metamorworks/iStock via Getty Images

For several years, the world of tech investing has been dominated by momentum: which are the newest, flashiest stocks? Which have been covered most fervently by the financial media, and what stocks generate the most buzz on traders’ social media?

2022 has turned tech investing on its head, however. All of the “obvious” growth plays have lost massive amounts this year, and as most of the market is prioritizing safety and value over growth, it behooves investors to look at some of the more unconventional names to remain exposed to the tech sector.

Progress Software (NASDAQ:PRGS) is nothing if not unconventional. This is a stock few have heard of, despite the fact that this company is looking to generate north of $600 million in annual revenue this year – far more than most of the high-growth tech stocks that investors are familiar with. On the tech side, Progress operates a portfolio of backend infrastructure tools – helping software developers craft their UI, test performance, and build applications on an agile platform. The kicker here is that, unlike most tech companies, Progress Software invests very little in R&D, and management focuses its attention on acquiring other companies and operating them.

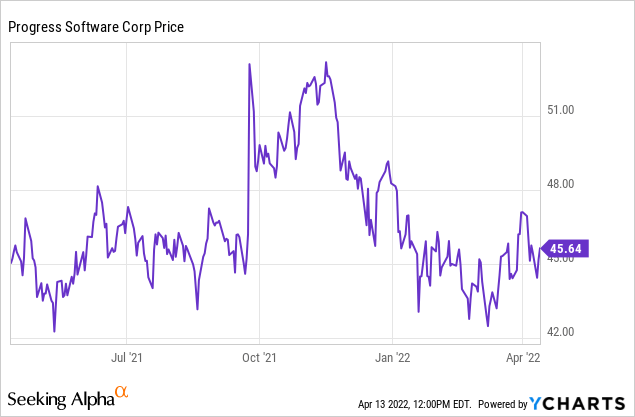

Year-to-date, shares of Progress Software are down -5%, beating the overall market and vastly outperforming most other software stocks:

Though growth via M&A is a very nonstandard strategy that I tend to leer at when it comes to other software companies, Progress Software is an exception. It has built up a big ARR base on top of solid operating margins, and the company is a reliable earnings generator. It has a goal of doubling its revenue every five years, while also acquiring targets that are profit-accretive. The companies it acquires tends to all fall into the infrastructure software category, and so Progress Software does run a unified brand and theme where customers can be cross-sold across various products in the portfolio.

Progress’ most recent acquisition is a company called Kemp, which it’s in the process of integrating. Kemp is a “load balancing” software tool – responsible for distributing traffic in a network for optimal performance. Despite also being a relatively unknown entity, Kemp surprisingly is a vendor to some of the most prominent companies in the world, including Amazon (AMZN), Audi, and NASA (yes, the federal agency).

Here’s a shortlist of all the reasons to be bullish on Progress Software:

- Very disciplined M&A approach. Progress isn’t just buying every company under the sun: it has specific criteria, including selecting only infrastructure software companies that come with a solid ARR base and strong customer retention. Take Kemp, for example: Kemp brings $70 million in annual revenue to the table and $40 million of ARR. The purchase price is only $258 million, or a ~3.7x multiple of revenue. That’s cheaper than virtually any publicly traded software company.

- Profit focus. On top of recurring revenue, Progress Software is also focused on the bottom line. Its typical acquisition targets are expected to be able to be accretive to the company’s overall target of 40%+ pro forma operating margins, which is well above most software peers.

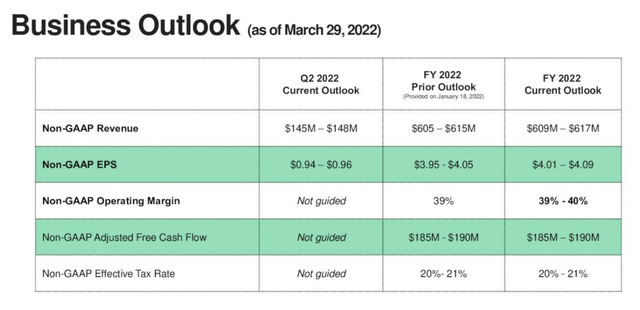

- Cheap valuation. Right now, Progress Software has updated its earnings outlook for the year to $4.01-$4.09 in pro forma EPS. Against the midpoint of that outlook, Progress’ current ~$46 share price represents just an 11.2x forward P/E multiple – which is quite a bargain for a company that intends to double revenue every five years, even if most of this growth will come inorganically. As long as Progress can maintain its 40%+ operating margins, there’s a lot of earnings leverage to be had here.

Alongside its Q1 earnings results that the company released in late March (which we’ll discuss in detail in the next section), Progress also boosted its full-year outlook. It’s now guiding to $609-$617 million in revenue, representing 9-11% y/y growth, and EPS that’s $0.05 higher at the midpoint alongside a 50bps boost to pro forma operating margin guidance.

Progress Software FY22 outlook update (Progress Software Q1 earnings deck)

The bottom line here on Progress Software: this may not look like other tech stocks, but I think it’s difficult to argue with Progress’ strong execution alongside its modest valuation. Stay long here and continue to ride the upward wave on this stock.

