seraficus

The recent market volatility has resulted in some opportunities for us to consolidate capital in our Core Portfolio at High Yield Landlord.

One of our long-time members, Catskills1, recently pointed this out on our chat board:

“Having been through the 2020 pandemic decline with you guys, at a certain point it made some sense to shift holdings sideways from less to more advantageous REITs. For example, I have a gigantic Simon Property (SPG) holding, and a moderate Macerich (MAC) holding. Would this be a good time to shift MAC? NewLake (OTCQX:NLCP) to Innovative Industrial Properties (IIPR)? Other candidates?”

The point of consolidating capital from one REIT to another is to:

- Get out of positions in which the fundamental outlook has deteriorated and/or the valuation has become less opportunistic relatively speaking.

- Possibly book a tax loss to boost the after-tax returns of the portfolio.

- Reinvest the proceeds into another REIT that’s down even more.

- Enjoy even greater and faster upside in the eventual recovery.

An example would be to sell a troubled REIT that’s down 30% to buy another REIT that’s 45%, despite actually enjoying better fundamentals. All else held equal, this would benefit you as it would optimize your taxes, reduce risks, and maximize your future upside potential.

In this situation, you are not necessarily selling the REIT because you think the REIT will be a poor investment going forward. On the contrary, it could be a great investment at that price. But you still end up selling because there is an even better opportunity out there, which will allow you to reduce risks and boost upside – all while sometimes also locking tax benefits.

And today, we have been presented with such an opportunity.

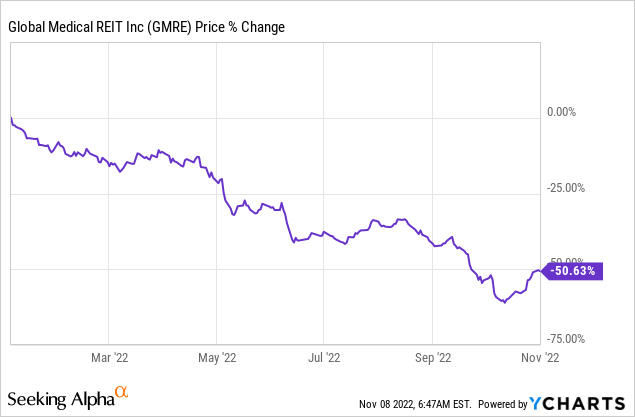

Global Medical REIT (GMRE), a medical office REIT that we have been closely monitoring, has dropped by 50% year-to-date, which is far more than your average REIT (VNQ), and even more than some of our most challenged holdings:

Despite that, GMRE is actually doing quite well from a fundamental perspective.

We think that it sold off for reasons that are mainly unwarranted and therefore, it has become very compelling after its recent sell-off. In fact, we believe that it has become a lot more compelling than three of our smaller holdings:

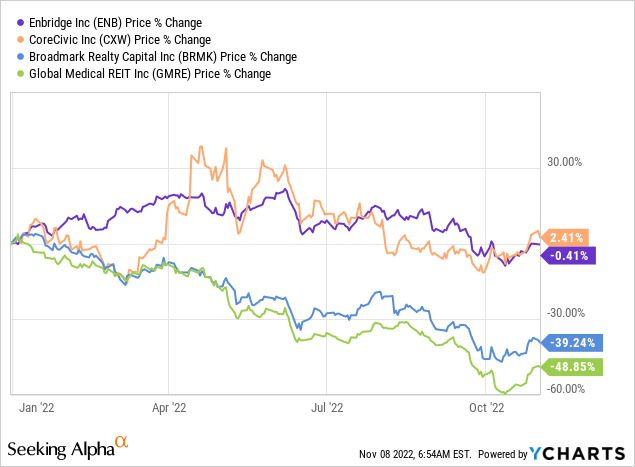

CoreCivic (CXW) is flat year-to-date but its private prison business is not immune to the rapidly rising interest rates. On the contrary, the bears would argue that the combination of rising interest rates and debt becoming harder to access for prison landlords is a big issue that should have led to more downside, at least relatively speaking. We suspect that CXW didn’t drop as much because a lot of investors saw that ‘The Big Short’ Michael Burry invested in this space and followed his trade. We remain bullish on the long-term thesis, but relatively speaking, it is now a lot less opportunistic since it resisted the recent sell-off.

