andresr/E+ via Getty Images

Introduction

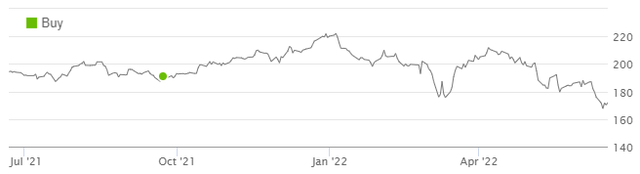

We review our investment case on Diageo PLC (NYSE:DEO) following a significant correction in its shares.

The price of Diageo’s American Deposit Receipts (“ADRs”) has fallen by 23.0% (in USD) since their peak in early January (while the price of Diageo shares in London has fallen by 13.9% in GBP):

|

Librarian Capital’s Diageo Rating History vs. ADR Share Price (Last 1 Year)  Source: Seeking Alpha (20-Jun-22). |

Diageo shares are now trading at 26.9x CY21 EPS and offer a 2.1% Dividend Yield. Structural growth in global spirits is continuing, FY22 will see a further recovery from COVID-19, and Diageo now targets a 6-9% organic EBIT CAGR in FY23-25. Our forecasts show a total return of 57% (16.6% annualized) by June 2025. Buy.

Diageo Buy Case Recap

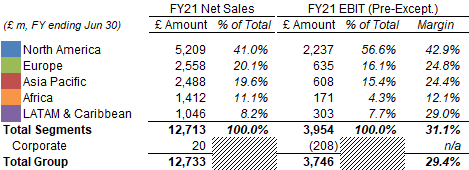

Diageo is the #1 global spirits company by size. It is broad-based geographically, with North America as its largest region, contributing 56.6% of segmental EBIT in FY21, followed by Europe (16.1%) and Asia Pacific (15.4%):

|

Diageo Net Sales & EBIT by Region (FY21)  Source: Diageo annual report (FY21). |

India was approx. 7.5% of sales in FY21 while China was approx. 5%. Travel Retail and Guinness (Diageo’s flagship beer brand) combined for 13% of sales in pre-COVID FY19, but have fallen to an estimated 7% by FY21 due to disruption by the pandemic.

Diageo is broad-based in product terms. Its largest spirits category by sales is Scotch (23% of net sales in FY21), followed by Vodka (10%) and Tequila (8%); it also has sizeable sales in International Whiskies, Gin, and Chinese Baijiu. Beer was approx. 15% of sales. Each category includes a number of strong brands.

|

Diageo Net Sales & EBIT by Category (FY21)  Source: Diageo annual report (FY21). |

Diageo also has exposure to cognac, champagne and wine though its 34% share in the Moët Hennessy joint venture with LVMH (OTCPK:LVMUY). Diageo’s share of after-tax profit at Moët Hennessy was £335m in FY21.

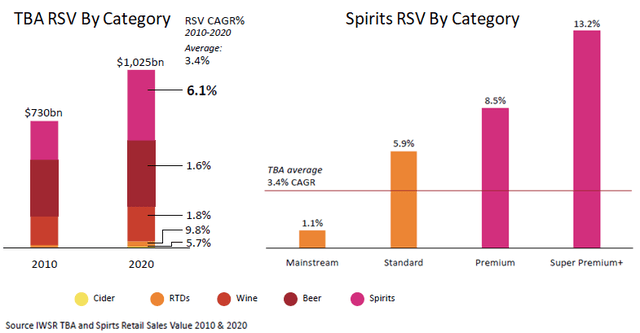

Our investment case on Diageo (initiated in July 2019) has been based on the structural growth in global spirits and Diageo’s ability to take advantage of this growth:

- The global spirits industry is benefiting from structural increases in the population of drinkers, penetration rates (including share gains from wine and beer) and premiumisation. In 2010-20, total Retail Sales Value of spirits grew at a CAGR of 6.1%, with Premium spirits growing at 8.5% and Super Premium+ spirits growing at 13.2%

|

Global Spirits Retail Sales Value Growth (2010-20)  Source: Diageo investor day presentation (Nov-21). NB. TBA = Total Beverage Alcohol, RTD = Ready To Drink. |

- Diageo can grow sales faster than the spirits market thanks to its strong brands, capabilities in innovation, marketing and distribution, as well as economies of scale

- Diageo’s operating margin will continue to expand, from a combination of pricing, positive mix shift, cost efficiencies and operational leverage

