kmatija/iStock via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on June 19th.

REIT Rankings: Cannabis

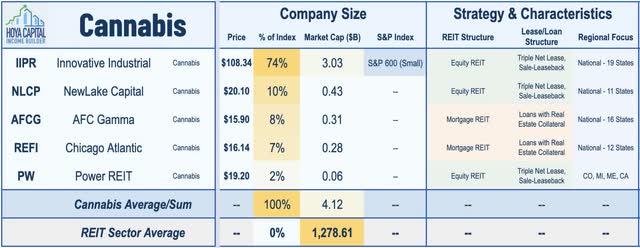

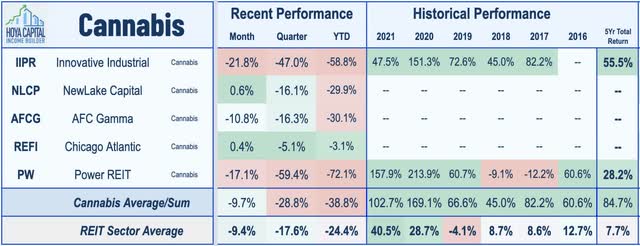

Is the pot party over? Coming down from a seemingly never-ending ‘high’ since emerging onto the scene in the mid-2010s, Cannabis REITs have been slammed in 2022 amid concerns over tenant financial health given the sharp re-pricing of risk, tighter financial conditions, and stalled progress on federal legalization. Within the Hoya Capital Cannabis REIT Index, we track the three cannabis equity REITs – Innovative Industrial (IIPR), Power REIT (PW), and NewLake Capital (OTCQX:NLCP) – along with the two cannabis mortgage REITs – AFC Gamma (AFCG) and newly-listed Chicago Atlantic (REFI) – which together account for roughly $4 billion in market value.

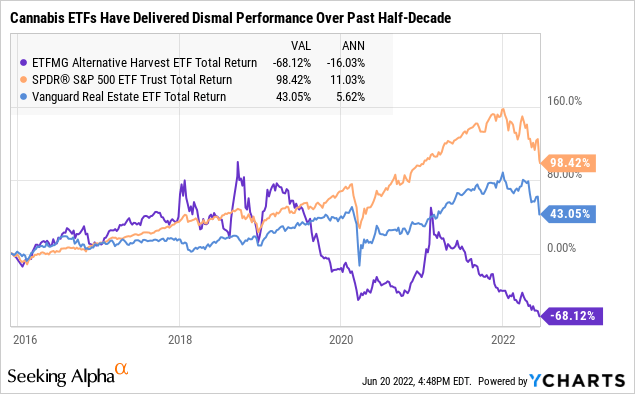

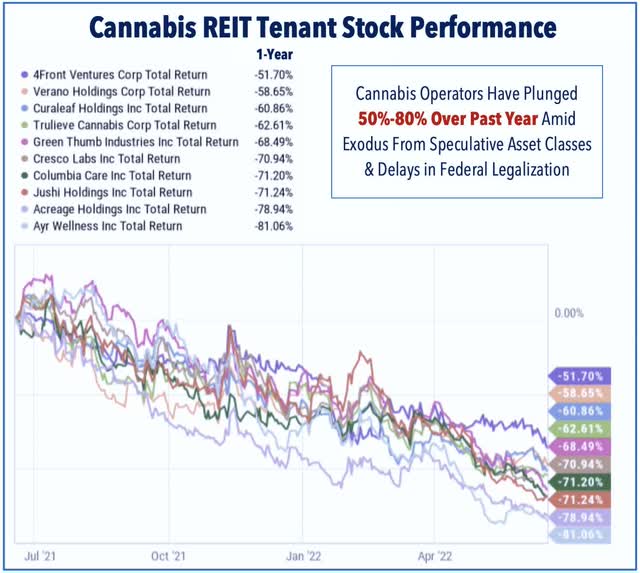

Owning the “Pharmland” – the physical real estate – had been one of the few cannabis plays that were working amid a half-decade-long stretch of dismal investment performance from broader cannabis ETFs, which primarily hold cannabis operators and non-REIT companies along the cultivation-to-retail supply chain. Cannabis REITs – which entered 2022 with the strongest five-year total returns, dividend growth, and FFO growth of any property sector – have been unable to escape the cannabis industry’s downward pressure this year amid amplified concerns over tenant rent-paying-capacity. The ten largest publicly-traded cannabis REIT tenant operators have plunged between 50% and 80% over the past year, hurt in part by a slowdown in stimulus-fueled sales growth and a far more-difficult capital raising environment.

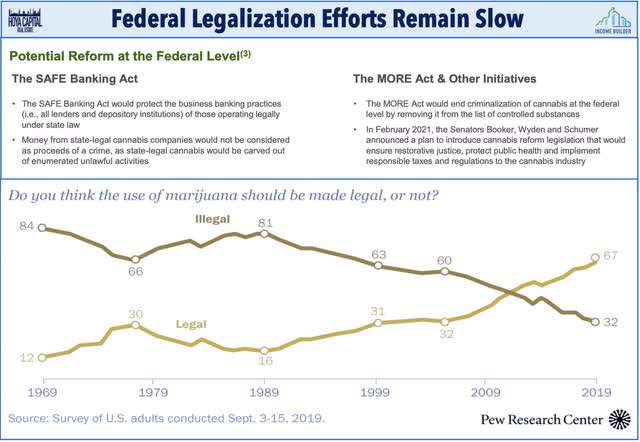

While the broader exodus out of highly-speculative asset classes has contributed to the selling pressure, stalled progress on federal legalization – which is typically the first investment case “bullet point” of multi-state operators (“MSOs”) – has been at the core of the recent weakness. Despite the Democrat sweep of the 2020 Elections, the once-ambitious legalization efforts has been defined by “broken promises” according to industry executives. Investors had widely expected the passage of several “low-hanging fruit” pieces of legislation that garner fairly bipartisan support including the SAFE Banking Act, which would enable legally operating cannabis firms to use banking services and credit cards. Senate Democrats have reportedly been slow to move on targeted legislation to hold out for a more all-encompassing reform package despite longshot odds of full Senate passage.

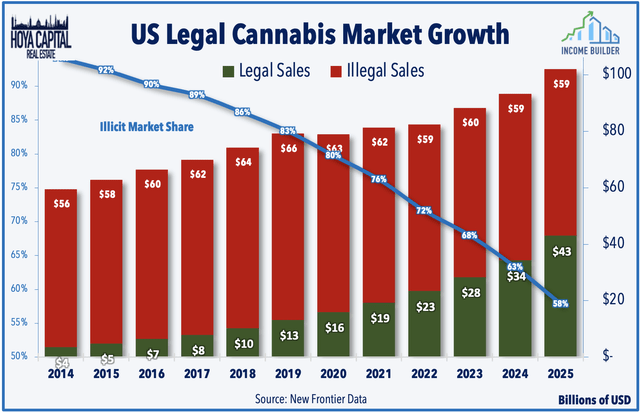

Existing in a legal “grey area” in which federal, state, and local laws often contradict, cannabis has been federally restricted since the 1930s, but medical usage is now legal in 38 states while recreational usage is legal in 18 states following a burst of activity last year which saw five additional states legalize weed: New Jersey, New York, Virginia, New Mexico, and Connecticut. Just four U.S. states currently maintain a full prohibition of any cannabis-based product. More than two-thirds of the U.S. population now support marijuana legalization, up from roughly 15% in the 1970s and 35% in the early 2000s while roughly 1-in-8 Americans consume cannabis regularly.

