owngarden/iStock via Getty Images

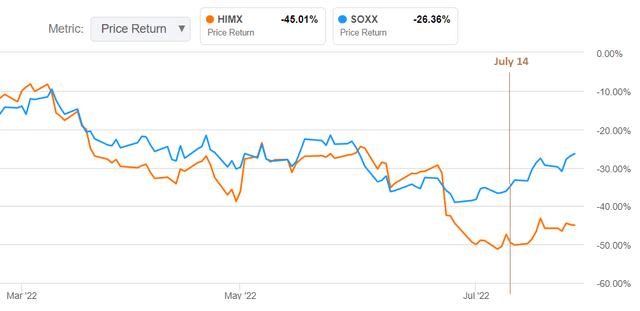

Taiwan-based Himax Technologies, Inc. (NASDAQ:HIMX) produces integrated circuits (“ICs”) that are used in everything from television, cars, and laptops to mobile phones. A look at its share price shown in the orange chart below shows that it has been underperforming with respect to the iShares Semiconductor ETF (SOXX) since July 14.

SA Charting (www.seekingalpha.com)

This downside could be related to Credit Suisse downgrading the stock with a target of $7, or roughly 15 cents below the current share price. Thus, the aim of this thesis is to assess whether this downgrade is justified by first looking at revenue growth in light of supply chain constraints.

Supply Chain Woes Likely To Continue

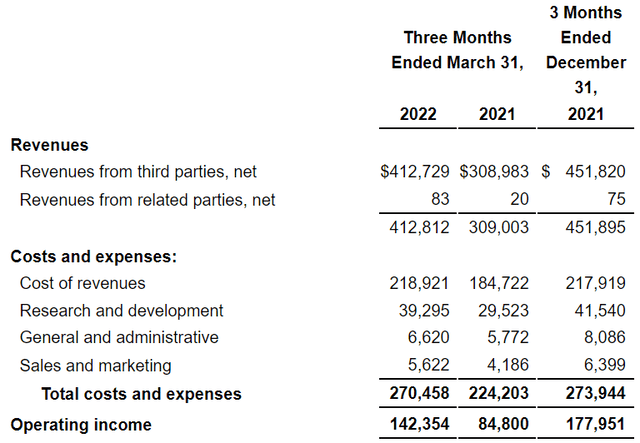

Revenues for the first quarter of 2022 of $412.7 million as shown in the extract below, represented a 33.6% increase over the same period last year. However, these constituted a sequential decrease when compared to the fourth quarter of 2021, by $39 million (or 8.6%), and were below the company’s own guidance.

Quarterly income statement (www,seekingalpha.com)

The reasons provided for the shortfall was that the first quarter is typically low seasonally but things were exacerbated by the Covid-19-related lockdowns in China and the Ukraine conflict, which both caused major disruptions in the supply chain.

For investors, while Himax operates in the semiconductor industry, it does not own foundries and thus has to source the chips it needs to build its ICs. Consequently, with components not reaching its assembly plants in time, the production of image processing products which it then ships to automotive and consumer electronics manufacturers has suffered, resulting in a shortfall in revenues.

Now, Himax’s first quarter lasts from January to March. Looking ahead, since China’s lockdowns occurred from March 26 and were gradually lifted only from May 27, it means that the worst effects of the lockdown will only be felt in the second quarter, lasting from April to June (earning report expected before the market open on August 11). Thus, expect a more significant drop in revenues when the next quarter’s financial results are announced. There could also be a drop in profitability in case the company resorts to expedited shipping to accelerate shipments, but this conversely implies more expenses.

Looking at the demand side of the equation, there was also a decline in smartphone sales due to market sluggishness. This decline is aligned with a regression in the global smartphone market as measured by Counterpoint Research, which points to factors like the East European conflict, economic slowdown in China, and components shortages due to successive waves of Covid. Since smartphone LCDs constituted 9.1% of overall revenues in 2021, expect pressure on sales to continue.

Therefore, in addition to the supply side, there is also a demand-led impact.

Some positives amid concentration risks

On the other hand, gross margins of 47% came within the guidance of 46% to 48%, despite falling from Q4-2019’s record high of 51.8%. This is due mostly to the absence of fixed costs related to factory ownership as the company outsources most of its manufacturing to third parties. To this end, capital expenses of less than $3.6 million remain low since Himax does not have to spend much to build factories.

There is also a strategic intent that explains part of the sales decline. Thus, in anticipation of certain clients slashing down inventories for certain types of products, Himax has been transitioning production accordingly. This is essential for a cyclical industry where one of the main risks is a late economic cycle when growth peaks and inflation accelerates.

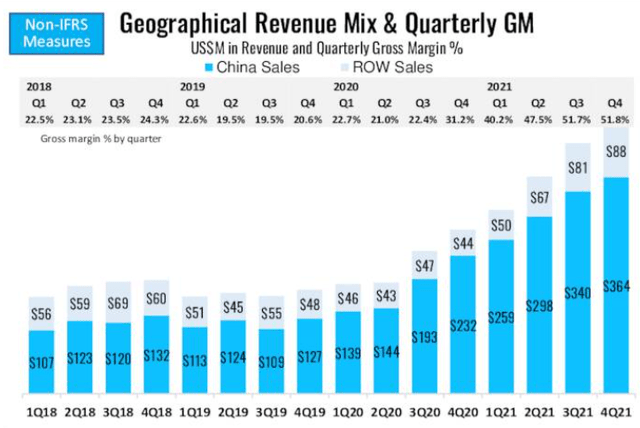

In this case, the main problem for the Taiwanese company remains its overwhelming exposure to the Chinese market, at 84% during the last quarter of 2021, or the same as in Q4-2020. This means that there has been no progress in exporting to the rest of the world.

Revenue exposure to China (www.seekingalpha.com)

Now, the Chinese central bank is not facing the same challenges as the U.S or Europe in terms of inflation and GDP growth, which are at 2.5% and 4.3% (expected for 2022) respectively for China. However, inflation is rising while growth is on the downside with one of the main problems facing China being the spread of Covid-19, which shows no sign of abating. To exacerbate matters from the economic standpoint, the country’s zero Covid-19 policy which entails locking down entire cities or regions to hamper the progression of the disease is proving detrimental to economic growth. Moreover, with the Chinese Communist party meeting scheduled some time towards the end of the year, the priority should rather be the health mandate, above all other considerations.

In these circumstances, one starts to wonder whether it is not preferable to avoid the stock despite its enticing dividend yields.

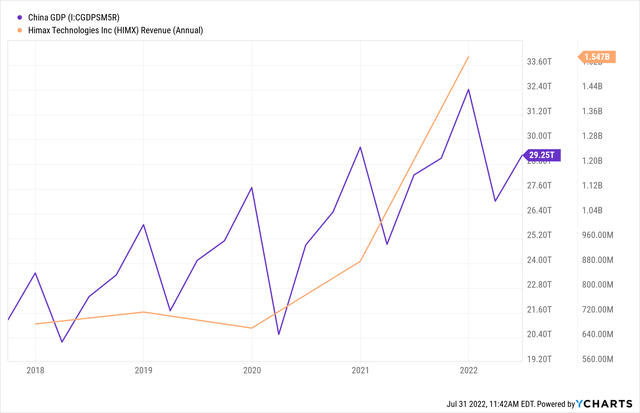

For this purpose, investors will note that Himax’s annual revenues as shown in the orange chart below, seem to closely follow China’s GDP, which from a record $32.4 trillion in 2021 fell sharply in 2022. However, it subsequently failed to rebound sharply as during the previous years. Therefore, in all likelihood, Himax’s annual sales have reached an all-time high and will see a decline this year.

Comparison of annual revenues with China’s GDP (www.ycharts.com)

Therefore, going forward, there are risks related to revenue being heavily skewed towards China, but, for those willing to overlook the risks, it is important to thoroughly explain the dividend part.

Dividend Yields, Valuations, and Conclusion

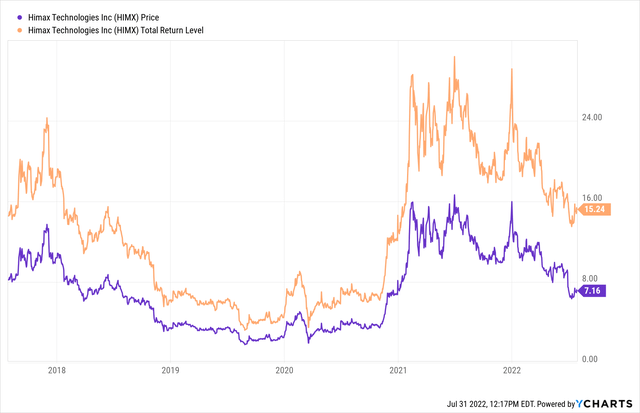

Himax pays a forward yield of 17.46%, but, this is paid on an annual basis, and distributions were already effected in July for those who owned the stock till June 29. Now, for those who want to purchase shares, its high yields can contribute to shielding the stock from downsides to some extent. This is evidenced by the trajectory of the total returns in the orange chart below which include both the price performance as well as dividends in case these are reinvested. These total returns have delivered double the stock price performance, but this remains conditional to the dividend payments being sustained.

Comparison of price returns and total returns (www.ycharts.com)

Still, looking at the past, the company has not been consistent in dividend payments which were considerably reduced in 2019 and 2020 following a significant decrease in cash generated from operations in 2018. Dividends were fully reinstated in 2021 after an improvement in cash flow but could be again reduced if operating income continues on a downtrend from the $142.3 million as shown in the quarterly income statement above.

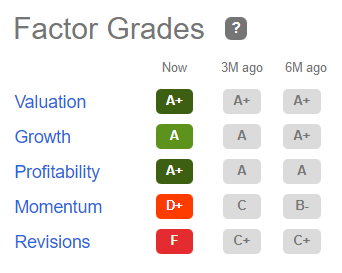

As for valuations, with price-to-earnings and EV-to-sales metrics which are undervalued with respect to the sector median by a whopping 80%, it is tempting to buy the stock, especially after a one-year drop of nearly 48%. But, here, SA’s factor grades which allocate a D+ for momentum and F for revisions remind us that pains may not be over and that volatility could persist in the second week of August when the company announces second quarter results.

Factor grades (www.seekingalpha.com)

Consequently, the downgrade by analysts is justified. Also, at the $7 level, and with valuation, growth, and profitability grades all in green, those looking for diversification in China which remains relatively more immune to the high inflation impacting other parts of the world, may be tempted to buy.

However, they should be able to stomach volatility caused by geopolitical risks due to any sudden escalation in trade disputes between the U.S. and China. Finally, with the latest Chinese PMI data falling below 50 because of Covid, it is preferable to avoid the stock till some concrete announcements are made about country-level diversification.

Finally, after having already suffered from an 8.6% drop in revenues in Q1, the revenues in the second quarter could actually fall and still be within the lower range of the expected 16% to 20% sequential decrease. This could result in an upside for those willing to trade the stock.

Be the first to comment