Q1 download

Progress Software released Q1 results for its February quarter (the company has an unconventional November year-end) in late March. Let’s go through the key highlights of the earnings:

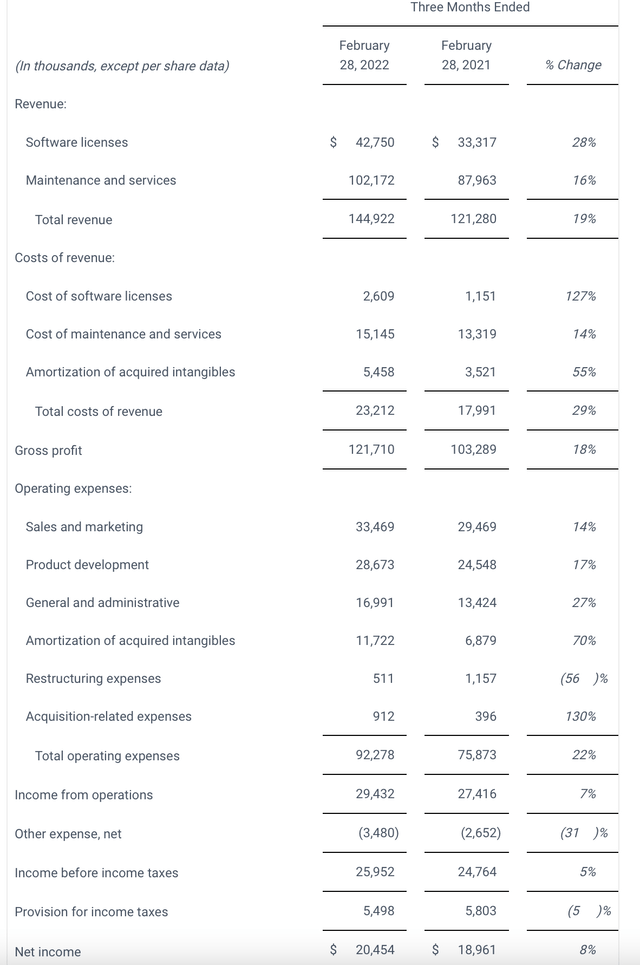

Progress Software Q1 earnings results (Progress Software Q1 earnings release)

Progress’ revenue in the quarter came in at $144.9 million (+19% y/y), beating Wall Street’s expectations of $139.1 million (+15% y/y) by a four-point margin. Progress itself had also only guided to $136-$139 million in revenue for the quarter. The majority of the growth was driven by Kemp, which the company had been in the process of integrating for four months ahead of the close of the quarter.

ARR in the quarter grew 3.5% y/y on an organic basis to $479 million, with Kemp ARR included in both current and prior-year periods; on an as-reported basis, ARR growth was 12.4% y/y. Net revenue retention rates in the quarter were 100.2%, indicating that upsells very slightly outweighed churn in the quarter.

Progress noted that demand was “strong across the board” for all of its products, with strong execution across all regions as well. The company noted its exposure to the geopolitical tension in Russia/Ukraine is minimal, though it has also stopped all operations in the region.

Of course, growth for Progress is all about M&A. Two things are going in the company’s favor at the moment: first, the pullback in equity values has made many deals more attractive; and second, despite rising rates, Progress noted that it was able to refinance a good chunk of its debt at a fixed 1% rate, reducing its interest rate exposure.

Here’s some helpful commentary from CEO Yogesh Gupta’s prepared remarks on the Q1 earnings call, detailing his view on the current M&A landscape:

Turning now to our total growth strategy and our outlook for M&A. M&A is another area where for Progress, the spike in inflation and recent pullback in the capital markets is an advantage. We have mentioned in the past that rising interest rates could put Progress in a more competitive position in the market for deals. Other players are less likely to use leverage as heavily in a higher interest environment.

We’re seeing some signs of a more promising M&A environment. Infrastructure software companies in our target zone, seek alternatives to public market exits or private funding strategies. At the same time, potential competitors who formerly were much more aggressive when money was cheaper are becoming more cautious. As a result, we expect our disciplined approach to bear more fruit in the future. Our radar scope remains doted with many possible targets, and we are working daily to vet an increasing number of quality acquisition candidates.

Progress remains well capitalized due to our strong and predictable cash flows, a sturdy balance sheet, an ample ability to finance possible transactions. As we announced in January, we refinanced our existing credit facilities at a very favorable way, with over half of our current debt is fixed at 1%.”

Pro forma operating margins took a slight dip in the quarter, to 39.8%, down from 43.0% in the year-ago quarter. The decline was primarily driven by absorbing Kemp’s expense base (though Kemp is profitable, it indexed slightly lower than Progress as a whole), as well as higher compensation costs in the current wage inflation environment. That being said, the company continues to seek out cost synergies with Kemp and continues to expect a 40%+ pro forma operating margin going forward, which is much higher than most software peers. The company’s pro forma EPS in the quarter also grew 2% y/y to $0.97, which beat Wall Street’s $0.85 expectations with 14% upside.

Key takeaways

It’s worth “going off the beaten path” and building up a small position in Progress Software. This is a company that has managed to drive substantial revenue and margin growth through a series of well-executed acquisitions. Stay long here.

Be the first to comment