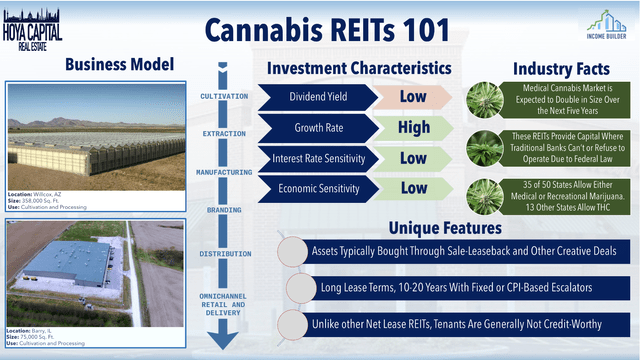

The ongoing federal prohibition – and the resulting limit on access to traditional banking – has forced cultivators and retailers to turn to alternative sources for capital. These REITs effectively serve as “non-bank” lenders to state-licensed cannabis cultivators who often are shut out from access to traditional lending from federally-regulated banks. For equity REITs, assets are typically acquired through sale-leasebacks of cultivation, processing, and retail properties and lease are typically structured as triple-net leases with lease terms of 15-20 years. Cannabis mortgage REITs, on the other hand, typically originate 5-10 year loans collateralized by the underlying real estate, which stays on the balance sheet of the borrower. In either case, the capital provided by the REIT is typically then used by the operator to build out a new facility or expand an existing cultivation facility, which are typically industrial-type facilities with specialized HVAC, lighting, and irrigation systems.

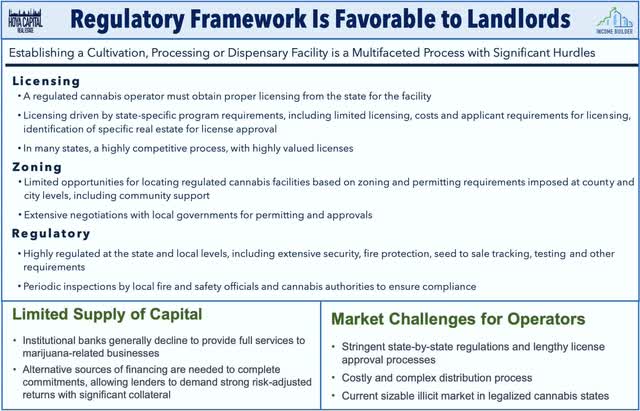

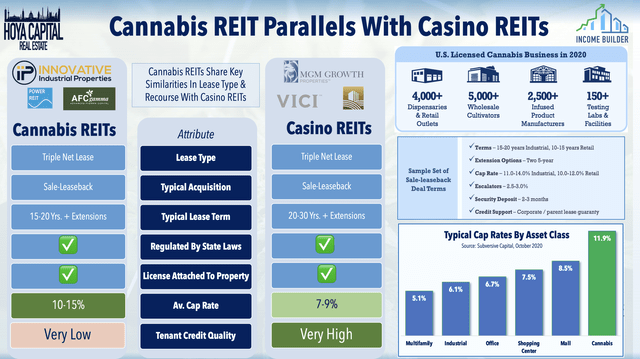

This sale-leaseback model has come under scrutiny recently with critiques outlined in several short-sale reports, but our research indicates that cannabis REIT leases are not unlike lease formats that are common across the triple-net-lease sector, and appear to adequately consider the evident tenant credit risks. Recent earnings calls have provided further color on the lease terms and underwriting process with IIPR detailing how leases are written such that investments are designed to result in dollar-for-dollar increases to replacement value that remain with the landlord in the event of tenant default. Leases are also generally subject to parent company guarantees covering operations throughout the United States and, critically, regulated cannabis operators typically must obtain licensing from the state for the facility which typically requires identification of specific real estate for license approval.

In a report on the linkage of cannabis businesses with an underlying real estate asset within state legal frameworks, Hoban Law Group notes, “In many cases, state marijuana statutes and regulations are closely tied to real estate laws.” In Colorado, for example, the marijuana license is attached to the physical premises and stays with the property in the event of default. This ideal legal framework effectively puts the real estate asset at the center of the business and grants the landlord significant protection from tenant non-payment while also serving as a barrier to entry to new supply growth. Under this framework of limited licenses controlled by the state – which is increasingly the “default” structure of newly-legalized states – suggests that REITs could continue to be a primary capital provider even with expanded access to traditional financing sources in the event of full federal legalization.

