4kodiak/iStock Unreleased via Getty Images

Amazon’s (NASDAQ:AMZN) subscription business is showing good momentum with solid year-on-year growth. The trailing-twelve-month revenue for this segment has crossed $30 billion. This massive revenue base has allowed the company to invest in improving its fulfillment services as well as expand the streaming budget. The company’s streaming budget increased from $7.8 billion in 2019 to $11 billion in 2020 and $13 billion in 2021. With some high-budget series like “Lord of the Rings”, we could see another big jump in the streaming budget of the company. This has not only improved the library for Prime users but also increases the target audience base for Prime membership in US and international regions.

Amazon has recently increased the annual membership fees in India from INR 999 ($13.5) to INR 1,499 ($20). This 50% membership fee hike was possible due to a massive increase in the local streaming content as well as an improvement in fulfillment services. Prime membership base had crossed 200 million according to the last announcement.

If the company continues to report YoY growth rate of close to 25% in the subscription segment, the annualized revenue base of this business should hit $100 billion by 2025-26. This will create a massive flywheel effect for other services. It will also allow Amazon to sustainably ramp up its streaming budget to $30 billion or more. Growth in subscription revenue will improve the moat for the company and provide a better growth runway. This can increase the return potential in Amazon stock for investors with a longer investment horizon.

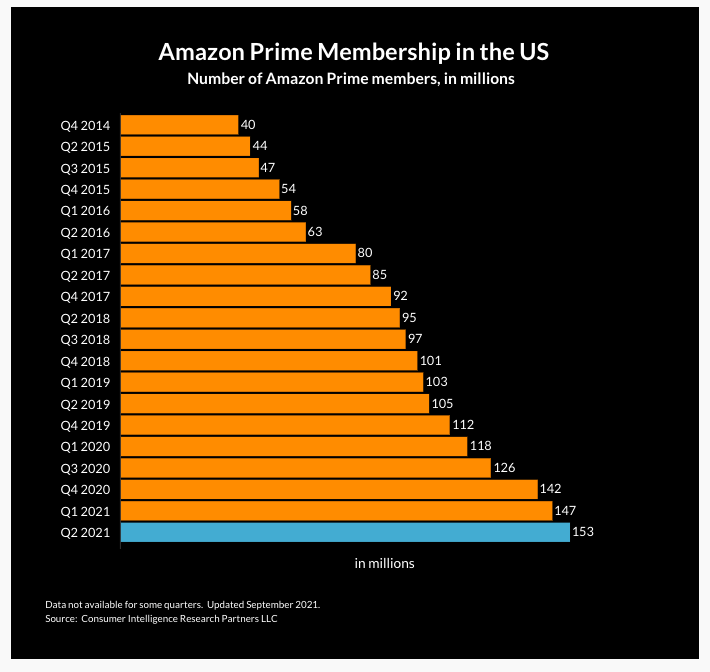

Membership base and churn rate

One of the key metrics for Prime membership is the churn rate of customers. If a price hike increases the churn rate significantly, it would not be worth the benefits. Bloomberg, had earlier mentioned that Amazon Prime’s retention rate is better than Costco’s (COST) which is considered as having one of the best membership loyalty within the traditional retail industry. Amazon’s membership has already crossed 200 million.

CIRP

Figure 1: Prime membership base in US. Source: CIRP, Digitalcommerce360

Amazon has also expanded the grocery pickup services from Whole Foods stores. It is rapidly improving its grocery delivery services. While one-day Prime shipment suffered due to the pandemic, we could see the company get closer to its target as the supply chain bottlenecks decrease. Amazon has also partnered with food delivery services like Deliveroo in international markets of UK and Ireland. Similar services could be rolled out in other regions which would make Prime membership more attractive.

Increase in international markets

It is important for Amazon to show growth in international regions as it reaches saturation within the domestic US market. Amazon has recently increased the Prime membership fee in India to INR1,499 ($20) from INR 999 ($13.5). This is a massive 50% increase in membership. It should be noted that most companies have focused on low rates in this region. Netflix (NFLX) offers its monthly subscription from INR 199 or less than $3. Hence, Amazon Prime’s price increase of 50% is a bold move that shows that the company is confident in retaining its members through better local streaming content and improved fulfillment services. Similar price hikes might be seen in other European and Latin American markets.

Amazon has front-loaded most of the Prime benefits for international customers. This allows international members to view popular streaming content at the same time as the domestic US audience. There has been strong growth in popularity of Hollywood content during the pandemic in many regions across the world. This should allow Amazon to distribute the cost of content to a larger audience base and thus help it improve margins.

Impact on Amazon stock

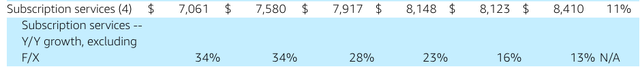

The trailing twelve-month revenue of the subscription segment is over $30 billion. Amazon has delivered strong growth in this segment over the last few quarters. The recent price hike in US and other international regions will be another tailwind for the subscription revenue in the next few quarters. This business has provided the company with a steady, recurring revenue stream which it can invest in improving the streaming content and logistics.

Company Filings

Figure 2: Increase in subscription revenue over the last few quarters. Source: Company Filings

If Amazon continues to show average revenue growth of 25% in the next few quarters, we could see subscription revenue touch $100 billion by 2025-26. In 2021, Amazon invested $13 billion in its streaming business. This is over 40% of the subscription revenue. Future growth in subscription segment will help Amazon divert more cash toward the streaming budget. It is likely that Amazon’s streaming budget increases to $30 billion by 2025 which can make it the biggest player in the streaming industry.

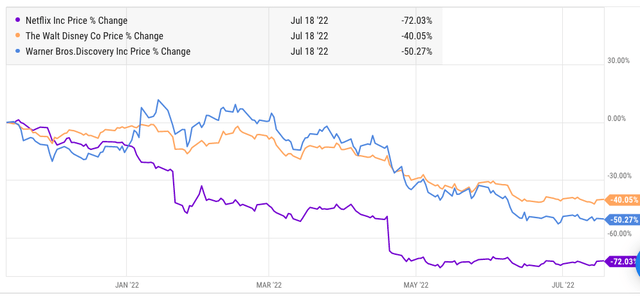

YCharts

Figure 3: Correction in most of the streaming players. Source: YCharts

In the last few months, there has been a significant correction in the top streaming players. Netflix stock has lost three-quarters of its valuation since the end of the last year. Amazon can come out as a clear winner in the streaming race. The ecosystem of services within Prime membership is difficult to replicate. The steady growth of subscription revenue will allow more investment towards the Prime content.

A correction in the streaming industry can also reduce the competition for Amazon. We have heard of massive investments by Netflix, Disney, and other players. The recent correction might force them to reevaluate their content spending. This will be a tailwind for Amazon’s streaming business.

Even after the correction, Netflix stock is trading at a PS ratio of close to 3. If we apply the same ratio to Amazon’s subscription business, then the standalone valuation of this business would be over $100 billion. However, Amazon’s subscription segment has reported higher YoY growth rate compared to Netflix. The churn rate of Prime membership is also a lot lower than Netflix’s subscription. Amazon also gains from a halo effect from its subscription business which helps its e-commerce, advertising, hardware, and other businesses.

It is likely that we will see a better sentiment towards Amazon stock over the next few quarters as the company reports better subscription revenue. This will increase the standalone valuation of subscription business and also give a boost to the overall ecosystem. The growth in subscription segment is likely to be a key driver for future price growth within Amazon stock.

Investor Takeaway

The subscription revenue of Amazon has been increasing at a healthy pace and is now over $30 billion in the trailing twelve months. Recent hikes in important international markets like US and India also show that the management is confident in retaining the membership base.

The recent correction in Amazon stock does not reflect the fundamental strengths in key businesses like subscription segment. Investors with a longer investment horizon can take advantage of the lower entry point for Amazon stock as the company steadily improves its subscription business and improves the long-term growth runway.

Be the first to comment