JHVEPhoto

We started covering Shopify Inc. (NYSE:SHOP) in February of this year and have written on it four additional times since then. There was never a dull moment in the comments sections with SHOP aficionados amorously defending the ludicrous sales multiple and putting their faith in the non-GAAP inflated earnings numbers. Even the broader analyst community was taking its own sweet time to get its estimates down from la la land.

While the price massacre has not surprised us in the least, we were amazed at the speed of it during the course of our coverage, which caused us to oscillate between “Dropify” and “Chopify” monikers for this crowd favorite. The last time we covered this we warned our readers of further turmoil for holders of SHOP.

We keep hearing that we should “buy before everyone else does”. Of course, that is a mathematical impossibility. If everyone wanted to buy and by extension nobody wanted to sell, the price would go to infinity and volume would be zero. But it is possible to book your tax losses before everyone else does. This is fairly critical in the case of SHOP.

A very large percentage of those who bought it in 2022 are underwater and sitting on big losses. In our estimate, the price is likely to go lower and the willingness to say “ta ta” to this story will increase as well. Tax loss booking is a bit away, but we think investors should get a head start on it.

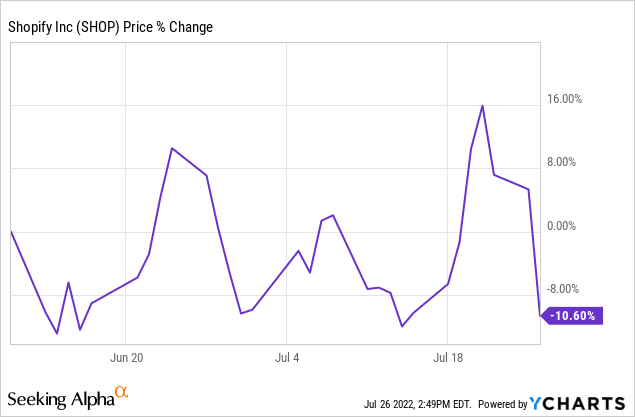

Source: Shopify: Book Tax Losses Before Everyone Else Does

SHOP investors have had it choppy since then and lost another 10% during this time frame.

We revisit this one once again today in light of its results and layoffs and share our updated outlook on this lockdown driven growth story.

Q2-2022

SHOP’s Q2-2022 results were bad in relation to analysts’ expectations. Sure, we saw growth and it was across the board. Total revenue was up 16%, monthly recurring revenue was up 13% and subscription solutions were up 10%. These still came in below the average analyst estimate. More importantly, the two latter numbers were lower than the top-line growth, suggesting a further slowdown in the quarter that the headline did not convey.

In this new era where investors have embraced unprofitable companies like SHOP, there is an obsession to find “profits” somewhere. In the case of SHOP, the focus is on gross profits. We would venture to say that Q2-2022 gross profits validated our thesis in full.

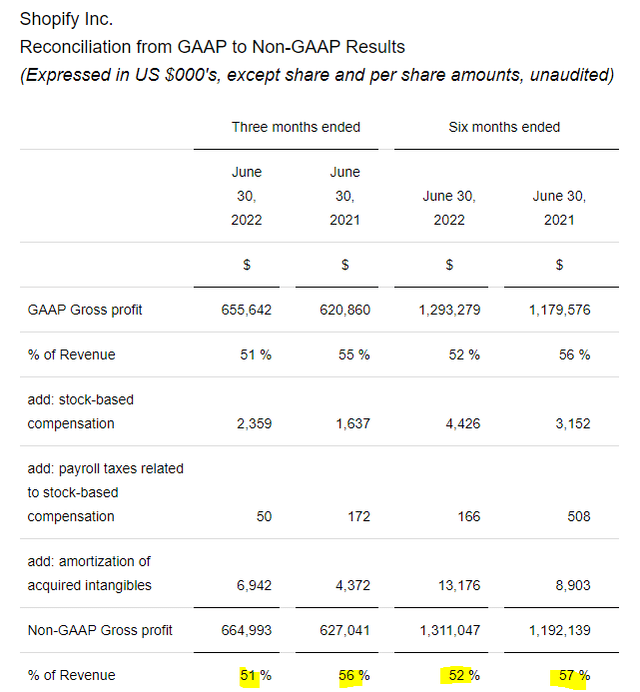

Gross profit dollars grew 6% to $655.6 million in the second quarter of 2022, compared with $620.9 million for the second quarter of 2021, reflecting primarily a greater mix of lower-margin Merchant Solutions revenue, lower margins in Shopify Payments due to merchant and card mix, and increased investments in our cloud infrastructure.

Adjusted gross profit dollars grew 6% to $665.0 million in the second quarter of 2022, compared with $627.0 million for the second quarter of 2021.

Source: SHOP Q2-2022 Press Release

6% growth in adjusted profits meant that we were seeing the margin compression hit in full bloom. GAAP gross profit margin was 5% lower year over year.

This is a big deal as such a compression at gross profit level will create a very high compression at the net profit level, when SHOP finally becomes profitable.

