by reports of the proposed combined entity seeing record-breaking sales to close out 2020. Share price more than doubled from November 2020 to February 2021, and discussions on the means of the acquisition seemed to have been put on the backburner

On May 27th 2021, just a week before the closing date, share price opened at $16.82, +289% higher than the previous day’s close of $4.32, before rock-bottoming to $1.84 the following day, a high to low decline of almost -90%. Management asserted that there was no foul play, but the writing was on the wall: shares outstanding would go from under 10 million shares to over 100 million after the transaction, and existing shareholders would be diluted over 15x on their equity.

A New Hope

After the dust had settled, Goedeker had turned into a profitable company with over a $500M yearly run rate and an 11% EBITDA margin. They have over $25M in cash, and their business seems to be humming along.

A slew of new talent joined the organization, most notably CFO Maria Johnson and CMO Jody Rusnak. They also internally promoted a new CEO, Albert Fouerti, to run the company post-acquisition.

Management delivered a strong first call in November of 2021, highlighting the key initiatives that they will be focusing on moving forward. Things seemed so optimistic that in December of 2021, Fouerti purchased over $1M of the common stock, and other insiders added to their bags as well. Goedeker has gone on to break company revenue records every quarter since the acquisition.

DCF Valuation

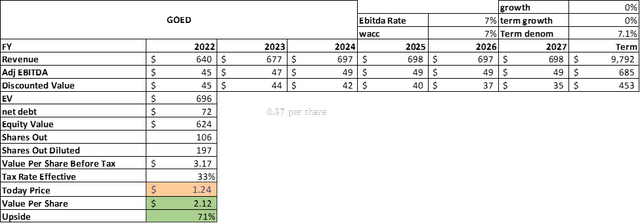

So how do we value the company? Seeing as Goedeker is now profitable, I believe a DCF valuation is in order. The following analysis will assume declining revenue growth that trends to 0% (more on that later), a 7% adjusted EBITDA rate, and a 33% effective tax rate:

Goedeker DCF Analysis (Author Jack Zhang)

Even after accounting for the 91M share dilution that will be exercised at $2.25, Goedeker is trading at a 71% discount to fair value as of Thursday’s close, and its fair price should be closer to $2.12 a share. Analysts have been calling for the likes of share buybacks to close this valuation gap, but I don’t think this will move the needle in today’s environment. By my estimation, the only way for Goedeker to earn some respect from Wall Street is if it can execute on one of the three initiatives that the Fouerti had emphasized when he first took office:

- Growth of the B2B segment – Fouerti mentioned at the end of Q1 2022 that the company has over $20M of bookings in their B2B pipeline. But one quarter later, Fouerti’s only remarks were that they were able to recently close a $1.2M deal. Early indications are that this initiative is slow starting out of the gates, but any good news on this front would be big for the stock price.

- Development of Distribution Network – Pay close attention to any developments here. As of the last update, this initiative has been put on the backburners due to high leasing costs and lower regional demand (more on this later). If this suddenly ramps back up, investors will have reasons to be optimistic.

- Rebranding – Digital presence is key for e-commerce companies, which is essentially what Goedeker is. I like the strategy of a rebrand in an attempt to open more creative opportunities to drive sales. They are supposed to make headway on this by the end of Q2 2022. Let’s see how this plays out.

Sales Growth Decline

Why is Goedeker trading at such a discount? One big reason is that the company massively burned existing shareholders during the acquisition of Appliances Connection. Wounds like that take time to heal. But looking under the hood, this suppressed valuation is also backed by something else: slowing sales growth.

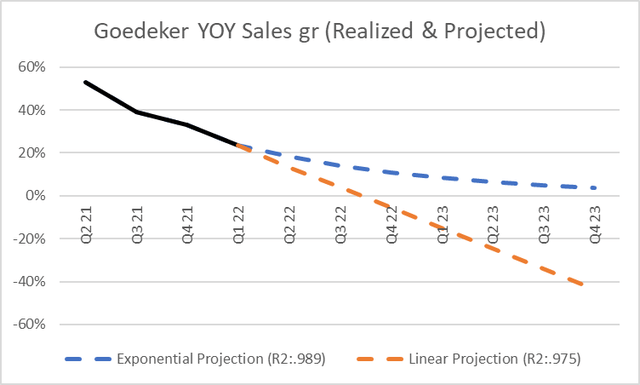

Over the past number of years, there has been a consolidation in the retail industry. During this time, there has been ample opportunity to either capture market share for big players, or become a big player for up-and-comers. The latter is what Appliances Connection, or now Goedeker, has done. In the first earnings call after the acquisition, Fouerti mentioned that sales had grown from roughly $150M to $400M over the previous five years (~25% CAGR). What the CEO didn’t mention is that the company’s growth is also slowing materially. This is confirmed after the most recent earnings call which paints the picture that quarterly YOY sales growth has been trending downwards: 53% -> 39% -> 33% -> 23% over the past 4 quarters:

Goedeker Sales Decline (Author Jack Zhang)

If this holds up through the end of FY 2022, an exponential regression model suggests a 17% sales growth in 2022, a number that CFO Maria Johnson seems to agree with when she guided “high teens” during the Q1 earnings call. This is a stark difference from the 46% growth that the company exhibited in 2021. If this guidance plays out, the exponential projection would then suggest a mid-single digit sales growth in 2023 as the best-case scenario. Worst case scenario? Negative growth, and the linear regression model suggests that pretty explicitly.

Canary in the Coal Mine?

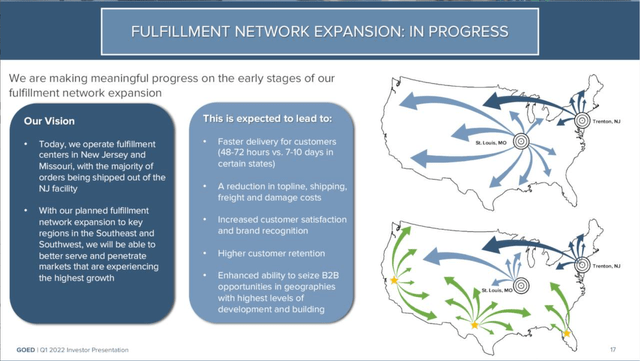

It can be hard to digest the bleak revenue picture that was just painted, but this can be backed up qualitatively as well. When Fouerti first took over, he emphasized the need to expand their warehouse footprint across the United States:

Goedeker Supply Chain Initiative (GOED Q1-22 Investor Deck)

The reason? They want to shorten delivery time and reduce damages for markets that are farther away from their current warehouses. Makes sense. Fouerti estimated that by the end of Q2 2022, they would “make major headway” on this initiative. Fast forward to one month before the end of Q2 2022, Fouerti’s only comments on the matter were that they were “focused on the ability to expand [their] fulfillment network.” This is a stark contrast from “making major headway” that the CEO had previously guided. Fouerti had insinuated that the only way this expansion isn’t executed is if there isn’t enough demand in the markets that they are expanding to. Reading between the lines, looks like this is like what is happening.

Additional Risks

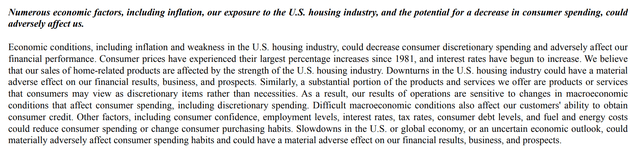

Slowdown in organic sales aside, we must consider recession risks that are brewing on the horizon. The luxury appliances that Goedeker sells should be treated as consumer discretionary products and would be affected the most from any economic downturn. From the company’s latest 10Q:

Goedeker Risk Assessment (GOED Q1-22 10Q)

Conclusion

So yes, Goedeker is very undervalued, and it’s not a bad buy at these distressed prices for a short-term pump to the upper $1s. But looking under the hood, growth metrics are starting to reverse. Over the long term, it is entirely possible that the new team turns things around for them to hit $1B in sales by the end of the decade. But as management has alluded, the next year+ will be transition years, and long-term investors need to have confidence that Goedeker can weather any potential storm on the macroeconomic front. If not, don’t get hung up on this company’s long-term valuation; there are lots of fire sales out there.

Be the first to comment