Thailand Photographer./iStock Editorial via Getty Images

In the article, we cover the valuation of Pinterest, Inc. (NYSE:PINS) after an in-depth overview of the Social Network market framework.

After understanding the drivers, investments, and principal risks of the sector, today’s article aims to deep-dive into PINS.

The PINS Platform

The company was born in 2010 from the idea of another application, Tote. The intent was to create the traffic of active users necessary to allow the monetization of advertisements made by companies through targeting of content to users.

Pinterest takes users in the process of discovery and purchase by offering effective advertising solutions to companies.

The platform is navigable in an appropriate way to the user’s objective.

You can scroll through your feed populated by content related to your interests (selected during registration and updatable). You can search by keyword (or by images) and explore the related content, profiles or products to buy.

Users can create from the most classic posts, such as images that refer through a link to the most diverse content, usually about products, recipes and do it yourself activities, or short videos typically on topics such as cooking, aesthetics and homemade projects, up to actual product pages with prices, quantities and possibly a link to the seller’s website.

Finally, you can create the so-called Idea Pins, pages containing videos, images, text and lists that allow you to create a tutorial, show a collection of items or tell a story.

Business

The company offers advertising solutions oriented to the brand or the performance; the latter type represents about two-thirds of the revenue for 2021 and has objectives clicks or accurate conversions. Among them, those that use the classic post formats are Standard Ads (simple vertical images of a product), Video Ads and Idea Ads, while other formats such as Shopping Ads (like Standard but exclusively for those who upload their product catalogue on Pinterest), Carousel Ads (multiple images or videos related to the product) and Collection Ads (showing the product in its ways of use in a hybrid format of pictures and videos) allow advertisers to create a unique content compared to user posts.

Advertisers can optimize their campaigns based on four types of user behavior. These include impressions (“CPM”), video views (“CPV”), clicks (“CPC”), and conversion events (“oCPM”), as well as being able to target their placement based on demographics, device types, audience and interests or keywords.

User And Revenue Metrics

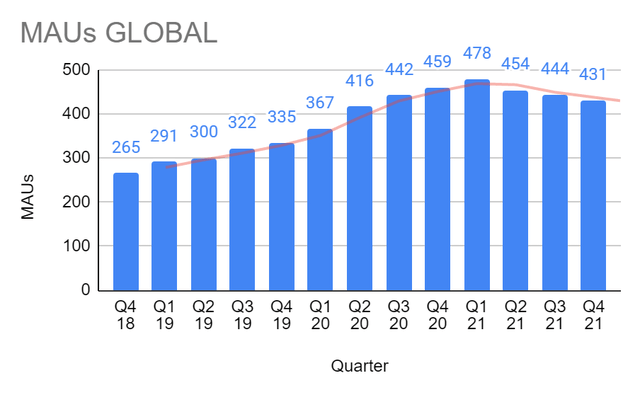

PINS went public in 2019, counting approximately 300 million monthly active users (“MAUs”). Today, there are over 400 million MAUs, consisting primarily of women between the ages of 18 and 64. Of these, about 25% reside in the U.S. In 2021, they generated about 78% of total revenue, highlighting the relevance of the U.S. market in terms of monetization. However, we should consider that the COVID-19 pandemic positively impacted MAUs, bringing them to a high of 478 million at the beginning of 2021 before returning down to slightly above the levels of the beginning of 2020 following the general easing of restrictions.

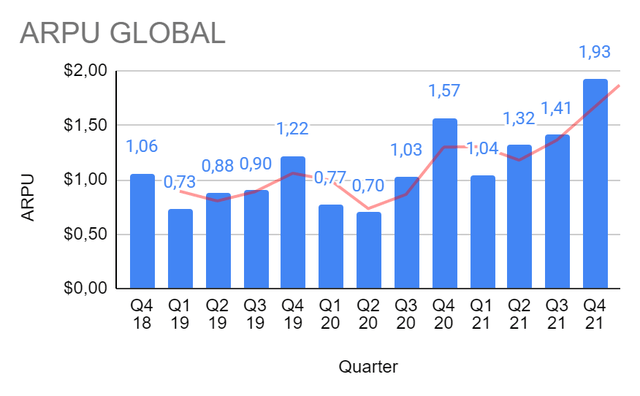

Average Revenue Per User (ARPU) is significantly higher in the U.S. due to the greater maturity of the advertising market and the company’s greater focus in that geographic area. It increased there 43% in 2021 compared to 2020, reaching $21.98 per user per year, while international ARPU (including countries other than the U.S.) increased 80% year-over-year reaching $1.59 per user per year. In addition, global ARPU grew 40% year-over-year to $5.7 in 2020.

