Lemon_tm/iStock via Getty Images

Banks are among the best-positioned companies in the face of rising rates, yet most are trading at bargain basement valuations. While I see value in the big 3 banks: Bank of America (BAC), JPMorgan Chase (JPM), and Wells Fargo (WFC), their dividend yields may still be unattractive for certain income investors. This brings me to U.S. Bancorp (NYSE:USB), which sports a meaningfully higher yield. In this article, I highlight why the sell-off presents a great buying opportunity on this large bank, so let’s get started.

Why USB?

U.S. Bancorp is one of America’s largest regional banks, with nearly $600 billion in assets. It has branch locations in over 20 states, primarily in the Midwest and West regions of the U.S. Its diversified offerings include retail banking, commercial banking, wealth management, credit cards, and mortgages. USB benefits from its scale and market positioning, helping it gain an attractive efficiency ratio of 58.9% in the latest reported quarter. Morningstar highlighted this strength in its recent analyst report:

U.S. Bancorp is one of the strongest and best-run regional banks we cover. Few domestic competitors can match its operating efficiency, and for the past 15 years the bank has consistently posted returns on equity well above peers and its own cost of equity. U.S. Bancorp’s exposure to moaty nonbank businesses and its consistently excellent core banking operations make us like the company’s positioning for the future. If we were to have a complaint, it would be that the bank was already on top of its game years ago, making it difficult for the firm to further optimize efficiency and returns, while peers seem to be gradually “catching up” over time.

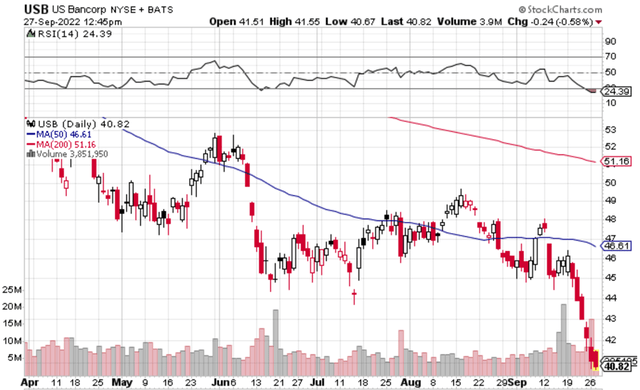

To get a sense of how cheap USB has gotten, at the current price of $41, it’s now trading 35% below its 52-week high of $63.57 achieved as recently as early this year. The recent material downturn for USB stock has pushed it well below its 50- and 200-day moving averages of $46.62 and $51.16, respectively. As shown below, USB stock now carries an RSI score of 24, indicating that it’s well within oversold territory.

USB Stock Technicals (StockCharts)

As one would expect, USB is solidly benefiting from higher interest rates, as its net interest income jumped by 9.5% YoY during the second quarter, outpacing the 8.3% YoY increase it saw in the first quarter. This was also driven by healthy loan growth of 4% and sequential deposit growth of 0.5%. Moreover, it generated a healthy return on average common equity of 15.3% and a return on tangible common equity of 20.5%. Notably, management is guiding for 5.5% revenue growth for the full year.

This isn’t to say that USB is without headwinds, as higher rates also make it difficult for new home buyers to take on a new mortgage. This is reflected by comments from USB’s CFO during the Barclays (BCS) Global Financial Services conference, in which he noted that mortgage revenue will be down 30% to 35% sequentially in the third quarter. Nonetheless, this headwind should be at least partially offset by the benefits USB should get from synergies and opportunities related to its upcoming closure of its MUFG acquisition, as noted by the CEO during the same conference:

Q: Obviously, you announced the acquisition of MUFG, I think a week after this conference last year, you did in hindsight foreshadowed it a little because everything you kind of said you were going to do, you did. But maybe talk to why you think that’s a good fit.

A: Sure. We announced this September 21 about a year ago, so just after the conference. And at the time and consistent with what we believe today, in an environment that scale is so important, this opportunity increases our scale by almost any measure, 20%. So you think about loans, deposits, 1 million customers, 190,000 small business customers, puts us in a meaningful market share in California.

And importantly, also, while we didn’t project any revenue opportunities, the customer base of Union Bank is higher deposit balances, but really less other products and services. So, under-penetrated in card, for example, we have a more robust set of digital capabilities. So I think this will be a terrific deal from an investor standpoint, $900 million of cost savings, a 20% IRR, but it’s also a good deal from a customer perspective, because we have a broader set of products and capabilities. And California is an important market, obviously, in the United States. So, it’s a great deal from that perspective.

Meanwhile, USB sports a strong A+ rated balance sheet and has a healthy CET1 capital ratio of 9.7%. Also, based on the results of the Federal Reserve’s 2022 stress test over the summer, it’s subject to a stress capital buffer of 2.5%, unchanged from the current level.

The recent share price downturn has driven USB’s dividend yield to an attractive 4.7%. The dividend is also well-covered by a 42% payout ratio and comes with 11 years of consecutive growth and a 5-year dividend CAGR of 10.4%.

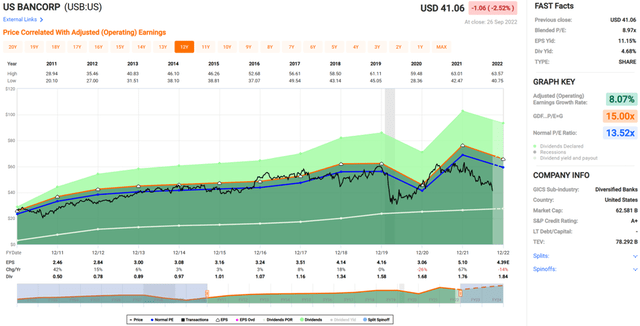

I see value in the stock at the current price of $41, with a forward PE of 9.7x, sitting well below its normal PE of 13.5 over the past 10 years. Morningstar has a $59 fair value estimate and sell-side analysts have a consensus Buy rating with an average price target of $54.71, implying a potential one-year 38% total return including dividends.

Investor Takeaway

In summary, USB now appears to be oversold and in deep value territory. While there are some headwinds on the horizon, such as lower mortgage revenue, I believe the market is overly discounting other benefits of USB, including its upcoming acquisition of MUFG, digital capabilities, and overall efficiency. As such, I see the current pricing as presenting a solid value opportunity for long-term value and income investors.

Be the first to comment