4×6/E+ via Getty Images

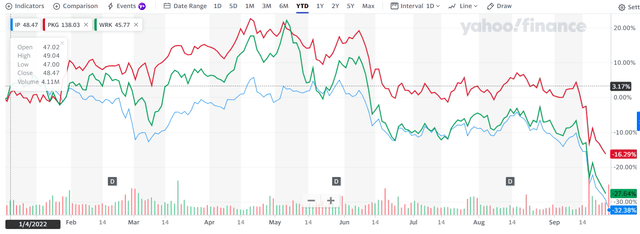

Our most devoted readers know that our internal team has a soft spot for paper companies. Within our universe coverage, we extensively follow International Paper (NYSE:IP) and WestRock (NYSE:WRK). Currently, both companies are rated as a buy. Given the recent market price performance, we would like to initiate Packaging Corporation of America (NYSE:PKG). Out of the three companies, it has always been the most resilient, and also the latest stock price decline due to FedEx preliminary results and a negative note from Jefferies proved PKG’s market solidity. YTD performance on IP, WestRock and PKG were -32.38%, -27.64% and -16.29% respectively (Fig. 1).

Here at the Lab, we have covered the story twice already, and we suggest PKG investors to check up on our previous publications so that they are informed of the story up to now:

- International Paper: we double down

- WestRock Is A Clear Buy At This Price

IP, WestRock and PKG stock prices evolution

Source: Yahoo Finance (Fig. 1)

Packaging Corporation of America at a Glance

The company engages its activities in manufacturing and selling corrugated packaging and containerboard mainly in the US thanks to two divisions: Packaging and Paper. It was founded in 1867 and is headquartered in Illinois employing approximately 15k people. In detail, based on production capacity, Packaging Corporation of America is currently the third largest producer of corrugated packaging and containerboard in the North American area. Today, the company is in our screening based on a compelling valuation and an interesting dividend yield. So, why are we confident?

First of all, PKG shared the same IP/WestRock thesis on long-term growth opportunities and ESG trends (so, no buy case recap on macro trajectories). However, today we are going to check out why PKG is a buy with some comps analysis.

PKG versus IP and WestRock (5-year analysis)

- Starting with the top-line performance, Packaging Corporation of America scored in second place after WestRock’s revenue CAGR. We already emphasized that WRK “has bought its way up through inorganic growth over the past several years“, resulting in higher impairments and restructuring costs that made its P&L more volatile;

- Selling General & Admin Expenses. In this line, PKG was the best performer both in absolute and relative value. Number in hands, Packaging Corporation of America has the lowest SG&A expense/Gross Profit versus its closest competitors. Looking at the LTM, the ratio stands at 27.6% compared to IP and WestRock at 46.92% and 44.33% respectively;

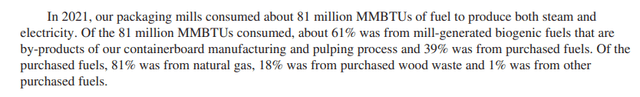

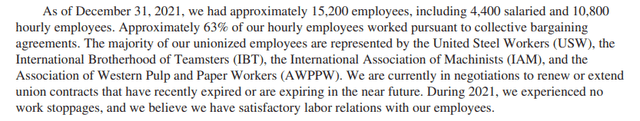

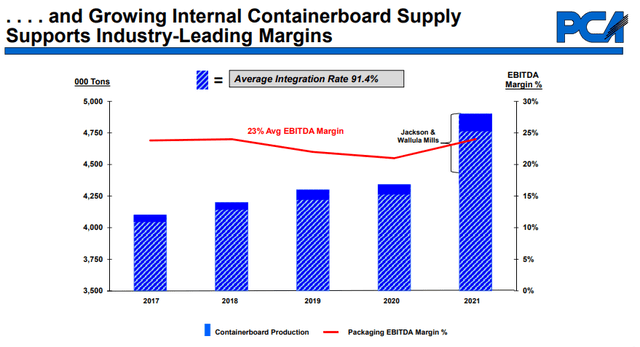

- Related to point 2), the company has the best profitability in terms of EBITDA. This is due to multiple reasons: 1) PKG industrial facilities are located in end-client proximity to minimize logistics costs, 2) centralized procurement, 3) energy requirements are almost self-generated (Fig 1), 4) direct sale representatives 5) higher hourly employees with respect to the total workforce compared to IP and WestRock (Fig 2);

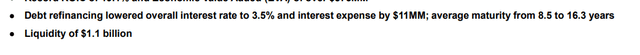

- Going down to the P&L, interest expenses are much lower for PKG. This is due to a lower total debt compared to its peers and higher duration. With PKG’s latest presentation, we clearly see that interest rates were lowered to 3.5% and duration increased by almost eight years (Fig 3). WestRock just recently announced a new acquisition in Mexico and given the current macro scenario, we believe that IP and WestRock will refinance at higher rates;

- Going to the remuneration, PKG has a lower payout ratio and increased its DPS year-on-year (even during the COVID-19 pandemic outbreak). Well, there is no need to explain that WestRock suspended the dividend payment while IP has maintained it, lowering later on after the Sylvamo spin-off;

- International Paper has a JV in Russia. That is not the case for WestRock and PKG.

PKG energy

Source: PKG annual report (Fig 1)

PKG employees

Source: PKG annual report (Fig 2)

PKG debt ref. and duration

Source: PKG Investor Presentation (Fig 3)

Conclusion and Valuation

Going to the valuation, here at the Lab, we used to value paper mills by combining and averaging two metrics:

- An 8.0x multiple on EV/EBITDA on our 12-month forward estimates,

- A DCF analysis in which our team assumes a 10% cost of equity and a perpetual growth rate of 2%.

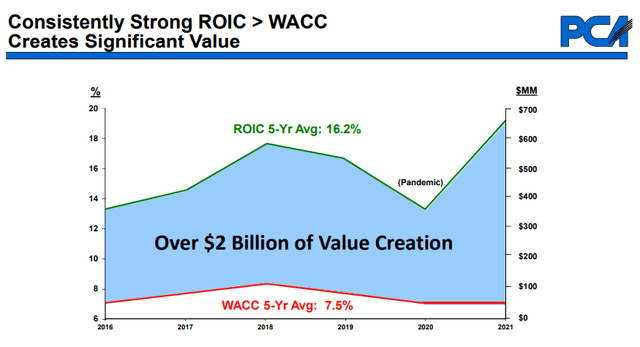

In our numbers, we forecast a $2 billion EBITDA for 2023, recognizing PKG as the industry-leading performer with a higher margin and a significant track record of shareholders value and so we do not add anything more. Our target price results in $160 per share versus the current market price of $114. We initiate with a clear buy rating.

PKG EBITDA margin

Source: PKG Investor Presentation

PKG ROIC vs WACC

Source: PKG Investor Presentation

The out-of-the-box idea that shares a similar thesis on ESG trends is Ardagh Metal Packaging. Here is our latest publication.

Be the first to comment