Importantly, even in the (rather unlikely) event of full federal legalization within the next several years, we don’t believe that this would fundamentally change the industry dynamics, as this process simply shifts the regulation onto the states, many of which have adopted this framework that is quite favorable to property owners with licenses that are “attached” to real estate – and limited in quantity – an ideal structure for these REITs and structurally similar to casino gaming licenses which stay with the property in the event of default. While still early in the evolution of the industry, we continue to see emerging parallels with the casino industry where REITs have carved out a profitable and attractive niche with a sustainable competitive advantage.

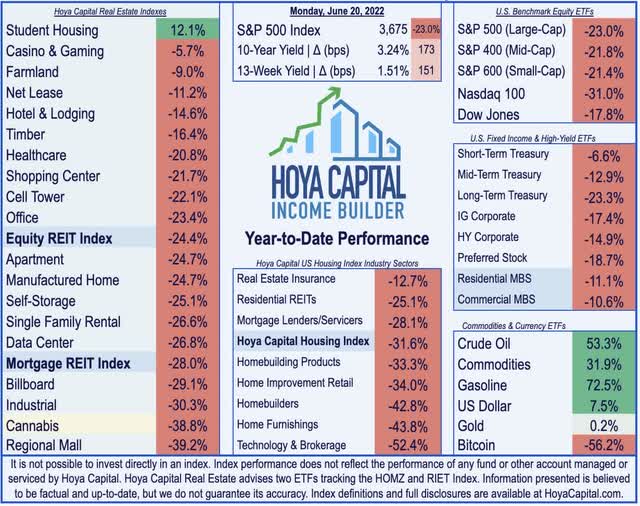

Cannabis REIT Stock Performance

Cannabis REITs have been slammed in 2022, pressured by the broader growth-to-value rotation and uncertainty over progress on federal legalization. The Hoya Capital Cannabis REIT Index has declined by nearly 40% this year compared to the 24.4% decline on the broad-based Equity REIT Index and the 23% decline on the S&P 500 ETF (SPY). Despite the sharp sell-off this year, Innovative Industrial is still the single-best-performing REIT since the start of 2017 with average annualized returns of over 40% compared to the roughly 5% annual returns on the broad-based Vanguard Real Estate ETF (VNQ) during this period.

Following two straight years of total returns of over 150%, micro-cap Power REIT has been hit especially hard with a decline of over 70% so far this year while industry leader Innovative Industrial is lower by nearly 60%. The declines among the cannabis mortgage REITs – each of which went public last year – have been less pronounced with AFC Gamma lower by 30% while Chicago Atlantic has actually been one of the best-performing REITs this year with declines of less than 5%.

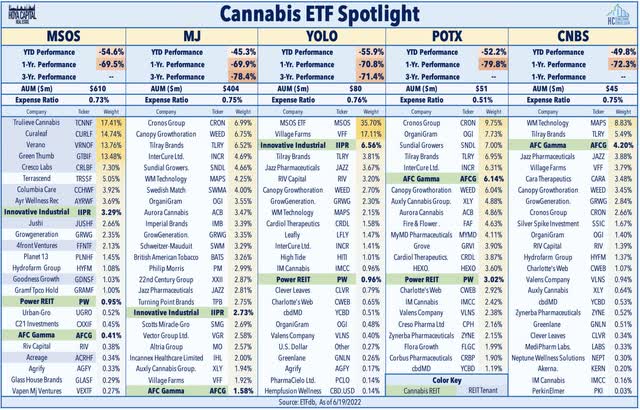

Cannabis REITs have delivered significant outperformance compared with broad-based cannabis ETFs over most recent and long-term measurement periods, a trend that we expect to continue if state regulatory frameworks continue to evolve in the “landlord-friendly” structure discussed previously. Underscoring the underperformance of many of these cannabis ETFs, since its launch in late 2015, the ETFMG Alternative Harvest ETF (MJ) – the oldest and largest cannabis ETF – has produced average annual total returns -19.8%, woefully underperforming the S&P 500’s 9.0% annual returns during this time, and being “left in the dust” by the two cannabis REITs.