Operating Performance

Revenue is generated from advertisements ((ads)) on the website and mobile app, purchased by advertisers directly from Pinterest or advertising agencies. Invoicing takes place once the service has been provided, depending on the type of contract.

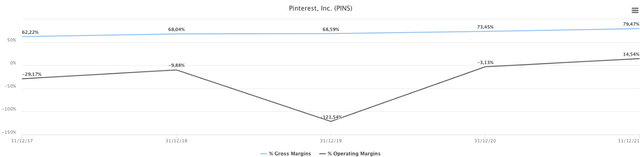

In 2021, Pinterest reported revenue that was approximately +52% higher than in 2020 and a sizable increase in net income from a net loss of $128.3 million in 2020 to a net income of $316.4 million.

The extraordinariness of the net income growth is due to an improvement in margins and an increase in revenue.

Why join Pinterest?

Pinners say they want a place where they can browse video content, follow people who inspire and specialize in skills and lifestyle, and less in celebrities and entertainment; they also increasingly see Pinterest as a place where the users can also make purchases.

The pinner experience is a lower funnel. What does that mean? Pinterest leads the end consumer to choose, often about products they were already following and were already interested in. They use the app primarily to take additional cues and inspiration and then make a final choice. The company is trying to take users from inspiration to action through the purchase journey.

Story Pins are the next step in this evolution, less about what someone else has done and more about what the user might do now or in the future; they never disappear.

Management defines Pinterest as a place for people to focus on themselves, understand what they truly love, not what others like, and imagine the best version of themselves.

What Happened in 2021?

The company wants to make the buying process seamless, to have people buy directly on the platform, and to do that, they worked to make products stand out. The ability for creators to tag their products (or other brands) in their content has been added to reward them for their work and give pinners another way to go from inspiration to purchase.

Slide Show Collections, which allow merchants to easily showcase more of their products in a full-screen video format, were also added in Q3. Moreover, PINS introduced affiliate links for Idea Pins and the new Watch Tab, where users can watch a vertical feed of full-screen Idea Pins, as well as a new feature called Takes, where users can post their spins and Idea Pins encouraging others to try those same ideas.

Some recent new features include a rewards program to pay creators to share their passions with their audiences and Pinterest TV, offering original live episodes with creators. Finally, Pinterest expanded the Verified Merchant Program into seven new markets. In 2021, publishing tools were made available in 37 markets, and the company launched 150 new features in total.

IDFA

In Q1, the company put efforts to improve “first-party” measurement solutions (information that a company collects directly from its customers and owns). In addition, this year, they began allowing users to turn any search into a shopping search, resulting in a significant increase in engagement on shopping surfaces.

Historically, app install ads, which rely heavily on IDFAs (Identifier for Advertisers), have not contributed a significant amount of revenue. With a rich first-party data set, the company is less dependent on third-party data to serve relevant ads. Because of this, the management thinks PINS models have been relatively resilient to the loss of data obtained from third parties. In addition, they have invested in the ad tech stack to improve visibility into conversions in privacy-centric solutions.

That is supported by the fact that ARPU, since the inclusion of IDFA in Q2 of 2021, still grew 46% to $1.93 in Q4 2021.

Conclusions

In the United States and globally, PINS monetization is still very low. If you compare the ARPU of Pinterest with that of companies such as Twitter (TWTR) or Snap (SNAP), you see a big gap. That might partially be due to the platform style, but we believe that PINS has a wider margin to increase its monetization metrics compared to other companies. We saw how this is important in 2021, with PINS able to scale so much its bottom line, even with shrinking active users.

Moreover, after 2021, with fewer active users, we expect to see in 2023 and over a return to the previous trend of growth seen before 2020. 2020 was a particular year, and its extraordinary growth metrics affected negatively 2021.

In particular, we expect growth in users and monetization in the next five years, with most of the adds from outside the United States.

Furthermore, we believe that PINS has a vast space to increase its margin as the company keeps scaling. With a gross margin of almost 80% in 2021, we expect PINS to reach an operating margin above 25% in the long run.

With shares priced at about $22.5/sh when we write, we believe Pinterest is a compelling choice, and we reiterate our buy rating.

Be the first to comment