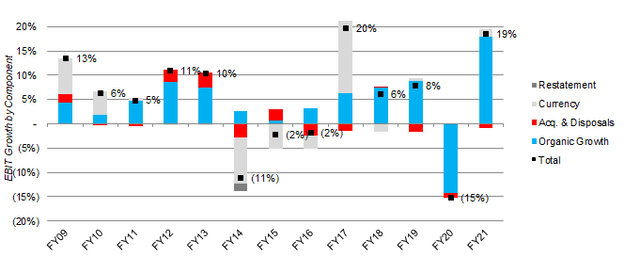

Diageo has historically achieved mid-to-high single-digit organic EBIT growth in most years, but it can be impacted by external events. In FY14-16, Diageo was hit by a series of one-off events, including the end of the U.S. vodka boom, an anti-corruption campaign in China, as well as a Highway Ban and “demonetisation” in India. COVID-19 meant EBIT fell 14% organically in FY20, before quickly rebounding by 18% in FY21:

|

Diageo EBIT Growth by Component (FY09-21)  Source: Diageo company filings. NB. EBIT is before exceptional items. |

Management is now targeting an 6-9% organic EBIT growth for the next few years.

Diageo Medium-Term Targets

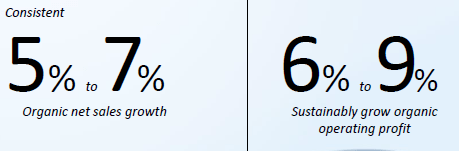

At its investor day in November 2021, Diageo set out new medium-term guidance, including “consistent” organic net sales growth of 5-7% annually and sustainable organic EBIT CAGR of 6-9% in FY23-25:

|

Diageo Post-COVID Medium-Term Guidance  Source: Diageo investor day presentation (Nov-21). |

The new EBIT CAGR target is higher than the pre-COVID target of 5-7%, reflecting the combination of faster growth in the market, as well as improvements in the quality of Diageo’s portfolio (through both innovation and M&A) and its execution capabilities. Growth is expected to be broad-based geographically, but with some regions growing faster than others. The percentage of sales from China, for example, is expected to double from 5% to 10% “over time”.

In addition to this FY23-25 guidance, management also stated its ambition to increase Diageo’s share of the Total Beverage Alcohol market by half, from 4% to 6%, by 2030.

We believe Diageo’s medium-term targets to be achievable, based on its performance in recent years.

Strong Growth Continuing in All Regions

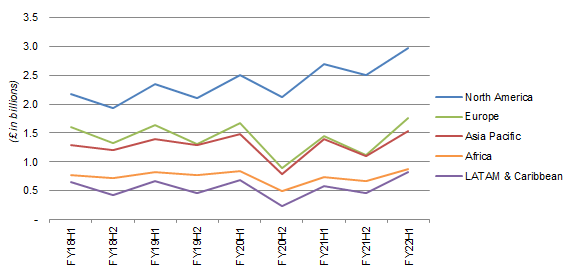

The chart below shows Diageo’s net sales by region since FY18, as reported in GBP. North America has continued to show consistent growth, excluding seasonality (with each fiscal H1 elevated due to the Christmas holiday), with minimal impact from COVID-19 because the region historically did not depend on restaurants and bars (the “on” trade represented only 20% of industry sales). Other regions were more impacted by the pandemic due to higher “on” trade exposure (for example 50% in Europe), Emerging Market macro weakness and currency, but have all recovered to their pre-COVID levels in GBP by H1 FY22 (July-December 2021):

|

Diageo Half-Yearly Net Sales By Region (FY18 to H1 FY22)  Source: Diageo company filings. NB. FY ends Jun 30. |

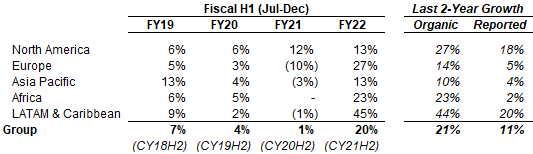

As of H1 FY22, measured in GBP, Diageo’s net sales were 11% higher than in pre-COVID H1 FY20 (July-December 2019). Organically, H1 FY22 net sales were 21% higher than in H1 FY20, with double-digit growth in every region including 27% in North America and 14% in Europe:

|

Diageo H1 Sales By Region (FY19 to FY22)  Source: Diageo company filings. |

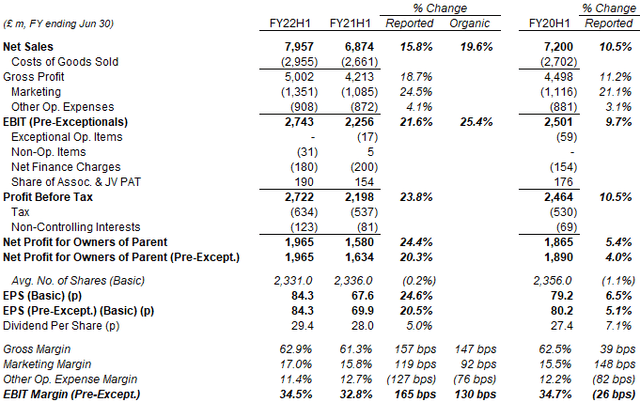

With H1 FY22 sales at 11% above H1 FY20, Diageo’s EBIT was also 10% higher, with the improvement in Gross Margin and lower growth In Other Operating Expenses being offset by a 21.1% increase in Marketing Spend:

|

Diageo Profit & Loss (H1 FY22 vs. Prior Years)  Source: Diageo company filings. |

Net Profit (Pre-Exceptionals) was only 4.0% higher than in H1 FY20, due to a higher tax rate, mainly from “tax rate increases in certain markets”. The share count was 1.1% lower, thanks to share buybacks that were suspended briefly during the pandemic but resumed in May 2021. EPS (Pre-Exceptionals) was 5.1% higher than in H1 FY20.

Diageo’s recovery from COVID-19 appears to have continued into H2 FY22 (January-June 2022).

FY22 and Read-Across from Peers

Diageo has not provided full-year FY22 guidance and does not provide quarterly updates. However, management stated at H1 FY22 results that they expected “organic net sales momentum to continue through” H2, albeit “lapping a tougher comparator”. EBIT margin is expected to expand organically again.

Q1 2022 results reported by Diageo’s peers indicate positive momentum is continuing:

- Pernod Ricard (OTCPK:PRNDY) reported a 20% organic sales growth for their Q3 FY22 (January-March 2022), including growth of 23% in the U.S., 19% in India, 8% in China and +24% in Travel Retail. Pernod Ricard does expect a Q4 impact from COVID lockdowns in China, post-COVID normalization in the U.S. and the Ukraine conflict, but is still guiding to FY22 organic EBIT growth of ~17%

- Brown-Forman (BF.A) reported a 27% organic sales growth for their Q4 FY22 (February-April 2022). For the next fiscal year (FY23), Brown-Forman is expecting a mid-single-digit organic growth in both its net sales and EBIT

Pernod Ricard has also set out FY23-25 targets that were similar to Diageo’s at its investor day in June 2022, including revenue growth of 4-7% and EBIT margin expansion of 50-60 bps annually (EBIT margin was 27.5% in FY21).

Resilience Against Recession & Inflation Risk

We expect Diageo earnings to be relatively resilient against recessions and high inflation, should these materialize.

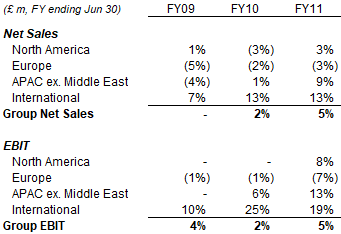

Diageo had stable earnings at the last recession. During the Global Financial Crisis, Diageo first saw organic growth of close to zero in net sales and 4% in EBIT in FY09 (July 2008 to June 2009), followed by organic growth of 2% in both net sales and EBIT in FY20. On a reported basis, measured in GBP, EBIT grew 13% in FY09 and 5% in FY10.

|

Diageo Organic Net Sales & EBIT Growth (FY08-10)  Source: Diageo company filings. |

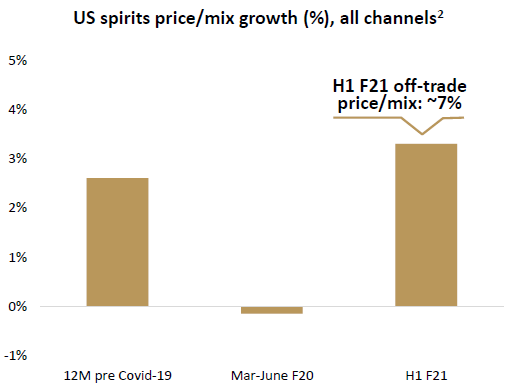

Diageo has strong pricing power, with more than 50% of its sales in premium products and average spend per consumer being relatively low (for example, at $17 per month for the average U.S. per household). In the U.S., price/mix growth was close to 3% in the 12 months before COVID-19, slightly negative in March-June 2020 and then more than 3% in July-December:

|

Diageo U.S. Spirits Price/Mix (Before & During COVID)  Source: Diageo results presentation (H1 FY21). |

Diageo should also be relatively insulated from the temporary slowdown in China brought on by continuing COVID lockdowns, as the Chinese market is still just 5% of group net sales.

Diageo Dividend Yield & Valuation

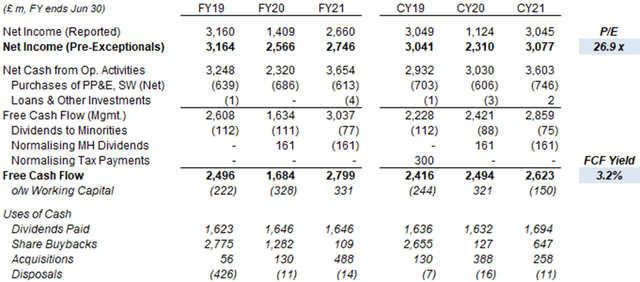

At 3,537.5p, relative to CY21 financials, Diageo stock is at a 26.9x P/E and a 3.2% FCF Yield:

These valuation metrics are calculated on historic GBP figures that understate Diageo’s current earnings. Current GBP/USD spot rate of 1.23 is approx. 9% lower than the translational rates in FY21 and H1 FY22 (of 1.35 and 1.36 respectively). (Current GBP/EUR spot rate of 1.16 compares with translational rates of 1.13 in FY21 and 1.17 in H1 FY22.)

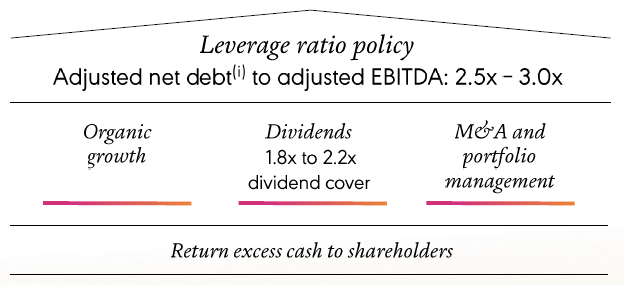

Diageo stock paid 74.0p of dividends in the past 12 months, representing a 2.1% Dividend Yield. The dividends should continue grow with EPS in the future, as Diageo targets a 1.8-2.2x dividend cover.

|

Diageo Capital Allocation Framework  Source: Diageo investor day presentation (Nov-21). |

Diageo repurchased £538m of its shares in H1 FY22, equivalent to 0.7% of its current market capitalization. This was part of a £4.5bn capital return program (buybacks and special dividends) that was first announced in July 2019 and is now expected to be completed by FY23 year-end. Further programs are likely to follow, as Diageo’s Net Debt / EBITDA has already fallen back to the low-end of its 2.5-3.0x target range as of H1 FY22.

Illustrative Diageo Stock Forecasts

We raise our illustrative forecasts to reflect Diageo’s higher growth targets and the weaker GBP. We now assume:

- FY22 Net Income to be 5% higher than in FY19 (was flat)

- FY23 Net Income growth to be 12.5% (9.0% growth + 3.5% currency)

- Thereafter, Net Income grows at 8.5% annually (was 6.5%)

- FY22 dividend growth to be 5% (was 2%)

- Thereafter, dividends to be based on a 50% Payout Ratio (unchanged)

- Share count to fall by 1.0% in FY22 and 1.2% annually after (unchanged)

- FY24 year-end P/E of 27.0x (unchanged)

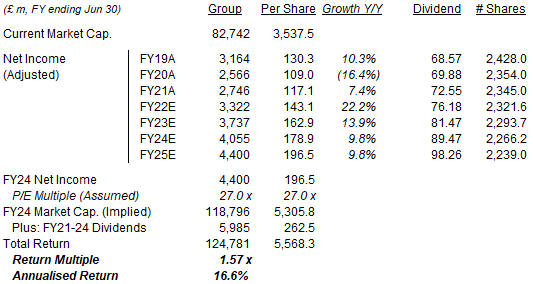

Our new FY25 EPS of 196.5p is 15 higher than before (170.7p):

|

Illustrative Diageo Return Forecasts  Source: Librarian Capital estimates. |

With shares at 3,537.5p, we expect an exit price of 5,306p and a total return of 57% (16.6% annualized) by June 2025, in just over 3 years.

Is Diageo Stock a Buy? Conclusion

Diageo stock has now fallen by 23.0% in USD from its peak in early January, and trades at a 26.9x P/E and 2.1% Dividend Yield.

Structural growth in global spirits is continuing. Diageo now targets a sales CAGR of 5-7% and an EBIT CAGR of 6-9% in FY23-25.

Sales were 21% higher organically than before COVID-19 in H2 CY21. Q1 CY22 peer results show sector momentum is continuing.

Earnings should be resilient against recessions and inflation, as demonstrated in the Global Financial Crisis.

With shares at 3,537.5p, we expect an exit price of 5,306p and a total return of 57% (16.6% annualized) by June 2025.

We reiterate our Buy rating on Diageo PLC stock.

Be the first to comment