SolStock/E+ via Getty Images

Investment Thesis

Lancaster Colony (NASDAQ:LANC) is like an empire that acquires and controls a ‘colony’ of market-leading businesses. For more than 50 years, the management has been astute in identifying businesses with a forward-looking outlook that appeals to new rising markets. Such acquisition strategies are proven to work if we look at the ever increasing results of the company’s net sales.

The company’s business is temporarily affected by the Ukraine war and inflation of food prices. These headwinds are not new as has happened from time to time over the last 50 years and hence, I think the company will recover eventually, as they have done before since its inception more than 50 years ago.

LANC is generous with issuing dividends to shareholders. The dividend amount has been increasing consistently which greatly benefits dividend investors.

LANC is currently overvalued by PEG valuation which means investors with a ‘growth investing’ mindset should hold and wait for the valuation to become more favorable.

Company Overview

Founded in 1961, Lancaster sells branded frozen dinner rolls and garlic bread, croutons, salad dressings, bottled sauces, and other specialty food products to retailers and restaurants.

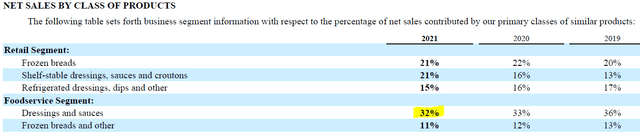

From the latest Annual Report 2021, we can see that ‘Dressing and Sauces’ contribute the lion’s share of the company’s Net Sales, although other food categories also contributed significantly. Hence, there is no concentration risk in terms of revenue diversification.

Company Net Sales (Annual Report 2021)

From the company’s website, these are the ‘core’ brands of the company:

- Marzetti sells mainly food dressings

- New York Brand Bakery sells mainly toasts, breadsticks, bread rolls, and other ‘bread-based’ finger food.

- Sister Schubert’s sells bread rolls for dinner and breakfast.

Outside of these ‘core’ brands, the company also owns these brands classified under the ‘others’ category:

- Flatout ‘flatbread’

- Reames frozen ‘egg noodles’

- Angelic Bakehouse ‘sprouted grains’

- Caesar Cardini’s ‘speciality dressing’

- Girardi’s ‘speciality dressing’

Successful Growth by Acquisition

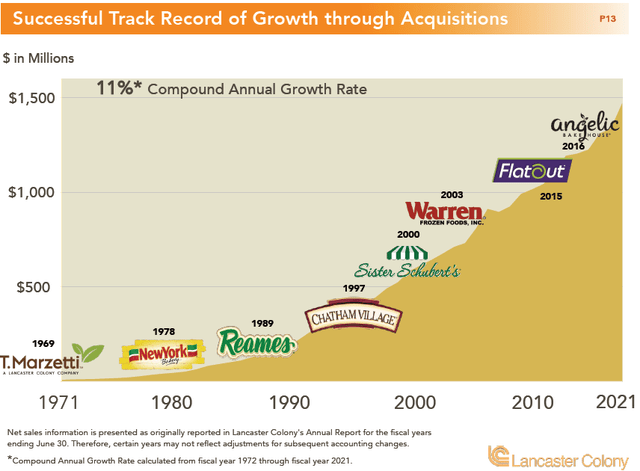

The company has had a healthy strategy of growth by acquisition since 1971, which is more than 50 years. This growth is sustained by the company’s astute acquisitions of companies with a forward-looking growth outlook.

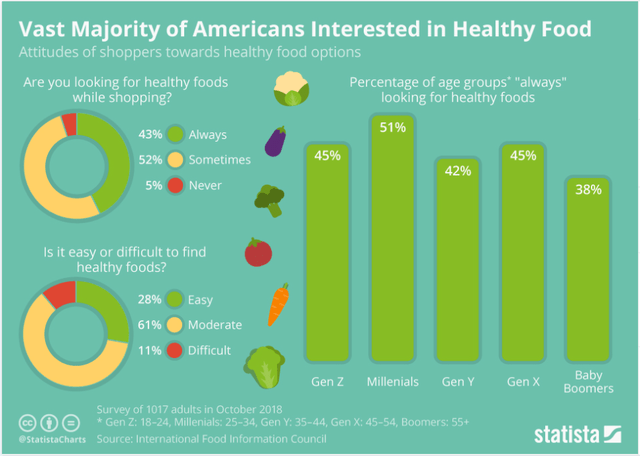

A study by Statista defines millennials (age 25-34) as the age group that is most health conscious:

Americans interested in Healthy Food (Statista)

LANC’s acquisition is observed to be strategically targeting these age groups. For example:

- The company acquired Angelic Bakehouse which sells healthy products of non-GMO, sprouted whole grain products which appeal to health-conscious millennials.

- The company also acquired Flatout Holdings in 2015 due to it being a fast-growing niche producer of flatbreads. Flatout produces flatbread products that are ‘mindful of calories and fat’, which resonates with millennials’ taste for healthier products as well.

These acquisitions are bearing fruits as can be inferred from this chart taken from the ‘6th Annual Future of the Consumer Conference’ deck showing its ever-increasing net sales after each acquisition since 1971.

Net Sales (6th Annual Future of the Consumer Conference)

Competitive Advantage in Market Share

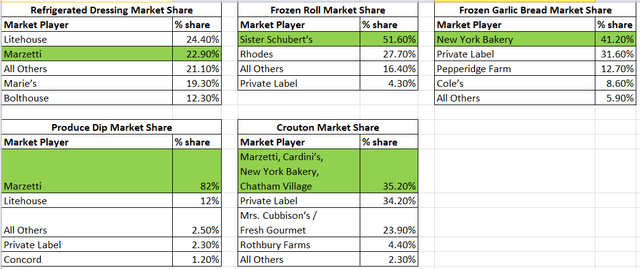

LANC’s market share can be inferred from the market share of its main products. From the same company’s Consumer Conference deck cited earlier, these are the market shares of the company’s main products which I extracted the figures and tabulated in table format:

Market Share (6th Annual Future of the Consumer Conference)

We can observe that in most of the categories, LANC is leading in either 1st or 2nd place in market shares. This is the result of LANC’s successful growth strategy as discussed in the previous section.

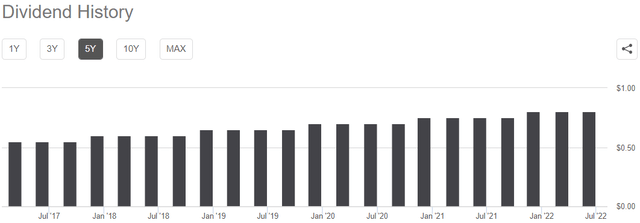

Consistently Rising Dividend Payout

The company is known to give dividend that is consistently rising. From the dividend history inferred from Seeking Alpha, we can observe a consistently increasing trend, which benefits dividend investors.

Dividend History (Seeking Alpha)

In fact, from the latest Annual Report 2021, the company has managed to increase its dividend rate for the last 58 years, including the latest year of 2021:

Dividend Rate (Annual Report 2021)

Competitive Comparison

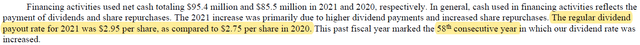

Morningstar listed Flowers Foods, Inc. (FLO) and John B. Sanfilippo & Son, Inc. (JBSS) as competitors of LANC listed in the US. We will compare LANC’s financials with these 2 competitors.

Key Financial Figures (Seeking Alpha)

Based on the financial figures found from Seeking Alpha, we can derive the following conclusion:

- LANC is growing its top-line revenue much faster than its competitors.

- As we drill down to the bottom line items of gross, net margins, and cash flow from operations, it is generally profitable.

- The most notable financial advantage is the fact that LANC is able to maintain a net cash position while all its other competitors are having a net debt profile on their balance sheets.

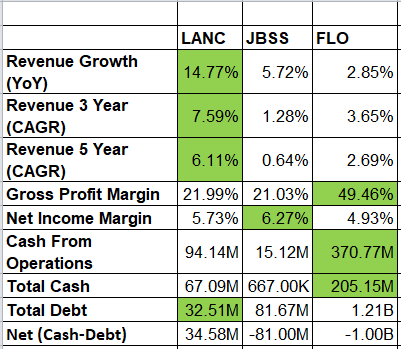

Valuation

We calculate the PEG ratio by taking the latest P/E and divide by the ‘Revenue 5 Year’:

Key Financial Figures (Seeking Alpha)

Assuming the companies in the comparison list are able to grow at the same rate as in the last 5 years, all 3 companies are overvalued. But comparatively, LANC appears to be the least overvalued.

Risk of rising commodity prices

The company uses a wide range of commodities as raw materials as observed from the latest Annual Report 2021.

Company Risk (Annual Report 2021)

Hence, LANC’s growth is significantly hit by rising commodity costs due to the Ukraine conflict and other factors.

If these macro headwinds persist for a prolonged period, the stock price may take a longer time to recover from its current pullback.

Conclusion And Key Takeaway

LANC has a successful strategy of growth by an astute selection of companies that has a forward-looking growth plan that is aligned with the general market tailwind. The success is attested by its ever-increasing net sales figure since 1971.

Its business is currently hampered by the current headwind of geopolitical conflict and inflation. In the long run, its business should recover as the macroeconomic tailwinds improve.

The stock is currently overvalued, growth investors should hold until the valuation improves significantly.

Dividend investors can consider a position since the company has proven to be able to increase dividend payout consistently for more than 50 years.

Be the first to comment