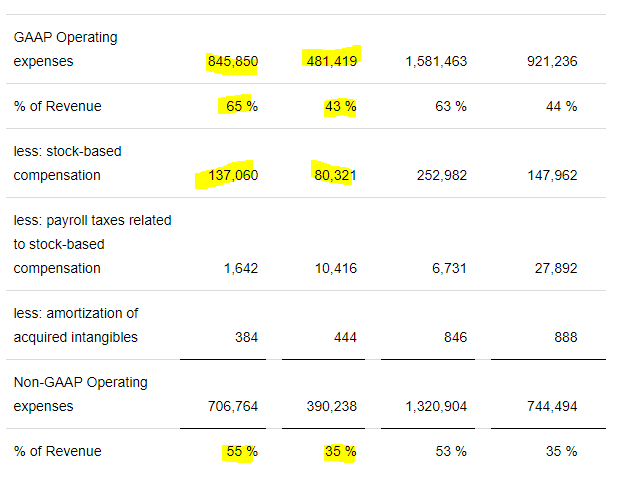

We wish that we could tell that was all that was bad in the results, but we would be lying. SHOP’s operating expenses (which is what happens after the gross profits) were far worse. Year over year increase was 75% ($481 million to $845 million). This completed negated the economies of scale argument that bulls had been laying it on thick for some time.

SHOP Q2-2022 Press Release

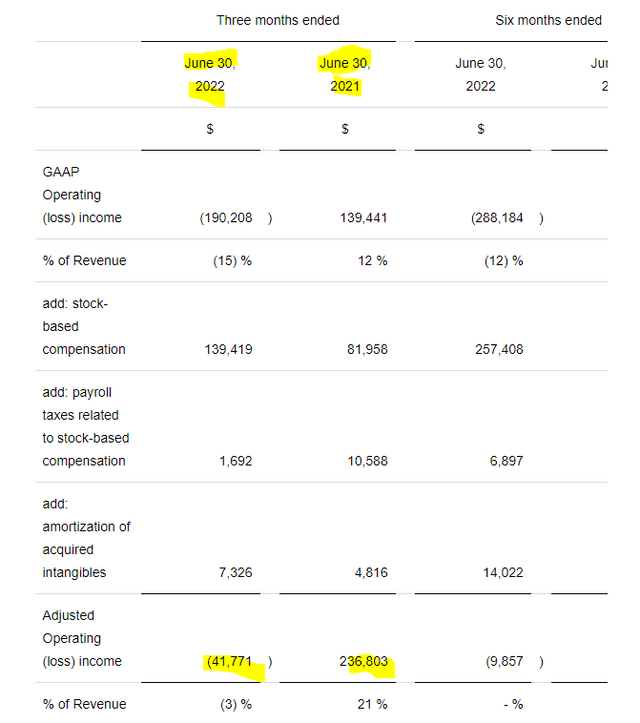

Operating expenses jumped to 65% of revenues and even excluding the rather onerous stock-based compensation of $137 million, it was still 55%. All of this led to an adjusted operating loss, which is far worse if you count the stock-based compensation.

Company’s Outlook

SHOP did not mollycoddle investor expectations and guided for some brutal results ahead.

Factoring in these expectations, we expect to generate an adjusted operating loss for the second half of 2022, with our third-quarter adjusted operating loss, excluding severance costs, expected to materially increase over the second quarter, reflecting time needed for the streamlining of our operations to take effect, the implementation of our new compensation framework, the first quarter of Deliverr operations, including approximately 450 team members, and related integration costs, and up to an estimated 50 million dollars for certain other operating items associated with these and other areas. As we decelerate operating expense growth into the fourth quarter, and with its higher seasonal GMV and revenue, we expect an adjusted operating loss in the fourth quarter that is significantly smaller than in the third quarter, but larger than in the second quarter.

Source: SHOP Q2-2022 Press Release

Our Outlook & Verdict

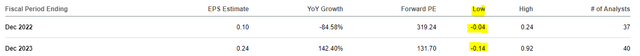

This fits with our thinking in the earlier articles where we predicted that SHOP will have losses in 2022 and 2023 and analysts were nowhere near pricing in reality. We now expect SHOP to have adjusted operating losses that are worse than the lowest number on the Street. The good part here is that the 10:1 stock split makes it look a little less gruesome.

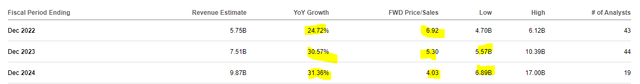

We will further add that the revenue estimates for 2023 and 2024 are completely out of sync with reality and we believe that the lowest sales estimates for those years are more likely to be close to the truth.

The company again validated this in their press release.

As ecommerce has reverted to a level slightly higher than its pre-COVID trend, in an effort to recalibrate our operations, Shopify took steps to streamline its workforce in July, reducing its total headcount by approximately 10%. After expanding the company in anticipation of rapid and sustained structural ecommerce market expansion, which has not materialized, we are recalibrating to meet the new reality.

Source: SHOP Q2-2022 Press Release

We are looking a 3X sales number with concurrent sales as a trough and SHOP likely trades in the teens before this is all over. A bounce is always possible, as investors try and buy this falling knife. Longer term, the growth story is dead and investors need to forget about the price they bought this at.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment