AvigatorPhotographer/iStock via Getty Images

With CPI numbers coming in hot for the month of May, and the Fed hiking rates by a surprise 75bps, the question remains whether supply side inflation is abating. We’ve seen news of freight rates declining and port congestions easing, but is this enough to bring the world out of the supply chain crisis?

Have Freight Rates Really Declined?

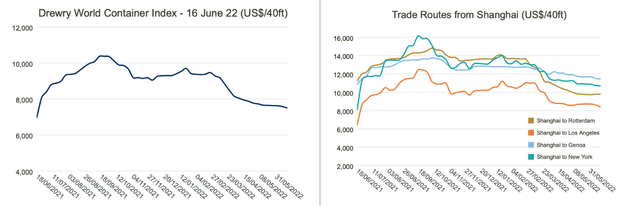

There’s some argument that freight rates are also declining. This is true to a certain extent. The Drewry World Container Index has been declining since March 2022, but it still remains 8% higher than a year ago.

Pricing for trade routes from Shanghai have come down since February and have remained relatively flat during the last three months, according to the Drewry World Container Index.

Drewry World Container Index (Drewry Supply Chain Advisors)

The reaction we’ve seen in market prices for commodities and equities have largely been driven by sentiment and anticipation, but not the actual effects of a decline in supply or a supply chain problem. Think back to last year. Supply chain problems were forming well before it translated into higher prices.

Port Congestion Remains a Major Factor

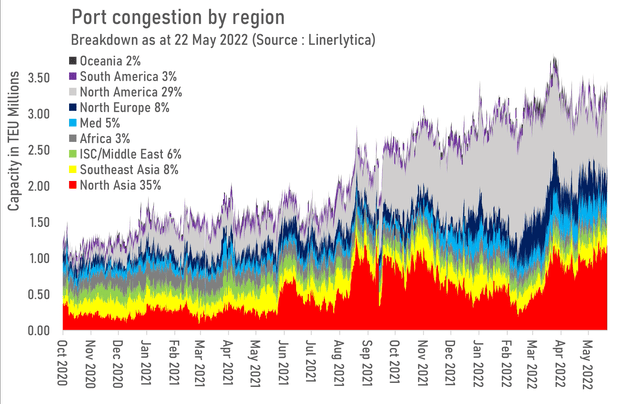

Port congestion by region still remains high. According to Linerlytica, port congestion in North America has inched higher but so has the rest of the world. We’re still far from where we were in Oct 2020 and until this situation abates, we will continue to see higher level of prices.

Port Congestion by Region – May 2022 (Linerlytica)

Hidden Costs Plaguing the Supply Chain

Freight rates and port congestion remain the two obvious factors that we look at when trying to examine the supply chain. However, there are other cost factors that need to be taken into account:

- Insurance Premiums: Since geopolitical tensions started in Europe, the cost of insurance has increased significantly. While these higher insurance premiums were originally just for routes around the Baltic region, we are now hearing reports of rising insurance costs globally. Shippers and insurance companies are no longer keen on taking chances because the situation in Europe reconfirmed that bad things can happen.

- Longer lead times and return journeys: We’ve already encountered the problems that shippers face with return journeys. If a shipper can’t confirm a return journey or if it costs them too much to actually take the journey, they sit at the ports. This is what happened last year when all the ships were off the coast of Los Angeles. Some of that still remains as port congestions continue. There is a cost to this however, and longer lead times create even more pressure on supply chains, increasing prices along the way.

Tracking Shipping Companies

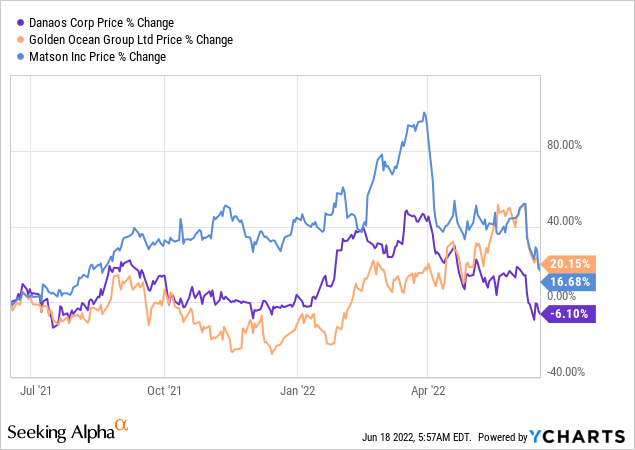

The era of high freight rates was certainly beneficial for shipping companies. Higher rates translated into improved profitability and better stock price performance. However, prices have been steadily declining with freight rates easing; not to mention selling pressures as part of the overall market decline.

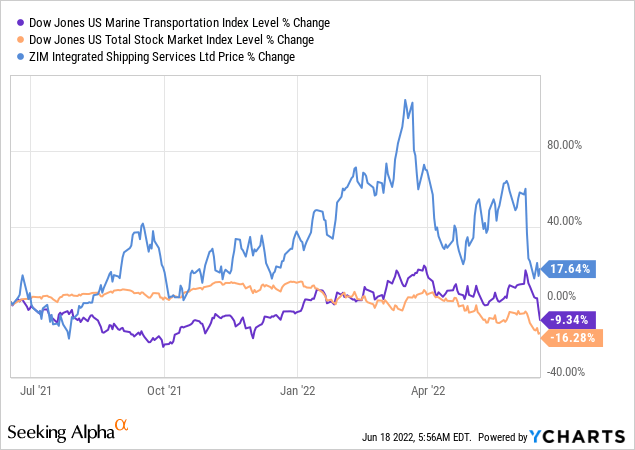

The supply chain disruptions gave shippers the opportunity to lock in longer term contracts of up to three years at perceived discounted rates. But one company held out with shorter term contracts of a maximum of 12 months because they believed in the upside growth of the trans-Pacific freight growth. That company was the new kid on the block – ZIM Integrated Shipping (ZIM), which went public in January 2021 at $15/share.

Since going public, the company has been steadily growing. Incorporate in 1945 and based in Israel, the company operates on a charter model operating 118 vessels of which only four are owned. ZIM has an asset-light model, which gives them an edge over other shippers in terms of accommodating lower freight rates. This stock would be one to watch.

The company has outperformed both the Marine Transportation Index (DJUSMT) and the broader market.

While it would seem that freight rates are easing, the supply chain crisis is far from over. The persistent lockdowns in China and the geopolitical situation in Europe are not easing. As long as these conditions persist, we are bound to have supply side inflation, which is not something the Fed’s policies can control.

Be the first to comment