Brandon Bell/Getty Images News

By Brian Nelson, CFA

There are few companies in the world more recognizable than McDonald’s (NYSE:MCD). The fast food giant has dominated the quick service landscape for decades, and we still think there is ample room for growth at the Big Mac maker. Not only does the company have a tremendous brand that resonates with consumers, but through the years McDonald’s has demonstrated the ability to adapt to whatever challenges are thrown at it (Super Size Me, for one). We expect this resilience and adaptability to consumer preferences to continue.

But that’s not all. McDonald’s is more than just a valuable brand. For starters, in an environment where labor is getting more difficult to come by, the company’s workforce has become a competitive advantage. Local mom and pop operations are struggling to find help, while McDonald’s is able to offer a more competitive salary and benefits and therefore attract and retain some of the best talent. The scale of its supply chain is also practically unmatched, having been augmented and refined over decades, and how can we forget the value of its franchisees? Local owners are key, and the firm’s move to a mostly franchisee business model has paid dividends along the way.

Frankly, in the fast-moving society of this day and age, McDonald’s has become so ingrained in our daily lives that it has almost become a conscious decision not to go there. The firm’s ability to reinvent its menu, especially with the variety of choices for a chicken sandwich, keeps consumers coming back for more, too. Even the value-conscious consumer can find what their looking for, whether it be 2 for $2 breakfast sandwiches or something else on the value menu for lunch or dinner. Other quick-service restaurants may be struggling to provide customers value for their buck, but not Mickie D’s. The company is in a sweet spot, even as inflation pressures franchisee profits.

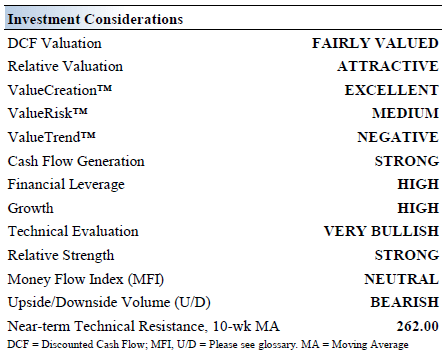

McDonald‘s Investment Considerations

Image source: Valuentum. The key investment considerations found in McDonald’s 16-page report on the Valuentum website. (Valuentum)

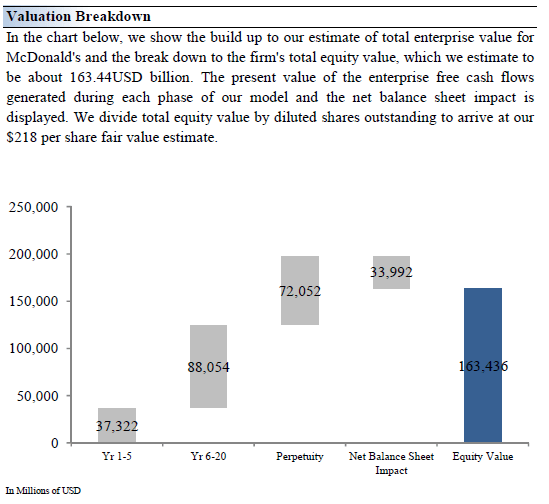

There are a number of key investment considerations we monitor at Valuentum. First and foremost, we look at the company’s value from a discounted cash-flow basis. That means we’re modeling its income statement, balance sheet, and cash flow statement to derive a fair value estimate on a per-share basis. At the moment, we value shares of McDonald’s at $218 each, or just slightly below where shares are trading at ($234 at the time of this writing).

We also look at McDonald’s relative value versus consumer discretionary peers on a P/E basis and forward price-earnings-to-growth basis as well as a number of other fundamental considerations. McDonald’s lofty return on invested capital earns it an excellent ValueCreation rating, and while there are always risks to the sustainability of its business model, we don’t think McDonald’s is any riskier than the average S&P 500 company, and therefore we assign a ValueRisk rating of medium.

We expect McDonald’s to keep growing through thick and thin, too, and while the global economic and geopolitical environment remains uncertain, particularly with respect to the prospect of Fed rate hikes and the war in Ukraine, McDonald’s is still able to throw off tremendous amounts of free cash flow and pay hefty dividends. It’s not an understatement to say that “McDonald’s is part of the cultural fabric in communities around the world (2021 Annual Report),” and long-term investors love this.

McDonald’s Investment Highlights

Home of the Big Mac, McDonald’s is the world’s largest quick-service restaurant brand. In 2021, the company set a record with respect to global systemwide sales, and its comp growth for the year was tremendous, coming in at a lofty 13.8% in the U.S. The restaurant’s management team is also extremely shareholder-friendly, returning billions to shareholders annually. McDonald’s has 40,000+ restaurants in ~120 countries and has been in business now for more than 70 years.

More than 90% of the company’s worldwide restaurant locations were franchised. McDonald’s recently launched a $250 million commitment in the U.S. over the next half decade to provide new ways for candidates to join as franchisees and keep the growth across communities going. McDonald’s aims to generate a free cash flow conversion rate north of 90% in the near term, aided by the asset-light nature of its business model.

Though it will be hard to produce another gem to the same success as McCafe, ‘all-day breakfast’ has been a needle-mover. Industry-wide traffic trends and competitive pricing in the U.S. are worth noting as they relate to comp performance, but the company continues to deliver for shareholders. McDonald’s seeks to franchise ~95% of its total restaurant count, which should further support its financial performance, keeping potentially increasing and inflationary franchisee costs off the income statement.

McDonald’s is modernizing its stores and upgrading its digital operations, while encouraging its franchisee partners to do the same. According to the company, more than quarter of the company’s systemwide sales came from the digital channel last year, and we wouldn’t be surprised to see this number creep ever higher in the coming years. McDonald’s continues to optimize its menu while improving the in-store dining experience and digital order delivery experience, too. McDonald’s has a bright growth outlook, as reflected in our key considerations.

Labor/wage market developments are worth keeping an eye on, and increasing competition from fast-casual and healthier menus is a permanent, structural change. However, McDonald’s, in part due to its scale and profitability, is able to offer various compensation packages that may include cash bonuses, stock-based awards, retirement savings programs as well as health benefits. This helps to retain talent and keep restaurants open.

On the basis of our evaluation, McDonald’s has a plethora of competitive advantages, and its ability to lean on its pricing power or drive more efficiencies within its global system to offset inflationary headwinds put it ahead of most of its quick-service peers. The McDonald’s brand has enduring strength, and we like the fundamental backdrop of the company quite a bit.

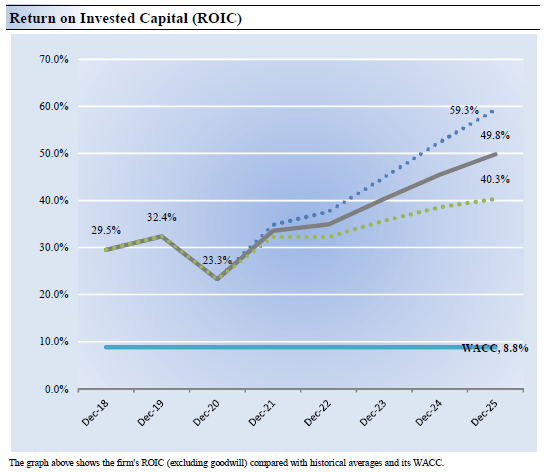

McDonald’s Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. McDonald’s 3-year historical return on invested capital (without goodwill) is 28.4%, which is above the estimate of its cost of capital of 8.8%.

As such, we assign McDonald’s a ValueCreation™ rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

For McDonald’s, its main customers are the franchisees that absorb a lot of the costs of running a restaurant. McDonald’s reaps the benefits of a mostly franchisee business model, and that means it generates lofty returns on a relatively low asset base. Its revenue and profits are predominantly driven by the fees from restaurants operated by franchisees (i.e. rent and royalties based on percent of sales), and to a lesser extent, the performance of its company-owned restaurants. We expect McDonald’s to continue to generate economic profits (ROIC > WACC) for the foreseeable future.

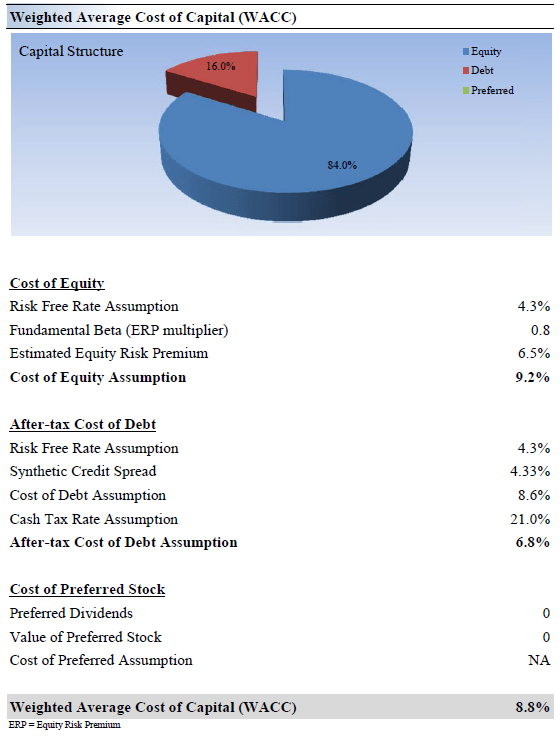

Image source: Valuentum. McDonald’s is a very strong economic-value generator. (Valuentum) Image source: Valuentum. How we calculate McDonald’s weighted average cost of capital. (Valuentum)

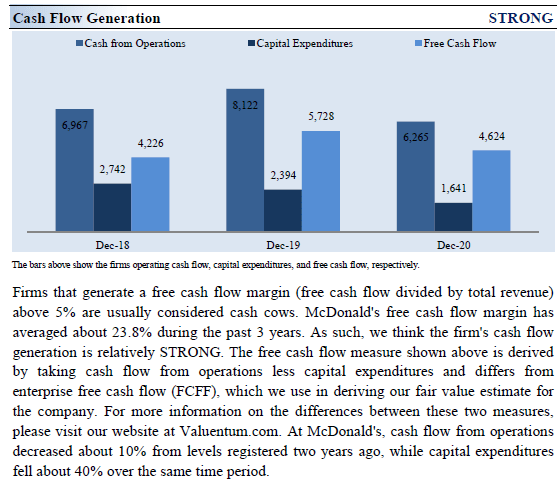

McDonald’s Cash Flow and Valuation Analysis

Image source: Valuentum. McDonald’s has a tremendous ability to keep generating free cash flows through thick and thin. (Valuentum)

Based on our discounted cash flow process and assigning a fair value range that accounts for varying scenarios of future expected free cash flows, we think McDonald’s is worth $218 per share with a fair value range of $169-$267. The high end of our fair value estimate range may reflect the value of McDonald’s should the global economic environment not enter recession and the U.S. 10-year Treasury remain at attractive levels, or in the 3% range. The low end of the range may reflect McDonald’s intrinsic value should there be a prolonged global economic recession and the U.S. 10-year Treasury soar to 5% or higher.

The margin of safety around our fair value estimate is driven by McDonald’s MEDIUM ValueRisk™ rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them. Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 11.2% during the next five years, a pace that is higher than the firm’s 3- year historical compound annual growth rate of -5.6%.

Our valuation model reflects a 5-year projected average operating margin of 44.7%, which is above McDonald’s trailing 3-year average. Its operating margin is so lofty, in part due to its mostly franchisee business model. Beyond year 5, we assume free cash flow will grow at an annual rate of 4.1% for the next 15 years and 3% in perpetuity. For McDonald’s, we use a 8.8% weighted average cost of capital to discount future free cash flows, which is about in line with the average company in our coverage universe.

Image source: Valuentum. How we assign value throughout the three stages of our discounted cash flow model. (Valuentum)

McDonald’s Margin of Safety Analysis

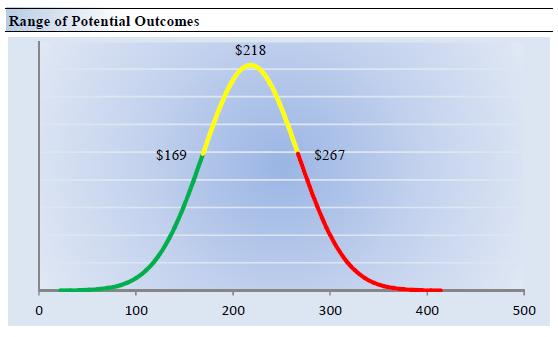

Image source: Valuentum. The fair value estimate range for McDonald’s. The most likely ‘true’ fair value estimate of McDonald’s is the highest point along this fair value distribution graph. (Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm’s fair value at about $218 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for McDonald’s. We think the firm is attractive below $169 per share (the green line), but quite expensive above $267 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

This is an important distinction for readers to understand. Stock prices and therefore values are driven by future expectations. Because the future is inherently unpredictable with any sort of precision, value will always be a range of probable fair value outcomes on the basis of those uncertain future free cash flows. The more uncertain the future free cash flows, the larger the fair value estimate range, and vice versa.

McDonald’s Future Path of Fair Value

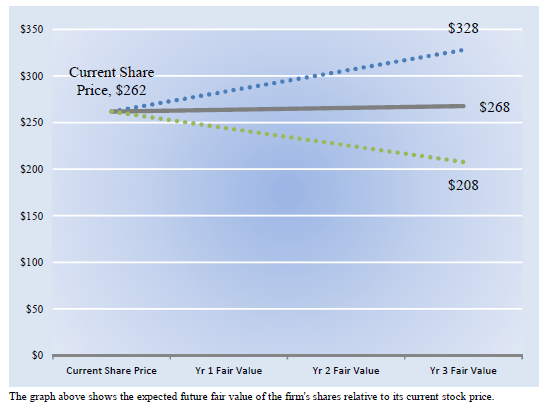

Image source: Valuentum. Value is never static. As companies collect free cash flow, their intrinsic value advances over time. (Valuentum)

We estimate McDonald’s fair value at this point in time to be about $218 per share. As time passes, however, companies generate cash flow and pay out cash to shareholders in the form of dividends. The chart above compares the firm’s current share price with the path of McDonald’s expected equity value per share over the next three years, assuming our long-term projections prove accurate. The range between the resulting downside fair value and upside fair value in Year 3 represents our best estimate of the value of the firm’s shares three years hence.

This range of potential outcomes is also subject to change over time, should our views on the firm’s future cash flow potential change. The expected fair value of $268 per share in Year 3 represents our existing fair value per share of $218 increased at an annual rate of the firm’s cost of equity less its dividend yield. The upside and downside ranges are derived in the same way, but from the upper and lower bounds of our fair value estimate range. We think it imperative for readers to think about value as an advancing range as free cash flows are generated over time.

Concluding Thoughts

McDonald’s operates a mostly franchisee business model, meaning most of the inflationary pressures will fall on its franchises, and the company will continue to reap the benefit of franchisee fees. Though we like this aspect of the company a lot and think it perfect for this inflationary environment, we also note that the firm is handling the market environment quite well, with its franchisees offering consumers value for the buck — and this is coming through in strong comp performance. We don’t think the McDonald’s equity is underpriced at present levels, but for exposure to the restaurant arena, it’s hard to go wrong with the firm’s stock. For dividend growth investors, shares yield a lofty 2.4% at the time of this writing, a level comfortably above the average S&P 500 company.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment