filmestria

Shell (NYSE:SHEL) is a large British multinational integrated energy company with an almost $200 billion valuation. The company has focused on adjusting its portfolio for a changing market to chase net-zero emissions while diversifying its energy assets. As we’ll see throughout this article the company’s diversification makes it a strong investment.

Shell Progress

Shell has focused on progressing along a variety of goals.

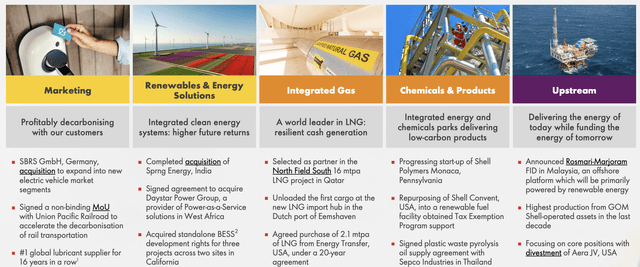

Royal Dutch Shell Investor Presentation

Source: Shell Investor Presentation

The company has worked to rapidly expand its marketing business and renewable & energy solutions businesses. Especially in the renewables business the company recently completed its acquisition of Spring Energy, India. The company is continuing to expand its assets at every stage including integrated gas, chemicals, and upstream production.

The company’s progress across all of its goals here shows its financial strength.

Shell Earnings

The company has continued to generate strong earnings in a higher priced environment.

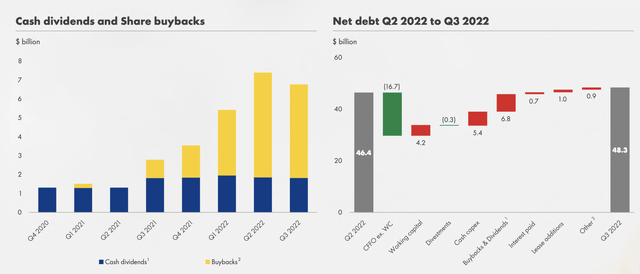

Royal Dutch Shell Investor Presentation

The company had $9.5 billion in adjusted earnings from the quarter from $21.5 billion in adjusted EBITDA. The company is planning $5.4 billion in capital expenditures and $7.5 billion in anticipated FCF for the quarter. That annualizes the company’s FCF at $30 billion or a 15% FCF yield for the company.

The company continues to have $48.3 billion net debt which increased slightly YoY, however, it remains incredibly manageable. The company’s FCF could pay down the entirety of its debt after 6 quarters.

Shell Financial Assets

Overall the company’s financial assets remain incredibly strong, which will support substantial shareholder returns.

Royal Dutch Shell Investor Presentation

The company continues to maintain an incredibly manageable net debt position with a 4% YoY increase. The company also rapidly ramped up the pace of shareholder returns through 2022. In Q1 2022 the company’s total returns were almost $6 billion. Out of this, the company’s quarterly returns are roughly $2 billion from its almost 2% dividend yield.

Share buybacks are expected to ramp up. In 2Q-3Q 2022 the company expanded share buybacks to almost $10 billion. That’s enough to repurchase 5% of its outstanding shares in a mere 2 quarters. The company has announced another $4 billion in share buybacks for 4Q 2022 or an 8% annualized share repurchase rate.

It’s also worth noting that this rapid pace of share repurchases helps to lower the company’s dividends and support future returns.

Shell Net Zero

Shell has announced a rapid pace to net zero emissions, something the company can comfortably handle.

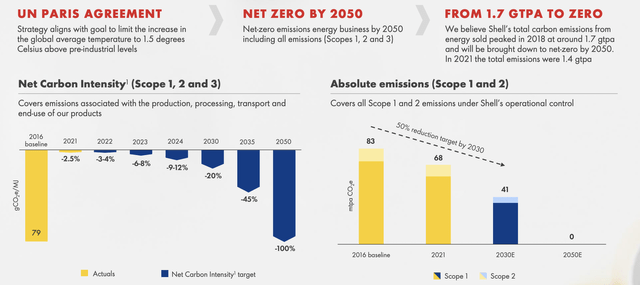

Royal Dutch Shell Investor Presentation

The company expects to get all emissions to 0 by 2050 including Scope 1/2/3, a massive target. By 2035, the company expects to already be 45% of the way towards its goal. For the company’s absolute Scope 1 and 2 emissions, the company also expects to hit net zero by 2050, but with a much faster 50% reduction by 2030.

That net zero goal is an admirable target for the company, and one that will enable it to handle a changing energy environment.

Our View

Shell is a major company that’s going through a more significant transformation.

The risk of an almost $200 billion company to go through a transformation is that there’s no guarantee it pans out. The company is spending $10s of billions on new capital obligations including renewable energy and customer marketing. There’s no guarantee that that capital obligation pans out for the company.

However, despite this, the company is continuing to generate massive cash flow that it can use for substantial shareholder returns. The company is paying a very affordable dividend yield. Additionally it’s started a massive share repurchase program to the tune of 2% of its shares on a quarterly basis. That will save dividend expenses and help with returns.

The company’s setup can comfortably support double-digit shareholder returns, however, there’s no guarantee it pans out.

Thesis Risk

Shell has an impressive portfolio of assets. Importantly, the company has adjusted its portfolio for a net zero environment while rapidly investing in building out its renewable portfolio. However, the company has the risk that if the market doesn’t change as expected, it could lose out of $10s of billion in mistimed capital spending, hurting its ability to drive returns.

Conclusion

Shell has a unique and strong portfolio of assets and a comfortably affordable dividend yield of more than 4%. The company is in the midst of a transformation but in the meantime its core assets are earning incredibly strong cash flow. By making the first move to renewable assets the company can establish a domination position.

Going forward we expect the company’s cash flow to continue improving supporting overall shareholder returns. The company’s aggressive share repurchases at this time can help expand overall shareholder returns in the future, highlighting how the company is a valuable investment. Let us know what you think in the comments below.

Be the first to comment