Enbridge (ENB) is not technically a REIT, but it is very similar to one and it is also flat year-to-date, which compares very favorably to the average decline of the REIT sector, and even more so to that of GMRE. Energy prices have been high and this has helped the market sentiment of MLPs and other midstream companies, relatively speaking. We think that ENB is a great business that will outperform in the long run, but it is not as opportunistic relative to the rest of the market as it used to be.

Finally, the tough one: Broadmark Realty Trust (BRMK). This is one of our worst-performing investments of all time. It is down 41% year-to-date (36% when counting its massive dividend). As we noted in a recent Portfolio Review, its fundamentals have deteriorated and at least part of its recent drop is justified. Hard money lending has become more competitive and as a result, BRMK’s yields have come down even as interest rates have risen, resulting in smaller spreads. Meanwhile, the risk of its loans is also getting larger as we potentially head into a recession and inflation continues to put pressure on new construction projects. Finally, the company discontinued its non-traded REIT likely because it couldn’t find enough loans that met its lending criteria. All of this is putting the dividend at high risk of being cut sometime in the near future. That’s bad news, but even then, we remain bullish and give it a Buy rating due to its low valuation, but our conviction level has come down due to the changing environment. At the same time, GMRE has come down even more, despite enjoying far stronger fundamentals.

On average, these three holdings are down 12% year-to-date – which is 4x less than GMRE:

Selling CXW, ENB, and BRMK allows us to book a tax loss, which we will use against the large gain that we recently booked on STORE Capital (STOR) to reduce the impact of taxes in 2022.

And by consolidating the capital towards GMRE, we think that we are reducing the risk of our portfolio all while boosting its future upside potential.

It is down so much already that it is hard for us to foresee much more downside (unless some major risk factor plays out), but its upside potential in a future recovery is very substantial. We think that the market has gotten it wrong and GMRE is far more resilient than its share price makes it seem to be. It could quite literally double from here and it pays a 9.5% dividend yield while you wait.

Bottom Line

The bottom line is that we believe GMRE has dropped way too low, way too fast. It is down 50% due to reasons that are mostly unwarranted and therefore, we think that it now offers exceptionally attractive risk-to-reward.

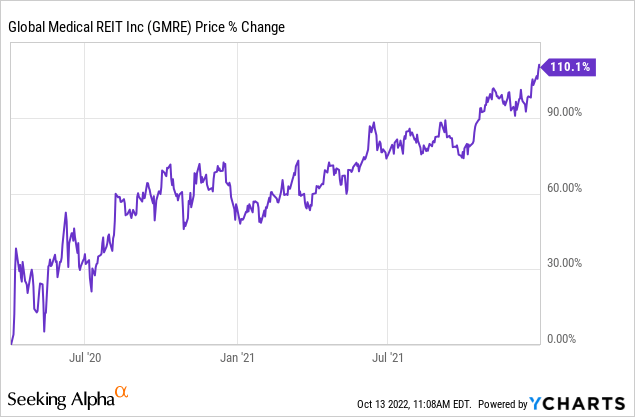

In a future recovery, we expect it to return to near where it traded in early 2021, which would lead to 100%+ upside from the current share price. This is exactly what happened following the early pandemic crash:

YCHARTS

CXW and ENB do not have as much upside potential, and while BRMK could present significant upside, it will likely take longer for it to recover since its business has been more negatively impacted by the current environment.

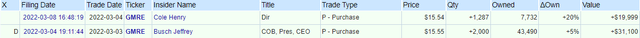

It is also worth noting that GMRE insiders bought more shares earlier this year at a share price that was 2x higher than what we are paying today.

Moreover, Medical Properties Trust (MPW) recently announced a plan to buy back shares, which adds further evidence that the healthcare REIT sector is currently undervalued.

Finally, while we wait for the upside we earn a 9.5% dividend yield, which we believe to be sustainable. This is higher than the average yield of CXW, ENB, and BRMK, which is 7%.

So to recap, by selling CXW, ENB, and BRMK and reinvesting the proceeds into GMRE, we manage to:

- Book a tax loss to optimize our taxes

- Reduce the risk of our portfolio

- Boost its average yield

- Position it for higher and faster upside in the recovery

- While also increasing our exposure to healthcare real estate

As noted earlier, we remain bullish on CXW, ENB, and BRMK, but the benefits outweigh the downsides and this is why we are consolidating capital toward GMRE.

Be the first to comment