Hoya Capital

The performance from newer cannabis ETFs – including AdvisorShares Pure US Cannabis ETF (MSOS), AdvisorShares Pure Cannabis ETF (YOLO), Amplify Seymour Cannabis ETF (CNBS), Global X Cannabis ETF (POTX), and Cambria Cannabis ETF (TOKE) – hasn’t been much prettier with 3-year average cumulative total returns of roughly -75%. Cannabis operators are the common top holdings among these ETFs including Canada-based Canopy Growth (CGC), Aurora Cannabis (ACB), Tilray Brands, Inc. (TLRY), Village Farms (VFF) and Cronos Group (CRON), U.K.-based GW Pharmaceuticals (OTCPK:GWPRF), and U.S.-based GrowGeneration (GRWG), Hydrofarm (HYFM), Scotts Miracle-Gro (SMG), and Charlotte’s Web (OTCQX:CWBHF).

Deeper Dive: Innovative Industrial

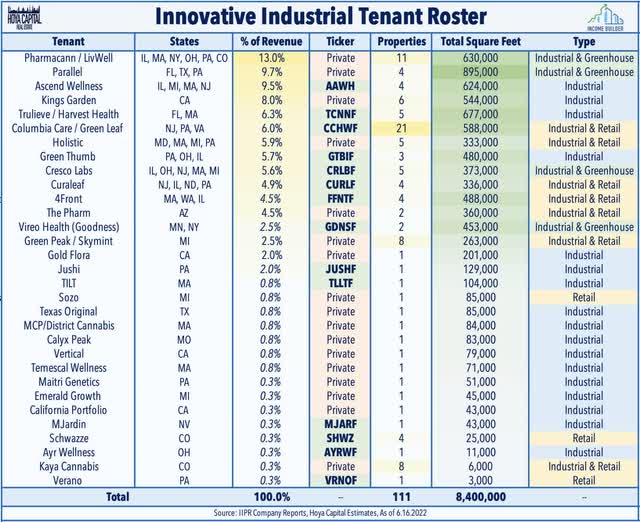

San Diego-based Innovative Industrial Properties was founded in 2016 with just a single property but has been on a continuous acquisition spree over the last five years, expanding its portfolio to include 111 properties spanning 19 states, all of which have legalized marijuana cultivation. IIPR owns a national portfolio of over 8.4M square feet comprised of specialized industrial and greenhouse buildings and retail distribution facilities, 100% leased to state-licensed medical-use cannabis businesses. IIPR’s tenant roster includes state-licensed cultivators comprised of a mix of unproven single-property “start-ups” as well as established multi-state operators – including thirteen publicly-traded operators.

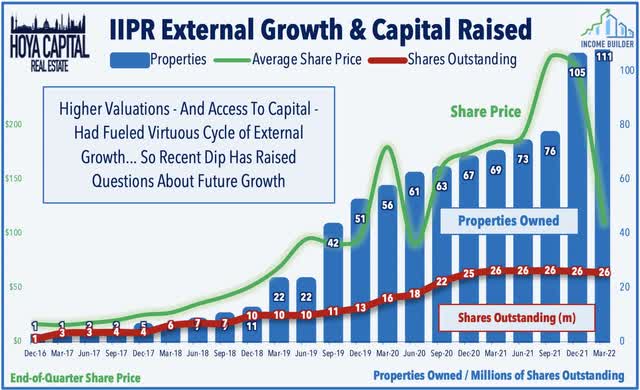

IIPR has taken full advantage of investor demand for cannabis stocks and its status as the top-performing REIT and cannabis-related stock, tapping the equity markets for additional “growth” capital every few months through a series of secondary equity offerings, expanding its share count by 20x over that time. Until the recent sell-off, IIPR had benefited from premium share price valuations which enabled it to acquire properties that are accretive to FFO, so the recent dip does raise questions about IIPR’s ability to continue its breakneck pace of acquisition-fueled growth – concerns that we believe are more-than-fully discounted into current valuations.

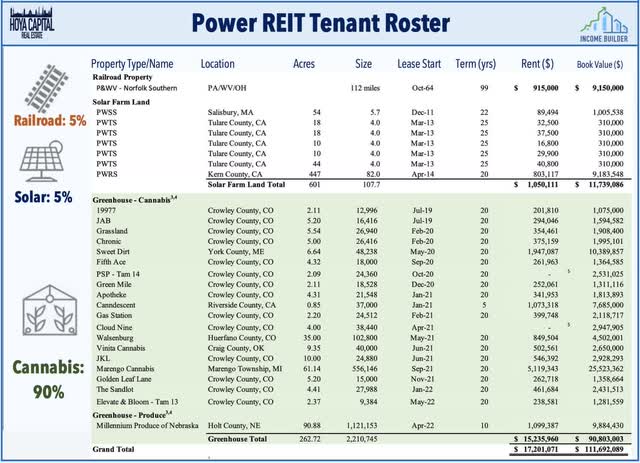

Deeper Dive: Power REIT

As analyzed in a recent deep-dive report by Income Builder REIT Analyst Philip Eric Jones, New York-based Power REIT has a more complex operating history, emerging in its current form in 2011 as the successor company to Pittsburgh & West Virginia Railroad. Until it began a strategy shift in 2018 towards a focus on cannabis real estate, the firm was focused on the ownership, development, and management of transportation and energy infrastructure-related real estate. Power REIT is currently diversified into 3 industries: Controlled Environment Agriculture (greenhouses), Solar Farm Land, and Transportation. Power REIT announced in 2019 that it intends to focus primarily on expanding its real estate portfolio of Controlled Environment Agriculture greenhouse. Power REIT owns 21 CEA properties in Colorado, Maine, and Oklahoma, comprised of 2.21M square feet of greenhouse and processing space.

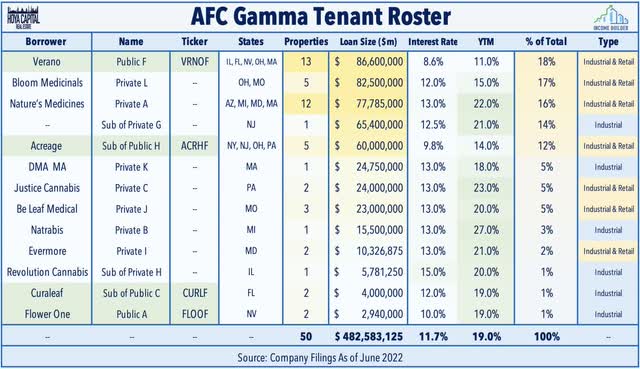

Deeper Dive: AFC Gamma

Florida-based AFC Gamma is one of the two newer publicly-listed cannabis REIT following its $115m IPO last March. Prior to its public listing on the Nasdaq, AFC Gamma operated as a non-traded REIT under the name Advanced Flower Capital and is led by Leonard Tannenbaum, who previously founded the asset management firm Fifth Street Finance. Unlike IIPR and PW which are both equity REITs, AFCG operates as an externally-managed mortgage REIT, originating and managing real estate-backed loans for cannabis companies. AFCG’s portfolio is comprised of loans to eleven different borrowers across roughly 50 individual properties, totaling approximately $480 million in total principal amount. Its loan portfolio has an average cash interest rate of 11.7% and its loans typically have up to a five-year maturity, secured by a lien on the real estate.

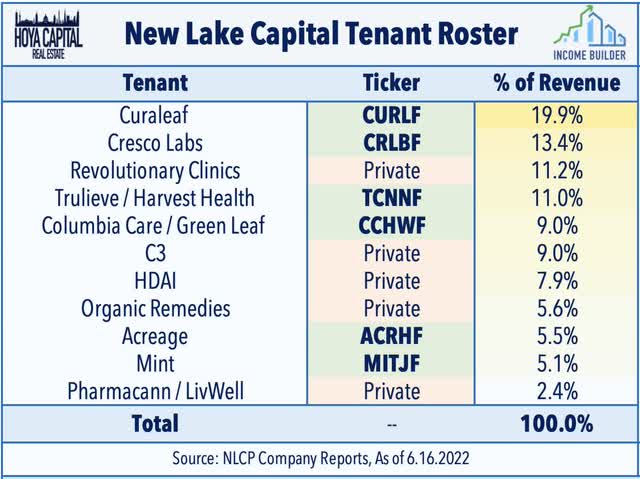

Deeper Dive: NewLake Capital

Connecticut-based NewLake Capital Partners began trading on the OTC Market last August following a $102M public offering. NLCP is an internally managed triple-net lease equity REIT that purchases properties leased to state-licensed U.S. cannabis operators. Despite its “OTC-status,” NLCP is the second-largest cannabis REIT by market capitalization and on its recent earnings call, the company noted that it is exploring an exchange listing on the NASDAQ, which remains a “top priority” for the company. NewLake Capital currently owns a geographically diversified portfolio of 29 properties across 11 states with 10 tenants, comprised of 17 dispensaries and 12 cultivation facilities, sharing many of the same tenants as IIPR including Curaleaf (OTCPK:CURLF), Cresco Labs (OTCQX:CRLBF), Trulieve (OTCQX:TCNNF), and Columbia Care (OTCQX:CCHWF).

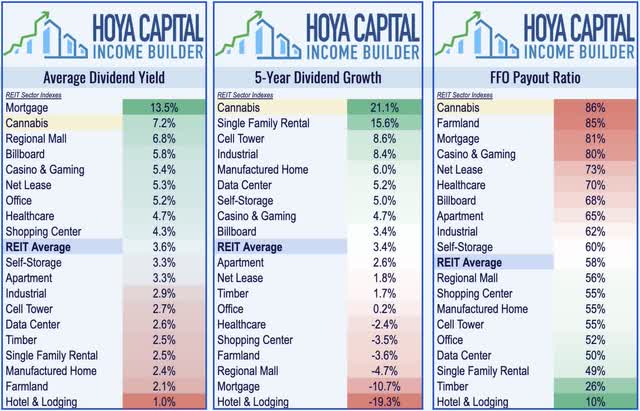

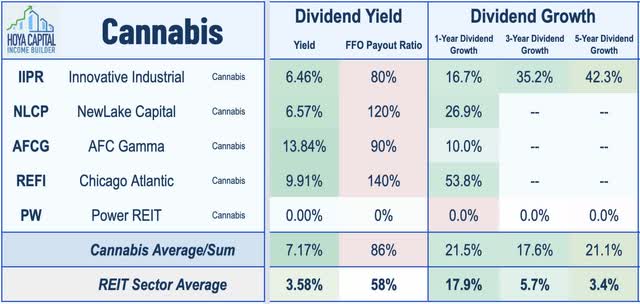

Cannabis REIT Dividend Yield & Preferreds

Buoyed by the two higher-yielding mortgage REITs and by another wave of dividend hikes this year, cannabis REITs pay an average dividend of 7.2%, which is well above the REIT market-cap-weighted average of 3.6%. Cannabis REITs have delivered the strongest dividend growth over the past five years, averaging more than 20% per year. Cannabis REITs pay out roughly 85% of their available FFO, however, higher than the REIT sector average.

Joining Innovative Industrial – which hiked its dividend by 17% earlier this year, a trio of cannabis REITs hiked their dividends last week: Chicago Atlantic Real Estate hiked its quarterly dividend by 17.5%, AFC Gamma hiked its quarterly dividend by 2%, while NewLake Capital hiked its quarterly dividend by 6.1%. After the hikes, IIPR and NLCP pay a dividend yield of around 6.5% while the two mortgage REITs currently have double-digit yields. Power REIT has not paid a dividend since 2013.

Takeaways: High Risk, High Potential Reward

Cannabis REITs – a perennial performance leader over the past half-decade – have been slammed in 2022 amid concerns over tenant financial health given the sharp re-pricing of risk and tighter financial conditions. Stalled federal legalization efforts are a double-edged sword for cannabis REITs that thrive in the murky legal environment, but also need healthy operators that can continue to pay rent. Cannabis REITs have faced remarkably few tenant non-payment issues – so admittedly the model remains somewhat untested – but we believe that the lease structure and regulatory grants cannabis REITs significant protection that isn’t fully reflected by market pricing and with the legal cannabis market expected to more than double in size over the next five years, we continue to see value in owning the “Pharmland.”

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment